As tax season continues, many individuals are anticipating receiving a tax refund — and figuring out what fun item or experience they’ll splurge on. As much fun as a new ATV would be, though, it might be smarter to invest the money – and paper series I bonds can offer a low-risk, high-reward investment that many would argue is inflation-proof.

Although investing your refund in series I bonds can be a sound financial decision, it’s essential to consider your financial goals and explore other options. A financial advisor can offer guidance and advice on investments, making the process less complicated.

Q4 2022 hedge fund letters, conferences and more

Series I Bond Basics

A Series I savings bond, also referred to simply as an I bond, is a type of savings bond issued by the United States Treasury. It has a fixed interest rate that is determined at the time of purchase, and it is also adjusted for inflation.

The Treasury determines the interest rate twice a year, in May and November, based on the estimated rate of inflation. Unlike some other U.S. securities, Series I bonds are sold at face value, meaning that a $50 bond is sold for $50.

The duration of Series I bonds is different from other bonds, as they can range from one year to 30 years. However, if the bond is sold before five years have elapsed since the time of purchase, the owner forfeits the last three months of interest.

Series I Bond Purchase Limits

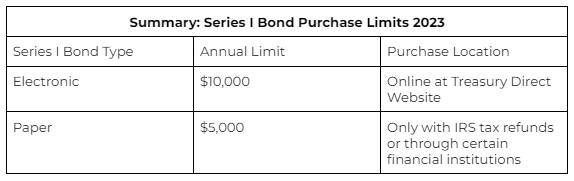

There are two versions of the Series I bonds, electronic and paper. There are limits to how much you can obtain depending on which you purchase. Here are the details:

The United States Treasury Department introduced I bonds in 1998 as part of the TreasuryDirect program. These savings bonds were launched in September 1998 as a type of inflation-indexed bond designed to help individuals save for long-term goals like education or retirement, while also providing a hedge against inflation.

There are some loopholes, though, that will help you bypass the annual limit in I bonds.

Buying a Series I Bond Purchase with your Tax Refund

From the chart above, you can see that the additional $5,000 purchase limit is reserved only for individuals who elect to purchase a Series I bond using their tax refund. Here’s how it’s done.

- Complete Form 8888 and include it with your tax return. On the form, you will need to indicate the amount you want to use to purchase paper I bonds and provide your mailing address.

- Wait for your tax refund to be processed and the paper I bonds to be mailed to you. The Treasury Department will mail the paper bonds to the address you provided on Form 8888. It may take a few weeks for the bonds to arrive.

- Once you receive your paper I bonds, store them in a safe place, such as a fireproof safe or a safe deposit box. You may also want to consider creating an inventory of your bonds and keeping it in a secure location.

Things to Know for Paper Series I Bond Purchases

- There’s a one-year wait time. Keep in mind that if you purchase paper I bonds with your tax refund, you won’t be able to redeem them for at least one year after the issue date.

- Redeemable only in person. Paper I bonds must be redeemed in person at a financial institution, while electronic I bonds can be redeemed online through the TreasuryDirect website.

- Potential loss of earnings. Be aware that if you redeem your I bonds before they are five years old, you may forfeit the last three months of interest.

Other Alternatives For your Tax Refund

While Series I Bonds are a safe investment with nearly zero risk involved, the big downside is their lack of liquidity. Electronic bonds lose three months’ worth of interest if redeemed before five years and paper bonds aren’t redeemable within the first year of purchase.

If you’re looking for a shorter-term investment with more liquidity options a financial advisor can help you determine your best investment alternatives. Plus, you may find that investing your refund may not be the best play for your current financial status. Here are some bases to cover first.

- Paying off high-interest debt: Depending on your interest rate, you could see a bigger return simply by paying off your debt that’s costing you in high fees and APR each month.

- Getting caught up on delinquencies or derogatory accounts: Returning any defaulted accounts back to a good standing can give your credit a boost and allow you to borrow again in the future.

- Saving for an emergency: Having a padded rainy day fund can help prevent you from going into debt in the first place when you’re blindsided by an unanticipated expense.

- Saving for an upcoming large purchase: Planning to buy a home, take a trip or purchase a vehicle? We can’t always know what’s up ahead, but when we do we can plan accordingly and not rely on high-interest debt to cover it.

The Bottom Line

If you have some disposable income coming down the pipeline via your tax refund there are some great investment options to consider — including the low-risk, inflation proof paper series I bonds.

Tips for Investing

- Balancing risk and reward in your investment portfolio is a challenge. Finding a financial advisor doesn’t have to be hard. SmartAsset’s matching tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is a fit for you. If you’re ready to find an advisor, get started now.

- If you are looking for low-risk options to balance out your investment portfolio, Treasury inflation protected securities (TIPS) are another great option. Before you buy either TIPS or I Series bonds, learn about the wide range of U.S. Treasury securities for both individual and institutional investors.

The post Torn On How To Spend Your Refund? This Investment Offers Low-Risk And Inflation Protection appeared first on SmartAsset Blog.