What’s New In Activism – Third Point Expands

Third Point Partners opened an office in Tel Aviv to expand its investments in the country, particularly in the technology sector.

Tel Aviv is the second outpost for the New York-based hedge fund, after Menlo Park in Silicon Valley, where its venture capital arm Third Point Ventures is located.

Loeb said that Third Point will scout for investments in the country in data infrastructure, cybersecurity, and enterprise software. The firm has made investments in Israel since 2015, including SentinelOne, Verbit, Next Silicon, Trullion, and Forter.

Q3 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

"Third Point Ventures' permanent presence in Israel is a natural extension of the commitment we have had to the country for many years, evidenced by previous early-stage investments made from our hedge fund," Loeb said, according to media reports.

Third Point's most recent target is Colgate-Palmolive, where it believes a spinoff of the company's pet food subsidiary Hill's Pet Nutrition would unlock value.

Activism chart of the week

So far this year (as of October 20, 2022), 35 U.S.-based companies have been publicly subjected to "push for M&A-related" demands. That is compared to 28 in the same period last year.

Source: Insightia | Activism

What’s New In Proxy Voting - Glass Lewis Weighs In At KLA Corp.

Glass Lewis urged shareholders of KLA Corp (NASDAQ:KLAC) to vote against a proposal asking the semiconductor manufacturer to report on how it intends to reduce greenhouse gas (GHG) emissions.

In an October 21 regulatory filing, the company informed shareholders of Glass Lewis' view that it had "already met the request of the proposal," as it currently "provides robust climate-related disclosures… and reporting in line with the recommendations of the TCFD [Task Force on Climate-Related Financial Disclosures]."

The proposal, led by As You Sow was filed on September 23 and asked the company to report on a timeline for setting net-zero GHG reduction targets, to disclose an enterprise-wide climate transition plan, and to report on progress made on related goals.

The company fought back against the proposal, arguing that whilst it recognizes the importance of taking action on climate change, the proposal is not aligned with "market norms," and fails to take an "industry-specific, materiality-driven approach."

Voting chart of the week

Combined, the big five investors voted for the dissident card 25 times out of 83 (30.1%) in 21/22, versus 14 out of 58 (24.1%) in 20/21. This comes from our Proxy Voting Snapshot 2022.

Source: Insightia | Voting

What’s New In Activist Shorts - Hindenburg v Establishment Labs

Hindenburg Research took a short position in breast implant manufacturer Establishment Labs Holdings Inc (NASDAQ:ESTA) calling the med tech "a financially stretched silicone safety charade."

Establishment Labs manufactures and sells breast implants that it claims are safer than competitors due to revolutionary technology. FDA approval is anticipated in mid to late 2023.

However, the Hindenburg report published on October 19 questioned the company's claims with regard to superior safety, revealing that it found that almost all key safety studies touted have "conflicts of interest, with many undisclosed or under-disclosed."

It's further claimed that Australian and French authorities expressed concerns with the company's data, with Australian regulators describing its main safety data as "observational uncontrolled studies". The report also alleged that "dozens of patient testimonials and multiple lawsuits stand at stark odds with Establishment’s claims of safety and satisfaction."

Shorts chart of the week

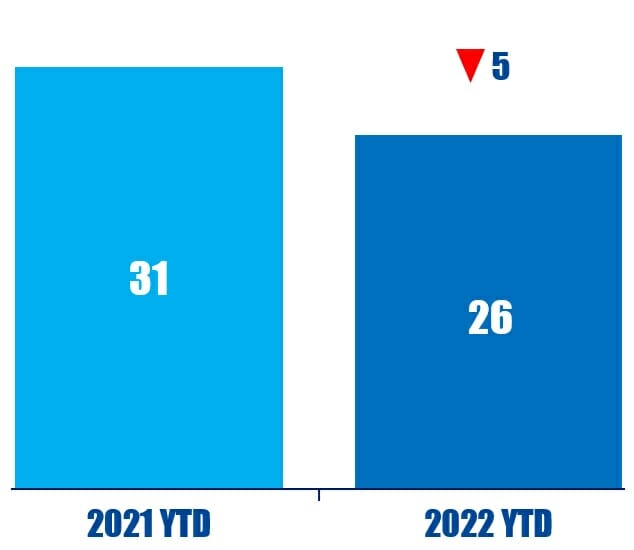

So far this year (as of October 21, 2022), 26 different short sellers have publicly subjected a company to an activist short campaign. That is down from 31 in the same period last year.

Source: Insightia | Activist Shorts

Quote Of The Week

This week's quote comes from Hindenburg Research in an October 19 short report on Establishment Labs. Read our coverage above.

“With the deal having closed on April 1, 2021, and now with the benefit of five subsequent reporting quarters, Spruce Point believes the Luxco merger has been an abysmal failure.” – Spruce Point Capital Management