Nikola Corporation (NKLA) – The SPAC is back (plus a magic money machine) by Value And Oppurtunity

Intro

Nikola Corporation (NASDAQ:NKLA) is a company I haven’t heard of until a week ago or so. It is a pre-revenue, prototype-product company that according to their web site develops Hydrogen fueled and electric trucks.

Q1 2020 hedge fund letters, conferences and more

The VC Past

Nikola Corporation did a Series D funding round in September last year at a pre-money valuation of 3 bn USD which is quite remarkable for such an early stage company and they seem to have received ~500 mn USD from corporate partners CNH, Bosch and Hanwa. Although the valuation would raise some eyebrows, this would be still not considered super crazy by VC standards if they have a great team and great technology assets.

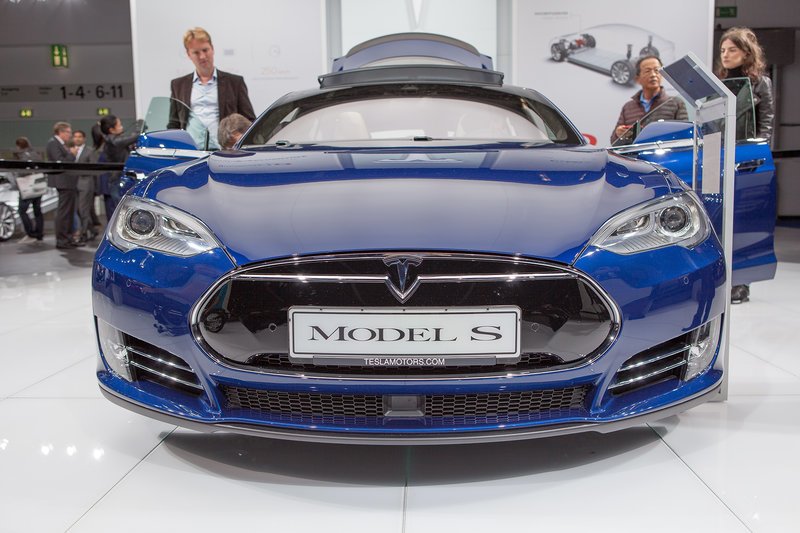

The company is obviously trying to piggyback on Tesla’s recent success, which the name of the company cleary does not hide (Nikola Tesla now has a a company each for his first name and his family name…) . Funnily enough, the first name sued the family name for a 2 bn USD patent infringement.

However some things were strange even at that stage:

- the company did not really disclose previous investors

- the amounts raised seemed to have been mostly “in kind” services from suppliers

- the published dates for the investments (Bosch and Hanwa) seem to be inaccurate

- no reputable VC has invested, with the exception of ValuaAct which is more a Hedge fund than a typical VC

- Right after that funding round, the CEO and founder Trevor Milton bought himself a nice 32,5 mn USD ranch

- They fell short of their fund raising target of 1.5 bn USD

Overall, I would personally doubt the 3 bn USD valuations. Unicorn companies often lie big time about their achieved valuations and few participants have an incentive to tell the truth.

Anyway, the series D round seems to have been only a semi success and not enough to actually secure start of production.

Enter the magic SPAC

I guess some of my readers know what a SPAC (Special Purpose Acquisition Company) is: It is a company that goes public and raises cash, with the intent of buying (or merging with) another promising company at some point in the future. At the end of the day it is a “backdoor IPO” mechanism that allows the future partner to avoid all the hassle with actually doing an outright IPO.

One of these SPACs or blank Cheque companies was a company called VectoIQ that went public in May 2018 with the target of finding a suitable operating company within the next 2 years. The company issued 23 mn shares at 10 USD per share, netting the company around 225 mn USD after fees.

The way these SPACs work is that he “founders” received another 5.75 mn shares basically for free before the IPO. So those people who bought the stock at 10 USD actually got diluted by ~1/3 already on the first day. As a “sweetener”, IPO investor received additional warrants to have a better upside potential in case something would happen and if now deal would have been done until may 18th 2020, the IPO investors would get their money back and the founder’s shares would be worthless.

For a long time, Vector IQ traded at around 10 USD, before in the beginning of March, VectoIQ announced that (fanfare) Nikola Motor would be the target. After a quick “Pop” , even one month after the announcement, VectoIQ traded at 10 USD per share, before finally the stock started to climb to around 34 USD pre merger.

Now the real magic begins:

The combined company after re-listing has 360.9 mn Shares outstanding, which at the pre-merger price of 34 USD would have meant a market cap of ~12.3 bn USD. But this is not the end of the story: In the first few days of trading, the stock “exploded” to 86 USD or a 31 bn USD market cap. AT the time of writing the stock price was still 70 USD or 25 bn USD market cap (plus Warrant).

As a small side story, as part of the merger, some “family and friends” were able to invest 500 mn USD at a valuation of 10 USD per share.

Another funny side story was that Nikola Corporation applied for a small business Corona-emergency loan in April and actually received 4 mn USD.

SPACs like VectoIQ are often used to quickly cash in on a trend with often inferior business models. The circumvention of the IPO allows the company to trade without big scrutiny from professional investors. Considering how soft IPO analysts usually are, going via a SPAC normally itself is a sign of weakness.

SPAC usage is often highest towards the peak of bull markets and the overall performance for SPACs is shitty:

They construct a sample of 158 SPACs for the period 2003-2008 and report positive performance in the range of 2% to 3% for SPACs in the short term. However, for long term performance, the average half year return is equals to -14%, average one year return is -33% and average three years return is -54%. They state that board independence and the structure of ownership do not affect returns.

The magic Nikola money machine: Selling the same truck twice

As Nikola Corporation not only wants to become the “Tesla of Hydrogen Trucks” but also in parallel wants to create the Hydrogen infrastructure, they probably need a lot more money than the roughly 1 bn or so they have now in the bank.

Here is an interesting interview with the founder on finances:

The first note is that Nikola was always claiming they had 14 bn of “pre orders” for their trucks, but actually it seems to be only a 800 mn USD order from Anheuser Bush so far.

However the most astonishing feature of this interview is the part where he explains the financing of the hydrogen network which is the “Most valuable asset” of the company (because we are a “Energy tech” company”):

“We sell the trucks to the customers, i.e. sell them the leases. Then we sell the leases off and use the money for building the Hydrogen Network”.

I listened to that passage at the end several times because I thought that I don’t understand it due to not being a native speaker, but after hearing it five times I am convinced that this statement is utter bullshit.

What Milton is basically saying is that someone supposedly is paying a second time for the very same truck that enables him both, to actually build the truck and additionally finance the hydrogen network. You will also not be able to “sell the lease” to the trucking company as a lease does mean that there will be no or only a very small upfront payments.

But it seems that such details do not bother a true genius.

Some differences to Tesla:

From what I understood, the main difference to Tesla is that part of the trucks will not be build by Nikola Corporation but by CNH in its existing factory in Ulm/Germany. The basis will be an existing Iveco truck plus an infotainment system and a Nikola Power train which itself seems to have been developed by Bosch.

They also seem to offer “freight as a service”, I.e. guaranteeing the customers a certain amount of driven miles including all costs. I guess this is the “Lease” he wants to selloff to someone else but the truck company will for sure not pay upfront and somehow he needs to finance the truck.

The biggest issue in my opinion is the fact, that all customers of Nikola will be businesses who run on very thin margins. So other than Tesla, Nikola will not be able to charge for any coolness factor, but the trucks need to be cheaper all in than the existing mass produced trucks by all competitors.

Summary:

All in all, Nikola Corporation looks like a cheap (and pretty bad) copy of Tesla, trying to ride the current Fuel cell /hydrogen /zero emission boom. For people who have a longer memory, they might remember a fuel cell boom 20 years ago with names like Ballard Power (which by the way has gained 300-400% in the recent months).

What I have seen so far from the CEO looks pretty bad with quite incoherent communication. I haven’t checked the technology behind Nikola Corporation but to me it looks like a big marketing story that used the “SPAC” structure toi create a quick “pump and dump” scheme to fleece retail investors that want to somehow participate in the next Tesla.

There is certainly a small chance that they are able to inflate this for some time and raise enough money to have a chance to do something, but I am still surprised how quickly after the Covid-19 crash we see such crazy schemes coming up again.

I also guess that this will not be the last Hydrogen “pump and dump”. Maybe I should try to find one among the many small shitty stocks in Germany and ride the wave too.