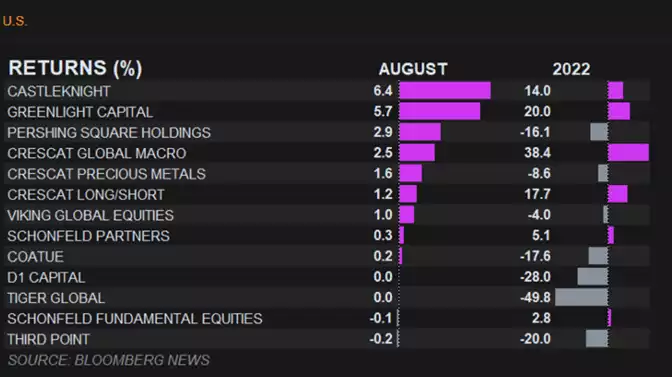

The Crescat Global Macro Fund was up 2.9% net in August and 38.8% net year to date. Mega Cap Growth shorts were the best performing theme overall generating a 2.3% absolute return to the fund while the S&P 500 was down 4.1%.

The Long/Short and Precious Metals Funds were also up in August. All Crescat strategies have outperformed their benchmarks in August, year to date, and since inception net of fees as shown in the table below.

Q2 2022 hedge fund letters, conferences and more

Crescat has a long-term firmwide track record across multiple business cycles and investment strategies.

Our persistent alpha across all of these products illustrates the value added by Crescat’s investment process which is driven by our macro models and themes, value-investing bias, and long-running equity fundamental model.

Bear Market Still Unfolding

A sharp cyclical bear market for overvalued, long-duration financial assets has much to play out, in our view, over the next one to two years as the Federal Reserve attempts to establish inflation-fighting credibility by continuing to raise interest rates and shrink its balance sheet.

Note the deterioration in financial conditions, a gravitational force exerting downward pressure on the S&P 500 Index as shown below. The latter still trades at high multiples relative to historic standards so appears to have significantly more downside ahead.

The extraordinary valuation bubble in financial assets that we have today was created by the ongoing Fed easing in the wake of the Global Financial Crisis only to be further accelerated during Covid. But inflationary pressures now have the Fed trapped.

It is forced to aggressively tighten monetary conditions. As a result, the unfolding bear market for financial assets and the coming recession over the next one to two years are likely to be pernicious. We remain positioned for it on the short side in our Global Macro and Long/Short funds.

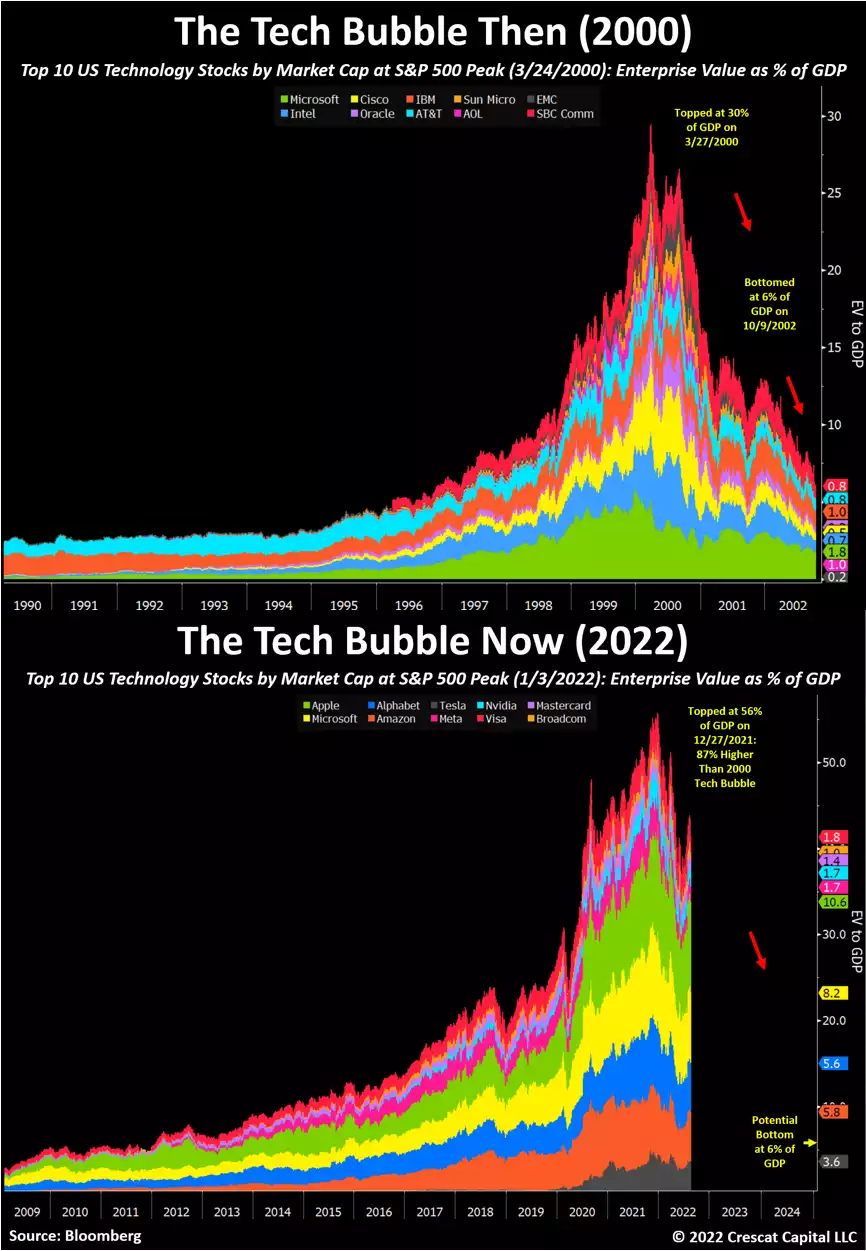

Note the comparisons to the Tech Bubble and Bust in the early 2000s. In terms of enterprise value to GDP, valuations of mega-cap tech stocks went 87% higher in this mania versus the last. While a bear market has arguably begun already, there is substantially more downside ahead for large cap tech stocks.

Deep Value & High Appreciation Potential In Natural Resources Industries

In addition to abundant short opportunities, there are incredible, deep-value, high-appreciation-potential long-side opportunities in the energy and materials sectors. Natural resource industries including mining & metals, oil & gas, and agriculture are beneficiaries of the current macro setup.

By its own admission, the Fed can only control the demand side of inflationary pressures. The problem is that supply shortages in natural resource industries are a bigger inflationary driver today. A declining trend of capital investment over the last seven-to ten-years is the culprit.

New natural resource production often takes years to permit, capitalize, and develop. As a result, we are likely to be in a grinding stagflationary macro environment.

Interest rate hikes accomplish short-term demand reduction via financial asset wealth destruction and recession. They do nothing to solve the bigger long-term supply-driven inflation problem. Paradoxically, the Fed’s tightening only prolongs the much-needed capital investment to alleviate inflationary pressure and grow the economy.

This presents an extraordinary opportunity for investors today seeking both high growth and inflation protection through resource industry investing. The timing for beat-up precious metals mining stocks is especially attractive right now. Such companies trade at extremely depressed valuations while simultaneously possessing high growth potential.

Gold and silver miners have undergone a long base-building process since 2015. Look at how cheap small-cap miners are relative to gold itself and how this setup yielded sharp gains over the next five to eight months in the two prior extremes since the 2015 lows.

The Philly Gold & Silver Index was down 9.5% in August and CPMF was up 0.8% net. Crescat’s activist holdings generated extraordinary alpha for the month while overall market sentiment plummeted on misguided Fed fears.

The Precious Metals Fund has truly an amazing collection of deep value, high appreciation potential, gold, silver, and copper, nickel deposits in quality jurisdictions all over the planet. That theme also remains our single biggest equity long exposure in Global Macro and Long/Short.

Year-To-Date Profit Attribution In Crescat Global Macro Fund

As seen in the profit attribution table below, our short-related positions accounted for five of our six top-performing themes. The combination of our themes is what generated the 38.8% net performance YTD in the Global Macro Fund.

We expect our short themes to continue to perform through year-end especially given still-high valuations and deteriorating financial conditions.

Recent Press Coverage From Bloomberg

Crescat’s Global Macro and Long/Short funds are among the top-performing hedge funds year-to-date as recently highlighted by Bloomberg.

Bloomberg also wrote a story on our China yuan theme and Global Macro Fund this month, which we encourage you to read.

Buy When There Is Blood In The Street

The pullback in precious metals is a blessing in disguise for investors who have been on the fence about adding to their investment or those who are not currently invested in Crescat.

It gives them the opportunity to take a position in our funds without feeling like they missed the boat. We think the sentiment on precious metals is due for a change soon as investors start to flock to the safe-haven asset class.

Lord Byron said it best, “O Gold! I still prefer thee unto paper, which makes bank credit like a bark of vapour.”

Sincerely,

Kevin C. Smith, CFA

Member & Chief Investment Officer

Tavi Costa

Member & Portfolio Manager

For more information including how to invest, please contact:

Marek Iwahashi

Client Service Associate

Cassie Fischer

Client Service Associate

Linda Carleu Smith, CPA

Member & COO

© 2022 Crescat Capital LLC