This firm’s industry-leading distribution network has driven consistent profit growth, higher margins than competitors and a leading market share. Despite the success, international expansion opportunities, and an impressive yield, the stock’s valuation does not reflect the strength of the firm. These strengths, along with a quality executive compensation plan, earn SYSCO Corporation (SYY: $61/share) a spot in December’s Exec Comp Aligned with ROIC Model Portfolio, our Focus List – Long and make it this week’s Long Idea.

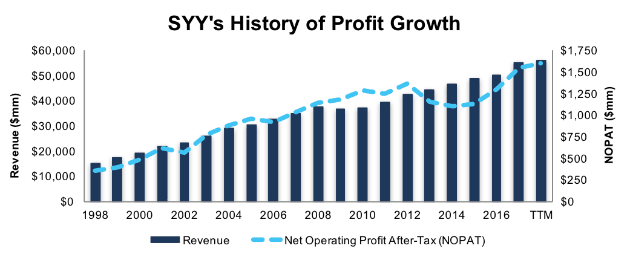

SYY’s History of Consistent Profit Growth

Over the past decade, SYY has grown revenue 5% and after-tax profit (NOPAT) 4% compounded annually, per Figure 1. Such consistency has been achieved via strict cost control, which has led to consistent margins. NOPAT margins, despite slight fluctuations year-to-year, have averaged 3% since 1998 and are currently at 3% for the last twelve months (TTM).

Longer term, SYY has grown NOPAT by 8% compounded annually since 1998.

Figure 1: SYY Profit Growth Since 1998

Sources: New Constructs, LLC and company filings

Not only has SYY managed to grow NOPAT consistently, it has also managed its balance sheet. SYY’s 11% TTM return on invested capital (ROIC) is equal to its 5-year average. Meanwhile, SYY has generated a cumulative $2 billion (6% of market cap) in free cash flow (FCF) since 2013. SYY’s $1.7 billion in FCF over the last twelve months equates to a 4% FCF yield compared to 2% for the average S&P 500 stock and 1% for the Consumer Staples sector.

Executive Compensation Plan Increases Focus on Creating Shareholder Value

SYY’s executive compensation plan properly aligns executives’ interests with those of shareholders. 33% of SYY executives’ long-term performance share units (PSU’s) are tied to three-year average ROIC. ROIC has been a target metric in Sysco’s executive compensation plan since 2012. The amount of PSU’s executives can earn is based on whether they hit the target ROIC set by the compensation committee. Better yet, SYSCO noted that “achieving 15% in return on invested capital” is one of its key goals to meet by the end of fiscal 2018.

Unfortunately, the remaining 67% of PSU’s are allocated based on adjusted earnings per share growth. We would like to see SYY put less emphasis on EPS and more on ROIC since there is a strong correlation between improving ROIC and increasing shareholder value. A recent white paper published by Ernst & Young also validates the importance of ROIC (see here: Getting ROIC Right) and the superiority of our data analytics.

Despite the larger focus on EPS, the inclusion of ROIC means that SYY’s executive compensation plan is better aligned with creating shareholder value than many other plans in the market. The focus on improving ROIC aligns the interests of executives and shareholders and helps to ensure prudent stewardship of capital. SYY has maintained an ROIC above 10% in every year going back to 1998.

In addition, SYY has grown economic earnings from $550 million in 2007 to $996 million TTM, or 6% compounded annually. SYY’s executive compensation plan also made it our featured stock on November’s Exec Comp Aligned with ROIC Model Portfolio, and it continues to hold a place in that portfolio.

SYY’s Business Model is Showcasing Its Competitive Advantage

SYSCO Corporation is a global distributor of food and related products to restaurants, healthcare centers, education and government buildings, and more. It provides products such as fresh and frozen meats, fruits, vegetables, dairy, beverage, and paper products. Competition includes local and regional food distributors, individual grocery stores, or direct suppliers such as farmers. Publicly traded competition includes US Foods Holding Corp (USFD), United Natural Foods (UNFI), SpartanNash Co. (SPTN), and Core-Mark Holding Co. (CORE).

Per Figure 2, ROIC across the industry has been falling since 2013, SYY included. However, SYY’s drop in ROIC has been less pronounced. In fact, SYY’s ROIC advantage has increased in each of the past three years and the TTM period.

Figure 2: SYY’s ROIC Advantage is Increasing

Sources: New Constructs, LLC and company filings.

Strict cost control and intelligent capital allocation (which includes a $3.1 billion acquisition of Brakes Group in 2016) has also allowed SYY to improve its margin advantage over its peers as well. Since 2013, SYY improved its NOPAT margin while the average across the industry fell. Its margin advantage in the TTM period is now more than double 2013 levels, per Figure 3.

Figure 3: SYY’s Margin Advantage Since 2013

Sources: New Constructs, LLC and company filings.

Moving forward, SYY’s higher margins allow the firm greater flexibility in expanding its product offerings and pricing, which are key components to remaining competitive in the foodservice industry.

Bear Case: Ignores Economies of Scale and International Expansion

In the food distribution industry, there is little room for product differentiation, outside of number of products available for distribution. Instead, the key to success is reaching economies of scale by building out a distribution network, which helps lower cost of sales as a percent of revenue. Bears of SYSCO are ignoring the impressive distribution network the firm has built, along with its international expansion that could lead to future profit growth.

At the end of 2016, it was estimated that SYSCO was the largest global distributor of food and related products in the foodservice industry. Based on industry data, SYSCO has an estimated 16% market share in the United States, which doubles the firm ranked second, US Foods (USFD). Not only does SYSCO hold double the market share, its distribution network dwarfs USFD’s, as well as any potential threat from Amazon leveraging its recent acquisition of Whole Foods.

At the end of its most recent fiscal year, SYSCO had 324 distribution facilities across the globe, 162 in the United States and a total of 48.7 million square feet in facilities. In comparison, USFD has 60 distribution facilities across the United States which totaled 18.1 million square feet. As of September 2017, Whole Foods (now owned by Amazon) operated 470 stores totaling 18.7 million square feet.

Whole Foods’ entry into the foodservice business would leave it with nearly 60% less distribution facility space when compared to SYY. Additionally, Whole Foods’ stores are not entirely devoted to foodservice distribution, which further lowers the available space to distribute food and non-food related products in bulk.

Without a significant increase in locations or integrating foodservice equipment into Amazon’s existing warehouses (which would require FDA approval), Amazon/Whole Food’s distribution network is a long way from posing a legitimate threat to Sysco’s business.

Versus current competition, SYY’s distribution center advantage has led to SYSCO’s cost of sales to fall from 82% of revenue in 2012 to 81% of revenue in 2017. By comparison, USFD’s cost of sales are 83% of revenue so far in 2017 and are on an upward trajectory.

Furthermore, SYSCO’s operating expenses sit at 15% of revenue, equal to USFD’s and in line with its average over the last five years. Ultimately, SYY’s distribution network provides it a competitive advantage which allows the company to maintain higher margins, service customers more easily, and win new business.

In addition to a strong domestic distribution network, SYSCO is looking to expand its footprint internationally. In mid-2016, SYSCO completed the acquisition of Brakes Group, which is a leading foodservice provider in the United Kingdom, France, and Sweden. The Brakes acquisition brought with it 65 distribution centers in the U.K, 38 in France, and seven in Sweden, along with a customer base of over 50,000. More recently, SYSCO completed the acquisition of the remaining 50% of a Costa Rican food distributor.

Prior to these acquisitions, international food services operations were 11% of revenue (in Fiscal 2016). In fiscal 2017, international operations were 19% of revenue. Expanding internationally can help diversify SYSCO’s business and limit downside in the event of an economic crisis. At the same time, entering new markets can offer more growth opportunities than the mature American market.

Apart from a leading distribution network and international growth opportunities, the bear case is further weakened by analyzing SYY’s valuation. The stock’s current valuation not only ignores the company’s years of profit growth but also significantly undervalues its business. More details are below.

SYY Has Been & Should be An Excellent Long-Term Holding

As the bull market continues on, SYY represents a strong option for those focused on fundamental risk/reward. While it may not exhibit the high-flying growth rates of more flashy firms, it also has a track record of consistently growing profits, including during the 2008/2009 recession.

After rising 13% year-to-date, while the S&P is up over 18%, SYY still presents a buying opportunity. At its current price of $61/share, SYY has a price-to-economic book value (PEBV) ratio of 1.2. This ratio means the market expects SYY’s NOPAT to grow no more than 20% over the remaining life of the firm. This expectation seems pessimistic considering SYY has grown NOPAT 8% compounded annually since 1998.

If SYY can simply maintain 2017 NOPAT margins of 3% (after two consecutive years of improvement) and grow NOPAT by just 4% compounded annually for the next decade, the stock is worth $75/share today – a 23% upside. Add in the potential 3% yield detailed below, and it’s clear why SYY could be a great portfolio addition.

Over Four Decades of Dividend Growth Along with Repurchases Provide Solid Yield: Over 3%

A long streak of dividend increases is widely considered to be a sign of a company’s strong competitive advantage. SYY has increased its dividend 49 times in the past 47 years and paid dividends continually since founding in 1970. SYY’s current annualized dividend of $1.44/share equates to 5% compound annual growth in dividends since the $0.85 paid in 2008. The current dividend also equals a 2.4% dividend yield.

In addition to dividends, SYY has returned capital to shareholders via share repurchases. After exhausting prior repurchase programs, SYY’s Board of Directors authorized up to $1 billion in repurchase through the end of fiscal 2019. SYY repurchased $1.9 billion both fiscal 2017 and 2016. Through fiscal 1Q18 (ends 9/30/2017), SYY has repurchased $550 million, but does not expect this pace of buying to continue through the remainder of the fiscal year. Even if SYY were to repurchase half this amount, or $275 million, a repurchase of that size would equate to 0.9% of the current market cap. When combined with the 2.4% dividend yield, the total yield to shareholders would be 3.3%.

Continued Earnings Beats and Activist Activity Could Boost Shares

Over the past year, SYSCO has beat earnings expectations twice, met them twice, and beat revenue expectations three times. Over this time, the stock has risen just 12%, compared to an 18% increase in the S&P. The trend of earnings beats causing little movement in the stock may be changing though, as SYSCO jumped 10% in the month after its recent top and bottom line beat, while the market increased just 2%.

Continued earnings beats could push SYSCO shares higher as investors realize that SYSCO’s economies of scale and market leading position provide a solid moat from old and new competition.

In addition to future earnings growth, activist investors Nelson Peltz could help send shares higher. Peltz gained a board seat at SYY in 2015, when he took a 7% stake in the company. Since starting the position, SYY is up 56% compared to a 35% increase in the S&P. More recently, in September 2017, Peltz added to his SYY position. With a track record of creating shareholder value, directly at SYY, and across many of his activist positions, investors could view his recent buying as a prelude to more positive changes for the company and more stock price appreciation.

In any case, this stock offers low valuation risk, a decent yield, and significant upside potential.

Insider Trading and Short Interest Trends

Insider activity has been minimal over the past twelve months with 1.8 million shares purchased and 2.7 million shares sold for a net effect of 881 thousand shares sold. These sales represent less than 1% of shares outstanding.

Short interest trends are more insightful. There are currently 15 million shares sold short, which equates to 3% of shares outstanding and seven days to cover. Short interest has fallen slightly from 15.3 million shares at the end of 2016. More recently, short interest has fallen 14% since mid-October. After impressive quarterly earnings in November, it would appear that we’re not the only ones recognizing the value in SYY.

Auditable Impact of Footnotes & Forensic Accounting Adjustments

Our Robo-Analyst technology enables us to perform forensic accounting with scale and provide the research needed to fulfill fiduciary duties. In order to derive the true recurring cash flows, an accurate invested capital, and an accurate shareholder value, we made the following adjustments to SYSCO Corporation’s 2017 10-K:

Income Statement: we made $1.3 billion of adjustments, with a net effect of removing $411 million in non-operating expense (1% of revenue). We removed $438 million in non-operating income and $848 million in non-operating expenses. You can see all the adjustments made to SYY’s income statement here.

Balance Sheet: we made $3.4 billion of adjustments to calculate invested capital with a net increase of $$3.1 billion. The most notable adjustment was $1.3 billion in other comprehensive income. This adjustment represented 11% of reported net assets. You can see all the adjustments made to SYY’s balance sheet here.

Valuation: we made $10.8 billion of adjustments with a net effect of decreasing shareholder value by $10.8 billion. There were no adjustments that increased shareholder value. The largest adjustment to shareholder value was $9.4 billion in total debt, which includes $475 million in off-balance sheet operating leases. The operating lease adjustment represents 1% of SYY’s market cap. Despite the net decrease in shareholder value, SYY remains undervalued.

Attractive Funds That Hold SYY

The following funds receive our Attractive-or-better rating and allocate significantly to SYSCO Corporation.

- PowerShares Dynamic Food & Beverage Portfolio (PBJ) – 5.3% allocation and Attractive rating.

- Clarkston Select Fund (CIDDX) – 4.8% allocation and Very Attractive rating.

- ICON Consumer Staples Fund (ICLEX) – 4.5% allocation and Very Attractive rating.

- First Trust NASDAQ Retail ETF (FTXD) – 4.1% allocation and Attractive rating.

- WBI Tactical LCV Shares (WBIF) – 4.1% allocation and Attractive rating.

This article originally published on December 13, 2017.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Article by Kyle Guske II, New Consstructs