Today’s update examines retail investors’ Most Bought and Sold Securities over the last seven days.

Below you will find the total share of the fund flows dedicated to each security.

Top 5 Purchased Securities This Week

- Vale SA (NYSE:VALE)

Shares of Brazillian mining heavyweight Vale sank 11.5% over the week, led by a falling iron ore price. The stock remains in the green for 2022, retaining 8% of the gains after being up over 50% in March. Vale now trades on an undemanding price-to-earnings ratio of 3.35x.

Q1 2022 hedge fund letters, conferences and more

Earlier in June, broker Jefferies upgraded their recommendation to buy the stock from hold with an updated target price of $24 from $17.

VALE has a consensus 'overweight' rating and a $21.70 target, suggesting a 45% upside for the stock. The target has remained firm above the $20 handle while the price has drifted lower since March.

- Petroleo Brasileiro (NYSE:PBR)

State-owned Brazilian petroleum giant Petrobras's shares declined 12% over the week as oil prices erased May's gains, bringing the company's price back to levels seen in the back half of 2021. Petrobras has been under the spotlight lately, with President Jair Bolsonaro announcing that he was looking to divide up the business at the beginning of June and again this week as the company decided to freeze petroleum prices for 45 days on the condition the government would withdraw its proposal to replace the CEO and board members.

Although geopolitical risks in the stock have weighed on the share price, Fintel retail investors have taken the opportunity to purchase shares that are trading on a 2.55x price to earnings multiple with a significant dividend yield.

PBR has a consensus 'overweight' rating and a $16.50 target, implying a 42% upside to the share price.

- Vinco Ventures Inc (NASDAQ:BBIG)

Vinco Ventures shares outperformed the market, rising 5.3% and recovering some losses experienced when the company announced plans to delay the Cryptyde spin-off distribution date for shareholders. Vinco's shares have been down 16.5% since 2022, although they generally don't follow most major market movements.

- Direxion Daily S&P 500 Bear 1X Shares (NYMARKET:SPDN)

The SPDN ETF acts as an S&P 500 shorting tool and aims to provide the opposite return to the normal index. SPDN rose 5.8% vs. the S&P500, which sank 5.8%...

The ETF is up 26% year to date and is purchased as a portfolio hedging tool and trading tool for investors looking to offset risk in other stocks or trading general market weakness.

- iShares 20 Plus Year Treasury Bond ETF (NASDAQ:TLT)

The iShares 20+ Year Treasury Bond ETF seeks to track the investment results of an index

composed of U.S. Treasury bonds with remaining maturities greater than twenty years. The ETF fell 1.5% over the week but has now fallen 22.3% since the beginning of 2022 in anticipation of further interest rate hikes.

Top 5 Sold Securities This Week

- SoFi Technologies Inc (NASDAQ:SOFI)

Neobank Sofi Technologies retreated 4% as the gains from the May rally were erased. The stock remains under pressure following plans announced by the White House to forgive $10,000 in student loan debt for specific borrowers. The stock is down 64% in total for 2022.

Institutions attribute an 'overweight' rating on the company with an $11.20 price target of almost double the current share price.

- ProShares UltraPro Short Dow 30 ETF (NYMARKET:SDOW)

The SDOW ETF aims to provide 3x inverse returns of the Dow 30 index. Retail inventors sold the ETF this week after pocketing almost a 35% gain generated over the last two weeks.

- Clover Health Investments Corp (NASDAQ:CLOV)

Shares of insurance provider Clover Health were broadly flat over the last week but have experienced a 17% fall in June alone. CLOV shares have been down over 80% in the previous year, with the trend not slowing down. Fintel posted a recap of first quarter results that can be found here.

Brokers are not overly bullish on the company's outlook, giving a consensus 'hold' rating and a $3.60 target on the stock. The target has trended lower in line with the share price since early 2021.

- SPDR S&P 500 ETF Trust (NYMARKET:SPY)

The SPY ETF provides investors exposure to the underlying companies in the S&P 500. The ETF sank 6.1% this week, slipping slightly more than the index.

The ETF is now trading at levels not seen since December 2020.

- MicroSectors U S Big Oil Index 3X Leveraged ETN (NYMARKET:NRGU)

The NRGU ETF provides 3x leverage to the ten largest energy/oil companies by market capitalization.

47% of the ETF's gains were wiped out over the last week, and investors jolted to take profits before losing them. The ETF is now only up 102% since the start of 2022 after being up over 330% earlier in June.

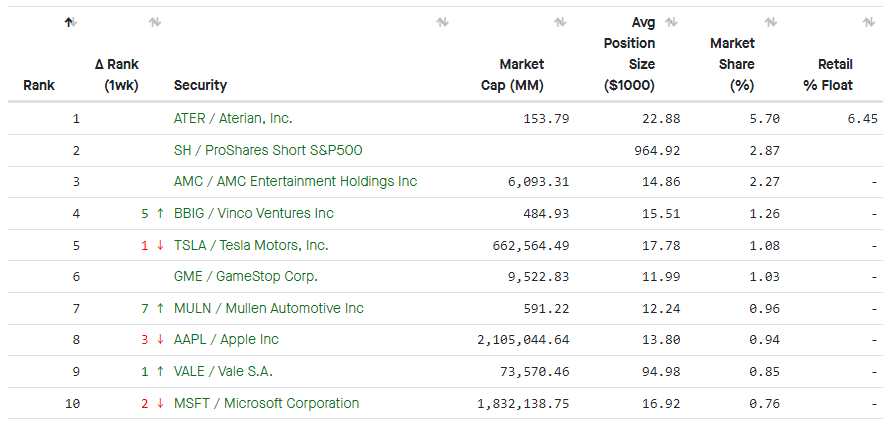

Top 10 most widely held securities this week on the Fintel platform:

The Fintel Retail Ownership shows the most popular securities held by Fintel users linked to their broker accounts. This list is based on actual ownership records from broker accounts.

Aterian held onto the first spot this week while the market share rose to 5.70%, from 5.61% in the week prior.

Vinco Ventures and Mullen Automotive saw strong retail trade flows, with both stocks gaining popularity.

Article by Ben Ward, Fintel