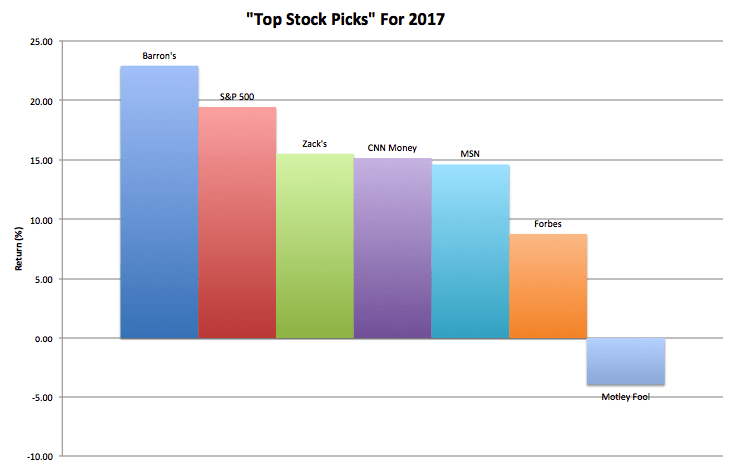

Back in July, we published a review of various “top stocks” for 2017 and their performance halfway through the year. With 2017 now behind us, we decided to review the same picks for a final report card. The analysis includes the notable Barron’s Top 10, Zack’s Top 10, a Top 5 from CNN Money, a Top 5 from Motley Fool, a Top 10 from MSN experts, and a Top 7 from Forbes, which consisted of seven investment strategists making their top picks for the year. After the mid-term report in July, three of the lists had outperformed the s&p 500 index 2017 returns, which had returned +8.49%: Barron’s (+15.59%), CNN Money (+13.61%), and MSN (+12.63). However, after the S&P 500 finished 2017 with an impressive return of +19.42%, only one of the six lists beat the s&p 500 index 2017 returns, and that was Barron’s.

Barron's Top 10

Barron's, the best of the lists in 2017, and the only one to beat the S&P 500 index 2017 returns had a return of +22.89%. Their performance was carried by heavyweights including Toll Brothers, Inc. (NYSE:TOL) up +54.9%, Apple Inc. (NASDAQ:AAPL) up +46.11%, Unilever PLC (NYSE:UL) up +35.97%, and Alphabet Inc. (NASDAQ:GOOG) up +35.58%. Barron's worst performer and only pick with a negative return on the year was Merk & Co. Inc. (NYSE:MRK) down -4.42%.

Zack's Top 10

Perhaps the second most well-known list next to Barron's is Zack's, who often touts their record as one that outperforms the market. While coming up short of the S&P 500's +19.42%, with a return of +15.49%, Zack's did have the best second half of 2017, given their portfolio return of -1.65% after Q2 with six of their ten stocks posting negative returns. However, only four closed 2017 in the red, including Under Armour Class A (NYSE:UAA) down -50.33%, and Ritchie Bros. Auctioneers (NYSE:RBA) down -11.97%. The losses were countered by some strong returns from FMC Corp. (NYSE:FMC) up +67.36%, VMware, Inc. (NYSE:VMW) up +59.18%, and Monolithic Power Systems, Inc. (NASDAQ:MPWR) up +37.14%.

CNN Money Top 5

CNN Money posted a return of +15.13% which was primarily dragged down by Envision Healthcare Corp. (NYSE:EVHC) who was down -45.39% in 2017. However, their remaining four stocks returned over ten percent, including Broadcom Ltd. (NASDAQ:AVGO) up +42.83%, Dycom Industries (NYSE:DY) up +38.78%, and State Street Corp. (NYSE:STT) up +25.59%.

MSN's Top 10

MSN's ten expert picks come courtesy of Investor Place and delivered a +14.59% return in 2017. Despite holdings such as NVIDIA Corp. (NASDAQ:NVDA) up +81.28%, Albemarle Corp. (NYSE:ALB) up +48.57%, and CoreSite Realty Corp. (NYSE:COR) up +43.51%, these gains were contained by some significant losses. These burdens include Newell Brands Inc. (NYSE:NWL) down -30.80%, TripAdvisor, Inc (NASDAQ:TRIP) down -25.68%, and Zynerba Pharmaceuticals, Inc. (NASDAQ:ZYNE) down -19.69%.

Forbes Top 7

Forbes' list is comprised of "the best stock picks" from seven investing professionals. The portfolio's return of +8.76% was hindered by Forterra Inc. (NASDAQ:FRTA) down -48.75%. Forterra aside, Forbes' list would have still come up short of the S&P 500 by about a percentage point. The list's other loss, IBM (NYSE:IBM) was down -7.57% in 2017. Top performers included Dycom Industries (NYSE:DY) up +38.78%, and USG Corp. (NYSE:USG) up +33.52%. The remaining three stocks all trailed the index.

Motley Fool Top 5

The worst of the "expert" lists, and only one to post a negative return, down -3.98%, was Motley Fool. Three of the five stocks had losses on the year, including Under Armour Class C (NYSE:UA) down -44.50%, and Core Laboratories N.V.(NYSE:CLB) down -8.74%. Their best performer, Diamondback Energy, Inc. (NASDAQ:FANG) was up +24.93% while their next best, T-Mobile US, Inc. (NASDAQ:TMUS) trailed the S&P 500 with a +10.43% return.

S&P 500 index 2017 returns vs. the experts - A Short Summary

These six lists in total posted a gain of +12.15%, which would not come as a surprise to industry icons like Warren Buffett and Jack Bogle who champion the success of investing with the index. This analysis shows that picking stocks is even trying in a euphoric year like 2017.