The Vatican and Pope Francis issued a blistering denunciation against over the counter (OTC) derivatives Thursday. While at first glance the move by a religious order to weigh in on a complex financial topic caught some Wall Street observers by surprise, the announcement was the result of years of study and consternation by those working around the Holy Se. With Spanish and Italian debt default threatening the European Union, Thursday’s holy pronouncement, one of the highest level statements the Vatican could send, comes as a topic seldom discussed in the public domain moves closer to becoming a global concern.

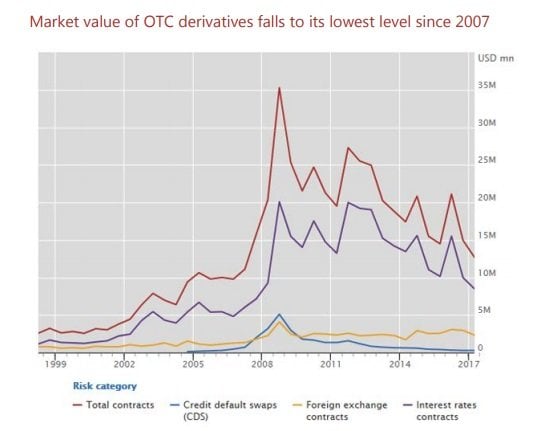

In the wake of the 2008 financial crisis, in which opaque derivatives played a role in causing the largest banks to require a government bailout, there were issues vexing those close to the listed derivatives industry as well as informed observers – and they remain today.

After the 2008 financial crisis certain OTC derivatives were still largely opaque with systematic risk exposure that was generally unknown to national security officials as well as the banks themselves. A 2015 report in ValueWalk illustrated the problem, noting that a large percentage of OTC derivatives remained in a paper format and not digitized into a risk management application. Combine this with the non-cleared nature of OTC derivatives that leaves the bank holding catastrophic risk exposure and concerns were made public. CMEGrouop’s Terry Duffy, for instance, has communicated the benefits of a central clearing solution relative to a closed, OTC market where the trade counterparty, serving the role of “exchange,” holds directional market risk.

While Duffy set the tone in the listed derivatives industry, discussions took place around the globe but generally centered on the United Nations, with Papal Nuncios at the UN in Geneva and New York in particular spearheading talks about derivatives relative to global financial stability and equality. These discussions that began in 2012 became increasingly formalized through published papers at the global ambassador level within the Vatican.

The Nuncio ambassadors along with UN sovereign debt experts were curious about the linkage between debt defaults and OTC derivatives. Eventually the mid-level debate made it through to upper level corridors at the Vatican, reaching a crescendo in February of 2015. The Greek debt crisis was raging and default by a populist government was considered a possibility, a move that could have geopolitical implications. In some corners, the potential for Greece to intentionally default and turn to the Soviet Union for assistance was considered. While the default impact of the cash sovereign bond market was a known number, the known unknown was the OTC derivatives impact.

In 2015 the issue boiled over from behind the scenes. The United Nations called a special session that included economist Joseph Stiglitz where the issue that was seldom discussed in public got a hearing. But the conversations that were not public were even more concerning, according to two sources with direct knowledge.

“There was a recognition of a much deeper problem during a systematic failure,” UN sovereign debt consultant and Jubilee USA Executive Director Eric LeCompte said. After the UN derivatives meetings, LeCompte spent time in the White House, which called a non-public derivatives meeting, he had previously told ValueWalk. LeCompte also briefed those inside the Vatican on the issue.

Underlying the Vatican’s Thursday announcement, which brings together multiple moral and theological subgroups in the church, is apparently using a financial logic that is well-known deep in listed derivatives circles but seldom openly discussed.

Thursday’s communique is perhaps some of the boldest language to be used regarding non-cleared derivatives. Stating the OTC system was built on an “ethical void,” the Vatican then pointed to accepted derivatives logic that the problem “becomes more serious as these products are negotiated on the so-called markets with less regulation.”

When he uses the “markets” in quotes this is referencing the fact that OTC “markets” had often been made by one bank or by a generally exclusionary, small group of highly interconnected financial institutions. “Such manipulation of the markets contradicts the necessary health of the economic-financial system, and is unacceptable from the point of view of the ethics respectful of the common good,” the Vatican stated. The OTC markets are not considered “free markets” in that they limit open participation and critical trade information on all contracts is not publicly available, as is mandated in the listed derivatives industry.

“In some types of derivatives (in the particular the so-called securitizations) it is noted that, starting with the original structures, and linked to identifiable financial investments, more and more complex structures were built (securitizations of securitizations) in which it is increasingly difficult, and after many of these transactions almost impossible, to stabilize in a reasonable and fair manner their fundamental value,” the Vatican statement said, pointing to unnecessary complexity surrounding OTC derivatives. “This means that every passage in the trade of these shares, beyond the will of the parties, effects in fact a distortion of the actual value of the risk from that which the instrument must defend. All these have encouraged the rising of speculative bubbles, which have been the important contributive cause of the recent financial crisis.”

The Pope called the OTC markets “regulated by chance, if not fraud.” Here he references the financial probability tables are often used to determine OTC prices using mathematical logic similar to what is done in the insurance and gambling industries. The “fraud” reference refers to opaque derivatives that were at the center of the 2008 financial crisis. This is when sub-prime loans were packaged in OTC derivatives contract structures and represented as high quality, creditworthy.

Not only is the Pope’s warning framed as populist forces in Italy and Spain are considering debt default, but it comes when other points of manipulation are evident. The recent fight over OTC derivatives issued to US homebuilder Hovnanian is a case in point. This is where the firm is accused of triggering an intentional default to force Goldman Sachs to payout on the OTC derivatives insurance contract. The case illustrates the catastrophic loss during an OTC derivatives payout, pointing to the highly leveraged notional value of the contract creating a negative event for the bank.

As John Dizard noted in the May 10 Financial Times, those suffering from a CDS default are “taxpayers, depositors, investors” while those benefiting from the OTC markets are “foreign billionaires, Bond villains, New York and London socialites.”

How about CDS on bank risk?

Well, we have the examples of Spain’s Banco Popular and Portugal’s Novo Banco. In both cases, the supervisory authorities and national governments ensured there was no “event of default” trigger that would lead to massive CDS payouts and a disruption of official bailout plans. You could, for that matter, buy protection through the CDS market on Citibank or JPMorgan Chase risk. Imagine getting paid by the seller in the chaotic circumstances of such an event of default, as specified in the fine print of the contracts. That is just science fiction. Well there is still plain corporate risk, where the CDS protection buyer is looking to hedge against the risk of default on a single company, or an index of companies. That is also proving to be a less credible proposition. In August, a “determination committee” of the International Swaps and Derivatives Association in Asia was unable to determine whether there had been an event of default by Singapore’s Noble Group. Finally, in March, Noble said it would default on a bond issue, and the CDS process for that “event” is playing out. In case you think Noble was a fetid outlier, Hovnanian, the US homebuilder, included a CDS event of default in its restructuring plan. The Commodity Futures Trading Commission tut-tutted but did not stop that process.

Dizzard then points to the most powerful and asks: “Can anyone find a way to bury this absurd pseudo-market?”

The Pope has that same question.