Trump vs Biden’s Energy Policies: How Diverging Energy Policies In The U.S. Presidential Election May Affect Credit Quality

Q3 2020 hedge fund letters, conferences and more

Key Takeaways

- President Trump and former-Vice President Joe Biden's energy policies vastly differ in their main tenets and will have different implications for the upstream and midstream oil and gas sectors.

- Regardless of the presidential election outcome, the upstream and midstream sectors still face headwinds that are making for a difficult operating environment.

- We believe renewables—especially solar--stand to gain significantly under a Biden administration. The $2 trillion plan highlights the extension of renewable tax credits as a key agenda item.

- In public finance, we expect a limited impact from the outcome of the presidential election in the short-term, although states with a comparatively large share of mining activities could face new headwinds should standing policies materially shift away from extraction and production.

- Overall, states and utilities have been less reliant on federal energy funding and have been responding to state-driven environmental regulations, which in some cases is stricter than those coming from Washington, D.C.

As we wind closer to the presidential election, one topic garnering a lot of attention is the candidates' respective energy policies. The tenets of President Donald Trump's and former-Vice President Joe Biden's energy platforms are in stark contrast to each other and could have vastly different outcomes. Trump supports promoting U.S. energy, protecting energy tax subsidies, increasing use of federal lands/waters for drilling, reducing regulatory hurdles for infrastructure spending, rolling back clean air emission standards, and eliminating methane gas emission regulations; a Trump re-election would likely result in more of the same. Biden's energy polices are more focused on reducing dependence on fossil fuels, protecting the environment, reducing greenhouse gas (GHG) emissions, and eliminating tax subsidies for fossil fuel producers.

Both energy platforms are subject to change, and Biden's energy polices in particular is still only an outline, but the major themes and differences are already apparent. In this commentary, S&P Global Ratings evaluates the implications on the oil and gas industry, utility, and power sectors, as well as states/municipalities that are concentrated to the U.S. energy industry.

Donald Trump vs Joe Biden's Energy Policies

Leases on federal lands/waters

According to the Department of the Interior, approximately 22% of U.S. oil production and 13% of natural gas production comes from federally owned land/water. Platt's Analytics predicts an immediate ban on federal leases could reduce U.S. oil production by approximately 2 million barrels by the end of 2024.

The Trump administration has clearly supported drilling on federal lands/waters. During his tenure, the president directed the U.S. Department of the Interior to roll back the Obama administration's 2017-2022 leasing plan for offshore oil and gas drilling in the Arctic, Atlantic, and Pacific oceans. In addition, he lifted the Obama's administration's moratorium on all new oil and gas drilling in approximately 120 million acres in the Arctic and Atlantic oceans. Under a Trump administration, we can expect continued executive support for offshore drilling and drilling on wildlife refuges, including opening up the 19.2 million acres of the Arctic National Wildlife Refuge for drilling.

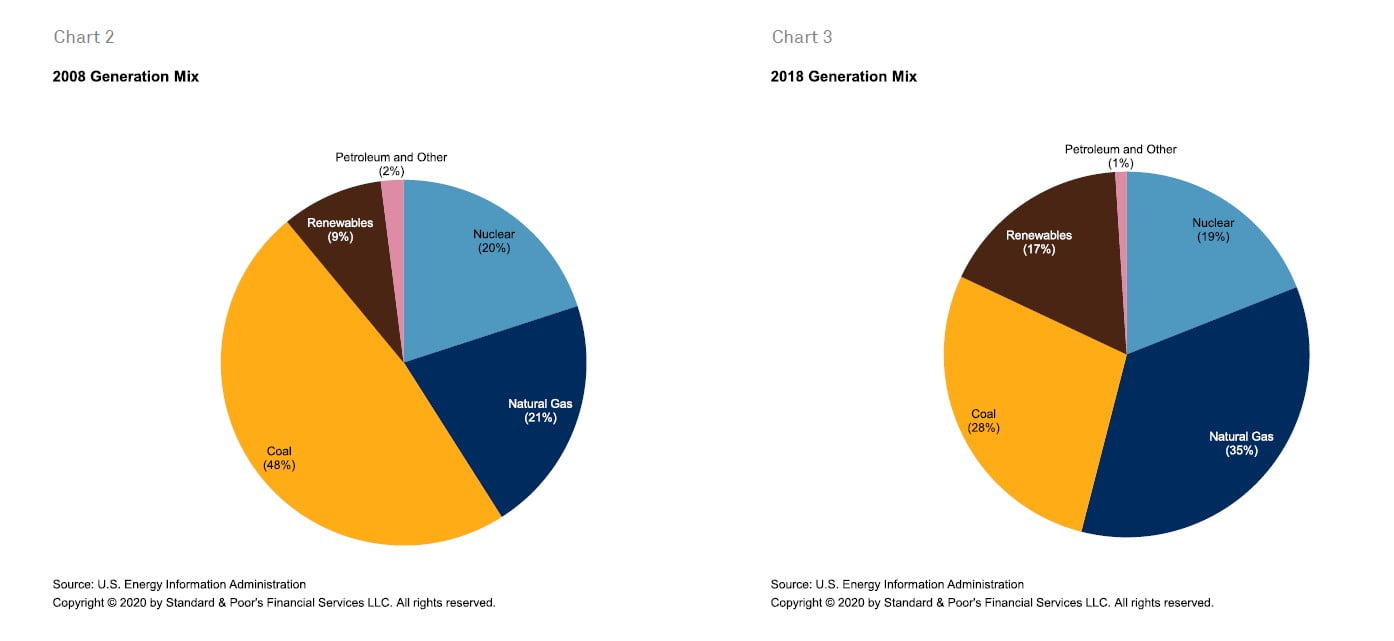

A Biden administration would most likely restrict or halt new leases on federally owned land/waters and seek to make such policy permanent. However, a Biden administration is unlikely to issue an immediate moratorium on existing drilling or permits. Also, Biden's energy policies does not call for a ban on the controversial technique of hydraulic fracturing (hydrofracking), and any such measure, in our opinion, would meet stiff resistance, considering the economic importance and importance to the nation's power grid: natural gas accounts for 35% of the nation's electricity generation. Hydrofracking has transformed the U.S. into a net exporter of oil and one of the world's largest producer of fossil fuels. According to the White House Council on Economic Advisors, shale hydrofracking saves U.S. consumers approximately $203 billion or $2,500 annually per a family of four.

Fossil fuel subsidies and tax cuts

Oil & Gas subsidies have a meaningful impact on the cost of doing business for oil and gas companies. Researchers at Oil Change International estimated that direct subsidies alone for the U.S oil and gas industry total at least $20 billion per year. Indirect subsidies have a far greater financial impact but are somewhat difficult to quantify. We would expect a Trump administration to support or implement further fossil fuel subsidies and tax cuts under the auspices of encouraging domestic production and promoting energy independence.

Biden is calling for the elimination of certain subsidies, as well as tax breaks and royalty payment relief for the oil and gas industry. We believe any such rollbacks would target intangible drilling costs, credits for enhanced oil and gas recovery methods, and the percentage deduction for depleting oil and gas wells. The Joint Committee on Taxation (JCT) concluded that eliminating the intangible drilling costs deduction would generate $1.6 billion in revenue for the U.S. government in 2017. The JCT also estimated that eliminating the depletion deduction would generate approximately $13 billion over the next 10 years. This could raise the overall cost profile for shale, which we view as being the marginal cost barometer for the global oil industry, but could ultimately provide a higher, longer-term floor for prices that could offset the higher costs.

Methane emissions

The Biden energy plan lacks specifics but will likely include restrictions on natural gas venting and flaring for new wells in addition to increasing monitoring and reporting of methane leakages. The IEA has stated that methane regulation could add several dollars per barrel of oil production.

President Trump has long been supportive of eliminating methane emission regulation. Indeed, in August, the EPA rolled back most of President Obama's methane regulation.

New pipelines and energy infrastructure

Biden's energy policies call for federal permitting to review any new infrastructure project and its effect on climate change and GHG. The Federal Energy Regulatory Commission (FERC) would likely implement more stringent guidelines for new gas pipeline and NGL (natural gas liquids) projects, which would likely increase the costs and hurdles to build new pipelines. This would probably not have much of an impact in the Texas Permian basin, which is regulated by the state of Texas, but could prevent other interstate pipelines--like Keystone XL--from being built. In fact, Joe Biden has stated he would rescind Trump's permit to construct Keystone XL.

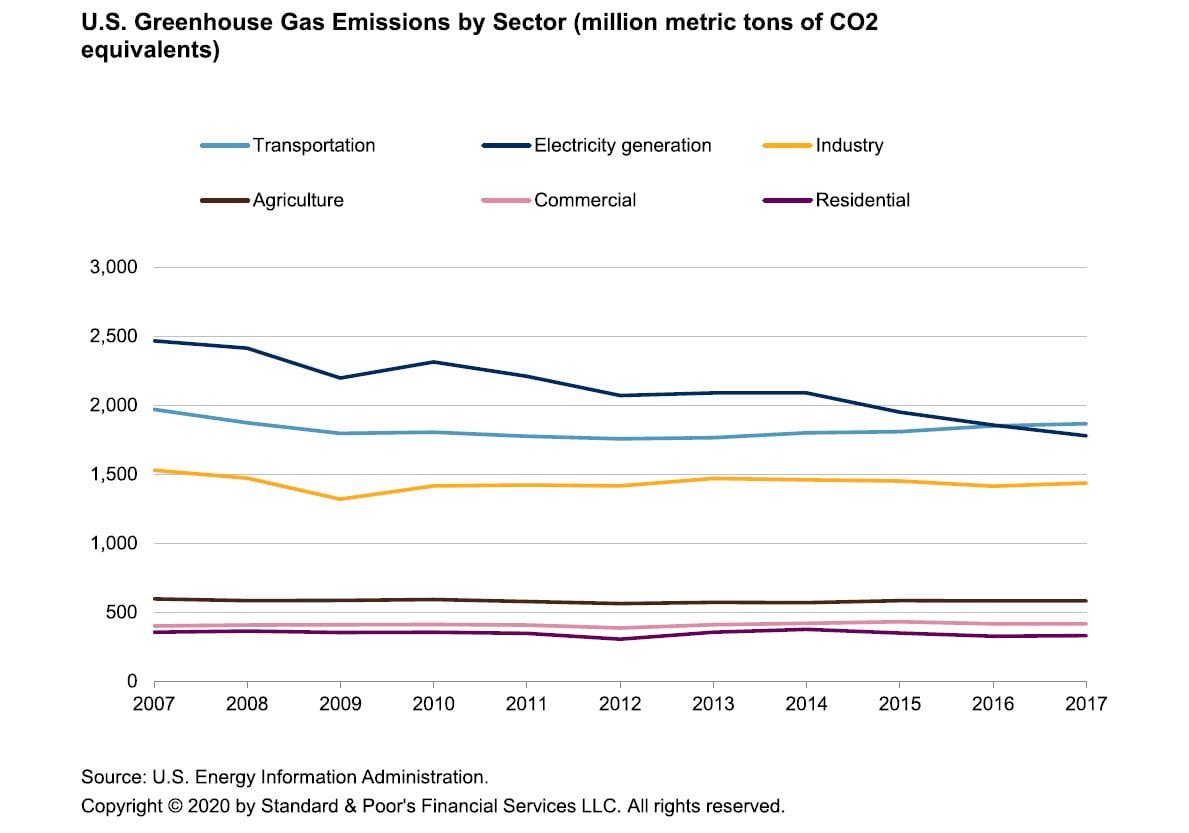

Carbon and GHG emissions

Biden has announced a greenhouse gas and carbon emission plan to eliminate carbon pollution from the power sector by the year 2035. The $2 trillion plan would provide a standardization and be a key driver for state renewable energy policy. With only 36% of the country's electricity (according to the EIA) generated from clean sources (including 20% from nuclear), the plan is ambitious and would most likely require significant advances in current technology to meet its objective. Biden is also calling for the nation to achieve 100% clean energy and net zero emissions by 2050.

Read the full analysis here by S&P Global Market Intelligence