According to investment strategist Louie Navellier, the release of three money center banks tomorrow morning will be an important catalyst for the market, and may well set the tone for the upcoming earnings season.

“One of these institutions on their own can move markets, but a trifecta could have an outsized impact,” Mr. Navellier said.

Q4 2022 hedge fund letters, conferences and more

The key figure to watch, separately and together, will be loan loss reserves. An increase will give the bears fodder to advance their case that a recession is imminent. A decreasing or flat figure will support a soft landing, and set the stage for a more upbeat earnings season.

Bank of America Corp (NYSE:BAC), Wells Fargo & Co (NYSE:WFC) and JPMorgan Chase & Co (NYSE:JPM) loan portfolios differ in composition, but taken together, will provide a broad-based look at the health of the consumers, businesses and the economy.

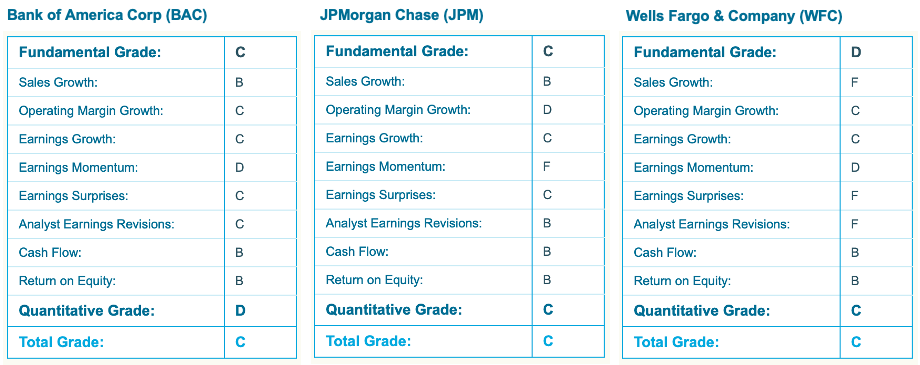

Mr. Navellier’s proprietary grade on these stocks is as follows:

Earnings Preview For Money Center Banks

JPM is very dominant in credit cards, so its guidance on if it has to boost its loan loss reserves will be crucial. The bank's revenue is forecasted to rise 13.2%, but its earnings are forecasted to decline 7.8%. I expect JPM will post a surprise due to the strength of the consumer.

BAC's revenue is forecasted to rise 9.8%, but its earnings are forecasted to decline 6.1%. Due to recent analyst cuts, BAC may not post a meaningful earnings surprise.

WFC's revenue is forecasted to decline 4.2%, while its earnings are forecasted to decline 47.2%. Big analyst cuts in recent months do not bode well for any meaningful WFC earnings surprise.