The US corporate credit cycle is nearing its end, and the cycle in parts of Europe isn’t far behind. This can create treacherous conditions for unprepared investors. The first line of defense, in our view, is knowing what to expect.

Check out our H2 hedge fund letters here.

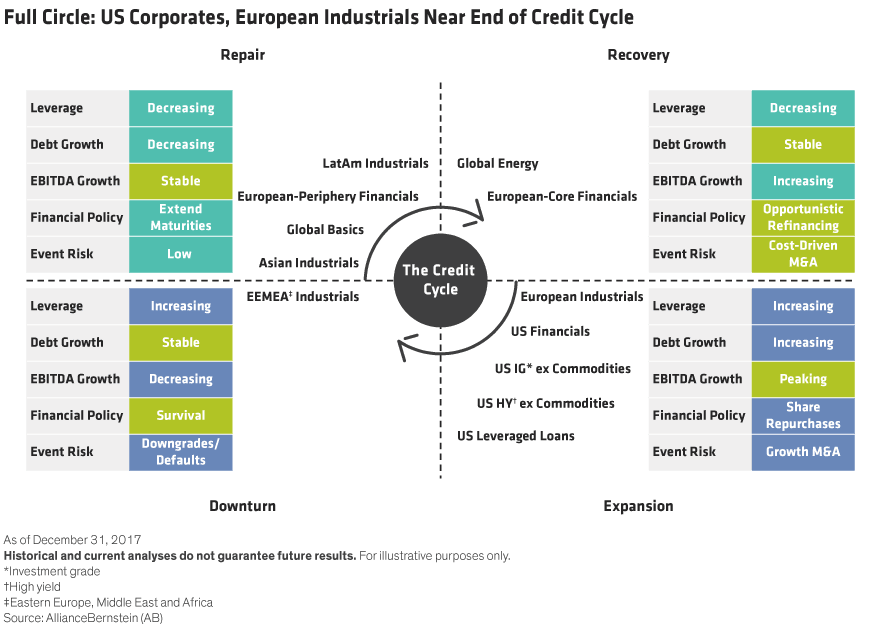

Credit cycles have distinct stages. During the expansionary period, easy access to credit helps boost earnings and prompts companies to take on debt. As debt levels rise, so does credit risk. Asset values start to decline. That raises default risk and causes lenders to get stingier. A rise in interest rates then leads to contraction and balance-sheet repair and, eventually, a recovery phase (Display).

The current US credit cycle began with the recovery that followed the global financial crisis and has nearly come full circle. The Federal Reserve is actively trying to tighten financial conditions and will likely raise interest rates several more times this year to counter inflation. And many US assets, including leveraged bank loans and many high-yield and investment-grade corporate bonds, are again nearing the contraction stage of the cycle.

The European Central Bank is a few steps behind the Fed. But it, too, is slowly winding down its easy monetary policy as the economy gains traction, and is expected to begin hiking rates in early 2019. That situation could eventually affect European industrial issuers, who today are adding leverage.

No one knows exactly when a credit cycle will end. In the US, new rules allowing companies to repatriate overseas profits at a lower tax rate could even extend the current cycle. But it’s clear that we’re closer to the end than the beginning.

The Importance of Staying Alert

Extended periods of low interest rates and long credit cycles can lead to complacency. Investors often get comfortable just as the credit and economic cycles are nearing a peak. But the end can come sooner than we expect.

For example, the US economy is about to get a jolt of fiscal stimulus (in the form of sweeping tax cuts) at a time when unemployment is low and wages are starting to rise. That should push up inflation and put more pressure on the Fed to tighten policy.

The stimulus will also require the government to borrow more to cover the estimated $1.4 trillion tax reform will add to the deficit. And with the Fed no longer in the business of buying Treasuries to hold down long-term rates, it will fall to global investors to buy all those bonds—and investors are going to demand higher yields. It’s not much of a stretch to see how this could eventually slow economic growth.

Navigating the Sharp Turns

That’s why understanding where we are in the cycle—and what’s likely to happen in each stage—is essential for making sound investment decisions.

Because the contraction stage that marks the end of the cycle usually coincides with higher interest rates, it often leads to lower asset prices and less investment income for corporate borrowers. That decreases cash flow and raises the risk that some borrowers may default.

This doesn’t mean that every cycle ends the same way. For example, defaults soared when the global financial crisis erupted in 2008. This time, we expect the increase to be smaller because companies haven’t increased leverage as aggressively. Leveraged buyouts, for instance, have been fewer and further between than in previous cycles.

And it doesn’t mean all sectors and regions are at the same stage of the cycle. Investors often speak of a single credit cycle, but there are always multiple cycles under way in different sectors and different parts of the world.

As the display illustrates, sectors such as European financials and Asian and Latin American industrials are either in the repair or recovery phase, a period when credit quality and return potential usually improve. Investors who narrow their focus to one or two sectors or regions can easily overlook this and miss attractive opportunities.

Even so, contraction in key regions and sectors can hurt return potential—even if defaults don’t skyrocket. This possibility is especially true today because years of loose global central bank policies have stretched asset valuations. US and European high-yield credit spreads—the extra yield these bonds offer over comparable government debt—are hovering near multiyear lows.

Understanding your bond portfolio’s exposure to both the interest-rate and credit cycles should always be a top priority. Too often, investors overlook the credit cycle and focus too intently on rates. In our view, now’s the time to double-check how exposed you are to a turn in the credit cycle.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Article by Douglas J. Peebles, Alliance Bernstein