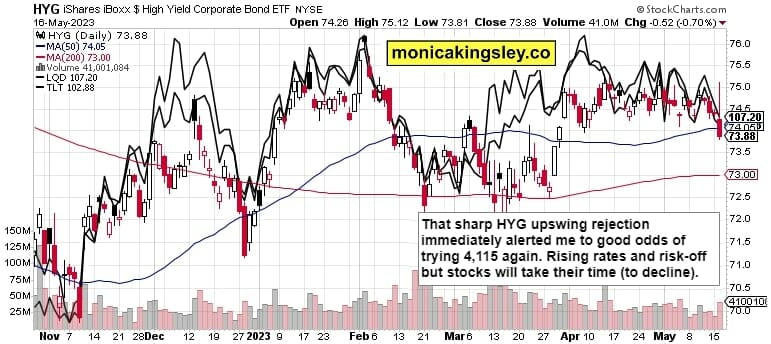

S&P 500 flirted with 4,115 again after that great intraday HYG reversal portended downside volatility when cyclicals didn‘t really point higher. The day ended with a profound deterioration in market breadth.

And unappealing sectoral overview.

Tech upswing invited selling interest, while value and especially Russell 2000 turned strongly south. ES though had been relatively resilient given both manufacturing and retail sales hits, and today‘s data in housing weren‘t slated to bring a disaster.

The figures are obviously more optimistic than they would have otherwise been if the market could clear itself by bringing in more supply, which isn‘t though a realistic expectation when mortgage rates have been locked low in a different era of 2020-2021.

Similarly retail (WMT, TGT) earnings aren‘t truly concerning – they merely underline the weakening consumer, and more bleak expectations for Q2 figures. The same for real estate not being out of the woods.

For now, the stock market advance remains concentrated in the top 10 (chiefly tech) stocks, and Wednesday‘s prospects aren‘t disastrous – with no overnight fall even if USD broke higher to 102.80, I‘m looking for another tight range muddle through day where 4,149 followed by 4,154 stand in the way, and a close clearly below 4,136 would be a nice bearish daily victory in this long lasting tight S&P 500 range. Watching today‘s rotations chiefly for clues.

Keep enjoying the lively Twitter feed via keeping my tab open at all times (notifications on aren’t enough) – combine with Telegram that always delivers my extra intraday calls (head off to Twitter to talk to me there), but getting the key daily analytics right into your mailbox is the bedrock.

So, make sure you‘re signed up for the free newsletter and make use of both Twitter and Telegram – benefit and find out why I’m the most blocked market analyst and trader on Twitter.

Let‘s move right into the charts (all courtesy of www.stockcharts.com) – today‘s full scale article contains 4 of them.

Credit Markets

Rising yields haven‘t brought down stocks much, let alone tech with the ever deteriorating breadth there. Today will mark a pause in the risk-off stance, not a reversal higher to last.

Thank you for having read today‘s free analysis, which is a small part of my site‘s daily premium Monica’s Trading Signals covering all the markets you’re used to (stocks, bonds, gold, silver, miners, oil, copper, cryptos), and of the daily premium Monica’s Stock Signals presenting stocks and bonds only. Both publications feature real-time trade calls and intraday updates.

While at my site, you can subscribe to the free Monica‘s Insider Club for instant publishing notifications and other content useful for making your own trade moves.

Turn notifications on, and have my Twitter profile (tweets only) opened in a fresh tab so as not to miss a thing – such as extra intraday opportunities. Thanks for all your support that makes this great ride possible!

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice.

Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind.

Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make.

Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.