Discusses the latest financial result with analysis from the street and the fintel platform

On Thursday, shares of personal finance insights company NerdWallet (NASDAQ:NRDS) were boosted more than 37% higher as the company’s third quarter results came in well ahead of forecasts.

NerdWallet’s Q3 Earnings

NerdWallet grew sales in the third quarter by 45% over the year to $142.6 million and came in 5.5% ahead of the streets’ forecast of $135 million.

Q3 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Despite the growth in sales, adjusted EBITDA fell (31%) over the year to $14.5 million but still managed to beat forecasts around $9 million. The decline in EBITDA resulted from total costs and expenses growing by 64% over the year to $151.4 million.

The group swung from a net loss of -$7.8 million in 2021 to a net profit of $0.7 million in 2022, resulting in EPS of 1 cent per share generated for investors. The street was expecting the firm to generate a loss of around 13 cents per share which resulted in a surprise beat to expectations.

NerdWallet had an average of 19 million active users, showing 11% user growth year-on-year.

CFO Lauren StClair attributed the outperformance to success from the credit cards, banking, personal loan and SMB verticals.

Management provided guidance for the fourth quarter during the result, setting expectations that they will generate sales of $138-141 million with adjusted EBITDA between $26-28 million. Both the sales and profit guidance was ahead of analyst expectations.

For the full year, NerdWallet expects to report an adjusted EBITDA margin of around 12% which will represent an increase of 5 percentage points over the year.

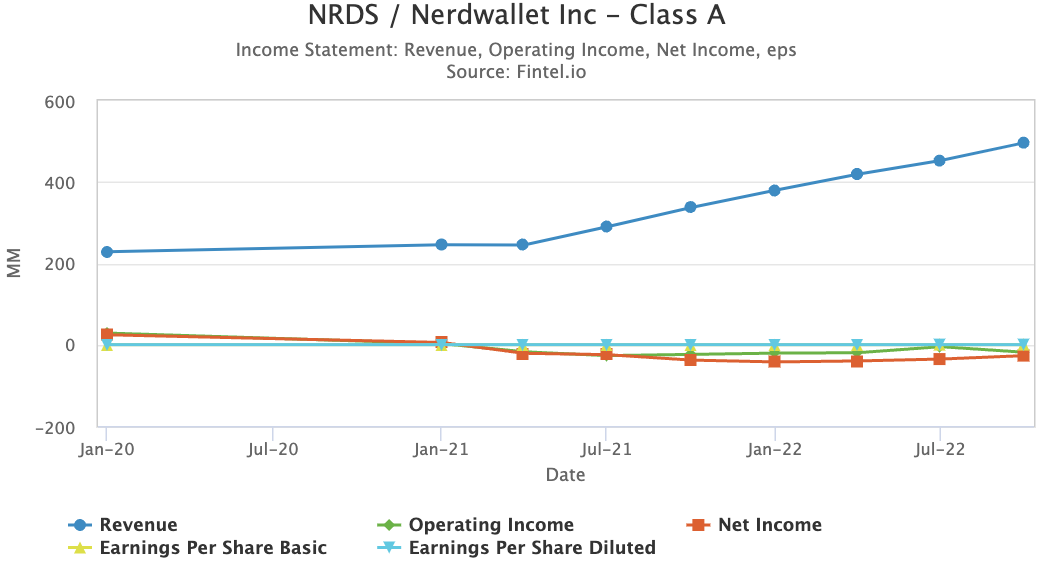

The chart included to the right from the Fintel financial metrics and ratios page for NRDS shows the scale up of revenue over the last few years.

Jed Kelley from Oppenheimer & Co discussed how the earnings beat reflected share gains from content advantages and product improvements which generated higher customer engagement.

Kelley highlighted that NRDS is gaining stronger card traction vs competitors while benefiting from less exposure to refinance and insurance. The firm has a $17 target on the stock with an ‘outperform’ rating.

NRDS has a consensus ‘buy’ rating and $24 average target across the street with almost all institutions having bullish views on the company.

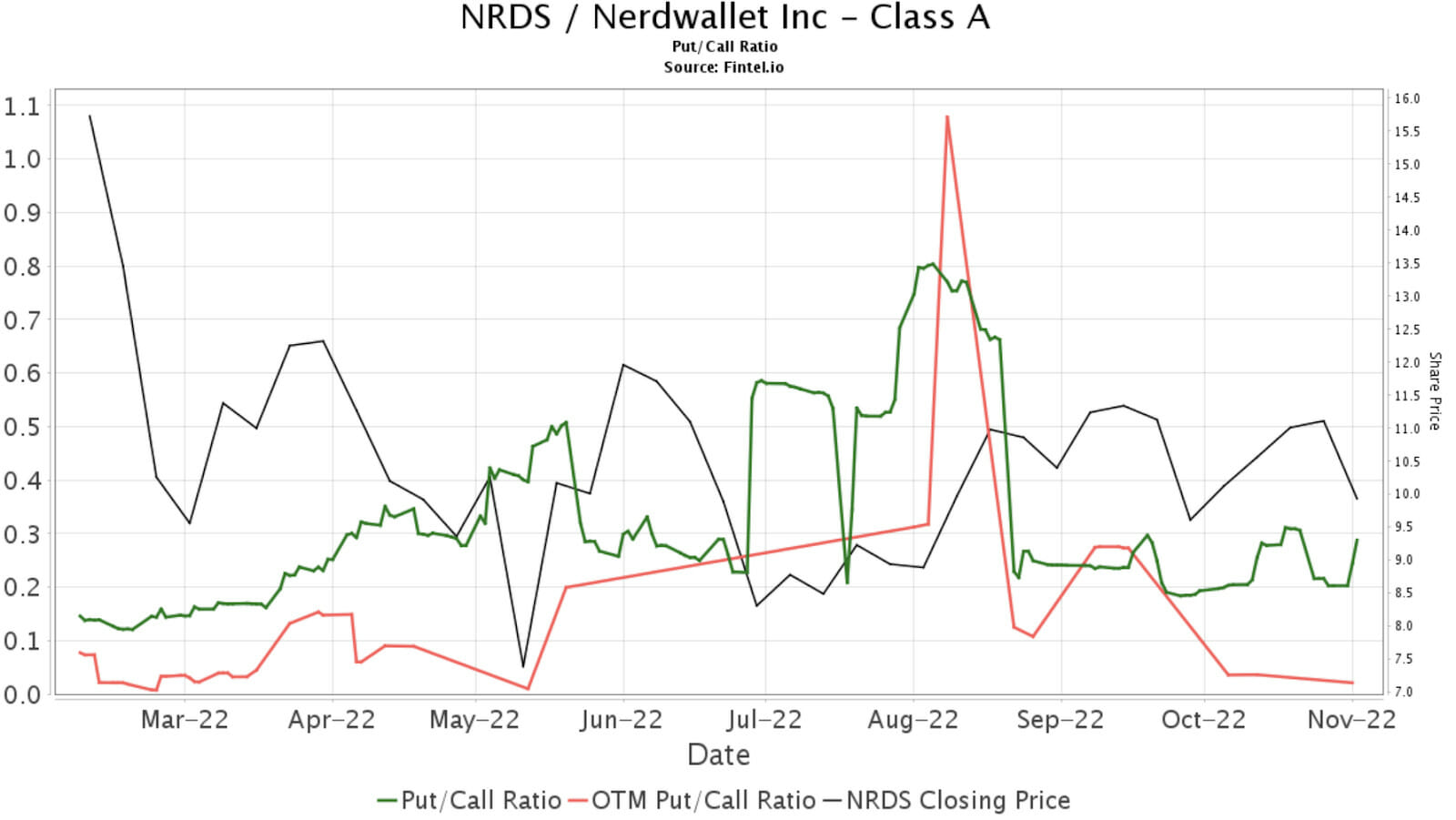

Fintel’s platform analysis of the underlying options market for NRDS suggests that investor sentiment remains bullish in the stock. This is explained by a Fintel put/call ratio of 0.45 which tells us that bullish sentiment from call option demand significantly outweighs bearish sentiment from put demand.

The put/call ratio is determined by analysing all put and call interest in the market for a stock over time with values towards 0 indicating stronger bullish sentiment as it means call open interest carries greater weight than put interest.

The chart provided below shows this ratio over the last 6 months and how it has behaved"

Article by Ben Ward, Fintel