For weekend reading, Ivan Martchev, investment strategist at Navellier & Associates, offers the following commentary:

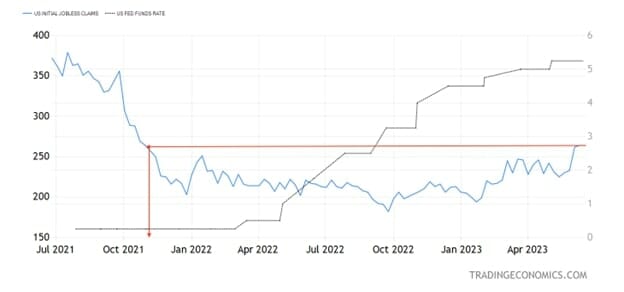

Last week, jobless claims came in at 264,000, the exact same number they were at the week before. One week further back they were at 262,000. On their own, those numbers are not so high, but they are the highest since October 2021, and in the preceding 18 months all such weekly reports have been lower.

Recession territory is when jobless claims accelerate past 300,000 and start to regularly reach the 350-400K range, which is a ways off, but suffice it to say that the job market has weakened somewhat.

All that mumbo jumbo about two more rate hikes is just tough talk. I think Powell has sufficient cover to deliver another skip in July, and if the job market keeps doing what it is doing right now, the Fed will ultimately deliver a full stop.

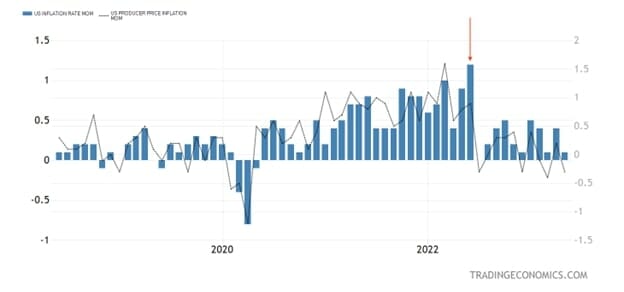

The cover for Powell’s continued pause is likely to be the July CPI report, where the horrific June 2022 1.2% month-on-month rise will roll off the chart (red arrow below) and July 2022 will be the base of comparison for the year-over-year numbers, when the month-on-month rise came in at zero.

If the month-on-month reading for July 2023 is low, we are likely to have good year-over-year and month-on-month readings next month. I don’t want to jinx the data, but July’s year-over-year CPI could be near 3%. All this does not mean the stock market will rally if we keep getting deteriorating PMI indexes and overall negative economic surprises, but it strongly suggests that Powell is done hiking rates.

As for the stock market, this is the last week of the second quarter, and I remember very well that in the last week of the first quarter, we had a very sharp rebound. Last week, we chopped around for a week after fresh 52-week highs in the S&P 500 and the Nasdaq 100, and I would not put it past the institutional investor community to run prices up again this week, at a minimum finishing the week on a high note.

There Never Was A Coup Attempt in Russia

I read the Drudge Report, as I generally find it informative, but last Saturday and Sunday, I found the “spin” from the mainstream media hilarious when it came to Russia. Here are some examples.

I think Vladimir Putin was in full control the whole time and may have engineered his own fake coup. Shots were fired but not too many, and nobody got hurt. Russian helicopter gunships blew up a few targets in “mercenary” territory to show that they were serious, and soon the farce ended.

What seems infinitely more believable – to somebody with working knowledge of Russian, as I had to take it in high school when I grew up in Eastern Europe, on the wrong side of the Iron Curtain – is the following tweet from one of my compatriots, Velina Tchakarova, employed as geopolitical strategist by the European Commission and other EU government organizations:

“This is not a coup by Prigozhin. This is an inner war between the St Petersburg gang of Putin and the Moscow gang of Gerasimov and Shoigu. This is the beginning of Putin‘s election campaign to become reelected on March 17, 2024. His lapdog Prigozhin is masquerading a coup to put the blame on Gerasimov and Shoigu for losing the war against Ukraine. Prigozhin can always be scapegoated if he fails like this has happened in the past.”

I find her view infinitely more believable. Fake coups are not new, as they have served a purpose in domestic politics for centuries. Recently, one blatant fake coup was that against Turkish President Erdogan in 2016, which allowed him to execute a massive purge in Turkish society and consolidate his grip on power (see “Did Erdogan Stage the Coup?” American Enterprise Institute, April 14, 2017).

By the way, Erdogan just got reelected.