Dear fellow investors,

Q1 2021 hedge fund letters, conferences and more

Now that investors are reconsidering active stock picking and are especially interested in value stock strategies, let’s analyze where excess stock market returns come from. Excess return, or alpha, comes in four basic ways. Alpha can come from stock selection, selection timing, concentration and long holding periods.

Stock Selection

Even though there are many styles of investing, alpha can come from stock selection within your style. Alpha is a deviation from whatever benchmark you are choosing. Therefore, to generate “abnormal returns” you must deviate from the benchmark. Consistent long-term outperformance must come from well-selected deviance. Owning stocks which deviate can mean you take your lumps from not owning the securities that have already gained favor in the marketplace or, like in the last three years, not owning enough of the popular stocks when they dominate everything else.

Selection Timing

Regardless of your investing style, alpha can be generated by “buying at points of maximum pessimism,” in the words of the great investor John Templeton. This is true regardless of your stock picking style. Templeton said, “If you wait for the light at the end of the tunnel, you’re too late!” You take your lumps by being early in stock selection.

Concentration

Commonly held academic studies have shown that the benefit of diversification reaches 93% at the 20th common stock. The lumps you take in concentration come in the form of volatility. Accepting the lumps in volatility is exactly what most people who search for good stock picking try to avoid. Professional/institutional investors try to find deviant stock pickers and attempt to avoid volatility. The great investor Bill Miller says, “volatility is the price you pay for performance!”

Long Holding Periods

At Smead Capital Management, we believe that the biggest source of alpha available to stock picking deviants is holding your winners to a fault. It is the one source of alpha where the price of the lumps is too high for most of our competitors. Warren Buffett is one the greatest stock pickers of all time, and he says his favorite holding period is “forever.”

An easy way to think of this is to look at what advantages the S&P 500 Index has versus active stock pickers. The index practices incredibly low turnover and saves money on trading costs and capital gains taxes. The Index only sells via takeovers or disastrous stock price performance. Our competitors turn their portfolio over 63% on average and cede that advantage to the S&P 500.

Secondly, the index never squanders their best winners by cutting them off early. Buffett calls compounded returns as the “eighth wonder of the world.” Most stock pickers sell a well-selected security at twice to three times their original price. The problem is that 100% of the stocks which go up five-to-tenfold came from ones that double. The lumps of temporarily giving back a big part of a double or triple in price is a price too high for most professionals regardless of style. In many ways we admire our growth stock owning competitors, because they respect riding winners to a fault more than value pickers do.

A Current Example of a Lump

We have been invested in home builders since 2013, when we bought NVR (NVR) for $940 per share. Since then, we have added Lennar (LEN) and D.R. Horton (DHI) to our portfolio in 2017 and 2020, respectively. They have done very well for us, but most stock market participants are haunted by rising home prices, rising input costs and the leftover nightmares of the 2003-2006 boom in housing, which laid the groundwork for the 2007-2009 financial crisis. The lumps you take to sit through a correction in these stocks isn’t worth it to most stock pickers and makes you a deviant if you do.

What could the reward look like for accepting these lumps? First, the demographics argue that a huge number of new homes are going to be demanded by 90 million millennials. Second, the market share of these companies has grown immensely since 1994. So, they will get an outsized part of the overall industry rewards.

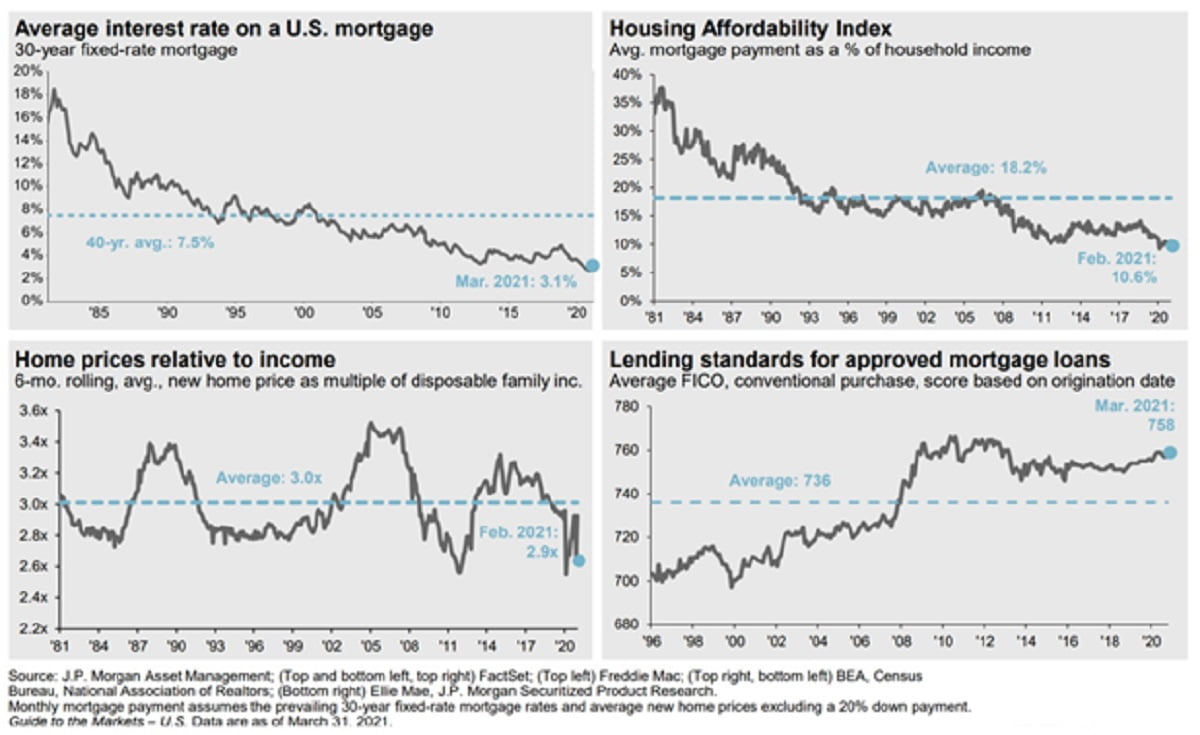

Third, interest rates and affordability are as good as we have seen in the last 60 years, other than during the low point from 2009-2012. We bought into Bank of America (BAC) in early 2012, because they owned one million foreclosed homes that we thought would become far more valuable in the future. They did!

Lastly, the stock market is treating this like a basic economic cycle in a typically cyclical industry. These stocks trade at a huge discount to the stock market and at massive discounts to their intrinsic values. However, this is a secular growth era in a normally cyclical industry.

In conclusion, our deviance is closely tied to the lumps we must ride through and our alpha creation. We plan on sticking close to this list of ways to generate alpha, relative to the indexes and to our peers. By being willing to ride through these lumps in the stock market, we believe we can avoid stock market failure.

Warm regards,

William Smead

The information contained in this missive represents Smead Capital Management’s opinions, and should not be construed as personalized or individualized investment advice and are subject to change. Past performance is no guarantee of future results. Bill Smead, CIO, wrote this article. It should not be assumed that investing in any securities mentioned above will or will not be profitable. Portfolio composition is subject to change at any time and references to specific securities, industries and sectors in this letter are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. In preparing this document, SCM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. A list of all recommendations made by Smead Capital Management within the past twelve-month period is available upon request.

©2021 Smead Capital Management, Inc. All rights reserved.