In a sign of how aggressively campaigns may be waged next year, Public Storage outed Elliott Management’s plans to advance a six-person slate to its board last week, citing a litany of metrics that pointed to the company’s growth and announcing three new board members.

Q3 2020 hedge fund letters, conferences and more

Elliott's Psuh To Change Public Storage's Board Composition

In a public letter following Public Storage’s announcement, Elliott said that it wants to substantially change the composition of the board, which had one of the lowest percentages of independent directors in the S&P 500 and an average board tenure of 12 years prior to its announcement.

Elliott said that there are opportunities for Public Storage to deploy capital in order to increase growth. The activist also suggested that the company’s operations, including in-store experience and occupancy optimization, could be significantly improved to increase shareholder returns.

To arrange an online demonstration of Activist Insight Online email us at [email protected].

What We'll Be Watching For This Week

- How will Japan's Faith react to RMB Capital's suggested strategy change, including an increased dividend?

- Will Whitebox Advisors launch a solicitation or lawsuit against LG in an attempt to block the company from spinning off a collection of affiliates into a new holding company?

- Santa!

Activist Shorts Update

Medical device maker Penumbra began a voluntary recall of all configurations of its JET 7 aspiration catheter, citing a risk of unexpected death or serious injury after short seller Quintessential Capital Management alleged the product was dangerous. The U.S. Food and Drug Administration (FDA) followed up with a public letter urging all users to stop using the device, and instructing facilities to remove it from their inventory.

Reacting to the news, Quintessential and fellow short seller Marc Cohodes said in a statement to Activist Insight Shorts that they are "pleased" with the FDA’s standpoint. Quintessential and Cohodes pledged to continue their work to unearth evidence of "extensive malfeasance" at Penumbra, saying that the catheter is just the "tip of the iceberg."

The stock was down more than 10% in pre-market trading on Wednesday at $159 per share, after the report was published. It has since recovered, closing up at around $186 yesterday.

To arrange an online demonstration of Activist Insight Shorts, email [email protected] or view our product brochure to find out more.

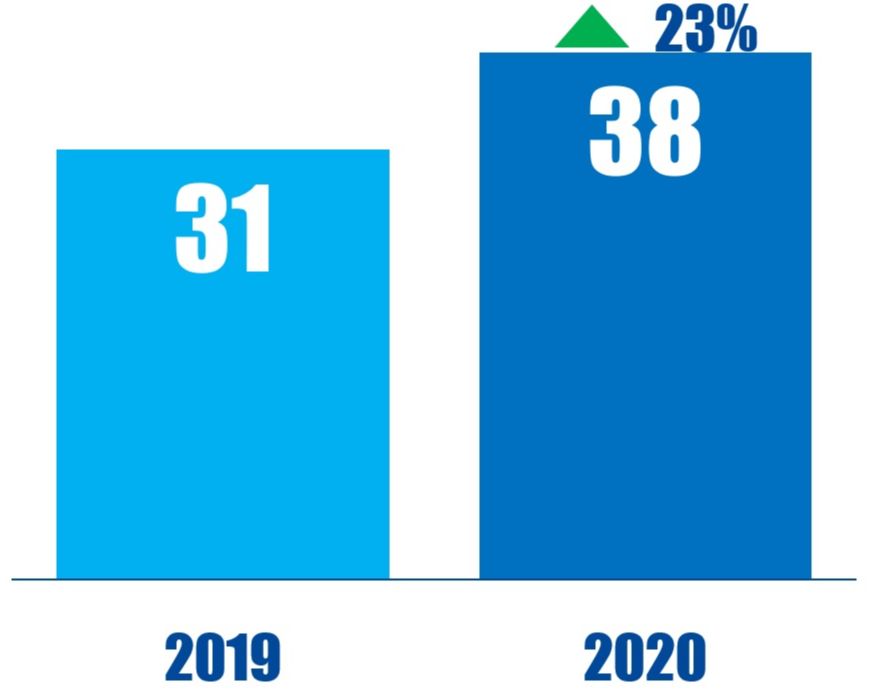

Chart Of The Week

The number of global public real estate companies publicly subjected to activist demands, between January 01 and December 18, in respective years.