In our gold chartbook from January 2oth, 2022, we assumed that gold should have some more upside potential given the favorable seasonality until the end of February. So far, gold indeed managed to climb higher and reached a 2-month high on January 24th at US$1,853. At that point, gold prices had recovered US$100 or 5.79% from the December lows within just six weeks. Seasonality favors another wave up.

Q4 2021 hedge fund letters, conferences and more

However, these gains attracted some profit-taking at prices around US$1,850. And in the aftermath of last week’s FOMC meeting, gold sold off for three days in a row. This merciless sell-off only ended at US$1,780 wiping out nearly all gains since mid of December. It was some form of the classic “the bull walks up the stairs and the bear jumps out the window” pattern, which is a typical behavior within an uptrend.

Hence and exactly for this reason, the deep pullback did not necessarily end the recovery in the gold market. Of course, in the bigger picture, the entire precious metals sector is still stuck in this tenacious correction which has been ongoing since August 2020. In the short-term, however, the pullback has created an oversold setup and once again proved that there is buying interest at prices below US$1,800.

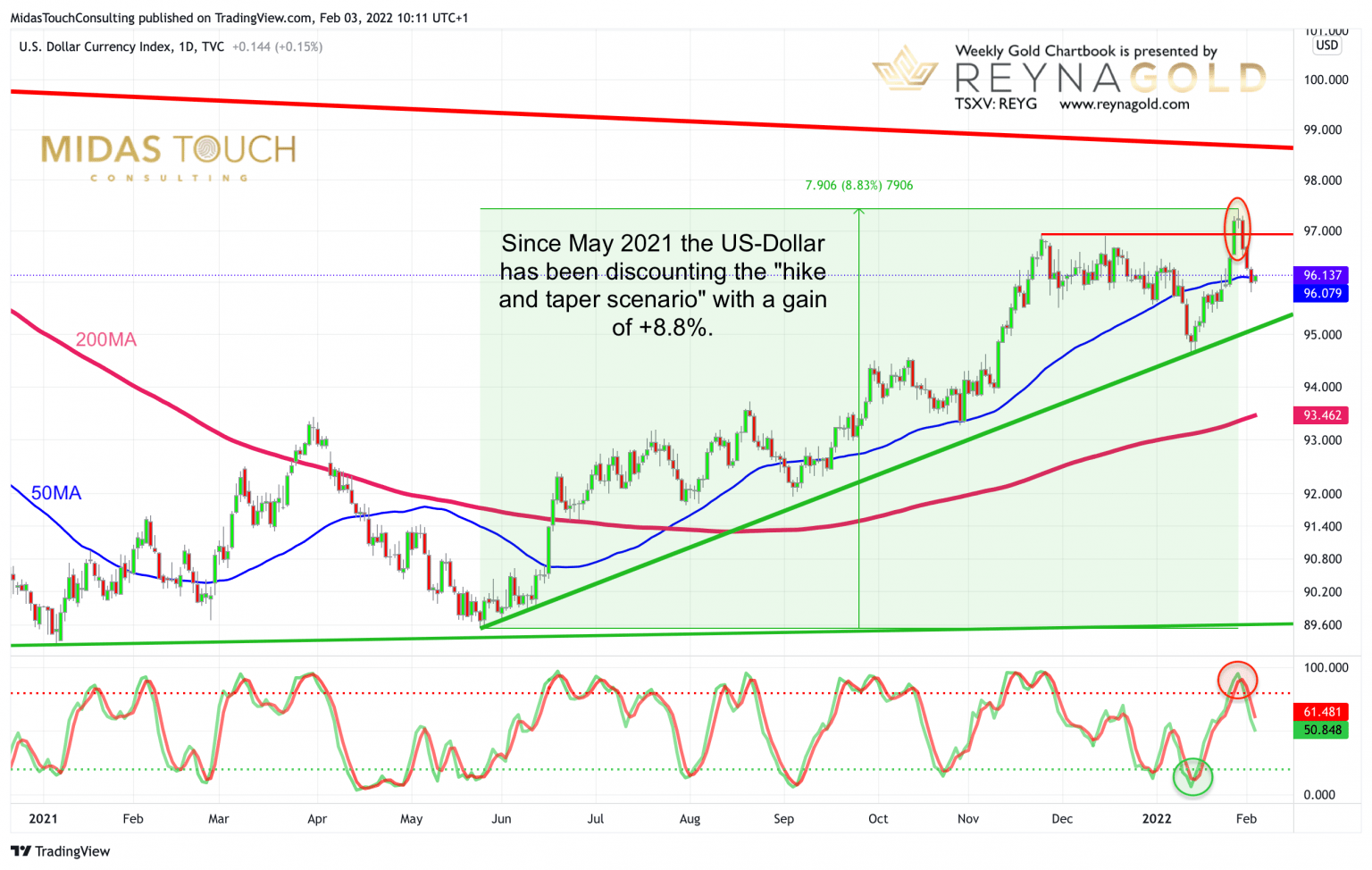

US-Dollar index, daily chart as of February 3rd, 2022. False breakout?

US-Dollar index, daily chart as of February 3rd, 2022.

It also seems that the US-Dollar might have hit an important top last Thursday and is now moving lower, which would be very supportive for gold, of course. Everyone is expecting the US-Dollar to go up as the FED is expected to raise interest rates. But the US-Dollar has been discounting this “hike and taper scenario” for several months already. Actually, the US-Dollar index has been rallying +8.8% since May 2021! During the recent FOMC meeting, however, big money might have used the seeming breakout to sell their dollar longs into a favorable high volume setup. At the same time, stock market sentiment was extremely bearish. Hence, last week likely triggered a top in the US-Dollar and a violent back and forth bottoming pattern for the stock-market.

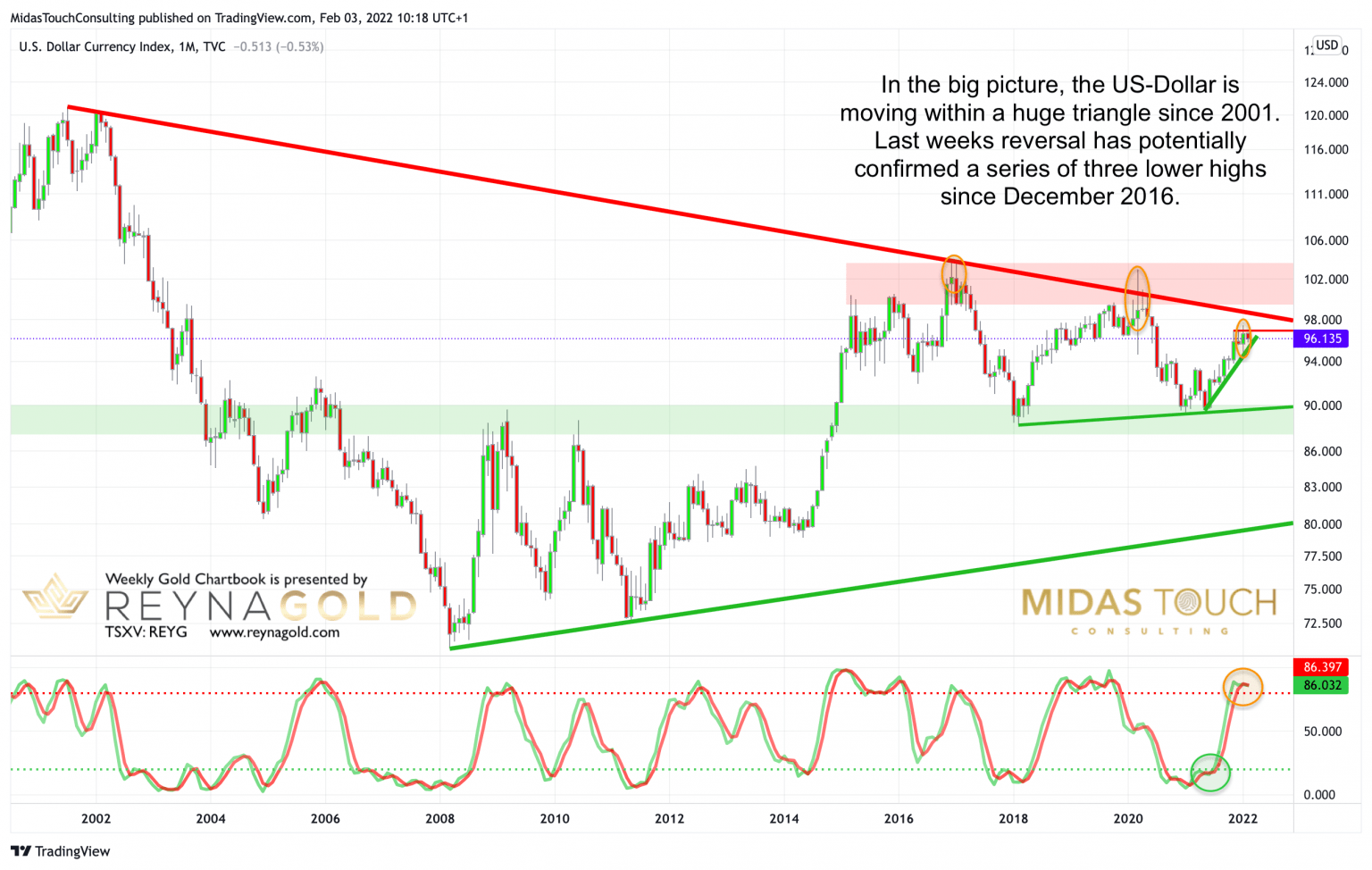

US-Dollar index, monthly chart as of February 3rd, 2022. A series of lower highs!

US-Dollar index, monthly chart as of February 3rd, 2022.

In the big picture, a top in the US-Dollar would continue the series of lower highs for the dollar. As well, the US-Dollar is moving within a huge triangle since 2001. After a series of three lower highs since December 2016, a test of the lower boundary of the triangle would give gold prices an extreme tailwind in the coming years. Hence, even if it´s hard to come up with any bearish arguments for the dollar at the moment, technically it looks like the dollar could roll over.

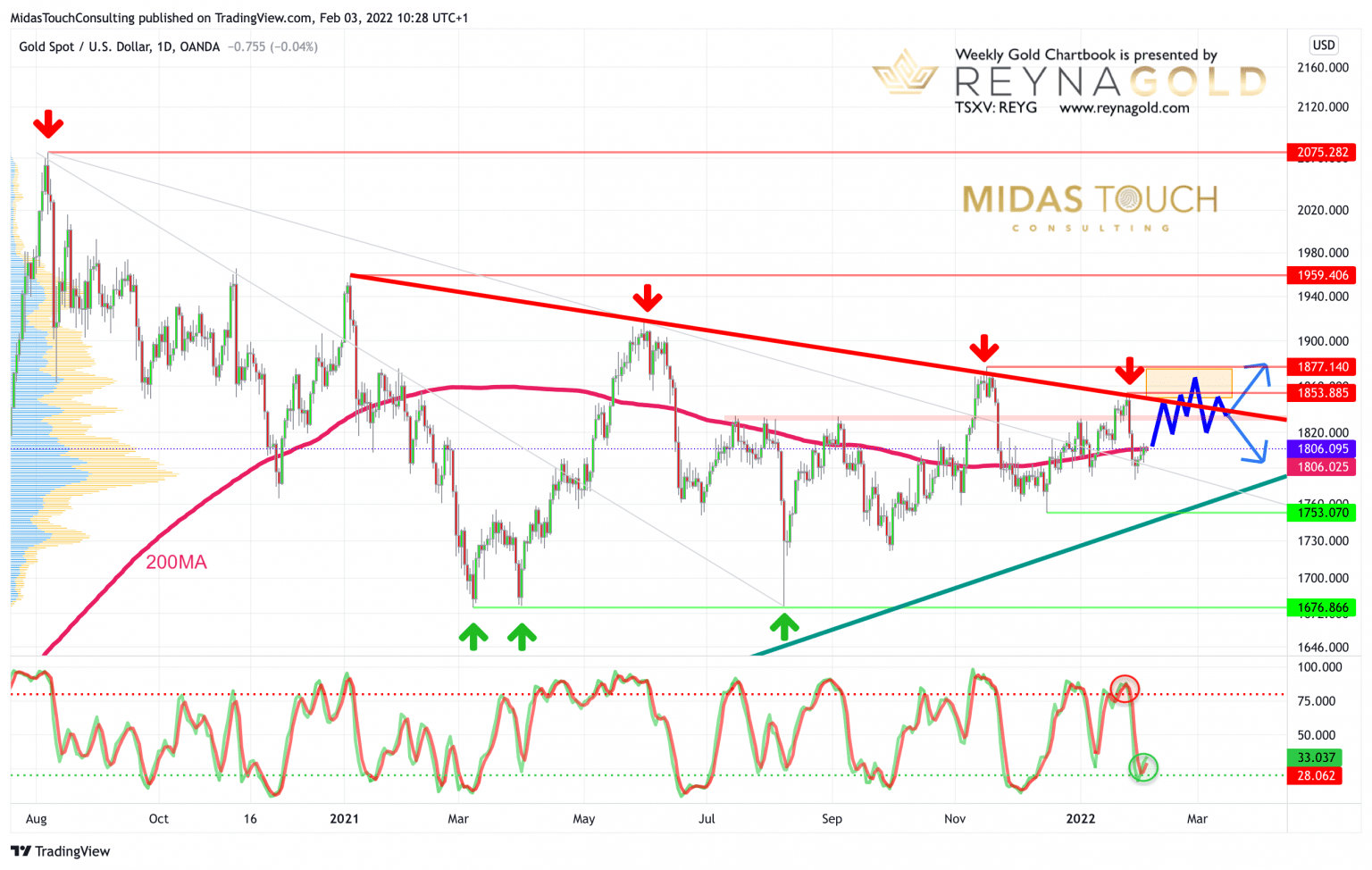

Gold in US-Dollar, daily chart from February 3rd, 2020. Gold’s behavior is changing.

Gold in US-Dollar, daily chart as of February 3rd, 2022.

For gold, a weaker US-Dollar would be very helpful. In fact, since the beginning of this week, we perceive an ongoing change in gold’s behavior. We are getting impressed by its intraday strength! Every small pullback around and below US$1,800 was rather quickly bought again. So far, gold has only recovered 38.2% of last week’s nasty sell-off and currently sits pretty much exactly at its 200-day moving average (US$1,805).

But the fresh buy signal from the slow stochastic oscillator on the daily chart promises more upside. Hence, we see gold fuming its way higher in the coming weeks. In the next step, gold will have to overcome the 38.2% resistance around US$1,808.50 and then continue its recovery towards US$1,830. In any case, the seasonal component is at least very favorable until the end of February. Therefore, even higher price targets are conceivable too. But gold needs to breakout above the triangle and clear US$1,850. Only then a more sustainable bullish momentum would emerge which could last further into spring.

If, on the other hand, gold takes out US$1,780, the recovery since mid of December might be over already and the medium-term correction might likely pick up again.

Conclusion: Seasonality Favors Another Wave Up

Overall, we assume that seasonality favors another wave up in the gold market. Thus, another rally towards at least US$1,830 is realistic. We are short-term bullish, mid-term neutral to skeptic and long-term very bullish for gold.

Feel free to join us in our free Telegram channel for daily real time data and a great community. If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can also subscribe to our free newsletter.

Disclosure: Midas Touch Consulting and members of our team are invested in Reyna Gold Corp. These statements are intended to disclose any conflict of interest. They should not be misconstrued as a recommendation to purchase any share. This article and the content are for informational purposes only and do not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. The views, thoughts and opinions expressed here are the author’s alone. They do not necessarily reflect or represent the views and opinions of Midas Touch Consulting.

Article by Florian Grummes, Midas Touch

About the Author: Florian Grummes

Florian Grummes is an independent financial analyst, advisor, consultant, trader & investor as well as an international speaker with more than 20 years of experience in financial markets. He is specialized in precious metals, cryptocurrencies and technical analysis. He is publishing weekly gold, silver & cryptocurrency analysis for his numerous international readers. He is also running a large telegram Channel and a Crypto Signal Service. Florian is well known for combining technical, fundamental and sentiment analysis into one accurate conclusion about the markets. Since April 2019 he is chief editor of the cashkurs-gold newsletter focusing on gold and silver mining stocks. Besides all that, Florian is a music producer and composer. Since more than 25 years he has been professionally creating, writing & producing more than 300 songs. He is also running his own record label Cryon Music & Art Productions. His artist name is Florzinho.