Introduction

How do you decide how much of your assets should be in stocks? One approach is to max out your 401k, IRA, etc and invest everything you possibly can into the market while you are young and less so as you grow older. Another is to have enough money in liquid assets to cover expenses for a few years and invest the rest into the market. Another approach is to be cognizant of the odds of a stock market crash and only have enough money in the market that you are comfortable losing and the rest in bonds or CDs. There are lots of ways to go about making this decision; in this post we are not going to examine the merits of each, but are instead going to study what decisions Americans are making about how much of their assets to invest in the stock market.

Q2 hedge fund letters, conference, scoops etc

Data

Our dataset is from the Survey of Consumer Finance (2016). This data set is collected by the Federal Reserve and collects data on the finances of consumers in the US. The data allows us to measure the exposure of households to the stock market by aggregating how much stock exposure households have through either direct individual stock ownership or through stock mutual funds. In addition, we are able to get insight into the size of retirement accounts, household income and other components of net worth.

Half the US Has No Exposure To The Stock Market

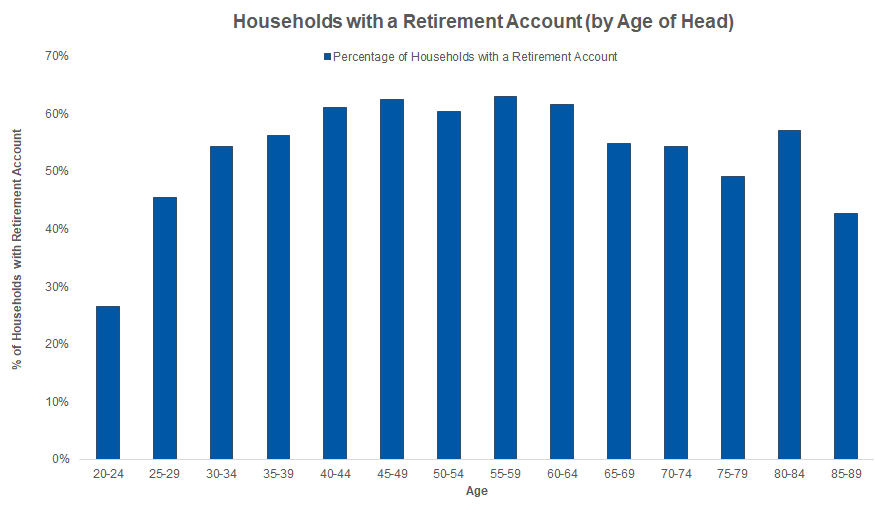

Most people who choose to invest in stocks typically do so indirectly under a retirement account such as a a IRA, 401k, a pension plan, or some other tax deferred account. However, 48% of the US population does not have any of these retirement accounts. This number varies significantly by age, with younger households and seniors lacking a retirement accounts relative to those who are aged 40 to 60. The graph below shows this pattern:

Outside of retirement accounts, the direct ownership of stocks either through stock mutual funds or individual stocks is fairly uncommon. Only 20% of households have exposure to stocks directly. This also varies by age, with only roughly 10% of millennials having some direct exposure to stocks compared to 30% for retirees.

How Much do Stock Owners Invest In Stocks?

When a household does have stock market exposure, how much do they have? Since roughly 80% of the population does not directly own any stocks, this question only pertains to a small and relatively affluent part of the population. The graph and data table below shows different age buckets of the head of household, along with how much exposure the households have to stocks as a percentage of their yearly income. We’ve excluded any households that do not have direct stock ownership from this analysis.

The data gives us a number of insights. It is rare for millennials, when they do own stocks in the first place, to have stock exposure that is a significant percentage of their income. Over 60% of those aged 20 to 30 who owned stocks have less than 10% of their yearly income worth of exposure stocks. As households grow older, make more money and have more in savings, the distribution changes. Once the households are of age 50 to 59, a significant portion of stock owners put more than 100% of their yearly income into stocks. You can use the table above to get a feel of how you rank in terms of stock ownership relative to your peers.

Stock Ownership Was An Older Affluent Person’s Game. Is This Changing?

It is clear that stock ownership outside of retirement accounts is a relatively uncommon phenomenon in the US. The obvious drivers of stock ownership are whether a family is affluent enough to have savings that they can then invest into the stock market. More subtle factors are the fact that financial advisers and annuity agents typically target consumers that have some amount of investable assets and are motivated to convince those households to invest in the stock market, so that they can collect a management fee. Apps such as Robinhood, Stash, and Acorns have made it easier for millenials to get access to the market. It is conceivable that by the time the next Survey of Consumer Finance is released, the numbers for younger households will look different.

Article by HiBenjamin