- On Holding makes On sneakers with its patented CloudTec cushioning technology for running, tennis, workouts, and hiking.

- Its popularity continues to grow as sales climbed 92% YoY to CHF366.8 million, crushing analyst estimates of CHF274.68. It also raised 2023 revenue guidance.

- On Holding is one of the rare retail stocks experiencing margin expansion, expecting margins to climb to 60% by mid-year and taper off to 58.5% for full-year 2023.

- ONON has a 9.97% short interest.

- 5 stocks we like better than ON

Q4 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Swiss sports and footwear maker On Holding AG (NYSE:ONON) has been creeping up under the radar since debuting its IPO in September 2021. Its shares climbed as high as $55.87 before plunging to a low of around $15.64 in October 2022.

The company makes premium sneakers under the On brand. Its shoes continue gaining popularity thanks to its patented CloudTec cushioning technology that makes them extremely light, buoyant, and supportive.

The design of the shoes looks like a cross between Crocs Inc. (NASDAQ:CROX) soles and V.F. Corp. (NYSE:VFC) Vans sneaker tops.

Big Fish in Little Pond Expanding

On Holding makes premium road and trail running, hiking, tennis, workout, and active life shoes. They were prevalent in Switzerland, capturing a 40% pre-pandemic market share edging out NIKE Inc. (NYSE:NKE) and 10% of Germany's running shoe market.

The company has expanded distribution to over 60 countries worldwide. The company is rolling out the "next phase" of its CloudTec and CloudTec Phase offerings. It expects the 2024 Paris Olympics to be a material growth driver.

The company signed many top athletes, including the reigning Olympic Champion Triathlete Kristian Blummenfelt and the women's number one ranked tennis player Iga Swiatek.

Margin Expansion

Most retailers have faced margin compression due to heavy promotions and discounting, competing in a race to the bottom to sway consumers. Athleisure and footwear maker Under Armour Inc. (NYSE: UAA) suffered a (615 bps) drop in operating margin due to margin compression as inventories ballooned 50% YoY.

Even premium athleisure brands like Lululemon Athletica Inc. (NASDAQ: LULU) suffered double-digit margin compression, trying to get tight-fisted consumers to spend again. Against this backdrop, On Holding stands out as one of the rare consumer discretionary companies experiencing margin expansion.

This is driven by high demand and low inventory, enabling them to maintain their higher price points at full price. Its premium shoes also appeal to a more affluent demographic that can absorb inflationary pressures better. Inventory is also normalizing due to improving supply chains.

Missed EPS But Furious Revenue Growth

On March 21, 2023, On Holding released its fiscal fourth-quarter 2022 results for the quarter that ended in December 2022. The company reported a diluted earnings-per-share (EPS) profit of CHF0.02, missing consensus analyst estimates for a profit of CHF0.06 by (CHF0.02).

Revenues grew 91.9% year-over-year (YOY) to CHF366.8 million, blasting through analyst estimates of CHF274.8 million.

Upbeat CEO

Co-CEO and CFO Martin Hoffman commented, "After navigating through a challenging 2022, including supply shortages, tight production capacities, and disruption of global trade lanes, we are looking forward to a great year with largely normalized operations.

We have made significant progress in many areas in the 18 months since our IPO, which will set us up for ongoing success and market share gains."

Upside Revenue Guidance

On Holding raised its fiscal full-year 2023 revenue guidance to CHF1.7 billion versus CHF1.52 billion consensus analyst estimates. It expects gross margin expansion towards 60% mid-year and 58.5% for the full-year 2023.

This is driven by scale gains in SG&A slightly offset by the re-acceleration of marketing expenses. Adjusted EBITDA is expected to grow by 15%.

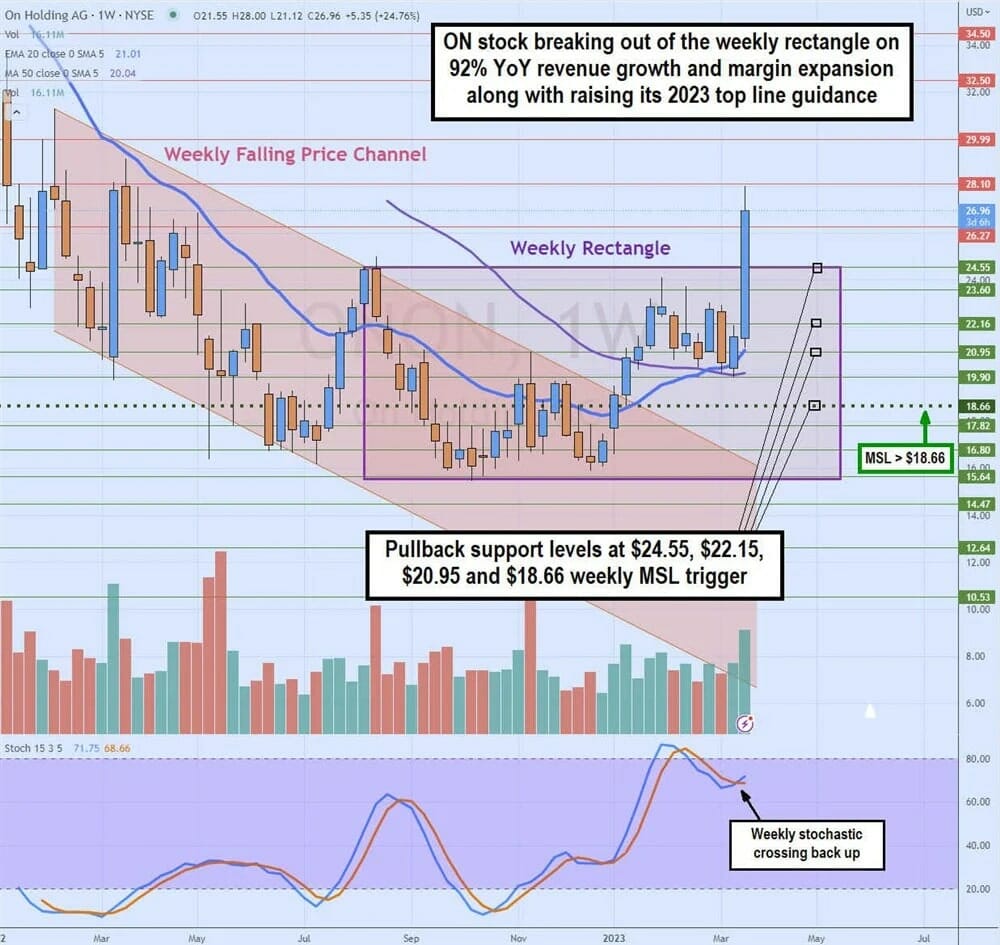

Weekly Falling Chanel to Rectangle Breakout

After a year of a weekly falling price channel, ONON stock finally stabilized at $15.44 in October 2022. A weekly rectangle formed, capping the trading range between $24.55 and $15.44. ONON triggered the weekly market structure low (MSL) breakout through $18.66 in January 2023, rising as high as $24.11 before peaking.

The weekly stochastic also peaked and fell under the 80-band as shared pulled back to the weekly exponential 20-period moving average (EMA) and 50-period MA supports.

They have also crossed over, indicating a breakout as the weekly 20-period EMA is rising at $21.01 support, followed by the weekly 15-period MA at $20.04. The weekly stochastic oscillation down was cut short on the earnings spike and is starting to cross back up again off the 60-band.

Pullback support levels are $24.55 rectangle upper trendline, $22.15, $20.95 weekly 20-period EMA, and $18.66 weekly MSL trigger.

Should you invest $1,000 in ON right now?

Before you consider ON, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ON wasn't on the list.

While ON currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

Article by Jea Yu, MarketBeat