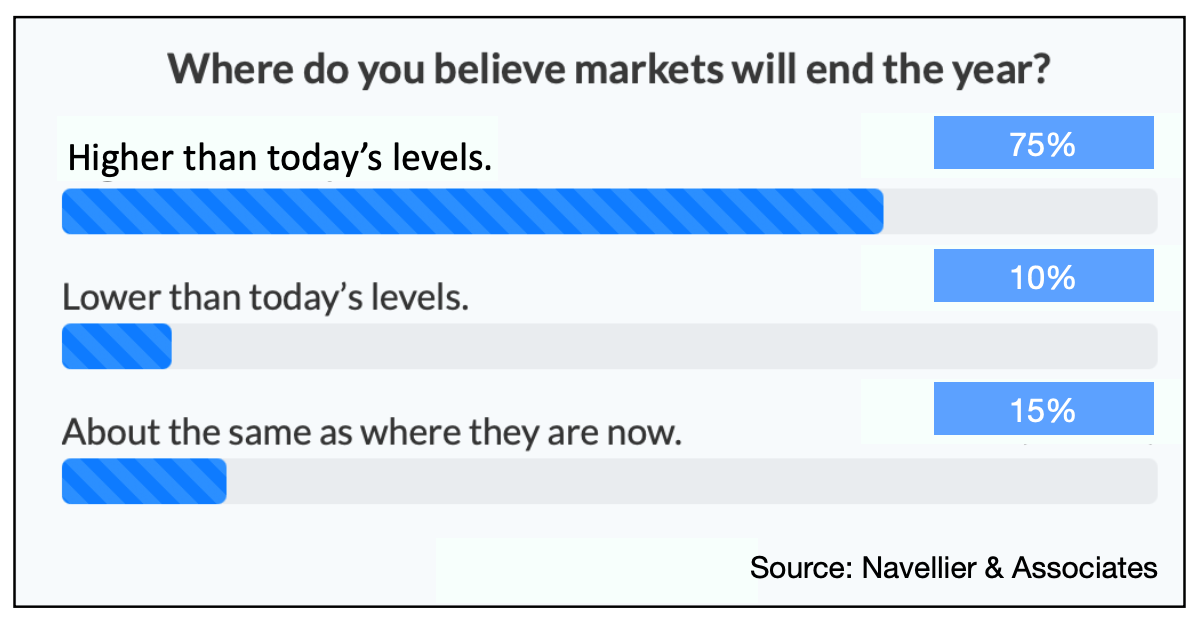

A survey of retail investors conducted by Navellier & Associates indicates retail investors are bullish heading into the fourth quarter.

Q3 2021 hedge fund letters, conferences and more

According to chief investment strategist Louis Navellier, while there are many crosscurrents in the markets which could provoke concern, the survey results and associated commentary suggests that investors are buoyed by the prospect of a robust earnings season.

Bullish Retail Investors

Further, he added, wage increases, though additive to inflation, appear to be perceived as a net positive to consumer spending by retail investors.

Bearish investors on the other hand cited inflation fears as the primary driver of their cautiousness.

That more investors were uncertain about the direction of the market, 15%, than were bearish, 10%, is notable according to Mr. Navellier.

“Undecided investors are like swing voters in an election,” he said. “Once their conviction becomes clear in one direction or another, it will have a large impact on the outcome of the election, and in this case, the markets.”

He added he believes that ultimately these swing investors will swing bullish and provide an important lift to the market. “Many of the immediate concerns — bottlenecks, energy pricing, inflation — will moderate as the year comes to a close, ultimately adding some optimism to the ‘undecided’ investors.”