In today’s edition, I will provide some updates on recent market developments for Natural Gas futures (NGF22) following my last article from Dec. 10th.

[soros]Q3 2021 hedge fund letters, conferences and more

Alternatively, you can find my initial trade plan (with projections) in last Monday’s Oil & Gas Trading Alert.

The Trading Plan

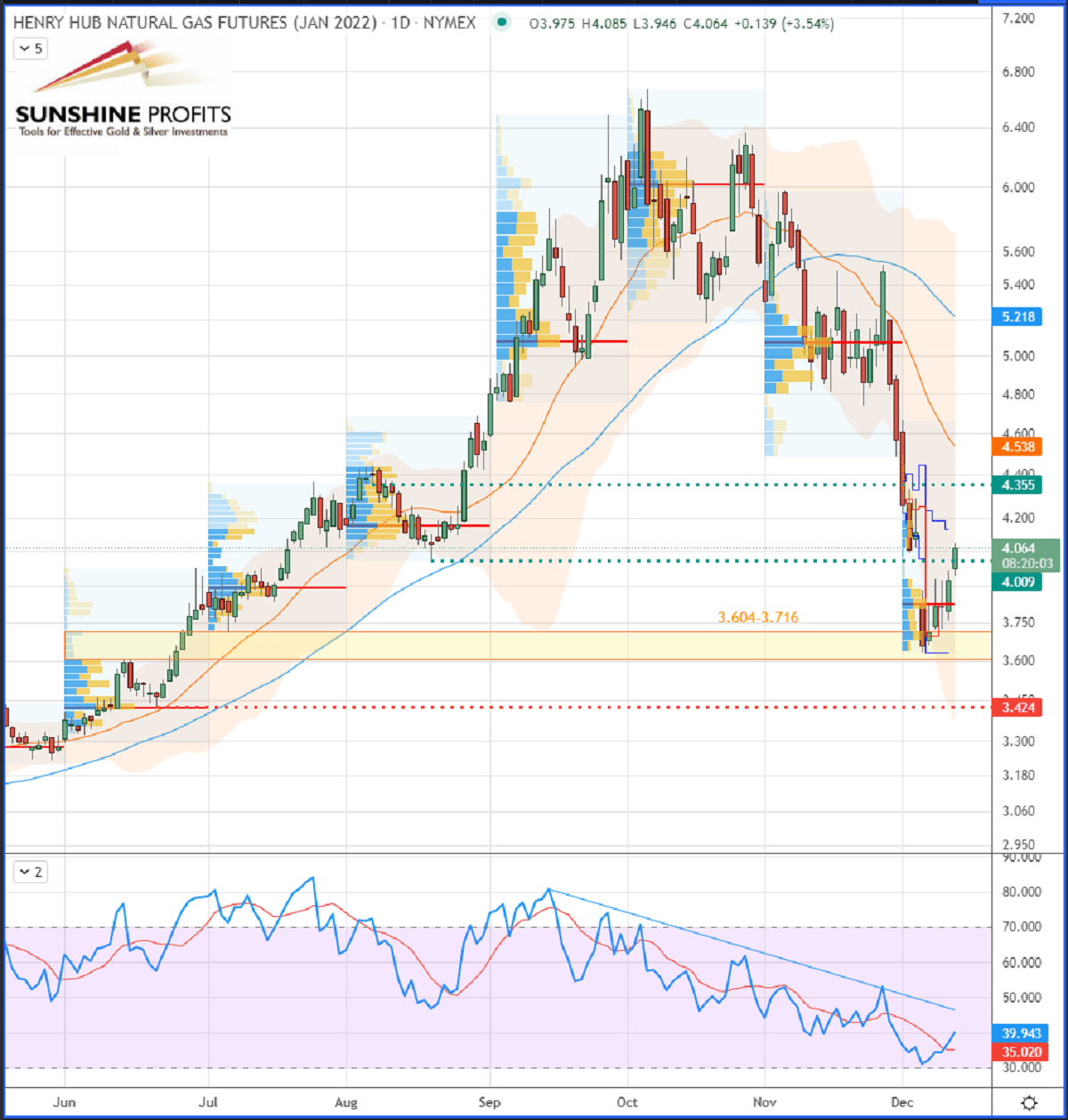

We all love it when a trade plan comes together! Since the market has to cope with stronger demand due to lower temperatures, you can see that the rebounding floor (support) provided was ideal for the Henry Hub. It has been supported by unyielding global demand for US Liquefied Natural Gas (LNG), and that also fueled its momentum. The recommended objective at $4,009 was thus hit this morning (during the European session) and the $4.355 level is now the next target.

As I explained in more detail in my last risk-management-related article to secure profits, my recommended stop, which was located just below the $ 3.424 level (below half-yearly swing low), was now lifted up around the $3.800 level, which corresponds to the 50% distance between the initial entry and target 1. By doing so, that trade turns out to be risk-free. Alternatively, you could also eventually use an Average True Range (ATR) multiple to determine a different level (above breakeven) that may better suit your trading style.

Henry Hub Natural Gas (NGF22) Futures (January contract, daily chart)

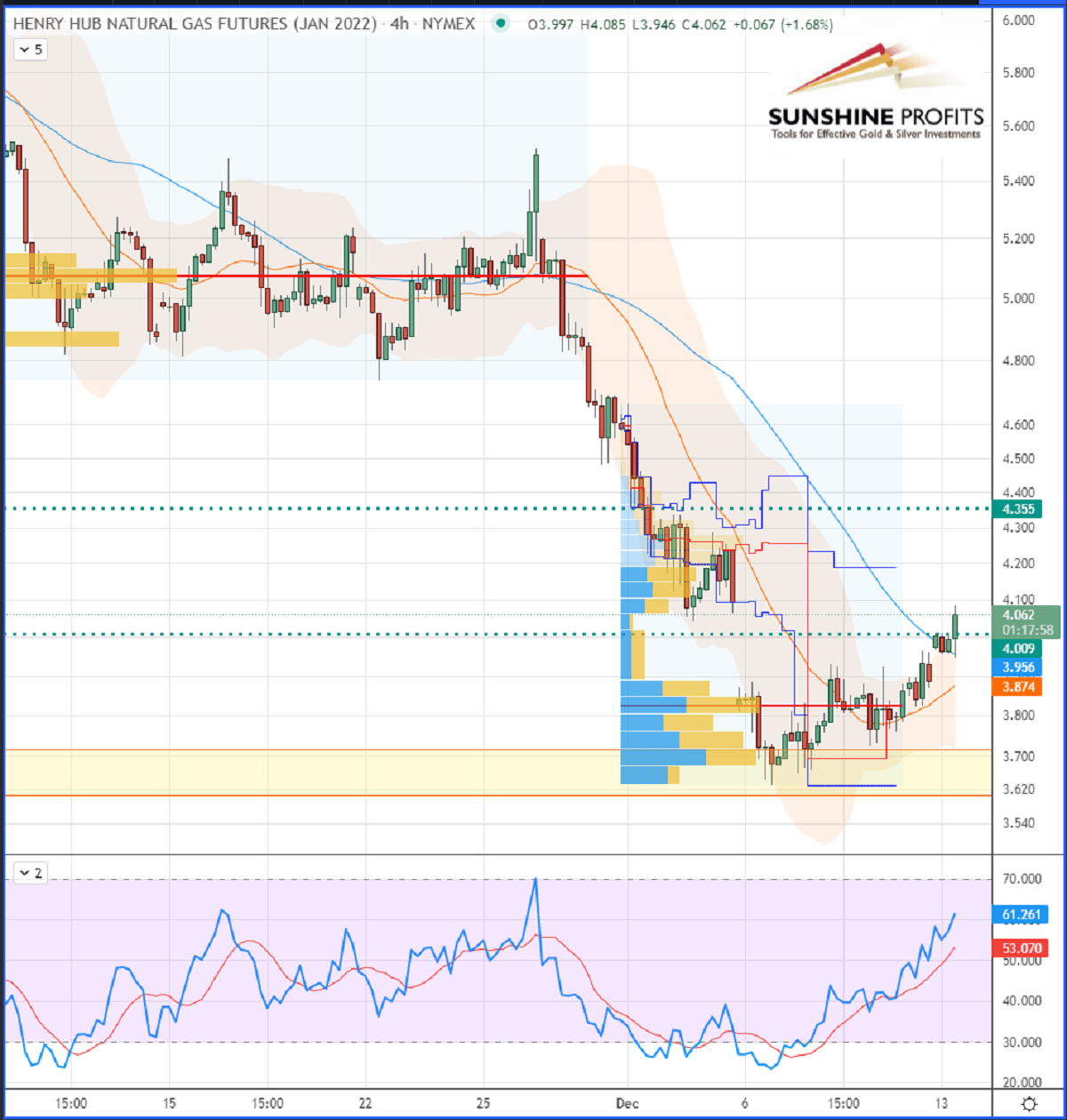

Now, let’s zoom into the 4H chart to observe the recent price action all around the abovementioned levels of our trade plan:

Chart – Henry Hub Natural Gas (NGF22) Futures (January contract, 4H chart, logarithmic scale)

That’s all for today, folks. Happy trading!

As always, we’ll keep you, our subscribers well informed.

Like what you’ve read? Subscribe for our daily newsletter today, and you’ll get 7 days of FREE access to our premium daily Oil Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist

The information above represents analyses and opinions of Sebastien Bischeri, & Sunshine Profits’ associates only. As such, it may prove wrong and be subject to change without notice. At the time of writing, we base our opinions and analyses on facts and data sourced from respective essays and their authors. Although formed on top of careful research and reputably accurate sources, Sebastien Bischeri and his associates cannot guarantee the reported data’s accuracy and thoroughness. The opinions published above neither recommend nor offer any securities transaction. Mr. Bischeri is not a Registered Securities Advisor. By reading Sebastien Bischeri’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Sebastien Bischeri, Sunshine Profits’ employees, affiliates as well as their family members may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.