Opposite winds tend to neutralize each other, but they can also lead to extraordinary phenomena… Are storms and hurricanes looming over the market?

Crude Oil Benchmarks Fall

The two crude oil benchmarks (Brent and WTI) had already fallen by more than 6% on Monday, carried away by fears of a global economic slowdown and the erosion of Chinese demand due to the epidemic outbreak that the country is currently experiencing.

Q1 2022 hedge fund letters, conferences and more

The proposed European Union embargo on Russian oil is currently blocked because it must be adopted unanimously by the 27 member states.

Hungary is the firmest opponent of this embargo, which would strongly threaten its energy supplies given that the country happens to be one of the most dependent on energy from the Russian bear.

The EU would be ready to adapt the sanctions package currently under discussion towards Russia. For example, by abandoning the ban on European tankers from transporting Russian oil, diplomatic sources indicated on Tuesday.

The ban on European tankers from transporting Russian crude was a problem for Greece, Malta, and Cyprus, among others, which feared severe consequences for their shipping industries.

Indeed, it should be highlighted that Greece accounts for about a quarter of the world's tanker fleet.

In the end, it is more likely that the risk of sanctions and supply disruptions will outweigh demand concerns.

Trade Review

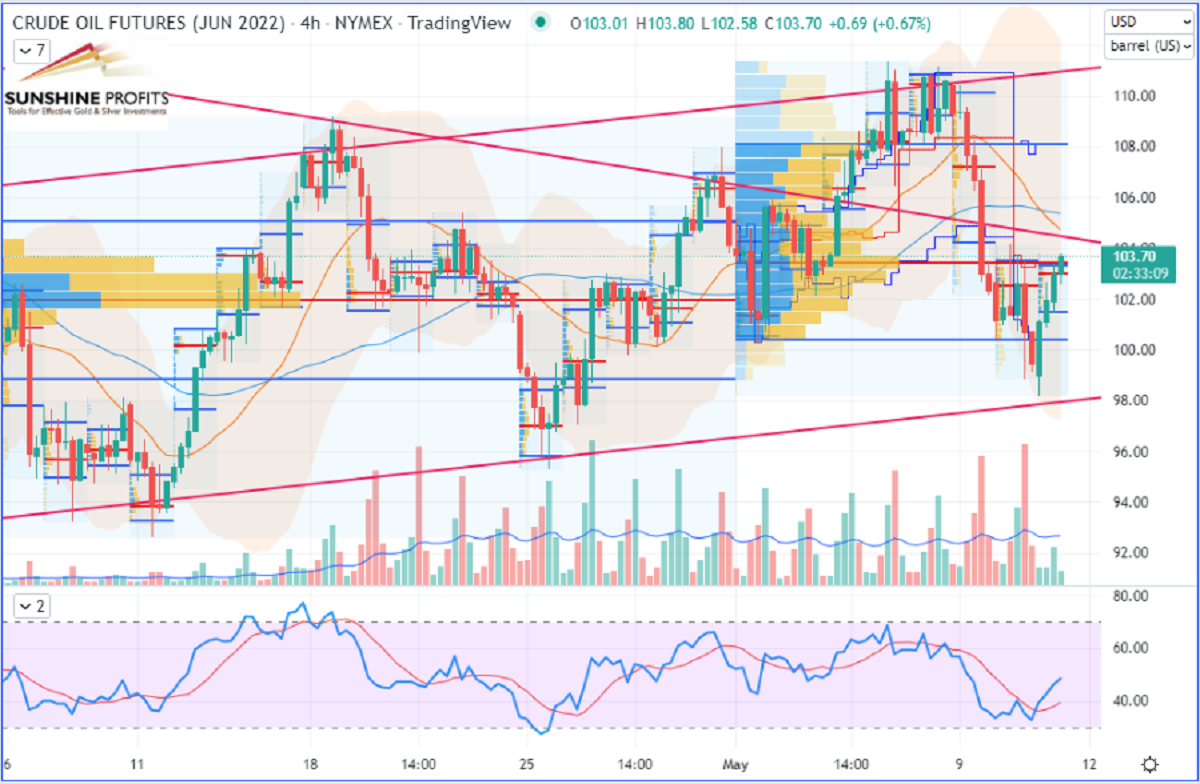

After a successful trade entry triggered at the beginning of the week during that oil drop, black gold recovered almost half of its previous two-day losses during the European session on Wednesday, in a ranging market.

Therefore, the initial stop can now be dragged to the next level, as described in our oil trading alert (members only) section, to reduce the risk.

To be continued as the market progresses.

WTI Crude Oil (CLM22) Futures (June contract, daily chart)

WTI Crude Oil (CLM22) Futures (June contract, 4H chart)

That’s all, folks, for today. Have a nice day and happy trading!

Like what you’ve read? Subscribe for our daily newsletter today, and you'll get 7 days of FREE access to our premium daily Oil Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist

The information above represents analyses and opinions of Sebastien Bischeri, & Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. At the time of writing, we base our opinions and analyses on facts and data sourced from respective essays and their authors. Although formed on top of careful research and reputably accurate sources, Sebastien Bischeri and his associates cannot guarantee the reported data's accuracy and thoroughness. The opinions published above neither recommend nor offer any securities transaction. Mr. Bischeri is not a Registered Securities Advisor. By reading Sebastien Bischeri’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Sebastien Bischeri, Sunshine Profits' employees, affiliates as well as their family members may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.