Following today’s report release of March’s plunged payrolls, Theodore Littleton, Associate Economist, Refinitiv says expect April to be much worse.

Q4 2019 hedge fund letters, conferences and more

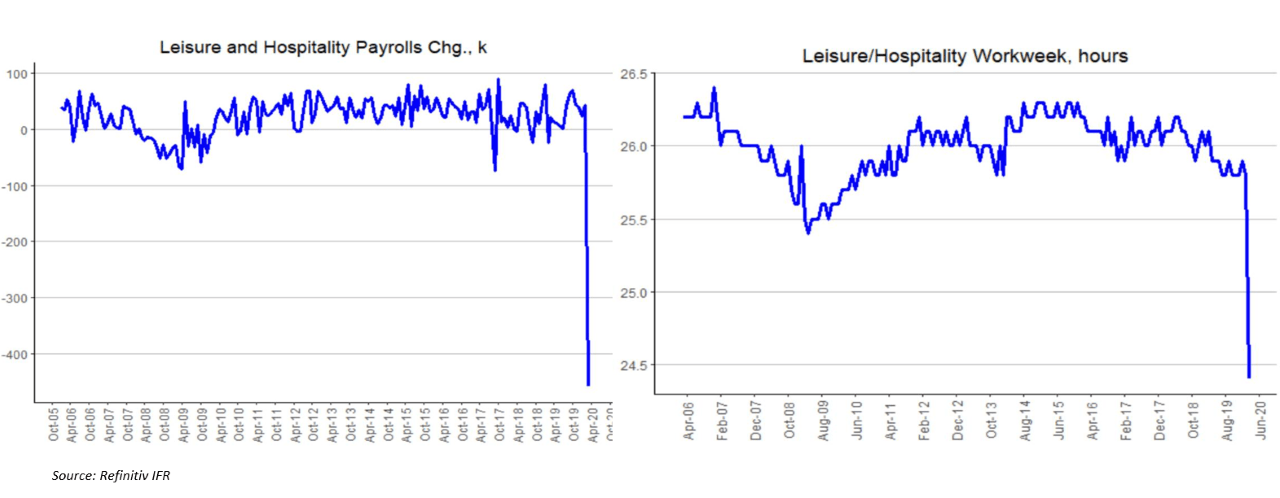

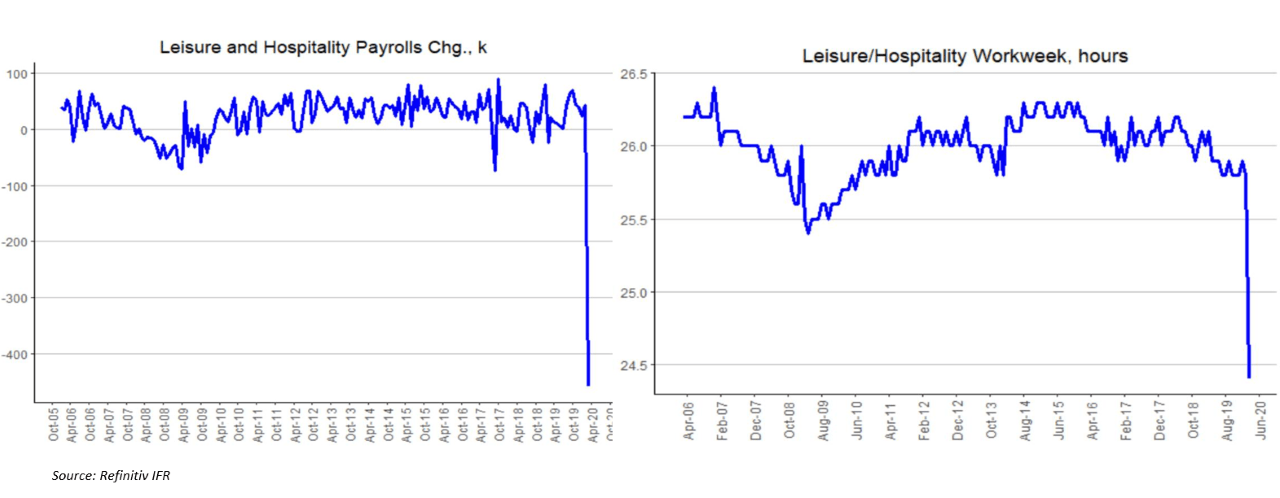

“Bottom Line Up Front: As expected, the damage was much worse for accommodation and food services than any other sector (food services alone down 417.4k), which unfortunately, was most likely the reason behind the higher than expected average hourly wage growth – more low-wage workers dropped out than high-wage earners. Expect much worse for April’s report.

Payrolls Plunged 701k In March

The Details: Payrolls plunged 701k in March, a far greater collapse than the expected, -100k. The unemployment rate (mkt 3.8%) was similarly much worse, up 0.9 pp to 4.4%. At least the workweek (mkt 34.1 hrs) only slipped 0.2, to 34.2, while average hourly earnings (mkt +0.2% m/m, +3.0% y/y) rose 0.4% on the month with y/y ticking up to +3.1%. Unfortunately, the latter appears to have been due to a composition effect, as payrolls in some of the lower-paying industries (accommodation and food services payrolls plunged 446.3k).

That's the bad news. The really bad news is that April will be much worse. February's payrolls growth was revised up from +273k to +275k though, so, there's that - but don't get too excited; January was revised down from +273k to +214k.

Jump In The Unemployment Rate

The jump in the unemployment rate was a mix of bad news and worse news. The household survey's employment level fell precipitously, down 2.987 mn, while 1.633 mn left the labor force. The labor force participation rate thereby fell from 63.38% to 62.72%, its lowest since August 2018, and the employment-population ratio fell from 61.15% to 59.97%, its lowest since February 2017. The number out of the labor force currently wanting a job jumped 547k to 5.509 mn, the largest single-month record in data going back through 1994.

The workweek tells a similar story, with a huge drop in leisure and hospitality, from 25.8 to 24.4. The previous record low for the ssector was 25.4. Most other service sectors ticked down only slightly, but overall both services (33.0) and goods-producing (40.1) sectors' weeks slipped 0.3 hours.

March's survey periods, which included the 12th of the month, were generally supposed to have avoided the great majority of the joblessness that we saw expressed in initial claims for the weeks of March 21 and 28. However, it's likely that in addition to layoffs, hiring was greatly arrested.”