Stanphyl Capital’s commentary for the month ended December 31, 2021, discussing their short position in Tesla Inc (NASDAQ:TSLA).

Q3 2021 hedge fund letters, conferences and more

Tesla's Absurd Diluted Market Cap

We remain short the biggest bubble in modern stock market history, Tesla Inc. (TSLA), which has a completely absurd diluted market cap of almost $1.2 trillion despite a steadily sliding share of the world’s EV market and a share of the overall auto market that’s only around 1.1% (yes, one POINT one percent). At some point when momentum-riding Tesla bulls (or, for that matter, bears) least expect it, TSLA will recouple with “reality,” and that’s why I continue to maintain a short position. So here’s “reality”…

- Tesla has no “moat” of any kind; i.e., nothing meaningfully proprietary in terms of electric car technology, while existing automakers—unlike Tesla—have a decades-long “experience moat” of knowing how to mass-produce, distribute and service high-quality cars consistently and profitably.

- Excluding sunsetting emission credit sales Tesla is barely profitable.

- Growth in sequential unit demand for Tesla’s cars is at a crawl relative to expectations.

- Elon Musk is a pathological liar who under the terms of his SEC settlement cannot deny having committed securities fraud.

Many Tesla bulls sincerely believe that ten years from now the company will be twice the size of Volkswagen or Toyota, thereby selling around 21 million cars a year (up from the current one million). To illustrate how utterly clueless this is, going from a million cars a year today to 21 million in ten years means Tesla would have to add a brand new 500,000 car/year factory with sold out production EVERY single quarter for ten years!

To do this even in twenty years would require adding a new factory with sold out production every six months, at which point Tesla would then be approximately twice the size of Toyota (current market cap: $257 billion) or Volkswagen (current market cap: $130 billion), making a Tesla twenty times its current size worth perhaps $500 billion in twenty years. If you discount that $500 billion back by 15% a year (which is likely a much smaller return than any Tesla bull expects) for twenty years, you get a net present value for Tesla stock of approximately $30 a share, down over 97% from 2021’s closing price. That’s why when idiot Tesla bulls look at the company’s current large trailing percentage growth from its recent tiny base and extrapolate that into the future they’re being, well… idiot Tesla bulls!

Q3 Deliveries

In October Tesla reported Q3 deliveries of 241,000 cars, a 40,000-unit gain over Q2 that’s a rounding error for an auto company trading at even one-tenth of Tesla’s valuation. (For Q4 the gain is expected to be another 45-50,000.) If in any quarter GM or VW or Toyota sold 2.04 million vehicles instead of 2 million or 1.96 million, no one would pay the slightest bit of attention to the difference. Seeing as Tesla is now being valued at over fourteen GMs, it’s time (as noted above) to start looking at its relatively tiny numerical sequential sales growth, rather than Wall Street’s sell-side hype of “percentage off a small base.” In other words, if you want to be valued at a giant multiple of “the big boys,” you should be treated as a big boy.

Perhaps the biggest reason Tesla has recently been able to post marginally increasing sequential quarterly deliveries is because competitors’ production (and thus inventories) are at the lowest level in decades due to the massive chip shortage, thereby eliminating a number of “Tesla alternatives.” Meanwhile, Tesla is enjoying record production because Musk (a notorious “corner-cutter”) is apparently willing to substitute untested, non-auto-grade chips for the more durable chips he can’t get; please see my Twitter post about this.

A favorite hype story from Tesla bulls has been “the China market” and its “record” number of 73,659 Q3 deliveries there. Let’s put this in perspective: this was only around 4000 more cars than in Q1 and only around 11,000 more than in Q2—again, these are “growth” rounding errors. (Thanks to drastically slashed production from chip-starved competitors, look for around 30,000 more in Q4.) And that “record” Q3 China quarter gave it just 1.5% of the overall passenger vehicle market and just 11% of the BEV market, and it had so much excess capacity that it exported tens of thousands of cars to Europe. Remember when Musk claimed that Tesla’s Chinese domestic demand alone would need multiple factories to satisfy? Ah, the good old days!

Meanwhile, Tesla remains a lousy business. In its Q3 earnings report the company claimed it made around $1.3 billion in free cash flow (defined as operating cash flow less capex). However, this number appears to be entirely due to working capital adjustments and not from the business itself. Let me explain:

Tesla claimed operating cash flow of around $3.2 billion for the quarter, but this came with the benefit of accounts payable increasing by $702 million, receivables declining by $167 million and accrued liabilities up by $665 million while (detrimentally) prepaid expenses increased by $144 million. Adjusting for that massive net working capital benefit, operating cash flow was only a bit over $1.8 billion and with capex at $1.8 billion it means Tesla’s Q3 free cash flow was essentially zero, and if you deduct stock comp (a non-cash item paid through share dilution) it was around negative $500 million.

Also in its Q3 report Tesla claimed it made around $1.45 billion in net income after excluding $279 million of pure-profit emission credit sales (excluded because they’ll almost entirely disappear some time next year when other automakers will have enough EVs of their own), and after adding back a $50 million Bitcoin write-down. However, that earnings number also includes what I estimate to be Tesla’s usual $300 million or so in unsustainably low warranty provisioning, and after adjusting for that and assuming no other fraudulent accounting, Tesla only earned around $1.06/share, which annualizes to $4.24. An auto industry PE multiple of 10x would thus make TSLA worth around $42/share (admittedly, more than the “$0” I once expected), while a “growth multiple” of 20x would value it at $84, which is a 92% discount to December’s closing price of around $1057. And before you tell me that a 100% premium to the industry’s PE ratio isn’t enough, keep in mind that—as noted earlier—Tesla’s sequential unit growth is an auto industry rounding error. In fact, one could argue that Tesla’s multiple should carry a discount, considering the massive legal and financial liabilities continually generated by its pathologically lying CEO.

Full Self Driving

Meanwhile Tesla continues to sell (and book cash flow, if not accounting revenue from) its fraudulent & dangerous so-called “Full Self Driving.” In a sane regulatory environment Tesla having done this for five years now…

…would be considered “consumer fraud,” and indeed the regulatory tide may finally be turning, as in August two U.S. Senators demanded an FTC investigation and in October the NHTSA appointed a harsh critic of this deadly product to advise on its regulation. (For all known Tesla deaths see here.) Are major write-downs and refunds on the way, killing the company’s slight “claimed profitability”? Stay tuned!

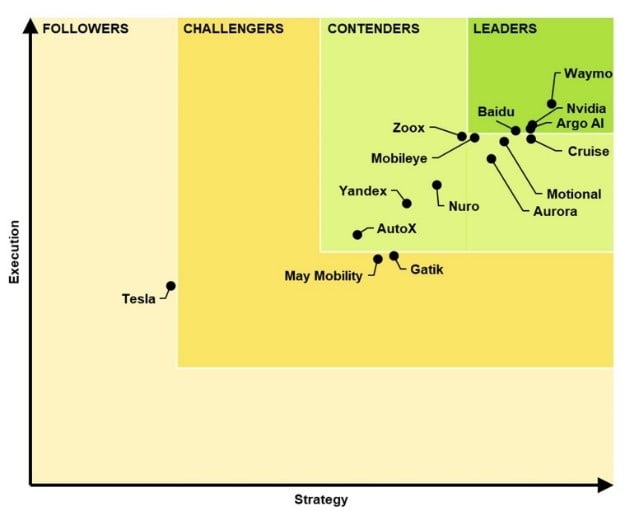

Meanwhile, Guidehouse Insights continues to rate Tesla dead last among autonomous competitors:

Another favorite Tesla hype story has been built around so-called “proprietary battery technology.” In fact though, Tesla has nothing proprietary there—it doesn’t make them, it buys them from Panasonic, CATL and LG, and it’s the biggest liar in the industry regarding the real-world range of its cars. And if new-format 4680 cells enter the market some time in 2022 (as is now expected), even if Tesla makes some of its own, other manufacturers will gladly sell them to anyone.

Tesla Build Quality Remains Awful

Meanwhile, Tesla build quality remains awful (it ranks second-to-last in the latest Consumer Reports reliability survey and in the bottom 10% of the latest J.D. Power survey) and its worst-rated Model Y faces current (or imminent) competition from the much better built electric Audi Q4 e-tron, BMW iX3, Mercedes EQB, Volvo XC40 Recharge, Volkswagen ID.4, Ford Mustang Mach E, Nissan Ariya, Hyundai Ioniq 5 and Kia EV6. And Tesla’s Model 3 now has terrific direct “sedan competition” from Volvo’s beautiful Polestar 2, the great new BMW i4 and the premium version of Volkswagen’s ID.3 (in Europe), plus multiple local competitors in China.

And in the high-end electric car segment worldwide the Audi e-tron (substantially improved for 2022!) and Porsche Taycan outsell the Models S & X (and the newly updated Tesla models with their dated exteriors and idiotic shifters & steering wheels won’t change this), while the spectacular new Mercedes EQS, Audi e-Tron GT and Lucid Air make the Tesla Model S look like a fast Yugo, while the extremely well reviewed new BMW iX does the same to the Model X.

And oh, the joke of a “pickup truck” Tesla previewed in 2019 (and still hasn’t shown in production-ready form) won’t be much of “growth engine” either, as it will enter a dogfight of a market; in fact, Ford’s terrific 2022 all-electric F-150 Lightning now has nearly 200,000 retail reservations (plus many more fleet reservations), Rivian’s pick-up has gotten fantastic early reviews, and in January GM will introduce its electric Silverado.

Regarding safety, as noted earlier in this letter, Tesla continues to deceptively sell its hugely dangerous so-called “Autopilot” system, which Consumer Reports has completely eviscerated; God only knows how many more people this monstrosity unleashed on public roads will kill despite the NTSB condemning it. Elsewhere in safety, in 2020 the Chinese government forced the recall of tens of thousands of Teslas for a dangerous suspension defect the company spent years trying to cover up, and now Tesla has been hit by a class-action lawsuit in the U.S. for the same defect. Tesla also knowingly sold cars that it knew were a fire hazard and did the same with solar systems, and after initially refusing to do so voluntarily, it was forced to recall a dangerously defective touchscreen. In other words, when it comes to the safety of customers and innocent bystanders, Tesla is truly one of the most vile companies on Earth. Meanwhile the massive number of lawsuits of all types against the company continues to escalate.

So Here Is Tesla's Competition In Cars (Note: These Links Are Regularly Updated)...

- Porsche Taycan

- Porsche Taycan Cross Turismo

- Porsche Macan Electric SUV Officially Coming in 2023

- Volkswagen ID.3 Headlines VW's Electrified Future

- Volkswagen ID.4 Electric SUV

- Volkswagen ID.Buzz electric van teased ahead of 2022 launch

- Volkswagen ID 6 to arrive with 435-mile range in 2023

- Volkswagen Aero B: new electric Passat equivalent spied

- VW’s Cupra brand counts on performance for Born EV

- Cupra, VW brand to get entry-level battery-powered cars

- Audi e-tron

- Audi e-tron Sportback

- Audi E-tron GT

- Audi Q4 e-tron

- Audi Q6 e-tron confirmed for 2022 launch

- Audi previews long-range A6 e-tron EV

- Audi TT set to morph into all-electric crossover

- Hyundai Ioniq 5

- Hyundai Ioniq 6 spotted ahead of 2022 launch

- Hyundai Kona Electric

- Genesis reveals their first EV on the E-GMP platform, the electric GV60 crossover

- Genesis Electrified GV70 Revealed With 483 Horsepower And AWD

- Kia Niro Electric: 239-mile range & $39,000 before subsidies

- Kia EV6: Charging towards the future

- Kia EV4 on course to grow electric SUV range

- Jaguar’s All-Electric i-Pace

- Jaguar to become all-electric brand; Land Rover to Get 6 electric models

- Daimler will invest more than $47B in EVs and be all-electric ready by 2030

- Mercedes EQS: the first electric vehicle in the luxury class

- Mercedes EQS SUV takes shape

- Mercedes-Benz unveils EQE electric sedan with impressive 400-mile range

- Mercedes EQE SUV to rival BMW iX and Tesla Model X

- Mercedes EQC electric SUV available now in Europe & China

- Mercedes-Benz Launches the EQV, its First Fully-Electric Passenger Van

- Mercedes-Benz EQB Makes Its European Debut, US Sales Confirmed

- Mercedes-Benz unveils EQA electric SUV with 265 miles of range and ~$46,000 price

- Ford Mustang Mach-E Available Now

- Ford F-150 Lightning electric pick-up available 2022

- Ford set to launch ‘mini Mustang Mach-E’ electric SUV in 2023

- Ford to offer EV versions of Explorer, Aviator, ‘rugged SUVs'

- Volvo Polestar 2

- Polestar 3 SUV Production Design Revealed. The US-built electric SUV will debut in 2022.

- Volvo XC40 Recharge

- Volvo C40 electric sedan to challenge Tesla Model 3, VW ID3

- Polestar 3 will be an electric SUV that shares its all-new platform with next Volvo XC90

- Chevy updates, expands Bolt EV family as price drops

- Cadillac All-Electric Lyriq Available Spring 2022

- GMC ALL-ELECTRIC SUPERTRUCK HUMMER EV

- GM to build electric Silverado in Detroit with estimated range of more than 400 miles

- GMC to launch electric Hummer SUV in 2023

- GM will offer 30 all-electric models globally by 2025

- GM Launches BrightDrop to Electrify the Delivery of Goods and Services

- Nissan vows to hop back on EV podium with Ariya

- Nissan LEAF e+ with 226-mile range is available now

- Nissan Unveils $18 Billion Electric-Vehicle Strategy

- BMW leads off EV offensive with iX3

- BMW expands EV offerings with iX tech flagship and i4 sedan

- BMW i7 Confirmed for 2022 Launch

- 2022 BMW iX1 electric SUV spied

- Rivian R1T Is the Most Remarkable Pickup We’ve Ever Driven

- Renault upgrades Zoe electric car as competition intensifies

- Renault Dacia Spring Electric SUV

- Renault to boost low-volume Alpine brand with 3 EVs

- Renault's electric Megane will debut new digital cockpit

- Stellantis promises 'heart-of-the-market SUV' from new, 8-vehicle EV platform

- Alfa Romeo is latest Stellantis brand to get all-electric future

- Peugeot e-208

- PEUGEOT E-2008: THE ELECTRIC AND VERSATILE SUV

- Peugeot 308 will get full-electric version

- Subaru shows off its first electric vehicle, the Solterra SUV

- Citroen compact EV challenges VW ID3 on price

- Maserati to launch electric sports car

- Mini Cooper SE Electric

- Toyota’s Electric bZ4X Goes On Sale in Spring 2022

- Toyota will have lineup of 30 full EVs by 2030; Lexus will be all-electric brand

- Opel sees electric Corsa as key EV entry

- 2021 Vauxhall Mokka revealed as EV with sharp looks, massive changes

- Skoda Enyaq iV electric SUV offers range of power, battery sizes

- Electric Skoda Enyaq coupe to muscle-in on Tesla Model 3

- Skoda plans small EV, cheaper variants to take on French, Korean rivals

- Nio to launch in five more European countries after Norway

- BYD will launch electric SUV in Europe

- The Lucid Air Achieves an Estimated EPA Range of 517 Miles on a Single Charge

- Bentley converting to electric-only brand

- All-electric Rolls-Royce Spectre to launch in 2023 – firm to be EV-only by 2030

- Aston Martin will build electric vehicles in UK from 2025

- Meet the Canoo, a Subscription-Only EV Pod Coming in 2021

- Two new electric cars from Mahindra in India; Global Tesla rival e-car soon

- Former Saab factory gets new life building solar-powered Sono Sion electric cars

- Foxconn aims for 10% of electric car platform market by 2025

And In China...

- How VW Group plans to dominate China's EV market

- VW Goes Head-to-Head With Tesla in China With New ID.4 Crozz Electric SUV

- Volkswagen’s ID.3 EV to be produced by JVs with SAIC, FAW in 2021

- 2022 VW ID.6 Revealed With Room For Seven And Two Electric Motors

- China-built Audi e-tron rolls off production line in Changchun

- Audi Q2L e-tron debuts at Auto Shanghai

- Audi will build Q4 e-tron in China

- Audi Q5 e-tron Confirmed For China

- Audi in cooperation company for local electric car production with FAW

- FAW Hongqi starts selling electric SUV with 400km range for $32,000

- FAW (Hongqi) to roll out 15 electric models by 2025

- BYD goes after market left open by Tesla with four cheaper models for budget-conscious buyers

- BYD said to launch premium NEV brand ‘Dolphin’ in 2022

- Top of Form

- Bottom of Form

- Daimler & BYD launch DENZA electric vehicle for the Chinese market

- Geely announces premium EV brand Zeekr

- Geely, Mercedes-Benz launch $780 million JV to make electric smart-branded cars

- Mercedes styled Denza X 7-seat electric SUV to hit market

- Mercedes ‘makes mark’ with China-built EQC

- BMW, Great Wall to build new China plant for electric cars

- BAIC Goes Electric, & Establishes Itself as a Force in China’s New Energy Vehicle Future

- BAIC BJEV, Magna ready to pour RMB2 bln in all-electric PV manufacturing JV

- Toyota partners with BYD to build affordable $30,000 electric car

- Ford MUSTANG MACH-E ROLLS OFF ASSEMBLY LINE IN CHINA FOR LOCAL CUSTOMERS

- Lexus to launch EV in China taking on VW and Tesla

- GAC Aion about to start volume production of 1,000-km range AION LX

- GAC Toyota to ramp up annual capacity by 400,000 NEVs

- GAC kicks off delivery of HYCAN 007 all-electric SUV

- Nio – Ready For Tomorrow

- Nio steps up plans for mass-market brand to compete with VW, Toyota

- Xpeng Motors sells multiple EV models

- SAIC-GM to build Ultium EV platform in Wuhan

- Chevrolet Menlo Electric Vehicle Launched in China

- Buick Introduces New VELITE 6 EV with Extended Range

- Buick Velite 7 EV And Velite 6 PHEV Launch In China

- Dongfeng launches the all-electric Voyah

- PSA to accelerate rollout of electrified vehicles in China

- SAIC, Alibaba-backed EV brand IM begins presale of first model L7

- Hyundai Motor Transforming Chongqing Factory into Electric Vehicle Plant

- Polestar said to plan China showroom expansion to compete with Tesla

- Jaguar Land Rover's Chinese arm invests £800m in EV production

- Renault reveals series urban e-SUV K-ZE for China

- Renault & Brilliance detail electric van lineup for China

- Renault forms China electric vehicle venture with JMCG

- Honda to start sales of new EV-branded vehicles in China in 2022

- Geely launches new electric car brand 'Geometry' – will launch 10 EVs by 2025

- Geely, Foxconn form partnership to build cars for other automakers

- Fiat Chrysler, Foxconn Team Up for Electric Vehicles

- Baidu to create an intelligent EV company with automaker Geely

- Leapmotor starts presale of C11 electric SUV on Jan. 1 2021

- Changan forms subsidiary Avatar Technology to develop smart EVs with Huawei, CATL

- WM Motors/Weltmeister

- Chery

- Seres

- Enovate

- China's cute Ora R1 electric hatch offers a huge range for less than US$9,000

- Singulato

- JAC Motors releases new product planning, including many NEVs

- Seat to make purely electric cars with JAC VW in China

- Iconiq Motors

- Hozon

- Aiways

- Skyworth Auto

- Youxia

- CHJ Automotive begins to accept orders of Leading Ideal ONE

- Infiniti to launch Chinese-built EV in 2022

- Human Horizons

- Chinese smartphone giant Xiaomi to launch electric car business with $10 billion investment

- Lifan Technology to roll out three EV models with swappable batteries in 2021

Here’s Tesla’s Competition In Autonomous Driving...

- Waymo ranked top & Tesla last in Guidehouse leaderboard on automated driving systems

- Tesla has a self-driving strategy other companies abandoned years ago

- Fiat Chrysler, Waymo expand self-driving partnership for passenger, delivery vehicles

- Waymo and Lyft partner to scale self-driving robotaxi service in Phoenix

- Volvo, Waymo partner to build self-driving vehicles

- Jaguar and Waymo announce an electric, fully autonomous car

- Renault, Nissan partner with Waymo for self-driving vehicles

- Geely’s Zeekr, Waymo partner on autonomous ride-hailing vehicle for the U.S. market

- Cruise and GM Team Up with Microsoft to Commercialize Self-Driving Vehicles

- Cadillac Super Cruise™ Sets the Standard for Hands-Free Highway Driving

- Honda Joins with Cruise and General Motors to Build New Autonomous Vehicle

- Honda launching Level 3 autonomous cars

- Volkswagen moves ahead with Autonomous Driving R&D for Mobility as a Service

- Volkswagen teams up with Microsoft to accelerate the development of automated driving

- VW taps Baidu's Apollo platform to develop self-driving cars in China

- Ford “Blue Cruise”

- ARGO AI AND FORD TO LAUNCH SELF-DRIVING VEHICLES ON LYFT NETWORK

- Hyundai and Kia Invest in Aurora

- Toyota, Denso form robotaxi partnership with Aurora

- Aptiv and Hyundai Motor Group complete formation of autonomous driving joint venture

- Amazon’s Zoox unveils electric robotaxi that can travel up to 75 mph

- Nvidia and Mercedes Team Up to Make Next-Gen Vehicles

- Daimler's heavy trucks start self-driving some of the way

- SoftBank, Toyota's self-driving car venture adds Mazda, Suzuki, Subaru Corp, Isuzu Daihatsu

- Continental & NVIDIA Partner to Enable Production of Artificial Intelligence Self-Driving Cars

- Mobileye and Geely to Offer Most Robust Driver Assistance Features

- Mobileye Starts Testing Self-Driving Vehicles in Germany

- Mobileye and NIO Partner to Bring Level 4 Autonomous Vehicles to Consumers

- Lucid Chooses Mobileye as Partner for Autonomous Vehicle Technology

- Alibaba-backed AutoX unveils first driverless RoboTaxi production line in China

- Nissan gives Japan version of Infiniti Q50 hands-free highway driving

- Hyundai to start autonomous ride-sharing service in Calif.

- Pony.ai Receives Approval for Paid Autonomous Robotaxi Services in Beijing

- Baidu kicks off its robotaxi business, after getting the OK to charge fees in Beijing

- Toyota to join Baidu's open-source self-driving platform

- Baidu, WM Motor announce strategic partnership for L3, L4 autonomous driving solutions

- Volvo will provide cars for Didi's self-driving test fleet

- BMW and Tencent to develop self-driving car technology together

- BMW, NavInfo bolster partnership in HD map service for autonomous cars in China

- GM Invests $300 M in Momenta to deliver self-driving technologies in China

- FAW Hongqi readies electric SUV offering Level 4 autonomous driving

- Tencent, Changan Auto Announce Autonomous-Vehicle Joint Venture

- Huawei teams up with BAIC BJEV, Changan, GAC to co-launch self-driving car brands

- GAC Aion, DiDi Autonomous Driving to co-develop driverless NEV model

- BYD partners with Huawei for autonomous driving

- Lyft, Magna in Deal to Develop Hardware, Software for Self-Driving Cars

- Xpeng releases autonomous features for highway driving

- Nuro Becomes First Driverless Car Delivery Service in California

- Deutsche Post to Deploy Test Fleet Of Fully Autonomous Delivery Trucks

- ZF autonomous EV venture names first customer

- Magna’s new MAX4 self-driving platform offers autonomy up to Level 4

- Groupe PSA’s safe and intuitive autonomous car tested by the general public

- Mitsubishi Electric to Exhibit Autonomous-driving Technologies in New xAUTO Test Vehicle

- Apple acquires self-driving startup Drive.ai

- Motional to begin robotaxi testing with Hyundai Ioniq 5 in Los Angeles

- JD.com Delivers on Self-Driving Electric Trucks

- NAVYA Unveils First Fully Autonomous Taxi

- Fujitsu and HERE to partner on advanced mobility services and autonomous driving

- Great Wall’s autonomous driving arm Haomo.ai receives investment from Meituan

- Plus.ai, Iveco to start L4 autonomous heavy-duty truck test in Europe, China

- T3 Mobility, IDRIVERPLUS to pilot Robotaxi operation in Suzhou with autonomous+manual model

Here’s Where Tesla’s Competition Will Get Its Battery Cells...

- Panasonic (making deals with multiple automakers)

- LG

- Samsung

- SK Innovation

- Toshiba

- CATL

- BYD

- Volkswagen to Build Six Electric-Vehicle Battery Factories in Europe

- How GM's Ultium Battery Will Help It Commit to an Electric Future

- GM to develop lithium-metal batteries with SolidEnergy Systems

- Ford, SK Innovation announce EV battery joint venture

- BMW & Ford Invest in Solid Power to Secure All Solid-State Batteries for Future Electric Vehicles

- Stellantis, LG Energy Solution to form battery JV for N. American market

- Stellantis and Factorial Energy to Jointly Develop Solid-State Batteries for Electric Vehicles

- Toyota to build plant in N.C. capable of making up to 1.2M batteries a year

- Toyota Outlines Solid-State Battery Tech, $13.6 Billion Investment

- Nissan Announces Proprietary Solid-State Batteries

- Daimler joins Stellantis as partner in European battery cell venture ACC

- Renault signs EV battery deals with Envision, Verkor for French plants

- Nissan to build $1.4bn EV battery plant in UK with Chinese partner

- UK companies AMTE Power and Britishvolt plan $4.9 billion investment in battery plants

- Freyr

- Verkor

- Farasis

- Microvast

- Akasol

- Cenat

- Wanxiang

- Eve Energy

- Svolt

- Romeo Power

- ProLogium

- Hyundai Motor developing solid-state EV batteries

- Daimler

- Morrow

Here’s Tesla’s Competition In Charging Networks...

- Infrastructure Bill: $7.5 billion Towards Nationwide Network of 500,000 EV Chargers

- Electrify America is spending $2 billion building a high-speed U.S. charging network

- 51 U.S. electric companies commit to build nationwide EV fast charging network by end of 2023

- GM to distribute up to 10 chargers to each of its dealerships starting early 2022

- General Motors and EVgo Boost Build Plan for High Power Fast Chargers Across the US

- Circle K Owner Plans Electric-Car Charging Push in U.S., Canada

- 191 U.S. Porsche dealers are installing 350kw chargers

- ChargePoint to equip Daimler dealers with electric car chargers

- GM and Bechtel plan to build thousands of electric car charging stations across the US

- Ford introduces 12,000 station charging network, teams with Amazon on home installation

- Shell Plans To Deploy Around 500,000 Charging Points Globally By 2025

- Petro-Canada Introduces Coast-to-Coast Canadian Charging Network

- Volta is rolling out a free charging network

- Ionity Europe

- E.ON and Virta launch one of the largest intelligent EV charging networks in Europe

- Volkswagen plans 36,000 charging points for electric cars throughout Europe

- Smatric has over 400 charging points in Austria

- Allego has hundreds of chargers in Europe

- PodPoint UK charging stations

- BP Chargemaster/Polar is building stations across the UK

- Instavolt is rolling out a UK charging network

- Fastned building 150kw-350kw chargers in Europe

- Aral To Install Over 100 Ultra-Fast Chargers In Germany

- Deutsche Telekom launches installation of charging network for e-cars

- Total to build 1,000 high-powered charging points at 300 European service-stations

- NIO teams up with China’s State Grid to build battery charging, swapping stations

- Volkswagen-based CAMS launches supercharging stations in China

- Volkswagen, FAW Group, JAC Motors, Star Charge formally announce new EV charging JV

- BMW to Build 360,000 Charging Points in China to Juice Electric Car Sales

- BP, Didi Jump on Electric-Vehicle Charging Bandwagon

- Evie rolls out ultrafast charging network in Australia

- Evie Networks To Install 42 Ultra-Fast Charging Sites In Australia

And Here’s Tesla’s Competition In Storage Batteries...

- Panasonic

- Samsung

- LG

- BYD

- AES + Siemens (Fluence)

- GE

- Bosch

- Hitachi ABB

- Toshiba

- Saft

- Johnson Contols

- EnerSys

- SOLARWATT

- Schneider Electric

- Sonnen

- Kyocera

- Generac

- Kokam

- NantEnergy

- Eaton

- Nissan

- Tesvolt

- Kreisel

- Leclanche

- Lockheed Martin

- EOS Energy Storage

- ESS

- UET

- electrIQ Power

- Belectric

- Stem

- ENGIE

- Redflow

- Renault

- Primus Power

- Simpliphi Power

- redT Energy Storage

- Murata

- Bluestorage

- Adara

- Blue Planet

- Tabuchi Electric

- Aggreko

- Orison

- Moixa

- Powin Energy

- Nidec

- Powervault

- Kore Power

- Shanghai Electric

- Schmid

- 24M

- Ecoult

- Innolith

- LithiumWerks

- Natron Energy

- Energy Vault

- Ambri

- Voltstorage

- Cadenza Innovation

- Morrow

- Gridtential

- Villara

- Elestor

Thanks and Happy New Year,

Mark Spiegel