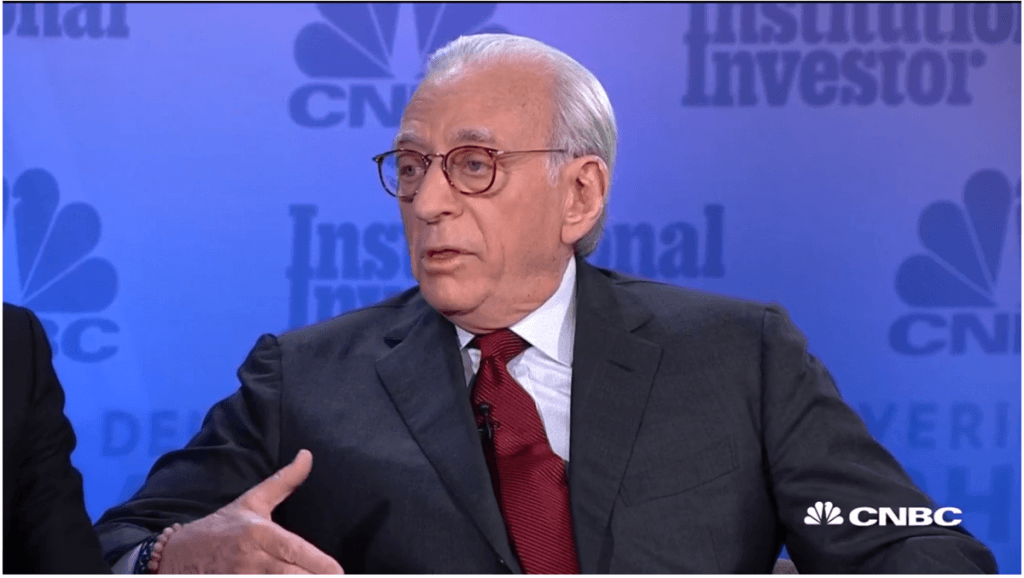

Nelson Peltz is a billionaire and activist hedge fund manager. Peltz co-founded Trian Fund Management in 2005 along with Ed Garden and Peter May. He is known for investing in underperforming, undervalued companies and then works with their management toward an operational turnaround. Peltz’s proxy fight for a board seat at Procter & Gamble back in 2017 is one of his biggest wins. Let’s take a look at the top stock holdings of Nelson Peltz.

Q2 2021 hedge fund letters, conferences and more

Top Stock Holdings Of Nelson Peltz

We have referred to the recent 13F filing (June 30, 2021) to come up with the top stock holdings of Nelson Peltz (Trian Fund Management). As per the 13F, Peltz has nine stocks in his portfolio. These are the top stock holdings of Nelson Peltz:

-

General Electric

Founded in 1903, this company operates via the following business segments: Healthcare, Renewable Energy, Power, Aviation, and Capital. Peltz owns 4,025,184 shares of General Electric, amounting to $433.4 million and accounting for 5.1% of his portfolio. He raised his stake in General Electric in Q2. The shares of the company are down more than 2% in the last three months, but are up over 17% YTD (year-to-date). General Electric is currently trading over $100.

-

Mondelez International

Founded in 1903, this company makes and markets snack food and beverage products. Peltz owns 8,638,085 shares of Mondelez International, amounting to $539.4 million and accounting for 6.3% of his portfolio. He reduced his stake in Mondelez International in Q2. The shares of the company are up more than 2% in the last three months, and over 9% YTD (year-to-date). Mondelez International is currently trading over $63.

-

Wendys Co

Founded in 1969, this company operates and franchises quick-service restaurants. Peltz owns 26,630,629 shares of Wendy's, amounting to $623.7 million and accounting for 7.3% of his portfolio. The shares of the company are up almost 1% in the last three months, and over 7% YTD (year-to-date). Wendy's is currently trading over $24.

-

Procter & Gamble

Founded in 1837, this company makes, markets and sells personal care products, such as Fabric and Home Care, Baby care, Feminine and Family Care, and more. Peltz owns 5,791,785 shares of Procter & Gamble, amounting to $781.5 million and accounting for 9.1% of his portfolio. He reduced his stake in Procter & Gamble in Q2. The shares of the company are up more than 6% in the last three months, and over 4% YTD (year-to-date). Procter & Gamble is currently trading over $144.

-

Janus Henderson Group

Founded in 1998, it is a holding company that offers asset management services. Peltz owns 21,223,084 shares of Janus Henderson Group, amounting to $823.7 million and accounting for 9.6% of his portfolio. He raised his stake in Janus Henderson Group in Q2. The shares of the company are up more than 15% in the last three months, and over 30% YTD (year-to-date). Janus Henderson Group is currently trading over $42.

-

Invesco Ltd

Founded in 1935, it is an investment management company that offers mutual funds, ETFs, closed-end funds, retirement plans and more. Peltz owns 36,755,775 shares of Invesco, amounting to $955.6 million and accounting for 11.2% of his portfolio. He raised his stake in Invesco in Q2. The shares of the company are down more than 8% in the last three months, but are up over 41% YTD (year-to-date). Invesco is currently trading over $24.

-

Comcast Corp.

Founded in 1963, this company offers video, Internet, and phone services. Peltz owns 20,797,466 shares of Comcast, amounting to $1185.9 million and accounting for 13.9% of his portfolio. He raised his stake in Comcast in Q2. The shares of the company are up more than 9% in the last three months, and over 13% YTD (year-to-date). Comcast is currently trading over $59.

-

Sysco Corp.

Founded in 1969, this company sells, markets and distributes food products to healthcare and educational facilities, restaurants, as well as lodging establishments. Peltz owns 17,875,724 shares of Sysco amounting to $1389.8 million and accounting for 16.2% of his portfolio. He reduced his stake in Sysco in Q2. The shares of the company are down more than 3% in the last three months, but are up over 5% YTD (year-to-date). Sysco is currently trading over $78.

-

Ferguson Plc

Founded in 1887, this company deals in the supply of plumbing and heating products to consumers and contractors. Peltz owns 13,117,373 shares of Ferguson, amounting to $1821.2 million and accounting for 21.3% of his portfolio. He reduced his stake marginally in Ferguson in Q2. The shares of the company are up more than 4% in the last three months, and over 17% YTD (year-to-date). Ferguson is currently trading around $139.