Prosperity Bancshares, Inc. (NYSE:PB) said on January 18, 2023 that its board of directors declared a regular quarterly dividend of $0.55 per share. Shareholders of record as of March 14, 2023 will receive the payment on April 3, 2023. Previously, the company paid $0.55 per share.

At the most recent share price of $74.73 / share, the stock’s dividend yield is 0.74%. Additionally, the company’s dividend payout ratio is 0.39, indicating it is retaining a low percentage of its earnings to reinvest in growth opportunities.

The company’s 3-Year dividend growth rate is 0.20%, demonstrating that it consistently increased its dividends over time.

Q4 2022 hedge fund letters, conferences and more

As of January 14, 2023, the average one-year price target for Prosperity Bancshares is $79.34. The forecasts range from a low of $69.69 to a high of $90.30. The average price target represents an increase of 6.17% from its latest reported closing price of $74.73.

The projected annual revenue for Prosperity Bancshares is $1,365MM, an increase of 20.05%. The projected annual EPS is $6.40, an increase of 14.42%.

Fund Sentiment

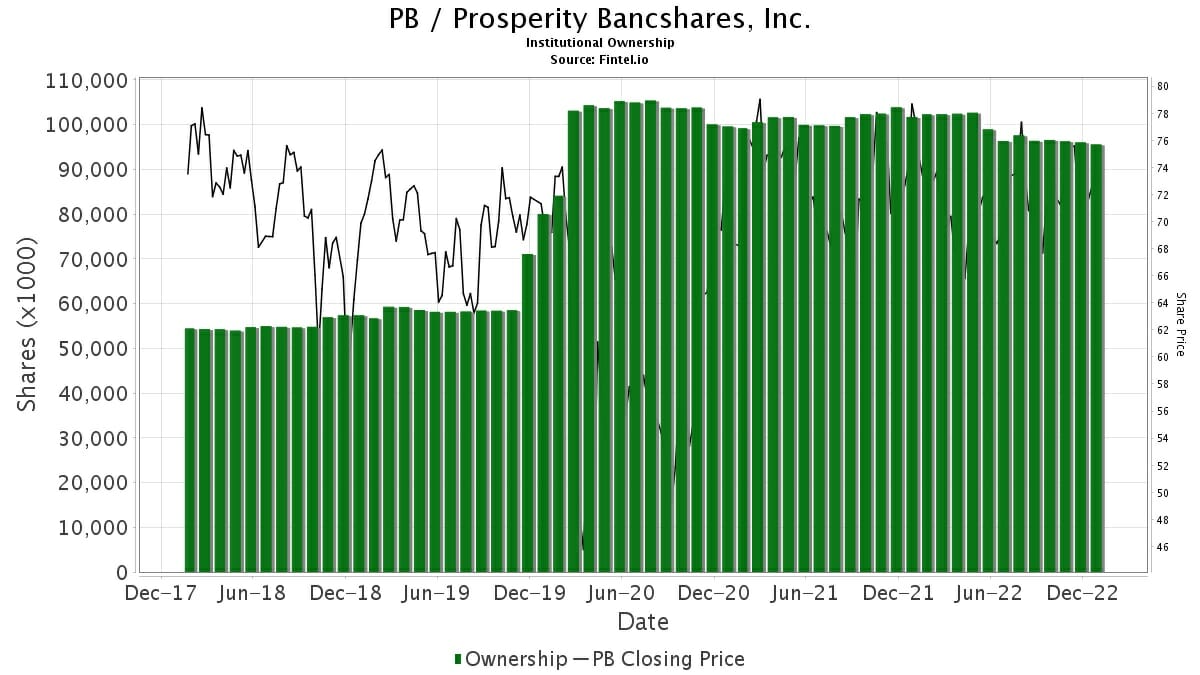

There are 737 funds or institutions reporting positions in Prosperity Bancshares, Inc.. This is an increase of 8 owner(s) or 1.10%.

Average portfolio weight of all funds dedicated to Prosperity Bancshares, Inc. is 0.3039%, an increase of 1.0128%. Total shares owned by institutions increased in the last three months by 1.86% to 95,586,584 shares.

Victory Capital Management Inc holds 5,337,462 shares representing 5.85% ownership of the company. In it's prior filing, the firm reported owning 4,856,706 shares, representing an increase of 9.01%. The firm increased its portfolio allocation in PB by 9.95% over the last quarter.

Massachusetts Financial Services Co /ma/ holds 3,059,072 shares representing 3.35% ownership of the company. In it's prior filing, the firm reported owning 3,213,953 shares, representing a decrease of 5.06%. The firm increased its portfolio allocation in PB by 0.81% over the last quarter.

Champlain Investment Partners, LLC holds 2,886,710 shares representing 3.16% ownership of the company. In it's prior filing, the firm reported owning 2,942,455 shares, representing a decrease of 1.93%. The firm increased its portfolio allocation in PB by 1.21% over the last quarter.

American Century Companies Inc holds 2,604,609 shares representing 2.85% ownership of the company. In it's prior filing, the firm reported owning 3,196,327 shares, representing a decrease of 22.72%. The firm decreased its portfolio allocation in PB by 14.37% over the last quarter.

Brown Advisory Inc holds 2,582,230 shares representing 2.83% ownership of the company. In it's prior filing, the firm reported owning 2,551,496 shares, representing an increase of 1.19%. The firm increased its portfolio allocation in PB by 135.11% over the last quarter.

Prosperity Bancshares Inc. Background Information

(This description is provided by the company.)

As of June 30, 2019, Prosperity Bancshares, Inc.® is a $22.4 billion Houston, Texas based regional financial holding company, formed in 1983. Operating under a community banking philosophy and seeking to develop broad customer relationships based on service convenience, Prosperity offers a variety of traditional loan and deposit products to its customers, which consist primarily of small and medium sized businesses and consumers.

In addition to established banking products, Prosperity offers a complete line of financial services including Online & Mobile Banking, Investment Services, Small Business (SBA) and Commercial Loans, Mortgage Services, Retail Brokerage Services, Cash Management, as well as traditional consumer services.

Article by Fintel