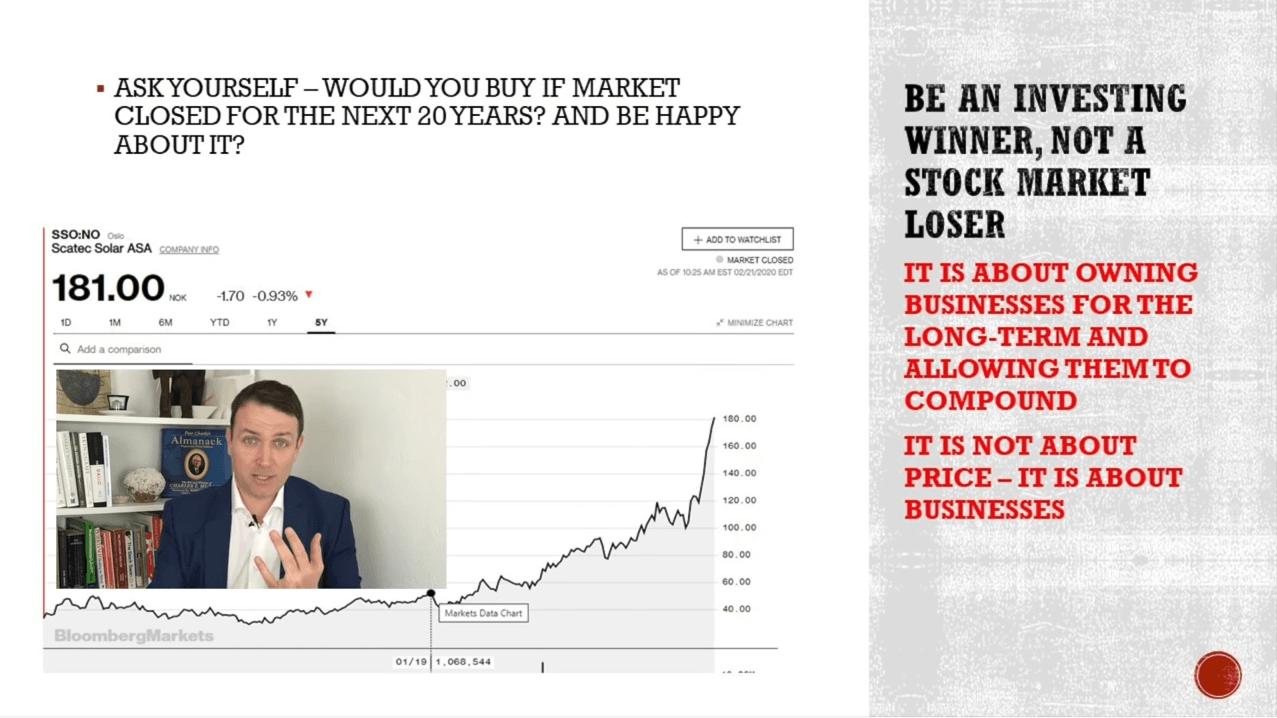

Many stock market beginners think investing is about stocks – it actually is about the business you are becoming an owner of. Also, in light of the current stock market declines, it is about investing long-term, accumulating stocks as parts of businesses. So, if you have your eye on great businesses, great stocks, you might buy the dip when the market offers it. In this video, Sven Carlin gives an example of how he found a great long-term compounder in the form of Scatec Solar.

Q4 2019 hedge fund letters, conferences and more

Scatec Solar - Be a Long-Term Winner And Buy the Dip

Transcript

Good day fellow investors. This video is about how to be an investing winner and not the stock market's loser. Stocks go up and down all the time and I get so many comments on stock price the stock prices down, what should we do? Is it overvalued? Is it undervalued? And that's unfortunately over the long term, a loser's game. On the other hand, you have investing where you buy businesses, owned businesses, and let wonderful businesses do the compounding. And that's what makes the difference in your lifetime.

If we take a look at the Forbes richest people in the world list, you have Jeff Bezos, Bill Gates, Warren Buffett, Carlos Slim, and Zuckerberg, Bloomberg, Larry Page, etc, etc. And how much trading did they do? How much undervalued, overvalued did they do? What did they do? They owned one business over their life time, they still own the business and they just let the business compound into infinity and become the richest person in the world. You don't have to be the richest person in the world.

But if you allow for compounding over the long term, you will be very very well off. There is constantly comments about overpriced, underpriced, and that's always relative. When you look at overvalued, undervalued, you always dependent on the market, you have to move fast, you have to trade work a lot. But if you shift your focus from the stock price, and that's difficult to the business. This is a business I like to own at this price. It gives me this and this return over the long term.

That's what I like to own and then you simply compare it to other businesses, given the return given the growth given the potential the most the quality, and you sell one business when you have something much, much better if this one gets overpriced from a business perspective, not from a market perspective and that's long term investing.

It's a hard message to send, it's a hard message to explain, but it makes the crucial difference when it comes to investing. So before buying a business next time, just stop for a second, get away from the stock market, from the stock prices, from the news, from the media, and focus on the business. Focus on what you're buying. And think, okay, if the stock market closes for the next 10, 20, 30 years, and I cannot sell it, I have to own it forever. Would I be a happy owner of what I buy? The number of buys sells gets down.

What you do is just by here and there. And if I find one, two businesses per year that fit that category, then I'm the happiest person in the world. That's also what I do on my stock market research platform, the more and more we focus on great businesses.

And one great business that I find found a year and a half ago was Scatec Solar, solar industry tailwind, great business model, cheap financing from international agencies, high return on capital, and a lot of growth. I bought the stock a year and a half ago starting then increase the position, and it's just the gift that keeps on giving. If it keeps on giving as it it's likely to keep on out simply hold it for ever and think, oh, what a big chunk of luck did I have or a lot of research to find such a gem in the early days?

And that's something that has to understand, yes, the stock price goes up and down. But that's not investing that speculating, investing, finding a great businesses and holding to it To infinity, allowing for that business to compound and just the final long term investment.

If you find a great business, if the stock price goes down, you're a happy person because you can reinvest even that 2.2% dividend if you can reinvest, it makes a huge difference over the long term if you add your 100 500 monthly savings into that stock that the business that went down because I don't know why went down, then you compound you multiply your investment returns over the long term.

I hope this was great motivation for you to have a long term mindset. And if you like that long term mindset, please subscribe to this channel. Click that notification bell and I'll see you in the next video.