What’s New In Activism – ValueAct Takes Stake In Spotify

ValueAct Capital Management took a stake in music streaming company Spotify Technology SA (NYSE:SPOT) in a move expected to push for a tightening on spending and overall efficiencies.

The new position was disclosed by the hedge fund’s CEO Mason Morfit during a Friday presentation at Columbia University in New York.

Q4 2022 hedge fund letters, conferences and more

"Spotify's superpower was combining engineering breakthroughs with organizational abilities — it organized creators and copyright owners to build an entirely new economic model that benefited everyone involved," Morfit said.

However, he added that the boom years saw Spotify's operating expenses and funding for content "explode." "It is now sorting out what was built to last and what was built for the bubble," the activist observed.

Activism chart of the week

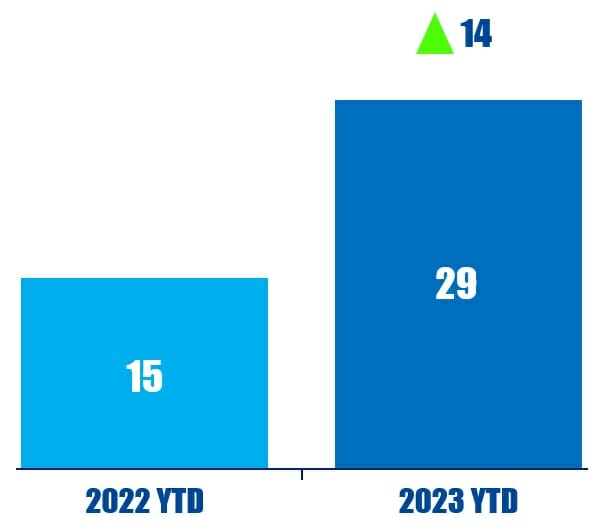

In the 12 months ending February 9, 2023, 29 Asia-based companies were publicly subjected to divestiture-related demands. That is compared to 15 in the 12 months ending February 9, 2022.

Source: Insightia | Activism

What’s New In Proxy Voting - ICCR Concerns At J&J

The Interfaith Center on Corporate Responsibility (ICCR) wrote to Johnson & Johnson (NYSE:JNJ) CEO and Chairman Joaquin Duato expressing its concern over alleged demands for payment for unwanted vaccines.

In the February 7 letter, ICCR noted that a recent New York Times article alleged that J&J demanded payment from vaccine alliance Gavi for more than 150 million unwanted vaccines. "Forcing Gavi to pay an exorbitant sum for vaccines that it has repeatedly told J&J it does not want verges on extortion," the letter contended.

ICCR further argued that such behavior is harmful for J&J shareholders due to the "significant reputational damage" generated by the controversy. The letter also claimed J&J risks alienating itself from its founding principle to "put the needs and well-being of the people we serve first."

"We are deeply concerned that the face of J&J has changed drastically in recent years, and that the ethical application of the Credo has diminished," the letter said.

Voting chart of the week

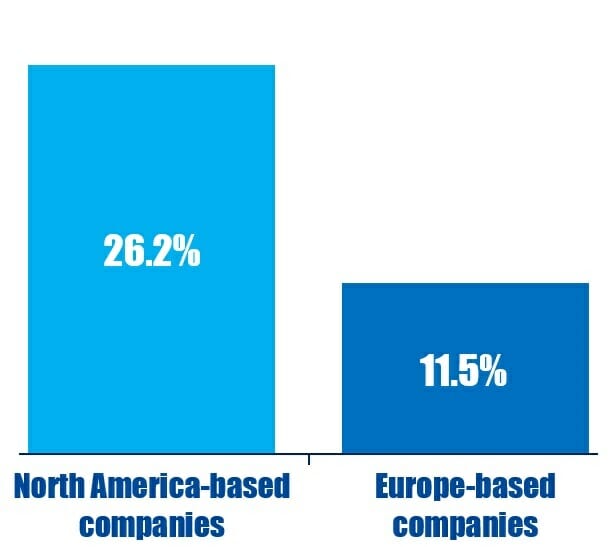

In the 12 months ending February 13, 2023, environmental and social proposals subject to a vote at North America-based companies received an average of 26.2% support. This is compared to just 11.5% at Europe-based companies.

Source: Insightia | Voting

What’s New In Activist Shorts - Adani Stocks Dip

Several listed companies within Indian conglomerate Adani saw their stocks dip yesterday following news on the group's move to trim its revenue growth target and investment plans. Adani has been going through a turbulent time since Hindenburg Research three weeks ago accused it of widespread fraud.

Adani now aims to grow its revenues by 15% to 20% for at least the next fiscal year, down from a previous target of 40%, people familiar with the matter told Bloomberg. They also said Adani would postpone new capital expenditure to protect the group's financial stability in the wake of a fraud scandal sparked by the short report from Hindenburg.

In late January, Hindenburg accused Adani of accounting fraud and stock manipulation in an attack that has so far wiped out more than $120 billion from the market value of several group companies, despite a pushback from Adani, which rejected the allegations and threatened to sue Hindenburg.

Shorts chart of the week

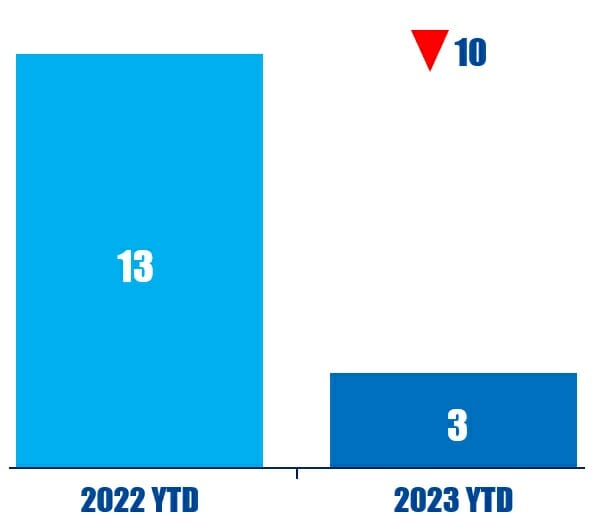

In the 12 months ending February 10, 2023, three China-based companies were subjected to a public activist short campaign. That is down from 13 in the 12 months ending February 10, 2022.

Source: Insightia | Activist Shorts

Quote Of The Week

This week's quote comes from Walt Disney Company as Nelson Peltz announced the end of his board fight at the entertainment giant. Read our reporting here.

“We respect and value the input of all our shareholders and we appreciate the decision by Trian Fund announced by Nelson Peltz this morning.” – Walt Disney Company