Whitney Tilson’s email to investors discussing U.S. inflation hits 31-year high; deflating your inflation fears; deflation? Berkshire Hathaway Inc. (NYSE:BRK.B) article; Berna Barshay on retail stocks.

Q3 2021 hedge fund letters, conferences and more

U.S. Inflation Hits 31-Year High

1) The Labor Department announced yesterday that U.S. Inflation Hit 31-Year High in October as Consumer Prices Jump 6.2%. Excerpt:

U.S. inflation hit a three-decade high in October, delivering widespread and sizable price increases to households for everything from groceries to cars due to persistent supply shortages and strong consumer demand.

The Labor Department said the consumer-price index – which measures what consumers pay for goods and services – increased in October by 6.2% from a year ago. That was the fastest 12-month pace since 1990 and the fifth straight month of inflation above 5%.

Based on many articles I'm reading and e-mails I'm receiving, many folks are freaking out about this.

I'm not...

I think it's a combination of short-term supply chain issues (which will get sorted out), a white-hot economy (which is good for stocks), and U.S. workers demanding and getting higher pay (which is good for America).

Other investors are shrugging this off as well, which is why the S&P 500 Index closed yesterday only 1.2% lower than the all-time closing high it reached on Monday.

Deflating Your Inflation Fears

2) And here's Jason Zweig with a smart piece in the Wall Street Journal about why you should resist the various schemes salespeople are peddling to protect you (supposedly) from inflation: Deflating Your Inflation Fears. Excerpt:

Inflation.

Few words strike more fear into investors' hearts, and for good reason. By eating away at the purchasing power of your assets, inflation is the nemesis of every investor.

Everywhere you turn nowadays, someone is peddling protection: Gold! Bitcoin! Value stocks! Energy stocks! Commodities!

And no wonder: After years of quiescence, inflation has surged, hitting 5.4% year over year in September. With interest rates near zero and governments spending trillions, more of the same seems as unavoidable as nightfall.

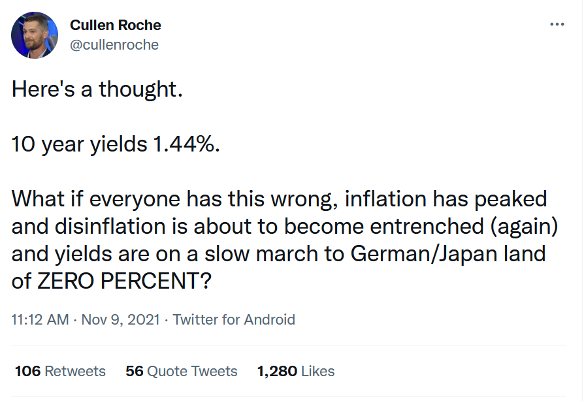

3) If you want to worry about some macro factor, here's a contrarian view (which I wouldn't rule out):

In summary, I spend zero time worrying about inflation (or deflation). If I own good stocks, I'm going to be fine no matter what...

Berkshire Hathaway Article

4) Speaking of which, I was quoted in this Business Insider article about Berkshire Hathaway (BRK-B): Finance guru Whitney Tilson explains why Warren Buffett's Berkshire Hathaway is the ultimate 'stay rich' stock. He dismisses its $7 billion in net stock sales this year, and calls for even faster buybacks. Excerpt:

Berkshire serves as a fantastic nest egg because its shareholders won't get blindsided by any surprises, Tilson said. The former hedge fund manager described it as "the safest stock imaginable" given its fortress-like balance sheet, strong cash generation, diversified cash flows, and the conservative management style of Buffett and his right-hand man, Charlie Munger.

"You're not going to wake up one day and find the stock's been cut in half," Tilson told Insider.

Berna Barshay on Retail Stocks

5) A quick follow-up to yesterday's e-mail, in which I mentioned my friend David Berman and my colleague Berna Barshay's views on consumer spending and the retail sector. Berna sent me this clarification:

I am bullish on the U.S. consumer, but this doesn't mean I'm bullish on retail stocks overall.

I am bullish on the two retailers I wrote about last week, Five Below (FIVE) and Foot Locker (FL), and of course, the ones I've recommended in my newsletter, Empire Market Insider.

But I'm not bullish (or bearish) on retailers as a group – they could go either way for a lot of reasons (supply chain, inflation, valuation, hard comps coming up, etc.).

Retail is a sector where stock picking is essential. Unlike energy or financials, where the stocks all tend to move together, there are always retail stocks that go up – even when the sector is a dog, and vice versa.

Thank you, Berna! Berna's stock picks are beating both the S&P 500 and Russell 2000 indexes since her Empire Market Insider service launched in June, with four double-digit winners. You can click here to learn more about Empire Market Insider.

Best regards,

Whitney

P.S. I welcome your feedback at [email protected].