In his Daily Market Notes report to investors, while commenting on the strong earnings, Louis Navellier wrote:

Q3 2021 hedge fund letters, conferences and more

Strong Earnings

The market opened down to more concerns about inflation after some noise from European bankers wanting to raise interest rates, that crude oil opened at a 7-year high fueling inflation concerns, and a weak 3Q GDP number out of China. But then the strength of earnings took over. 80% of the 41 companies which have already reported beat their EPS expectations. New forecasts are for the S&P 500 to bring in 30% growth for the quarter, the best quarterly growth since 2010. On the sidelines is the new BitCoin ETF expected to debut tomorrow and Apple announcing a new line of MacBooks today.

Covid is not out of the picture yet; the UK hit a 3 month high of cases on Sunday and here in the US Colorado has the highest hospitalizations of the year. It should be comforting to investors that the Wall of Worry is being climbed by strong earnings rather than speculation of Fed timing or new bills out of Congress. While the overall market will likely rise due to the weak alternative that fixed income offers in a rising interest rate environment, and with cash paying next to nothing, a return to a focus on earnings would once again favor stock picking over buying Indexes and will reward investors with better, more experienced advisors.

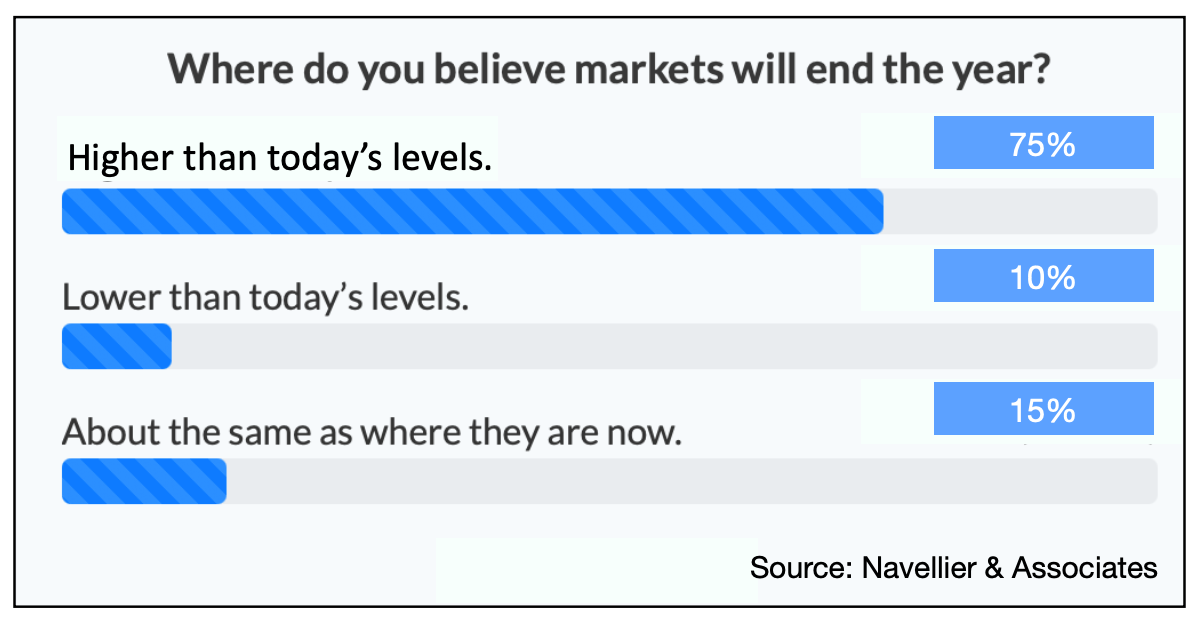

Despite inflation concerns, our survey shows retail investors are bullish heading into the fourth quarter, while 15% remain undecided. Undecided investors are like swing voters in an election. Once their conviction becomes clear in one direction or another, it will have a large impact on the outcome of the election, and in this case, the markets.

China In Recession?

China’s National Bureau of Statistics announced that GDP grew at a 4.9% annual pace in the third quarter. Between a domestic real estate bubble bursting, the Evergrande debt crisis, electricity power outages, plus negative service and manufacturing PMIs in September, the deceleration in the Chinese domestic economy has been very swift. I am a bit skeptical that China’s GDP expanded at a 4.9% annual pace in the third quarter since the latest PMI data signaled a recession.

Energy Inflation

In the Western world, economic growth has also slowed dramatically. The Atlanta Fed is now estimating only 1.2% annual third-quarter GDP growth. Energy inflation is now squelching growth worldwide as “green energy” proved to be very unreliable, especially in Europe as a high-pressure system neutered the wind turbine output. There are also big concerns that solar panels are made in China by forced labor by Uyghurs. Furthermore, cobalt is largely dependent on child labor from the Congo, so the electric vehicle revolution now needs to find an alternative to lithium-ion batteries.

Belgium, which is sandwiched between pro-nuclear France and pro-natural gas Germany, is making the transition to natural gas, but high prices are making Belgium rethink its energy sources. Currently, Belgium has seven nuclear plants that generate half of its electricity, but these nuclear plants are scheduled to go offline in 2025 and make a big transition to natural gas. I suspect that Belgium’s nuclear plants will remain online beyond 2025, based on cost, carbon emission goals and natural security goals.

Heard & Notable

LinkedIn lost 50 million users following its shut down in China. LinkedIn voluntarily sacrificed its third-largest audience due to concerns around increased censorship. Source: Statista