The Broad Market Index was down 5.05% last week and 57% of stocks out-performed the index.

The last time USA corporate growth peaked at near the current level was in 2000 when sales growth was 20% and the gross profit margin was the highest ever having risen in the prior decade largely due to the labor cost benefit of globalization.

Q1 2022 hedge fund letters, conferences and more

2000 - 2002 Experience

Growth was at an all-time high and falling more frequently in the third quarter of 2000. Stock indexes were unusually extended relative to bonds and index average price to sales was near 3X. Shares fell from 2000 to 2002 and were down over 50% before the growth decline ended in 2002.

In the most recent annual period US corporate sales growth is 23% and the frequency of improvement is down for the second quarter in a row. Average sales growth is lower (steeply lower at retailers). Stock indexes trade at an all-time high relative to bonds and index average price to sales is 3.7X

Major Stock Indexes Outlook

This illustrates the magnitude of what is to come. Major stock indexes will be at half their current value before worst is passed. In the 2000 to 2002 experience, we could defend ourselves with bonds. Long treasury bond yields were 5.5 % and remained unchanged while stocks indexes dropped in half.

Inflation was measured at 3% and fell with stocks until 2002 which produced a stable premium return from bonds. They did their job as defensive investments.

FED Responding

The Federal Reserve responded to the stock market decline with lower interest rates. The 90day treasury bill yield was 5% in 2000 the fed reduced that to .9% by the summer of 2002. Currently, Tbills are yielding 1% while inflation rages at 8%.

There is simply no way for the FED to provide stimulus as corporate growth falls. Quite the opposite. Interest rates must rise steeply to counter higher inflation expectations. Companies are already announcing price increases many of which are anticipating higher costs, not really responding to higher costs.

Interest Rate Alternatives

Interest rates are still too low relative to inflation to act as a defense against falling growth. Inflation is very sticky and will not drop until short term interest rates are higher than inflation and the yield curve is inverted. That means that the long treasury bond yield will double to 6% from the current 3%.

The value of long-term bonds portfolios will drop in half and stock indexes will perform worse than that. Cash will not protect us from the decline because interest rates are so low that they guarantee a loss of 7% per year.

Find Rising Growth

The only way to navigate through these very challenging circumstances is with stocks of rising growth companies. In the 2000-2002 experience, rising growth companies outperformed the broad indexes by over 100%.

As we collect second quarter financial statements in coming weeks, make sure that all your portfolio companies maintain a sales growth rate of 8%+ (higher than inflation) and rising profit margins.

Market Outlook

In the current update, our Otos.io recent Securities & Exchange Commission (SEC) filing update is 97% complete. The volume of SEC financial statement filings will decrease in coming weeks.

Corporate growth is unusually high and falling more frequently. Inflation is likely to remain high and interest rates will advance further. Falling growth and rising interest rates is a terrible combination for stocks and asset values generally.

Maintain portfolio companies with high sales growth and rising profit margins (tall green MoneyTree in a golden pot). Look for companies like Pegasystems displaying strong growth and depressed share price.

Pegasystems Inc (PEGA) $52.470 BUY This Rich Company Getting Better

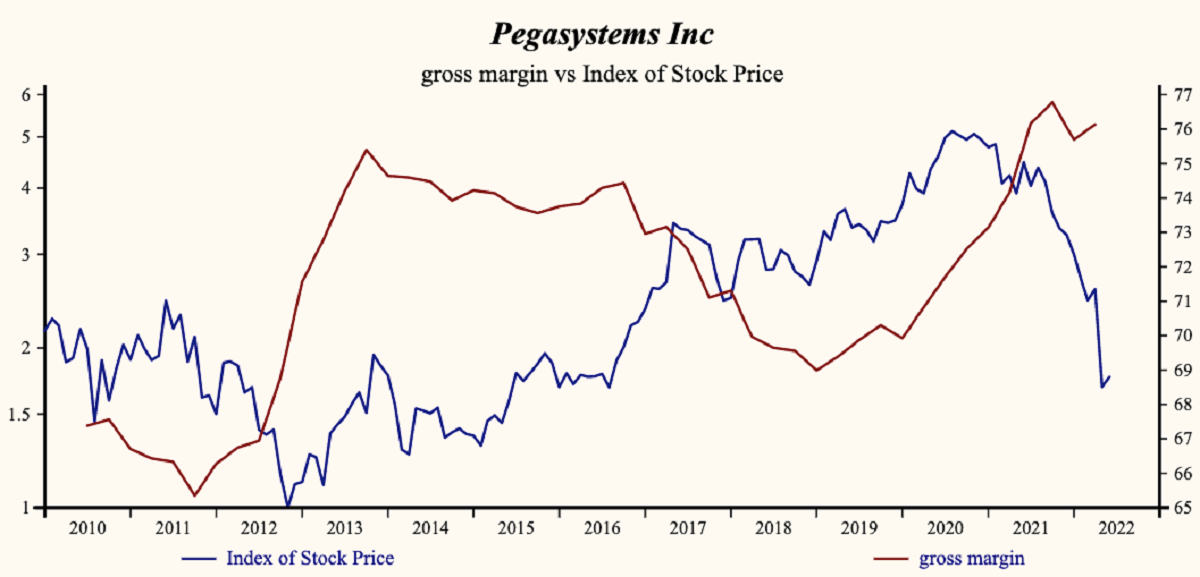

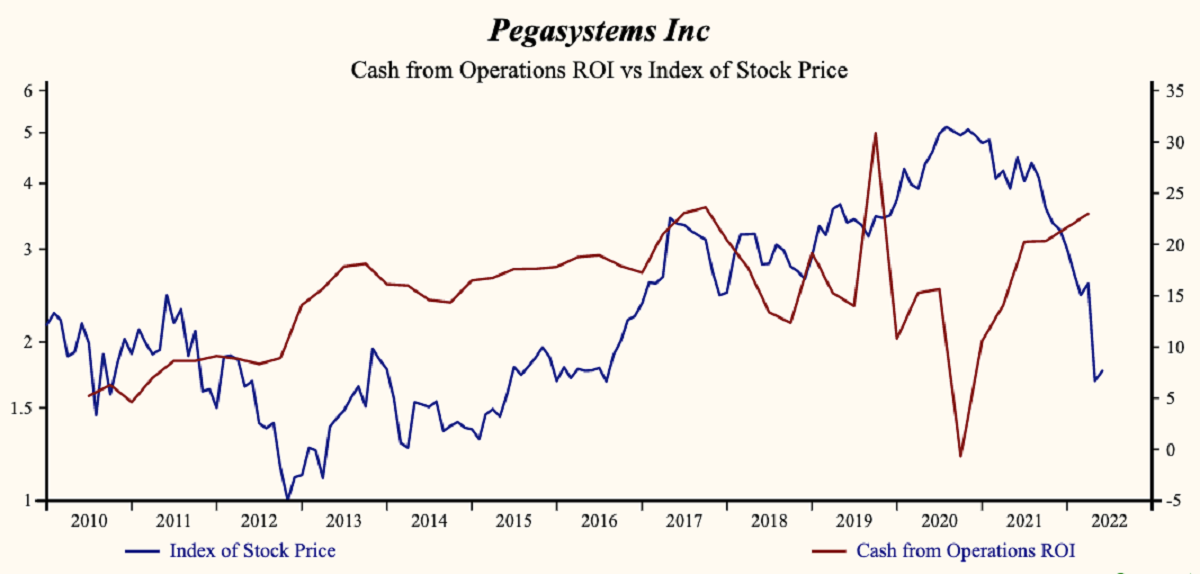

Pegasystems Inc (NASDAQ:PEGA) has been a profitable company with inconsistently high cash return on total capital of 12.3% on average over the past 21 years. Over the long term, the shares of Pegasystems Inc have declined by 65% relative to the broad market index.

The shares have been very highly correlated with trends in Growth Factors. The dominant factor in the Growth group is Net Shareholder Wealth which has been 87% correlated with the share price

Strong Top-Line Growth

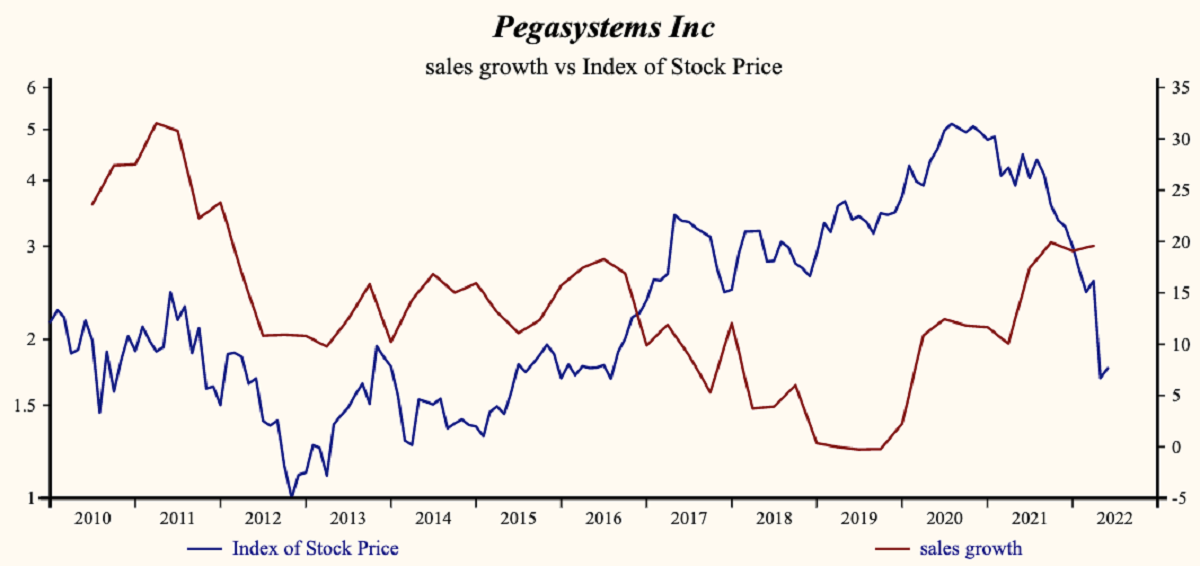

Currently, sales growth is 19.6% which is high in the record of the company and higher than last quarter. The shares have been highly correlated with the direction of sales growth. The company is recording a rising gross profit margin.

More recently, the shares of Pegasystems Inc have declined by 65% since the August, 2020 high. The shares are trading at lower-end of the volatility range in a 22-month falling relative share price trend.

The current depressed share price provides a good opportunity to buy the shares of this evidently accelerating company.

Learn more and sign up for our Otos NOtos notifications at OTOS.io and experience your financial reality as FREEDOM AND EMPOWERMENT.