Perritt Capital Management manager commentary for the fourth quarter ended December 31, 2017.

Year In Review

There is an old saying on Wall Street that the markets climb a “Wall of Worry.” The past quarter and year certainly had several concerns, but the markets continued higher and finished the year at all time highs. Some of these recent concerns were several Hurricanes. Hurricane Harvey came first, pummeling Houston on August 25th. Less that two weeks later, Irma battered the Caribbean and Florida. Jose and Maria followed shortly after, striking the Caribbean and crushing Puerto Rico’s infrastructure. The cost is estimated to be in the hundreds of billions of dollars and will take years to repair. The financial markets hardly noticed.

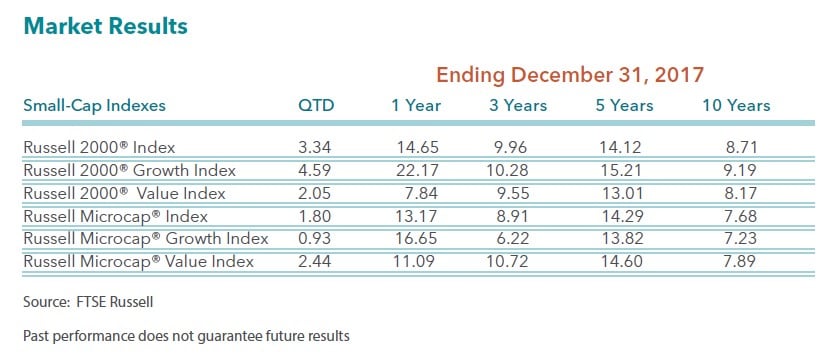

For the fourth quarter of 2017, large stocks continued to be the leader. The S&P 500 Index climbed more than 6% in the fourth quarter and rose by more than 20% for 2017. Smaller stocks performed well, but lagged their large cap brethren. The table above shows the performance results for the small/micro-cap indexes from Frank Russell & Company. During the past year, growth trumped value in both small-cap and micro-cap indexes. However, value outperformed growth within the micro-cap indexes in the fourth quarter. We are not sure if value’s leadership within micro-cap stocks is in a leadership reversal.

Worry?

Hurricanes were not the only concern. There were political debates over health care, the debt ceiling, the National Football League and the Russian investigation. Then there were words raged between North Korea’s supreme leader Kim Jong Un and President Donald Trump. The belated announcement of a data breach at Equifax, potentially impacting nearly one in every two Americans, increased the already big concern about cybersecurity. How about all the Trump Twitter Tweets? It goes on and on. I think you get my point. The bottom line is that it seems that nothing will bring this market down, and it continues to climb that “Wall of Worry.”

For the fourth quarter of 2017, large stocks continued to be the leader. The S&P 500 Index climbed more than 6% in the fourth quarter and rose by more than 20% for 2017. Smaller stocks performed well, but lagged their large cap brethren. The table above shows the performance results for the small/micro-cap indexes from Frank Russell & Company. During the past year, growth trumped value in both small-cap and micro-cap indexes. However, value outperformed growth within the micro-cap indexes in the fourth quarter. We are not sure if value’s leadership within micro-cap stocks is in a leadership reversal.

A deeper drive into the small/micro-cap universe shows that while the breadth was strong, it was not as strong as one might think given the gains last year. The table below shows the number of stocks that posted gains versus the number of stocks posting losses last year. Of the 3,244 publicly traded small/micro-cap stocks, 1,878 rose last year while 1,366 declined last year. A more interesting data point is that while the standard stock climbed nearly 15% last year, the median gain was only 5.51%. To us, the true standard company’s stock did not perform well last year. We believe there is a decent chance that the standard stock may do better in the future. Let’s look at several factors that could influence small/micro-cap stocks in 2018.

Interest Rates

Including yours truly, there have been many professional investors that have been forecasting higher interest rates for many years. The Federal Reserve spent the past year beginning the process of resetting short-term interest rates. Bond vigilantes may follow this year and reset yields. However, there have been several times in this recovery when bond yields attempted to rise only to be terminated and reversed. The obvious reason for this is that the U.S. economic data turned soft, but we think most of the blame came from other markets, which included Eurozone blowing up, China economy slowing, or various other global economic issues. This period, however, the U.S. recovery is broader, global recovery is more synchronized, confidence is stronger among businesses and individuals, and we are closer to full employment than ever before.

The 10-year Treasury yield is currently just above 2.60%, which is up from 2.12% from July 2017 and 1.46% in June 2016. While inflation is still relatively low, it appears inflation is rising, and more importantly, inflation expectations appear to be on the rise. Should evidence support an increase in inflation, it should force yields to head even higher. Bonds have been in a bull market for more than 30 years, but given the current economic backdrop we believe the bond bull market is over. Even the charts support this theory. If you examine the long-term trend line of all the government bond yields, you will see most government bonds have broken their long-term trend line. The 30-year Treasury Bond is the only bond that has not broke the long-term trend line. We believe once the 30-year Treasury Bond breaks its long-term trend line, the bond market will officially enter a bear market. We have often said that rising interest rates are not a bad thing for smaller stocks. Smaller stocks have performed well in rising interest environments. Please refer to our white paper on Interest Rate Hikes and Small Cap Returns.

Tax Cut

The Trump Administration was successful in lower taxes for corporations. It depends on your individual situation, but taxes were lowered for some individuals too. The corporate tax rate was permanently lowered from 35 percent to 21 percent, which brings the rate closer to countries like Canada at 15 percent and Ireland at 12.5 percent. Analysts are busy reviewing financials to adjust their earnings estimates for 2018 and 2019. Since several companies have operations around the world and some have tax deferred assets that need to be adjusted or written down, the adjustment to earnings estimates is not that easy. We, and many analysts have a great deal of homework. Earnings estimates need to be adjusted for these new facts. Regardless, estimates for the several companies will be on the rise, which we believe should be a net positive for stock prices. In addition, we believe higher corporate profits and increased cash flow should bode well for merger and acquisition activity. As you may have seen from our research, as of 12/31/17 nearly 60% of all public merger and acquisition activity occurs at the micro-cap level. Please refer to our white paper on Top 10 Reasons to Invest in Microcap.

U.S. Economy and Global Growth

The U.S. economy experienced two quarters in a row of economic growth above 3%, and unemployment is near a 50-year low. The Trump Administration continues to lobby for its pro-growth agenda. The pro-growth agenda includes slashing onerous regulations that have stifled business, a proposed $1 trillion infrastructure spending schedule for this year, a significant increase in military budget, and the already passed tax cuts discussed above.

Global growth is improving overseas too. We are in the middle of a global economic growth recovery which has provided strong support for market gains. For the first time since 2007, all 45 economies tracked by the OECD (Organization for Economic Co-operation and Development) Composite Leading Indicators Index have positive GDP growth for the year. Furthermore, despite minor interest rate increases in the U.S., global central bank policies remain very accommodating with low interest rates around the world. Most importantly, recession risk in the next year could be low.

There are few excesses you would normally associate with a recovery like this one. Both household and businesses have strong and liquid balance sheets, and will likely improve with the recent tax cuts. The Leading Economic Indicators (LEI) just rose to a new all time high. In our view, the U.S. has not experienced a meaningful capital spending cycle since the Dot-com boom in the 1990s, but we believe the conditions are more conducive for investments. We would not be surprised if the U.S. economy produces growth near 4% or more in one of the quarters this year.

Valuations and Investment Outlook

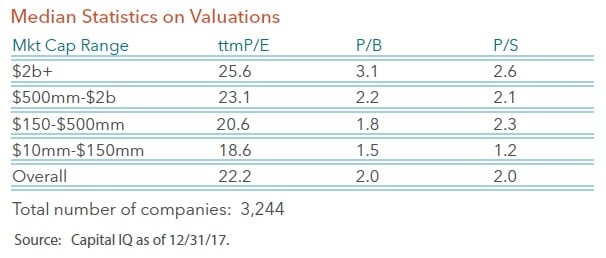

Given the fact that stock prices rose by double digits in each of the past two years, and corporate profits rose, but by less than stock prices during that period, one should be concerned about valuations. We certainly agree that valuations are not cheap. Just review the table below. This is the small-cap universe of 3,244 companies broken down for various market capitalization ranges. The typical company within the small-cap universe trades at more than 22 times trailing earnings, which is not cheap in our opinion. However, with the economy still improving and corporate tax cuts now in place, earnings growth should be very robust this year, which means valuations may be lower in the future.

Given our thoughts on interest rates, tax cuts, and the global economy, our investment focus remains on capital good sectors. Throughout most of the bull market, leadership has been concentrated among consumer stocks and bond surrogates. However, investment spending seems to be in a position to drive the capital goods area. We view the four major capital good sectors as technology, industrial, materials, and energy. We belive technology represents the leaders and are characterized by string secular unit growth. Industrials offer a play on global infrastructure revival. Materials are the quintessential inflations play in the economy, and are likely to face intensifying overheat pressures. Lastly, Energy offers a contrarian play, but good value which could benefit from rising inflation and higher yields. While we will not entirely ignore the other sectors of the economy, it is likely that these capital good sectors will be our larger weights within the portfolios.

See the full PDF below.