Logica Capital commentary for the month ended November 30, 2022.

Summary

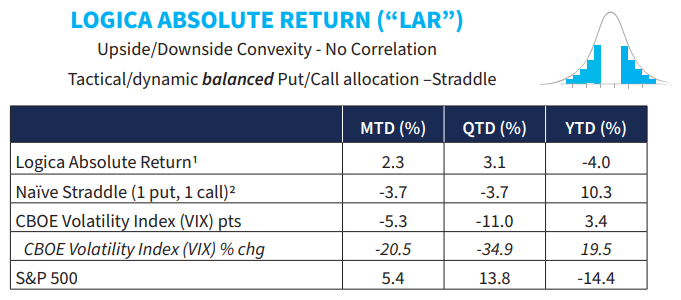

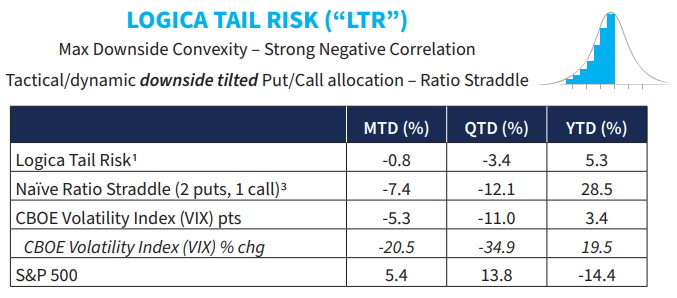

November brought us several fascinating storylines, from spectacular collapse(s) in the crypto space, to a historic equity/bond day in traditional markets. Concurrently, we experienced a fairly predictable relationship between implied volatility (IV)/VIX and the S&P 500, with perhaps slightly more volatility crush than normally expected. Logica’s strategies fared well, all things considered, due to several factors we discuss below.

Q3 2022 hedge fund letters, conferences and more

Commentary & Portfolio Return Attribution

“It’s not whether you get knocked down; it’s whether you get up.”

– Vince Lombardi

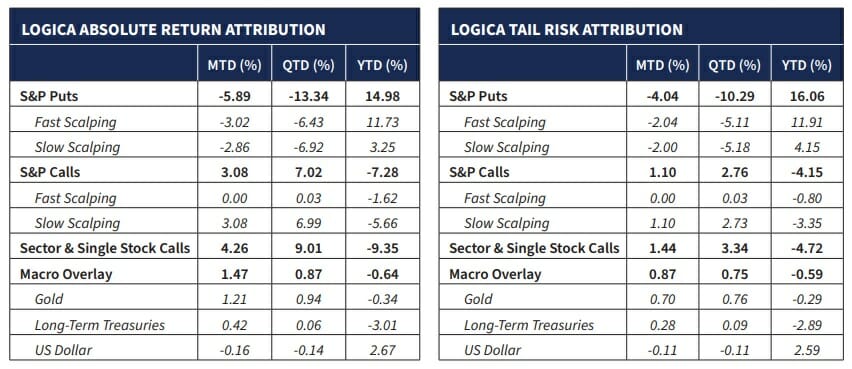

At long last, the star of the month was our Macro Overlay, which contributed about half the total return for LAR and buoyed LTR in November. In fact, one of the most historically anomalous S&P 500/Long Bond days occurred on November 10th (after the CPI data was released) when the S&P rose +5.5% and TLT also rose 3.8%. Below we visualize the S&P 500’s top 15 up days since July 2002 as compared to the TLT return on the same day:

Ignoring its unusual relationship to the equities market, TLT was unusual even on a standalone basis, as this was its 7th biggest up day since 2002, where 5 of the other 7 were in March 2020 or late 2008. Interesting times, indeed.

The rest of the book performed about as expected, with Single Stock Calls coming in slightly lower than the market, but still outperforming considerably for the year.

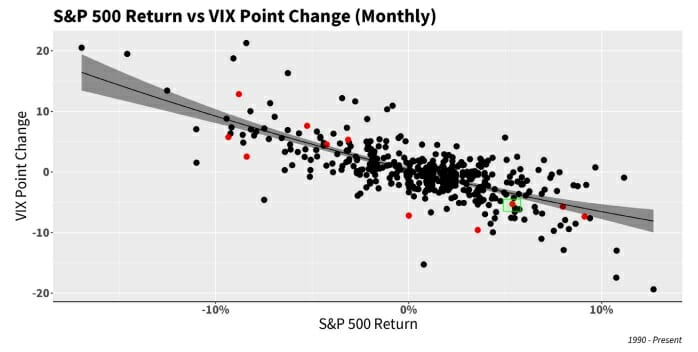

With respect to the volatility environment at large, November 2022 (the red dot in the green box below) was nearly in line with expectations of the long-term S&P 500/VIX relationship, landing almost spot on the best fit curve, albeit slightly below it, as we have tended to experience all year long with S&P upside moves:

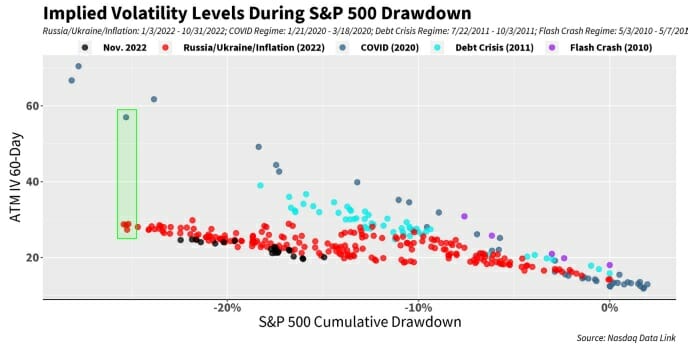

Similarly, with respect to the current YTD drawdown in the S&P 500, we see more of the same of what we’ve been describing all year long: a measured drawdown with lack of IV upside reaction given the extent of S&P downside, and then alongside that, larger than normal IV crush during equity market upside. November did nothing to change this phenomenon, as we can see by the black dots below:

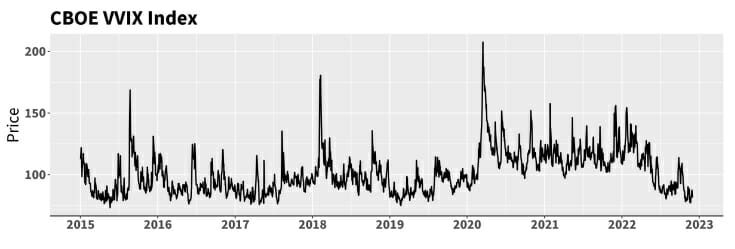

Relatedly, we see the CBOE VVIX Index tracking at multi-year lows. The VVIX Index, outside of some mathematical gymnastics, can basically be thought of as “volatility of volatility,” or, how much implied volatility itself (VIX, in this case) is bouncing around. If implied volatility is not bouncing around (as represented by a lower value of VVIX), there are typically fewer trading opportunities for those that scalp Vega, as Logica does.

Our VVIX explanation is somewhat simplified for the sake of clarity of communication, and we encourage readers that are so inclined to take a look at its full methodology for themselves:

https://www.cboe.com/us/indices/dashboard/vvix/

“Instead of connecting with new things, widening our worlds, algorithms have shrunk it to a narrow chamber with mirrored walls.”

-Olivia Sudjic

Looking at the chart above, the fascinating data for 2022 is not only that VVIX, aka VolofVol, is relatively low, but that it has spent the year getting substantially lower. What this demonstrates is an ironic feedback loop; while VIX itself has been generally unresponsive, it has gotten increasingly LESS uncertain about its own unresponsiveness! If we imagine IV to be consensus opinion, it’s as if earlier in the year, the consensus had some uncertainty about how panicky to be, then leaned on the “be less panicked, stay calm” side, and then, as the year marched forward, became increasingly certain about its decision to be more calm.

So now the question is… why might this be the case? As with many other areas of the market, we see the all too familiar behavior of a “feedback loop,” which said in slightly different words, is the hyper-familiar concept we all call “momentum”. But whether dubbed a “feedback loop” or “momentum”, the backdrop to this behavior is that the market is getting more and more familiar and/or comfortable with its decision, and an increasing number of players are joining in on that decision path. In terms of VIX/IV, this agrees strongly with the supply/demand dynamics over the course of 2022, wherein the VIX has made a lower high at each successive new S&P low, following a large S&P down leg (refer to our September letter illustrating the S&P down legs and successive deeper bottoms in January, June, and then September, corresponding to lower highs on the VIX for each, respectively). To tie this in, the lower highs represent quicker selling into the further S&P drops as a result of increasing distrust of Vol’s payoff; if it didn’t work in January, then June’s move becomes the next opportunity to get out quicker, and then when that 2nd leg demonstrates greater weakness (because it looked back to the first), the 3rd leg down in September is sold out even faster. In other words, the feedback loop of Vol’s unreliability begets quicker selling, and the related “momentum” of unresponsiveness. Similarly, this behavior occurs at smaller timeframes; as mentioned above, numerous smaller Vol pops during the month have been rapidly unwound by faster sellers, which lead to quick Vol crushes shortly thereafter. And so VolofVol contracts.

But then for the next, even more valuable question, what does this suggest looking forward? Well, from our perspective, this is great news. Why the excitement? Because if we look at the long-term behavior of momentum, and really, almost all feedback loops, we generally find negative skew on the horizon; that is, they go, and go, and go… until they don’t. At which point – precisely because of how long they’ve been going, and how many participants have jumped on the train — the reversal is often sharper and more extreme. Further, this ties into the natural results of the supply/demand dynamic described above, for as the sellers sell out, there is of course less and less inventory remaining. The first lot sold out in January, the second bunch sold out even quicker in June, etc… and in viewing the year-to-date path, we get the contraction of VolofVol, which effectively equals greater participation in the new sentiment, i.e. all agreed on the unreliability and unresponsiveness of Vol.

We analogize this slow capitulation of sentiment to a coiling spring, which as one pushes down, gets tighter and tighter, but as soon as it faces a sufficient release trigger … well, that’s when, with little in its way, it can leap sky high. That’s when the negative skew of all the selling momentum begets the positive skew for those persistent holders. From this perspective, Vol is not dead, it is merely sleeping; there simply has not been enough uncertainty, or panic, in 2022 to wake it up. We described this concept as “bounded uncertainty” in a prior letter, identifying the narrow bands of uncertainty surrounding rolling inflationary numbers and Fed related decision-making. The point being, we believe that if there is an actual unbounded uncertainty event (a shock like COVID-19, ’08 GFC, 9/11, etc…), humans would panic just the same, and Vol would inevitably do what we all expect it to do. Vol would again be wide awake. But then – breaking news — all those participants who unloaded their inventory and moved on to seemingly greener pastures undoubtedly become the aggressive bids that fight to buy the breakout – ironically, to own the unknown.

At Logica, we don’t want to fight to own the unknown, we want to constantly carry inventory precisely so that we don’t have to aggressively overpay at the worst of times or chase the breakout. We prefer to fight against the bleed of sleepy Vol given the absolute unknowability of tomorrow, and the shock events that do not obey investor sentiment.

Separately, every so often in our letters we have been keeping track of a couple of products/indices that use volatility as a hedge for long positions: one product through VIX Calls, and the other using S&P 500 Puts – and both of which use OTM options as their long volatility component. We continue to see these products not only fail to provide benefit, but through the end of November, actually detract from a standalone S&P 500 Index investment performance. The point here is not to demean these products and/or their construction, but rather to highlight the incredible difficulty of long volatility given the behavior of this year’s declining market as compared to other recent crisis periods – and especially with regards to out-of-the-money (OTM) protection, as these 2 products employ.

“The opposite of a true statement is a false statement, but the opposite of a profound truth can be another profound truth.”

– Neils Bohr

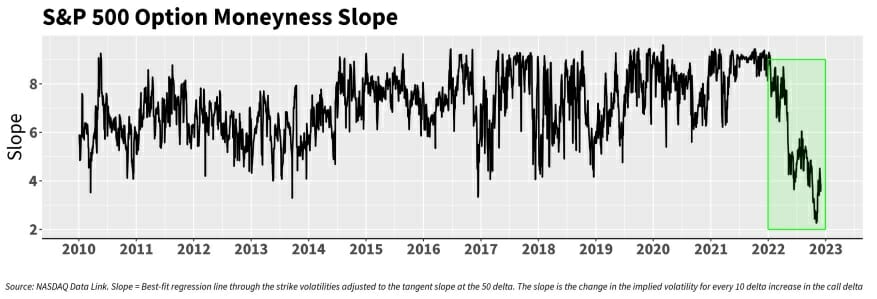

Similarly, we observe the lack of “pop” of OTM options by visualizing how steep the “moneyness slope” is in relative terms. A steep slope would indicate that OTM implied volatility is dramatically higher than ATM, i.e. high skew. A flatter slope, of course, would indicate that OTM implied volatility is not popping enough to cause its IV to be much higher than ATM, i.e. skew compression.

Bringing everything together: the fact that 1) Implied Vol/VIX in general hasn’t been very responsive in 2022 and that 2) the moneyness slope (or, skew) has dramatically flattened, starkly contrasts with the biggest crisis events, where we typically see two opposite outcomes: all strikes along the moneyness continuum see their implied volatility rise dramatically, and the rate of increase in OTM IV outpaces the rate of increase in ATM IV (skew steepens). One of the many reasons that we consider ATM “safer” than OTM is that the reliance on skew, and the additional concern about its steepness vs. shallowness, introduces an additional dimension in the management of risk. More specifically, it introduces basis risk into the already difficult problem of managing downside market behavior. Downside markets are hard enough to calibrate — imposing further complexity is, to some degree, just adding risk to that calibration. For example, one might get both market direction AND IV gain totally correct, but lose more on skew compression, thereby not accomplishing the core objective. Broadly, this all translates into why Logica loves ATM, because of its greater path independence for as many as possible downside paths.

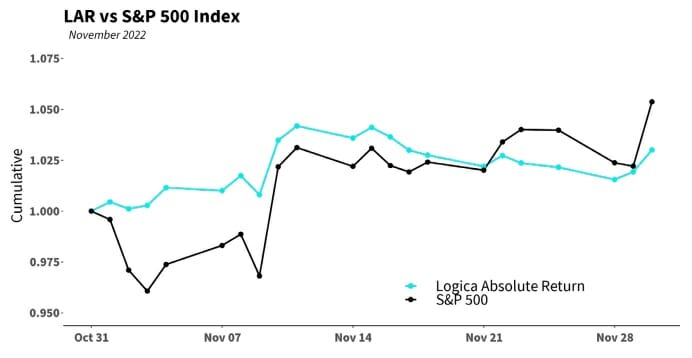

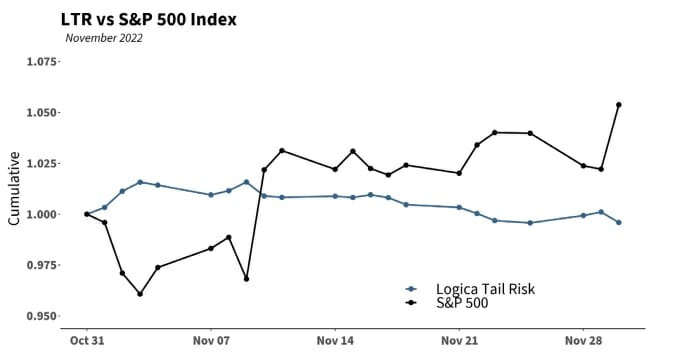

Finally, taking a look at the daily movement of our strategies for the month, we can see that LAR kept pace nicely with the S&P upside, and LTR was able to minimize losses (while holding significant protection and negative Delta tilt at all times).

Follow Wayne on Twitter @WayneHimelsein