New Study: Tipped Workers Nearly 40 Percent Less Likely to be Poor than Minimum Wage Earners

Q4 2020 hedge fund letters, conferences and more

Ending the federal tip credit would have little to no effect on poverty, cost nearly 700k workers their jobs

The Impact Of Eliminating The Tip Credit On Tipped Workers And Minimum Wage Earners

Washington, D.C. (Feb. 10, 2021) - Today, the Employment Policies Institute (EPI) released a new study which finds that tipped workers are nearly 40 percent less likely (6.4 percentage points) to be poor than minimum wage workers.

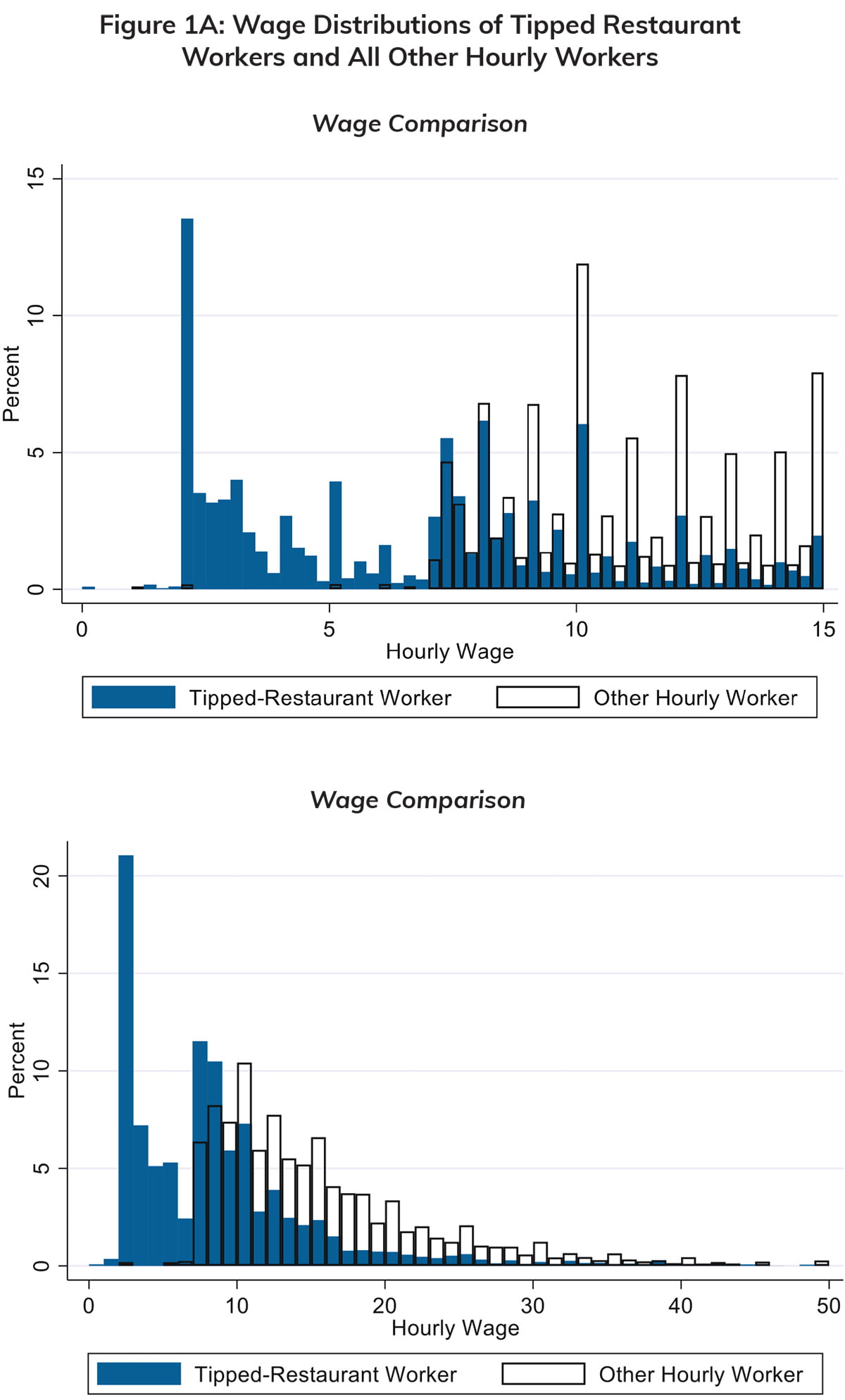

The study, entitled “Tipped Workers, Minimum Wage Workers, and Poverty,” analyzes data on tipped workers’ hourly wages and poverty status to determine the potential impact of eliminating the tip credit.

Analyzing Census Bureau data, authors David Neumark and Maysen Yen (University of California-Irvine) also find that tipped workers are five percentage points less likely to be categorized as “extremely” poor. The authors conclude that elimination of the federal tip credit is less likely to help poor families than a standalone increase in the minimum wage while maintaining the tip credit.

The Negative Impacts Of Raising The Minimum Wage On Employment

The authors' analysis does not take into account potential negative impacts on employment of raising the minimum wage or eliminating the tip credit. These effects are documented in "The Case for the Tip Credit,” a companion brief which summarizes the research on tip credits and the history of tipping. The brief also documents the success of bipartisan, worker-based movements to maintain state tip credits and the failure of restaurant experiments to end tipping.

“Tipped workers have fought against tip credit elimination because it's bad for their bottom line,” said Michael Saltsman, managing director of the Employment Policies Institute. “Congress should reject any attempts to upend the tipping system or eliminate tip credits, which will put hundreds of thousands of good-paying jobs at risk. There are better solutions to help raise the wages for minimum wage workers without affecting the income of tipped workers – who are clearly different than their minimum wage-earning counterparts.”

Read the full study here.

Read the companion brief here.

About the Employment Policies Institute

Founded in 1991, the Employment Policies Institute is a non-profit research organization dedicated to studying public policy issues surrounding employment growth. In particular, EPI focuses on issues that affect entry-level employment. Learn more at EPIOnline.org.