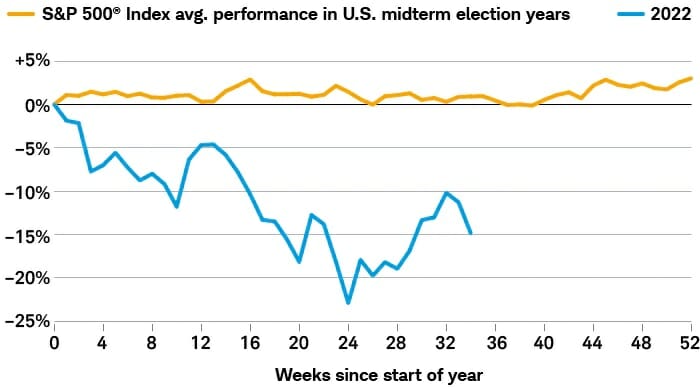

When the largest economy in the world goes to the voting booth, the markets are abuzz with action – and in most cases, this leads to an upswing. But, as you may have heard (more than once in the past couple of years), this is a historic election – and in lockstep with that, the usual midterm rally in the markets is also under question.

So, once everything is considered, how could these elections impact the stock market?

The Impact of Midterm Elections On The Stock Market

As of the time of writing, the situation is still developing, but let’s look at what is already known. Historically, markets have experienced significant positive moves after all but two midterm elections since the end of the Second World War.

Q3 2022 hedge fund letters, conferences and more

The expectation of a red wave has been squashed by the races that have already been called - although the exact number of seats either party will have in either house is still to be determined, it doesn’t look like there will be any major upsets.

Granted, while the Republicans are still on track to take control of the house, this can ultimately only serve to hinder Biden’s domestic agenda - and gridlock of that sort has historically been good for markets.

While a resounding election result would allow investors to use party policies to determine where to invest, gridlocks do make things a little muddier.

Using the example of the energy sector, a clear Democratic victory would have likely spurred on more subsidies for green energy, whereas a Republican victory would have been good news for traditional energy such as oil and gas - in this case, neither of these is likely to ride the coattails of Washington.

However, industries tied to issues where there is wide bipartisan consensus - such as defense and the Ukraine war are likely to remain on their current track in terms of growth. Other industries that were previously contested across partisan lines - marijuana, in particular, are poised to enter new markets as political consensus on the issue inches ever closer.

The Inflation Issue

Inflation remains, by and far, the most critical issue for both voters and markets. Although inflation has taken a bite out of the Dollar’s strength, higher oil prices and the Dollar’s dominant position in international financial markets led to a generally optimistic sentiment among investors in the immediate post-midterm markets.

The November 10 consumer price index report turned out better than expected - and although that performance will have been replicated for months on end for the Fed to slow down interest rate hikes, investors are acting cautiously optimistic.

We’ve already mentioned that gridlocks are good for markets - with limited legislative and regulatory action providing a stable bedrock for investors. However, this isn’t only good for the financial markets - these results, in particular, make it much less likely that the Biden administration will have the necessary support to raise taxes.

On the same note, a stronger Republican presence in the House will likely mitigate government spending in the new Congress. Additional spending brought on by a new Congress is what typically drives the post-midterm bull run - in this case, the effect is likely to be less pronounced.

While this will translate to less momentum than one would expect from the midterms, it will also go a long way in reducing volatility and helping to patch up the macroeconomic woes that are currently faced.

As demonstrated in the chart above, this year’s market performance is already well below the usual. With the influx of new funds from Congress being both a driver of inflation and unlikely to occur, the phrase “much ado about nothing” comes to mind - perhaps a bitter pill to swallow after a high-octane election cycle, but that ultimately is what happened.

Once all is said and done, it can be boiled down to this - a demure election result that doesn’t signal any major course corrections in the U.S. economy will likely give markets a little room to breathe, and we are likely to see a short, equally demure upswing.

However, the sheer weight of today’s unprecedented macroeconomic factors makes only one thing certain - true recovery will take a lot of time, and it will be a rough ride ahead.

As for now, expect no major changes - the current trajectory, for better or worse, will continue - and the changes in the economy in the next two years, along with the upcoming presidential elections, are where real, significant changes and momentum can occur.

Get Smarter on Crypto and Macro. Get the 5-minute newsletter that keeps investors in the loop. Five Minute Finance is an independently run newsletter covering the latest and most important trends in crypto, macro, and global markets.