What’s New In Activism – Musk Pulls Out

Elon Musk will not be joining Twitter Inc (NYSE:TWTR)’s board, changing his mind at the last minute on Saturday.

“I believe this is for the best,” CEO Parag Agarwal said in a statement on Twitter. “We have and will always value input from our shareholders whether they are on our board or not. Elon is our biggest shareholder and we will remain open to his input.”

Q1 2022 hedge fund letters, conferences and more

Musk recently disclosed a passive 9.2% stake in Twitter and later announced that he would join the board. The way he disclosed the stake raised questions over whether he broke Securities and Exchange Commission (SEC) rules by not reporting his stake earlier. Our in-depth story from April 8 explores the subject in more detail.

To arrange an online demo of Insightia's Activism module, send us an email.

Activism chart of the week

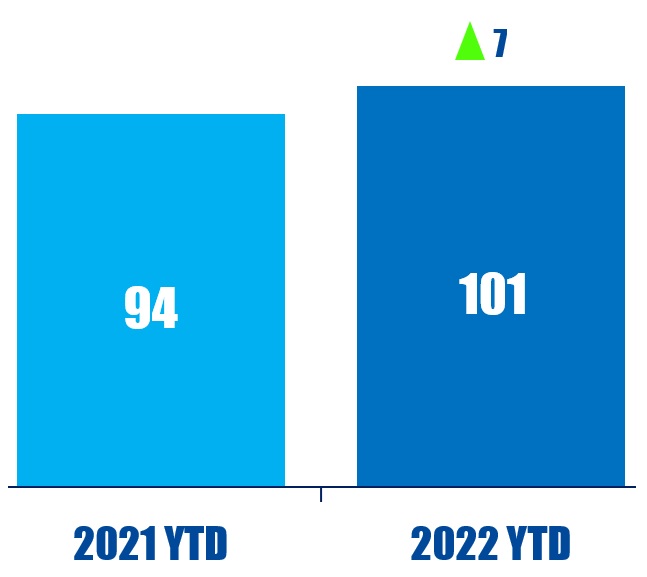

So far this year (as of March 31, 2022), globally, 101 companies have been publicly subjected demands to appoint personnel. That is up from 94 in the same period last year.

Source: Insightia | Activism

What’s New In Proxy Voting - Glencore 'Say On Climate'

The Australasian Centre for Corporate Responsibility (ACCR) called on shareholders to oppose Glencore's upcoming "say on climate" proposal and the re-election of environmental committee Chair Peter Coates, arguing the company's decarbonization strategy is in "clear conflict" with Paris Agreement goals.

ACCR argued that the Swiss mining company's climate transition plan is insufficient, with the company's "significant coal expansion" being "likely" to increase Glencore's total emissions by 17% throughout the course of 2022.

Concerns were also raised regarding Glencore "underreporting" its methane emissions from coal mining in Australia and Scope 3 emissions from its investments, ACCR said.

"Investors must vote against Glencore's second 'say on climate' vote to ensure they are not tacitly supporting new and expanded coal mines inconsistent with the Paris Agreement," said Dan Gocher, director of climate & environment at ACCR, in a press release.

To arrange an online demo of Insightia's Voting module, send us an email.

Voting chart of the week

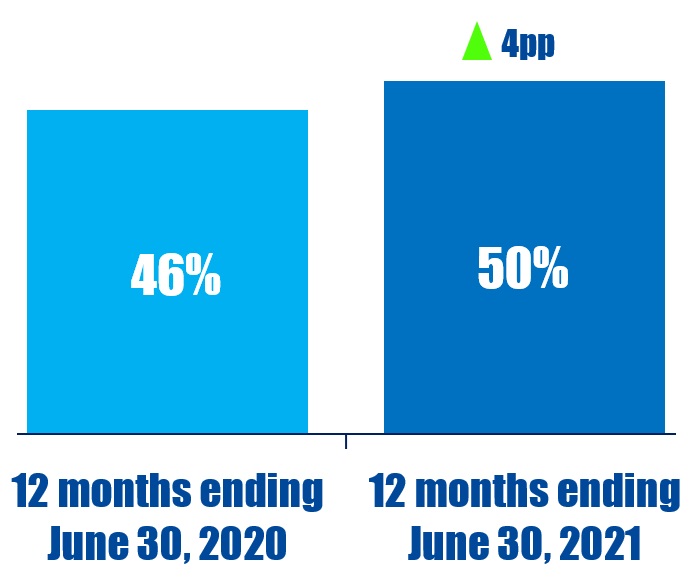

In the 12 months to June 30, 2021, globally, investors supported shareholder proposals 50% of the time on average. This is up from 46% in the previous 12-month period.

Source: Insightia | Voting

What’s New In Activist Shorts - Hindenburg V Mullen Automotive

Hindenburg targeted electric vehicle startup Mullen Automotive Inc (NASDAQ:MULN), saying the company is nothing more than a "fast-talking EV hustle".

The short outfit questioned Mullen's estimation that it would start selling its solid-state battery technology in 18 to 24 months, noting that the company only spent $3 million on research and development last year. The short seller also claimed that Mullen's two planned electric cargo vans are actually Chinese EVs rebranded with a Mullen logo, according to import records.

Hindenburg cited press releases by Mullen about orders and partnerships. The short seller said one from August last year touting a $60 million order for 1,200 vans came from a small cannabis retailer with only one location.

"We have seen this story before, but Mullen strikes us as one of the worst. With echoes of Nikola, Lordstown, Kandi and Ideanomics, we think Mullen is just the latest in a long line," said Hindenburg.

To arrange an online demo of Insightia's Shorts module, send us an email.

Shorts chart of the week

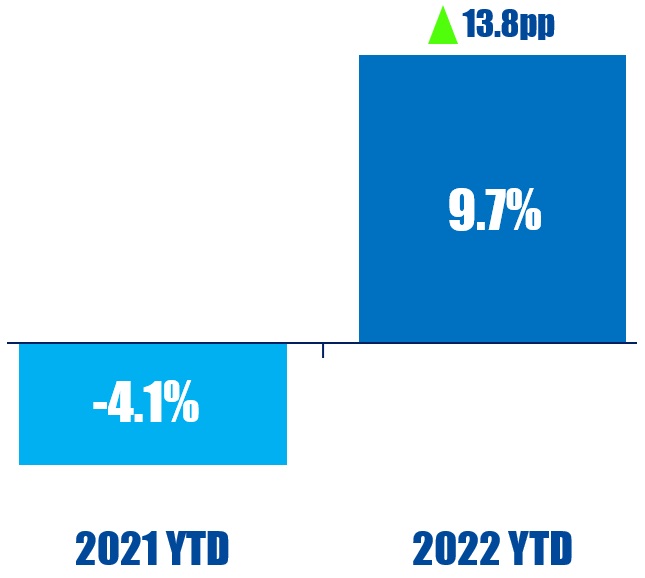

So far this year (as of April 8, 2022), the average one-week campaign return for public activist short campaigns at U.S. companies is 9.7%. That is up from -4.1% in the same period last year.

Source: Insightia | Shorts

Quote Of The Week

This week's quote comes from Southwest Gas in an April 7 open letter to activist investor Carl Icahn. Read our reporting here.

“To prove us wrong, all we ask that you do is provide a simple statement: ‘We will not do anything to cause the record date to be moved from March 21st.‘”