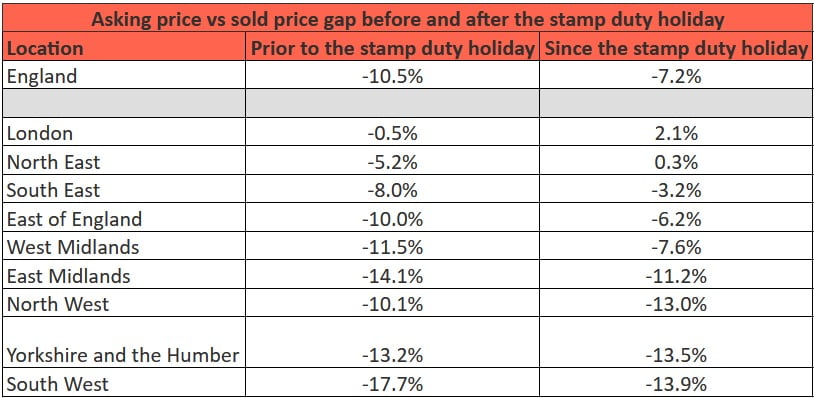

The latest research by GetAgent.co.uk has revealed that the asking price to sold price gap has closed as a result of the stamp duty holiday, while in London and the North East, homesellers are actually achieving above asking price on their sale.

[reit]Q4 2020 hedge fund letters, conferences and more

GetAgent’s research shows that:

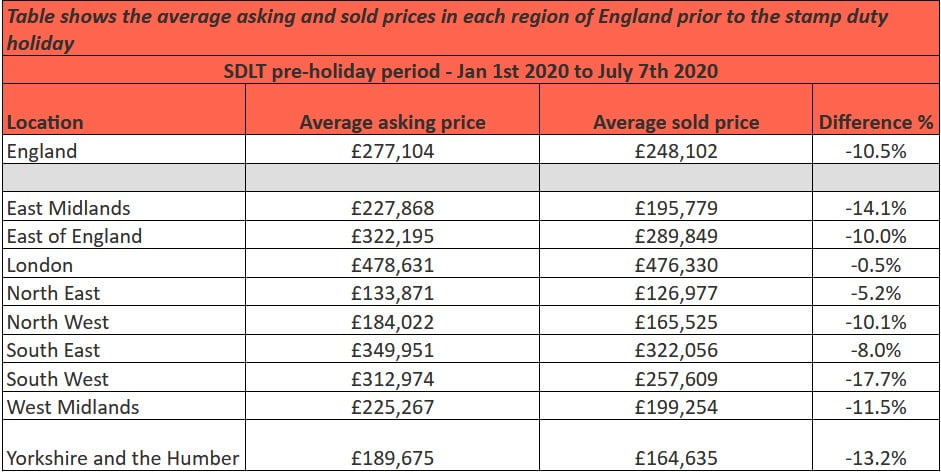

- Prior to the stamp duty holiday, asking prices across England averaged £277,104, while sold prices averaged £248,102 – a -10.5% difference.

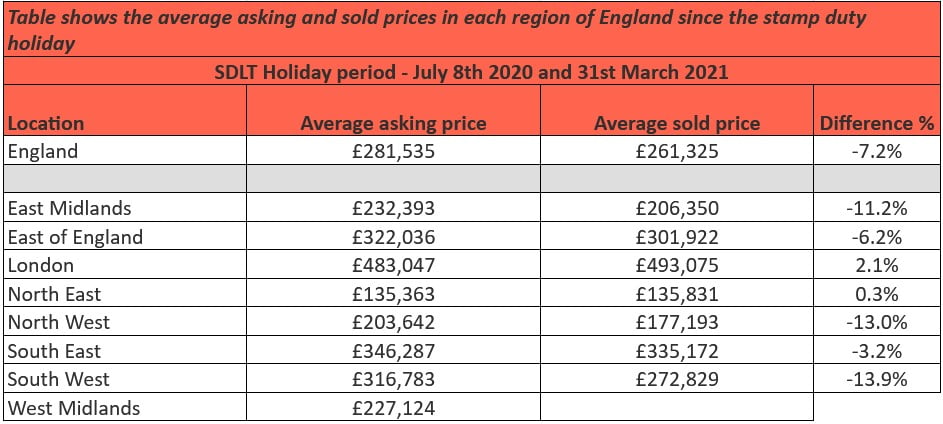

- However, the heightened market activity seen as a result of the stamp duty holiday has caused this gap to close to just -7.2% since 8th July last year.

- Prior to the stamp duty holiday, sold prices in London came in -0.5% lower than the average asking price. However, since its introduction, the capital’s homebuyers are selling at an average of £493,075, 2.1% more than the average asking price of £483,047.

- The North East has also seen sellers benefit the most. Prior to the launch of the holiday, the average asking price was £133,871, while sold prices came in -5.2% less at an average of £126,977. Since the holiday launched, homes are selling for an average of £135,831, 0.3% more than the average asking price of £135,363.

- The South East (-3.2%), East of England (-6.2%) and West Midlands (-7.6%) are home to the lowest gaps between higher average asking prices and the average sold price paid by buyers.

Stamp Duty Holiday Rush Closes The Asking To Sold Price Property Gap

Last week, the latest market insight from, GetAgent.co.uk, revealed that it’s now taking 43 days longer to sell a home due to the delays caused by the stamp duty holiday. But what has this heightened level of market activity done to the gap between the asking price expectations of sellers and the sums buyers are actually willing to pay?

GetAgent.co.uk keeps a comprehensive record of property sales across the nation, using data from all of the major online portals to record the point at which a home is listed for sale online. GetAgent then cross-references this sale with the Land Registry using proprietary algorithms to see when the sale completes, revealing what is selling, where, for how much and how long it’s taking.

Prior to the stamp duty holiday, asking prices between January 2020 and June 2020 averaged £277,104, while buyers paid £248,102 on average – a -10.5% difference.

However, the heightened market activity seen as a result of the stamp duty holiday has caused this gap to close to just -7.2% since 8th July last year.

This has largely been down to buyers packing more punch with their stamp duty saving and committing to higher purchase prices. Sold prices have averaged £261,325 since the introduction of the holiday, up a notable 5.3% when compared to the previous average of £248,102.

That said, this gap could have closed even further, but savvy sellers have looked to make the most of buoyant buyer activity with a marginal increase in asking prices of 1.6% since the introduction of the holiday.

Where Is The Gap Now The Lowest?

Prior to the stamp duty holiday, sold prices in London came in -0.5% lower than the average asking price. However, since its introduction, the capital’s homebuyers are selling at an average of £493,075, 2.1% more than the average asking price of £483,047.

The North East has also seen sellers benefit the most. Prior to the launch of the holiday, the average asking price was £133,871, while sold prices came in -5.2% less at an average of £126,977. Since the holiday launched, homes are selling for an average of £135,831, 0.3% more than the average asking price of £135,363.

The South East (-3.2%), East of England (-6.2%) and West Midlands (-7.6%) are home to the lowest gaps between higher average asking prices and the average sold price paid by buyers.

Competition In The Housing Market

Founder and CEO of GetAgent.co.uk, Colby Short, commented:

“It’s inevitable that sellers will enter the market at a higher price than they’re likely to sell for and so sold prices are almost always going to come in at a lower average than asking prices.

However, in hot market conditions, this gap tends to close as more buyers fight it out for the same property and at present, we’re seeing a pretty hot market indeed. So much so that sold prices in both London and the North East have actually crept above the average asking price since the introduction of the stamp duty holiday, while all but one other region has seen the gap close.

With more money in their pockets and more competition when trying to secure a home, buyers are paying that little bit more. Of course, this gap would be wider, but savvy sellers are also entering the market at a higher price point in order to make the most of these buoyant market conditions.”

Below data sourced from GetAgent.co.uk based on average asking price of homes listed online versus the average sold price listed by the Land Registry between each time frame for before and after the stamp duty holiday.