The long holiday weekend offers a good opportunity to not only consider green energy, but where income can be found in it.

Q1 2021 hedge fund letters, conferences and more

Green Is Trending

Not a day goes by without investors finding new articles addressing green energy in their email inboxes. “Green” is trending red hot. The global and domestic narrative over enhancing the transition to green energy usage is embedded in local, state, federal, and international agendas, laws and regulations that aim for net-zero-carbon emissions in the world by 2050.

There is reason to be optimistic about reaching such a lofty goal, as there is no shortage of capital pouring into the green space armed to fund this endeavor. Total investment in renewable-energy projects, electric vehicles, and other green efforts exceeded $520 billion last year, a record, according to Bloomberg New Energy Finance, which tracks green investments. Green spending was up 12% from a year earlier and up nearly 60% from 2015, according to Bloomberg data – all despite the pandemic and steep 2020 recession.

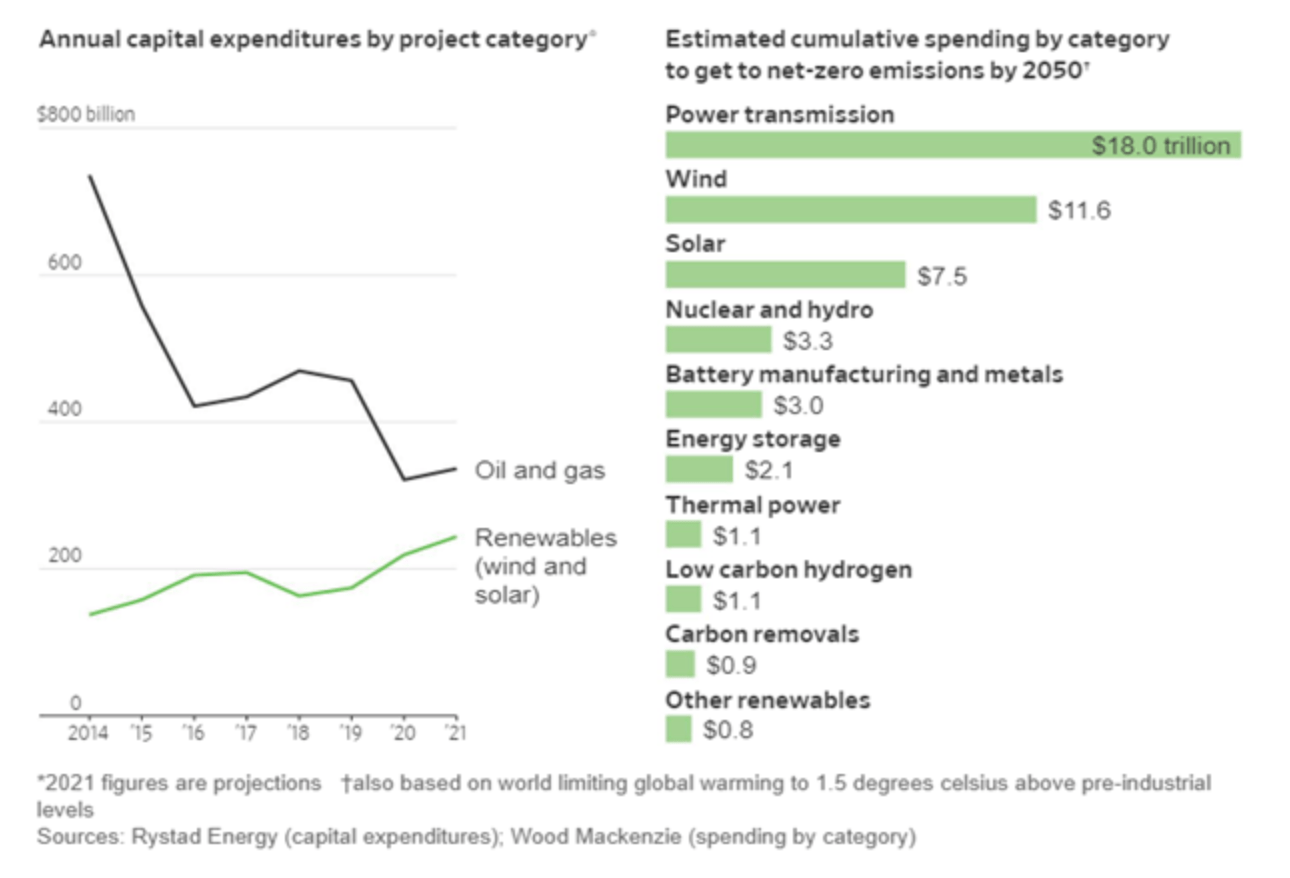

The Wall Street Journal reported this past weekend that, “as recently as 2014, the world’s energy companies spent $735 billion on oil-and-gas extraction. The figure was less than half that last year, while spending on wind and solar projects rose to nearly $220 billion, up from about $135 billion six years earlier, according to Rystad Energy, a consulting firm. Some analysts predict spending on renewable energy will exceed oil and gas in the next several years.”

Reducing Greenhouse-Gas Emissions

The Journal article goes on to state that consulting firm “Wood Mackenzie has estimated that at least $50 trillion in investment will be needed to reduce fossil fuel and other greenhouse-gas emissions by 2050 to meet the goals of the Paris climate accord. Roughly half of that money, the firm said, needs to go to areas such as wind and solar power and battery storage. Another $18 trillion is needed to modernize the electric grid, in part to transition to cleaner energies such as solar and wind.”

“Assets in investment funds focused partly on the environment reached almost $2 trillion globally in the first quarter, more than tripling in three years. Investors are putting $3 billion a day into these funds. More than $5 billion worth of bonds and loans designed to fund green initiatives are now issued every day. The two biggest U.S. banks pledged $4 trillion in climate-oriented financing over the next decade.”

Green Energy Plays For Income Investors

With the mighty tailwinds of capital being deployed by Wall Street, global institutional investors, retail investors, the Biden proposals, and those around the world by governments in a race to see who can save the planet from itself fast enough, the obvious question for income investors is who the biggest publicly listed winners are going to be, and are there green energy plays that pay juicy yields.

That is a quandary, since the ESG movement is still relatively young in terms of its scaling up, and almost all assets dedicated to ESG energy projects are purely organic growth investments in nature. Finding yield with good risk/reward profiles is a challenge, yet there are some places for income investors to examine.

One place would be the electric utilities sector of the market. Historically, the power utility stocks underperform during periods of inflation, as capital rotates into more cyclical sectors of the market more leveraged to inflationary forces and upward pricing pressures. But this time around is different. The multi-trillion-dollar transformation to green and renewable energy will in my view have an insulating effect on how utility stocks trade going forward, resulting from upward revisions in rates of growth.

Transition From Fossil Fuels To Renewable Energy

Even with bond yields ticking higher, America and the rest of the developed and emerging market economies are fast moving to transition from fossil fuels to renewable sources of energy. These companies are on the receiving end of current and future massive capital inflows and it can be argued that these stocks are trading near or at new all-time highs due to the rising amplitude of inflation rhetoric.

Consider the fact that for every new and additional EV car, truck, delivery van, 18-wheeler, motorcycle, or scooter that hits the streets, the need for electricity to charge and recharge it will skyrocket for many years to come. And this is just the transportation subsector. Smart homes, smart cities, and over three billion devices being connected by the Internet of Things (IoT) will also cause demand for electricity to surge.

Therefore, it stands to reason those utilities that dominate the electric grids will benefit immensely in both revenue and profit growth while generating attractive and growing dividend payments. Renewable energy means recurring revenue without the cost and fluctuating prices of fossil fuel inputs. Once solar, wind, hydro, thermal, and biomass infrastructure is built and operating, it becomes a cash flow machine.

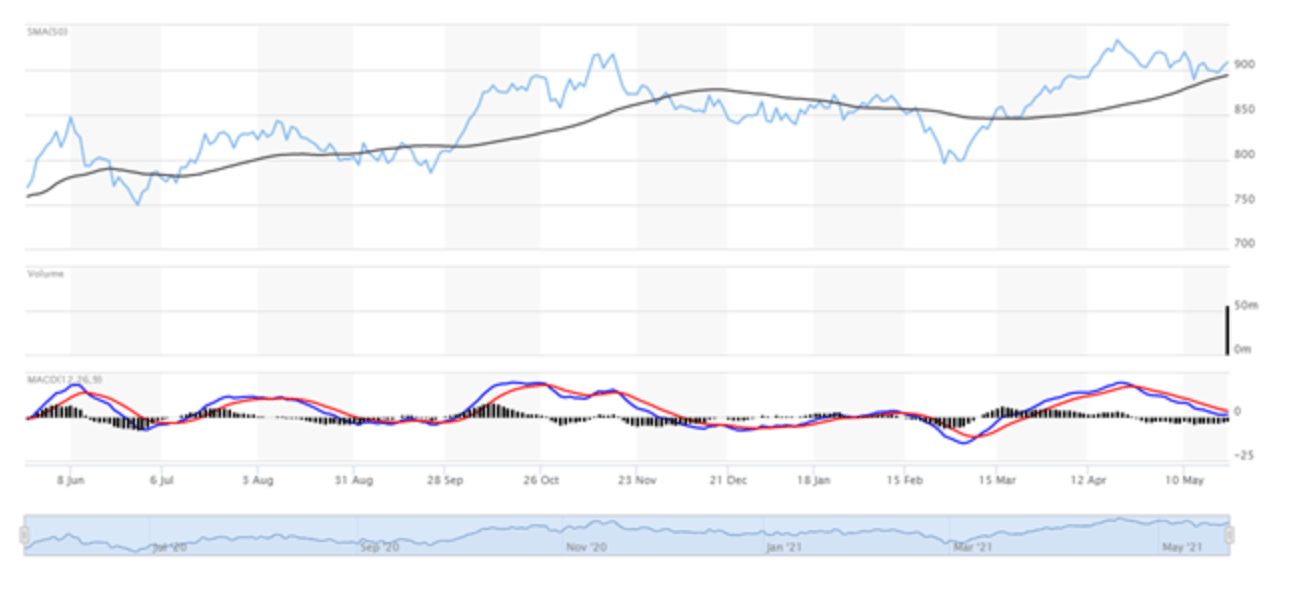

A one-year chart of the Dow Jones Utility Average Index (below) shows a sector that has recently pulled back off its recent highs, along with many sectors of the market, where an attractive entry point has presented itself. The top two utilities ETFs are the Utilities Select Sector SPDR Fund (XLU) that sports a current yield of 3% and the Vanguard Utilities ETF (VPU) that pays a current dividend yield of 3.07%.

Utilities that were once stodgy coal, oil, and natural gas-burning companies with low single digit growth rates are now tomorrow’s power companies. Though many are still regulated, they will be generating wider profit margins as renewable assets become paid for and represent a bigger percentage of revenue.

Natural gas will still play a major role in power generation that coincides with the push for renewables. Natty gas is clean, cheap, and incredibly abundant within the U.S., making the long-term transition to renewables – alongside the high utilization rate of natural gas – a harmonious path to meet long-term goals without major disruptions like what occurred in Texas this past winter. That ugly situation showed exactly what can and will go wrong if energy policy is not undertaken with a balanced approach.

To that end, here are a handful of non-MLP gas pipeline stocks that pay 1099 dividends with yields of 5%-7%: Kinder Morgan Inc. (KMI), ONEOK Inc. (OKE), and Williams Companies (IWMB). There are also pipeline ETFs utilizing some leverage that pay 8% to 9% in 1099 dividends. They are Alerian MLP ETF (AMLP), Virtus InfraCap MLP ETF (AMZA), and Global X MLP ETF (MLPA).

Navellier & Associates does not own Kinder Morgan Inc. (KMI), ONEOK Inc. (OKE), and Williams Companies (IWMB) in managed accounts.