Global pharmaceutical medical cannabis company Tilray Inc (NASDAQ:TLRY) experienced extraordinary volatility towards the end of last week with shares rallying 30.8% on Thursday to $3.90 following commentary from President Biden before erasing most gains and falling -18.7% on Friday after releasing first quarter results with the stock closing at $3.17.

Tilray, along with the rest of the Cannabis sector received a boost of investor buying after President Joe Biden on Thursday announced that he had pardoned all people formerly convicted of federal marijuana possession. Tilray rose as high as $3.93 before closing at $3.90. A link to the Fintel article on the news can be found here.

Q3 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

The rally saw many investors buy into Tilray the day before releasing their first quarter update to inventors.

Tilray has risen seven ranks this week and is now the 25th most held security by retail investors who have linked their portfolio for free with the Fintel platform.

Tilray's Q1 Earnings

Early on Friday morning before market open, Tilray reported to inventors that during the first quarter of FY23 they had generated net revenue of $153.2 million, which missed analyst consensus forecasts of around $156 million and representing a -9% decline over the year.

Gross profits declined by a lesser amount of -5% over the year at $48.6 million. This filtered through to an adjusted EBITDA of $13.5 million, growing 7% over the year and slightly beating consensus expectations of around $13 million.

The adjusted net loss however remained negative as Tilray reported a -$45.0 million figure and adjusted EPS of -8 cents per share. The adjusted net results were an improvement on the -$57.9 million lost in 2021 equating to -13 cents per share on a comparative basis.

The street was forecasting the company to post a net loss of -7 cents per share and it is unclear if this is comparable as Tilray’s statutory net loss per share was -13 cents.

Tilray ended the quarter with approximately $500 million of cash on the balance sheet which is over one quarter of the group's $1.84 billion market capitalization.

The result marked the firm's 14th consecutive quarter of positive adjusted EBITDA which is an achievement that not many other producers are experiencing.

The groups CEO and Chairman Irwin Simon accompanied the result with the following key comments and points from the results stating:

“We have also optimized our performance through an ambitious and expanded cost savings across the platform”

Simon discussed how the firm has already realized $95 million out of their $100 million cost savings plan and $13 million of the more recently launched cost optimization plan which expects to save a further $30 million. In total, Irwin expects to remove $130 million of costs from the business.

Additionally, the CEO discussed how they plan to realize an additional $40 million in sales and interest payments from the firm's recent HEXO transaction.

Irwin Simon ended the release stating “These initiatives, combined with our market share and revenue gains, should position Tilray Brands extraordinarily well for the future, allowing us to reconfirm our guidance of $70 to $80 million of adjusted EBITDA and be free cash flow positive”

The $75 million dollar mid-point of the full year guidance was marginally ahead of the streets’ forecast of around $73 million.

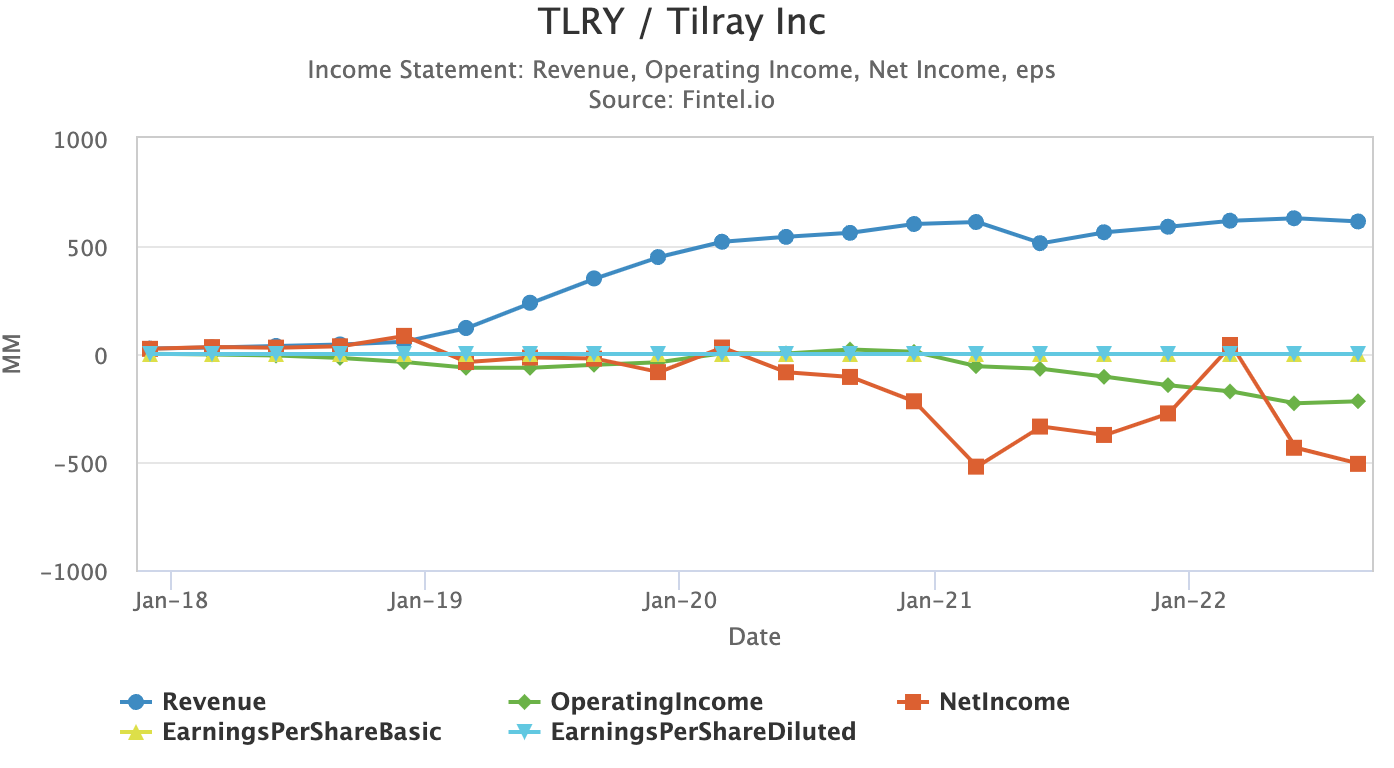

The chart to the right has been included from the Fintel financial metrics and ratios page for Tilray and shows the growth in sales and the rolling level of profitability over the last few years:

Analyst Pablo Zuanic from Cantor Fitzgerald believes Tilray is well-placed to benefit from various markets legalizing recreational cannabis (focusing on US/Germany) and or medical.

Zuanic believes cannabis stocks are going to be driven by sentiment around US reform in the medium term.

The firm remains ‘neutral’ rated on the stock but increased his target from $4.15 to $4.50 post result. He notes that the neutral stance is based on valuation vs peers.

Tilray has a consensus ‘hold’ rating and a $4.55 average target price across the street.

Article by Ben Ward, Fintel