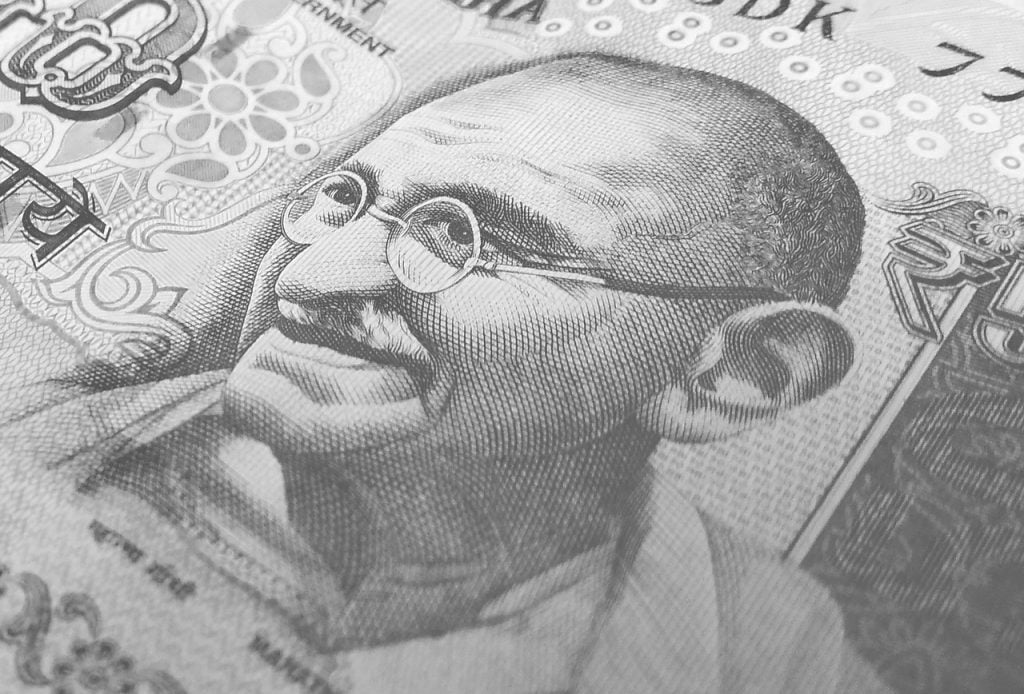

Emerging markets are a good investment, and one of the best emerging markets to invest in is India. The country is a hub for information technology and business process outsourcing. Also, India ranks among the top five worldwide in farm output. India is poised to regain its growth post-Covid, while its young and highly educated population will help the country sustain the growth rate. If you are planning to invest in India, but don’t know where to start, the best way to invest is through India Equity funds. Such funds invest more than 70% of their assets in Indian securities. Detailed below are the top ten India Equity funds.

Q1 2021 hedge fund letters, conferences and more

Top Ten India Equity Funds

We have used the past one year return data (from U.S. News) to rank the top ten India Equity funds. We have considered both mutual funds and ETFs. Following are the top ten India Equity funds:

-

WisdomTree India ex-State-Owned Enterprises Fund (IXSE, 58%)

IXSE tracks the price and yield performance of the WisdomTree India ex-State-Owned Enterprises Index. This index includes companies incorporated and traded in India, but excludes state-owned enterprises. It has a YTD return of more than 12%. IXSE has $4.93 million in net assets, and its expense ratio is 0.58%.

-

Franklin FTSE India ETF (FLIN, 60%)

FLIN works to replicate the performance of the FTSE India RIC Capped Index. This index tracks the performance of Indian large- and mid-capitalization stocks. FLIN normally invests in the securities of the underlying index and depositary receipts representing such securities. It has a YTD return of more than 14%. FLIN has $28.38 million in net assets, and its expense ratio is 0.19%.

-

Vaneck Vectors India Growth Leaders USD Etf (GLIN, 61%)

GLIN aims to match the investment performance of the MarketGrader India All-Cap Growth Leaders Index. GLIN has a YTD return of more than 15%. It has $73.52 million in net assets, and its expense ratio is 0.94%.

-

First Trust India Nifty 50 Equal Weight ETF (NFTY, 66%)

NFTY tracks the performance of the NIFTY 50 Equal Weight Index. This index tracks the 50 largest and most liquid Indian securities listed on the NSE (National Stock Exchange of India). NFTY, during normal times, invests a minimum of 90% of its net assets in securities included in the index. NFTY has a YTD return of more than 18%. It has $77.93 million in net assets, and its expense ratio is 0.80%.

-

Eaton Vance Greater India Fund Class A (ETGIX, 72%)

ETGIX’s objective is long-term capital appreciation, and it normally puts money in equity securities of Indian companies, as well as in neighboring countries. ETGIX has given a return of 7.93% in the last three years and more than 12% in the past five years. It has $260.20 million in total assets, and its net expense ratio is 1.56%. The top three holdings of this fund are Infosys, ICICI Bank and Axis Bank.

-

Wasatch Emerging India Fund® Investor Class (WAINX, 73%)

WAINX aims for long-term growth of capital, and normally invests in companies that are economically connected to India. WAINX has given a return of 11.87% in the last three years and more than 16% in the past five years. It has $466.12 million in total assets, and its net expense ratio is 1.64%. The top three holdings of this fund are Bajaj Finance, HDFC Bank, and Divi's Laboratories.

-

Matthews India Fund Investor Class (MINDX, 78%)

MINDX seeks capital appreciation, and normally invests in common stocks, preferred stocks and convertible securities of firms located in India. MINDX has given a return of 3.13% in the last three years and more than 8% in the past five years. It has $695.31 million in total assets, and its net expense ratio is 1.15%. The top three holdings of this fund are HDFC Bank, Reliance Industries and Infosys.

-

WisdomTree India Earnings ETF (EPI, 78%)

EPI tracks the price and yield performance of the WisdomTree India Earnings Index. It invests at least 95% of its assets in securities included in the underlying index and securities with similar characteristics. EPI has a YTD return of more than 17%. It has $863.55 million in net assets, and its expense ratio is 0.84%.

-

ALPS/Kotak India Growth Fund Class A (INAAX, 79%)

INAAX aims for capital appreciation, and invests a minimum of 80% of its assets in equity and equity-linked securities of Indian companies. INAAX has given a return of 7.89% in the last three years and more than 12% in the past five years. It has $328.28 million in total assets, and its net expense ratio is 1.31%. The top three holdings of this fund are Infosys, Reliance Industries and Tata Consultancy Services.

SMIN tracks the investment performance of the MSCI India Small Cap Index. This fund normally invests at least 80% of its assets in the securities of the underlying index. SMIN has a YTD return of more than 25%. It has $314.42 million in net assets, and its expense ratio is 0.81%.