Logica Capital commentary for the month ended January 31, 2023.

Summary

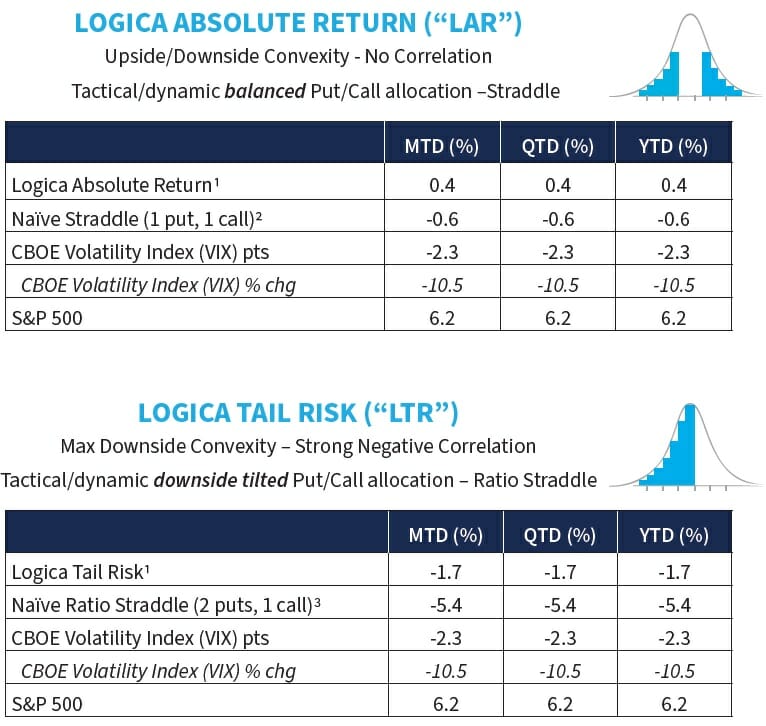

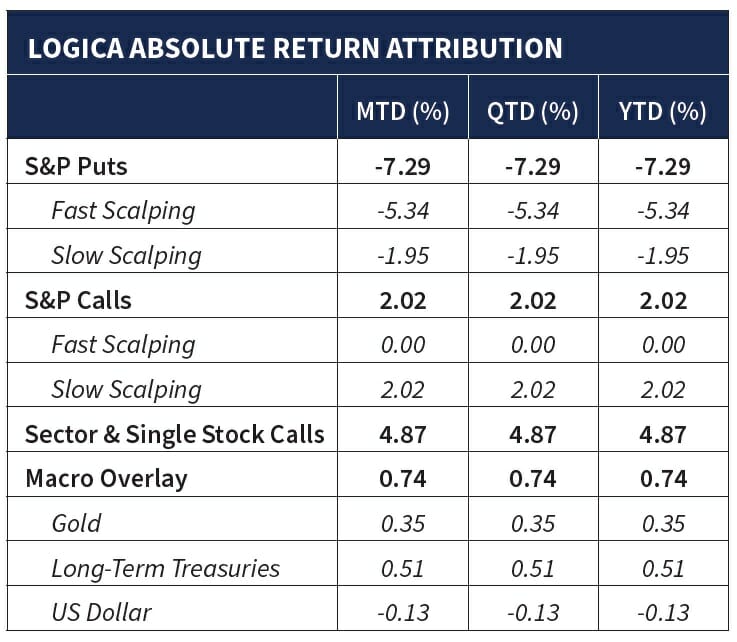

January started the year off with a bang; major indices gained between +6.2% (S&P 500) and +10.6% (Nasdaq 100). We saw minimal deterioration in VIX/Implied Volatility despite the large move in the S&P. Realized vol continues to trend downward, while factor rotations remain a major story.

Commentary & Portfolio Return Attribution

“Appear weak when you are strong, and strong when you are weak.”

– Sun Tzu

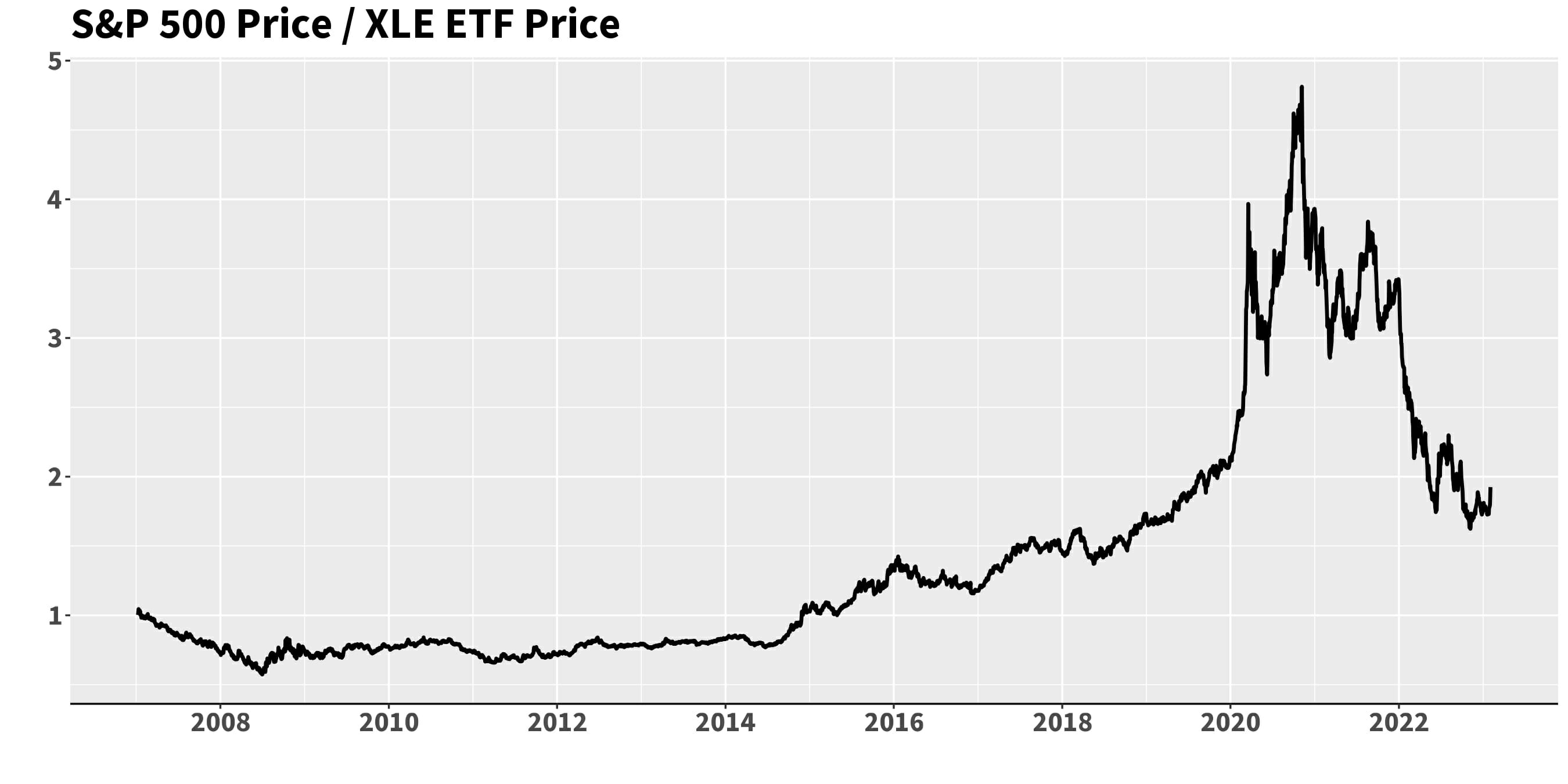

While January seemed to give us a broad, blasting upward market, we saw a significant factor rotation and some dispersion beneath the surface. As mentioned above, the Nasdaq 100 strongly outperformed the S&P 500, as did the Vanguard Small Cap ETF (VBR), and even the equally weighted S&P 500 ETF (RSP). At the same time, the SPDR Energy ETF (XLE) returned a paltry +2.8%, paring its gains from a huge run – and being the strongest area of the market – over the past year. Concurrently, and to illuminate the contrast, the Dow was up only +2.95% in January.

On a related note, an internal strategy that we run/track which picks “anti-momentum” (overly beaten down names) returned an astounding +26.5% in January, highlighting “junk” as the strongest component of the market’s rally. As readers may recall, we implemented this LFB module (“Logica Focus Bottom”) after Q1, 2020, and participated in the aggressive rally in oversold sectors like the airlines after the Covid-19 meltdown dragged them down almost beyond recognition. That said, our portfolio construction model did not trigger engaging the LFB module in January, and so we did not deploy that exposure. However, we clearly see its results, and so more acutely understand the market dynamics that took place in January.

What this all translated into for our strategies is that both components of our Sector & Single Stock Calls – our momentum “LFT” module (+3.0% as a standalone), and our diversified “LFD” module (+5.2% as a standalone), underperformed the S&P 500 on the month.

Elsewhere, our Macro Overlay performed positively on the month, continuing to provide value after a decent Q4 2022.

“Don’t expect to build up the weak by pulling down the strong.”

– Calvin Coolidge

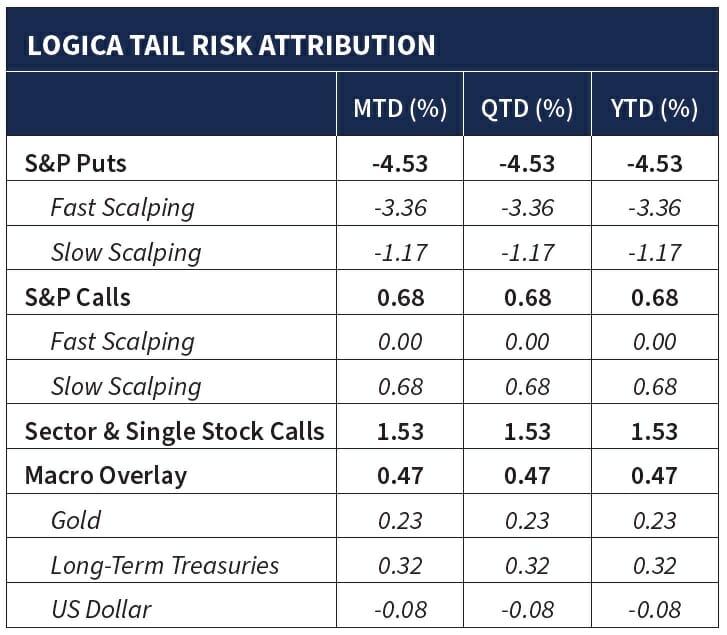

As touched on above, January saw a fairly dramatic rotation out of the energy complex alongside other recent strongholds (Utilities, Health Care and Consumer Staples). These sectors all performed relatively well in 2022 but were actually down in January as investors rotated into the most beaten down names/sectors (Consumer Discretionary & Communications) which generated double-digit % returns.

On this point, we draw further attention to the powerful run that the energy complex (XLE) has seen over the past couple of years, enabling it to “catch up” to the remainder of the S&P 500 (note the chart below is S&P relative to XLE, wherein the ratio more than chopped in half from 2021 forward). Looking even more carefully at the chart below, we can see a small upward tick in January. And more broadly, while we appear to be back to somewhat “more reasonable” levels as of recent months, the “ideal” level is of course anyone’s best guess:

“Life comes in clusters, clusters of solitude, then a cluster when

there is hardly time to breathe.”

– May Sarton

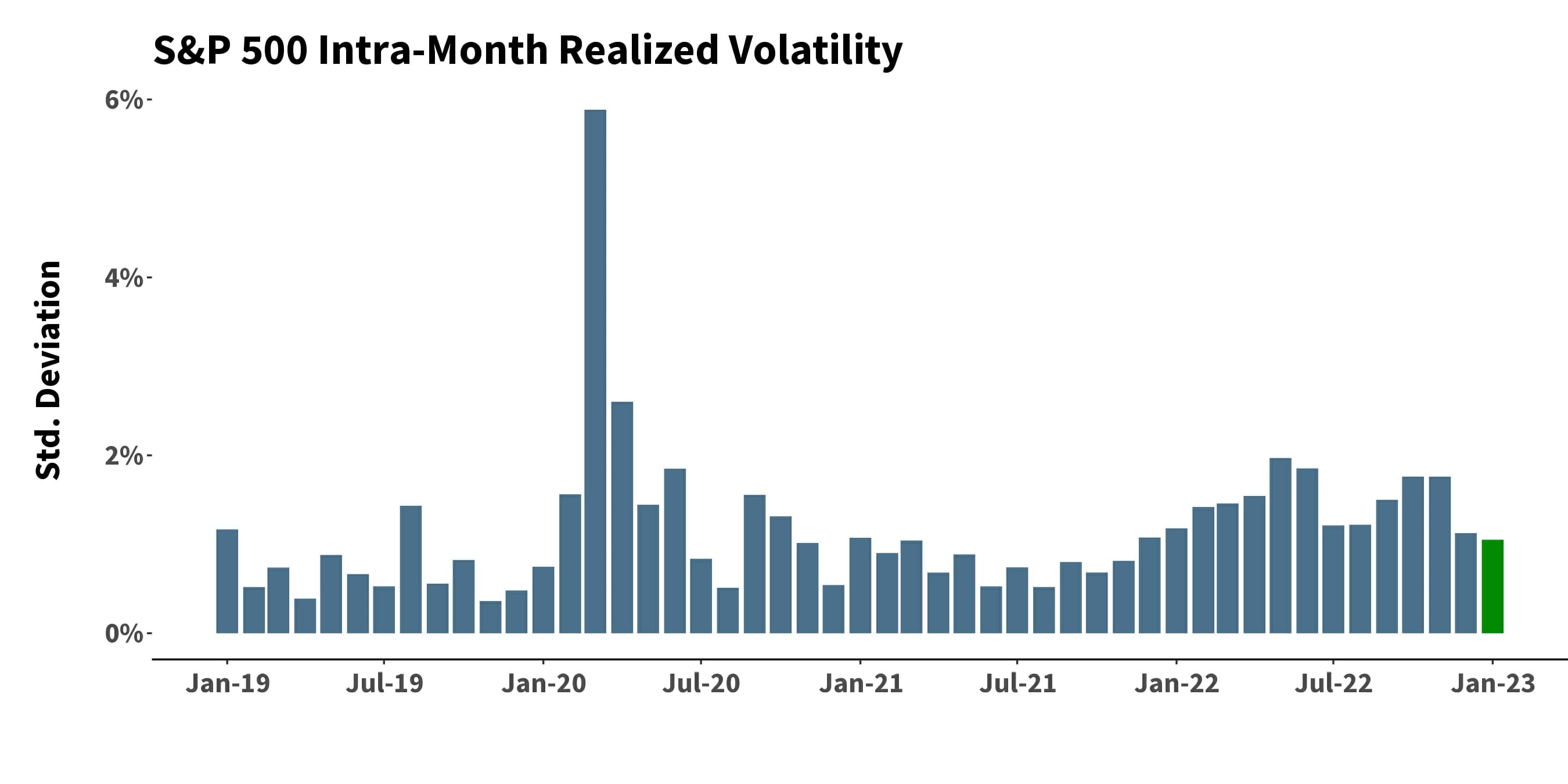

Moving over to the picture on Volatility, we note that realized volatility continues to trickle downward, but certainly did not “collapse” alongside the strength of the market rally:

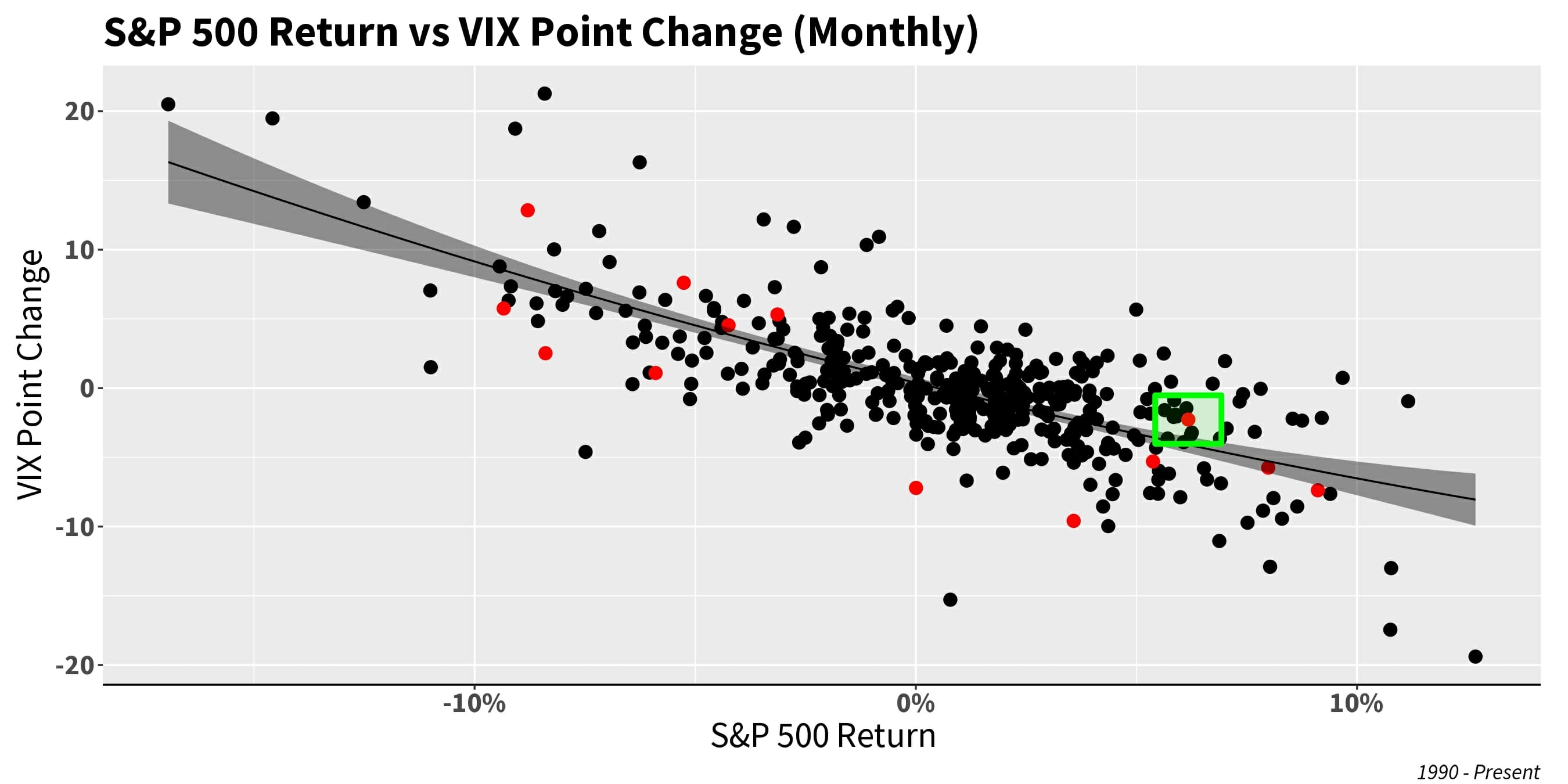

From Logica’s perspective, VIX/Implied Volatility provided a decently favorable environment in January, as it didn’t fall quite as much as one would expect given the S&P 500 run upward and the historical relationship between IV and S&P moves. Looking at this relationship (monthly) in the chart below, we note that IV held “above average” relative to its expected decline for a similar magnitude move. As always, this can be interpreted with a narrative, backed by the inflation story not yet over and/or by the supporting empirical research, which demonstrates that Vol tends to be “sticky”, or cluster, and so it will take more than a short time to move to a very different level. Of course, both the reasonable narrative and the somewhat reliable characteristic behavior of Vol might both be the reality, and deeply intertwined, such that it’s hard to separate what is quantitative from what is qualitative.

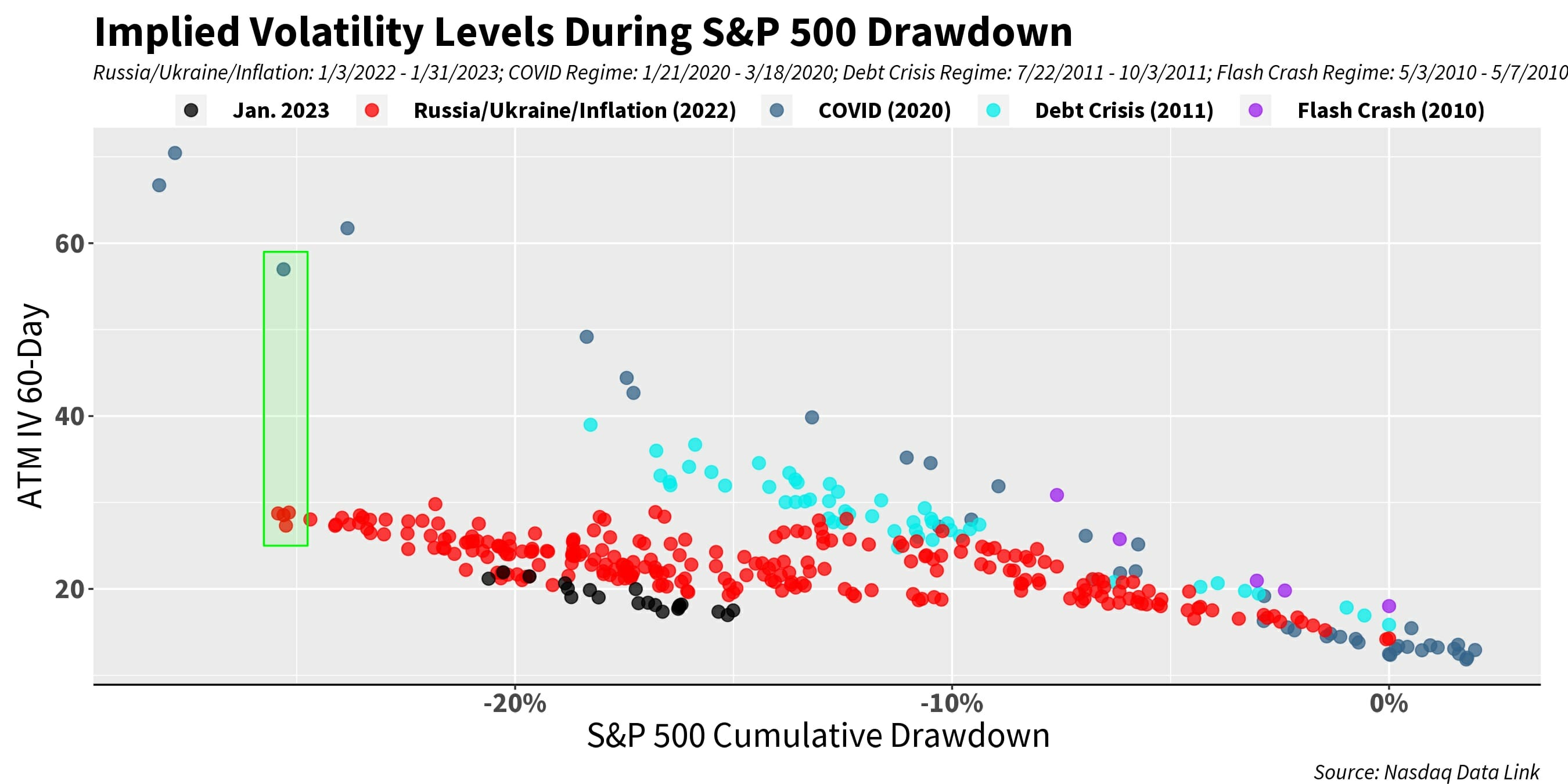

Relatedly, and despite the slight downward move in realized vol, we still see implied volatility levels as extremely low relative to the magnitude of the cumulative S&P 500 drawdown. And though it is an arbitrary level overall, it’s interesting to see that IV has come down to a very similar level to the early days of the cumulative drawdown that began in early 2022! One might dare to say that in terms of IV, nothing happened at all year-over-year! Not sure we can say the same for the equity market.

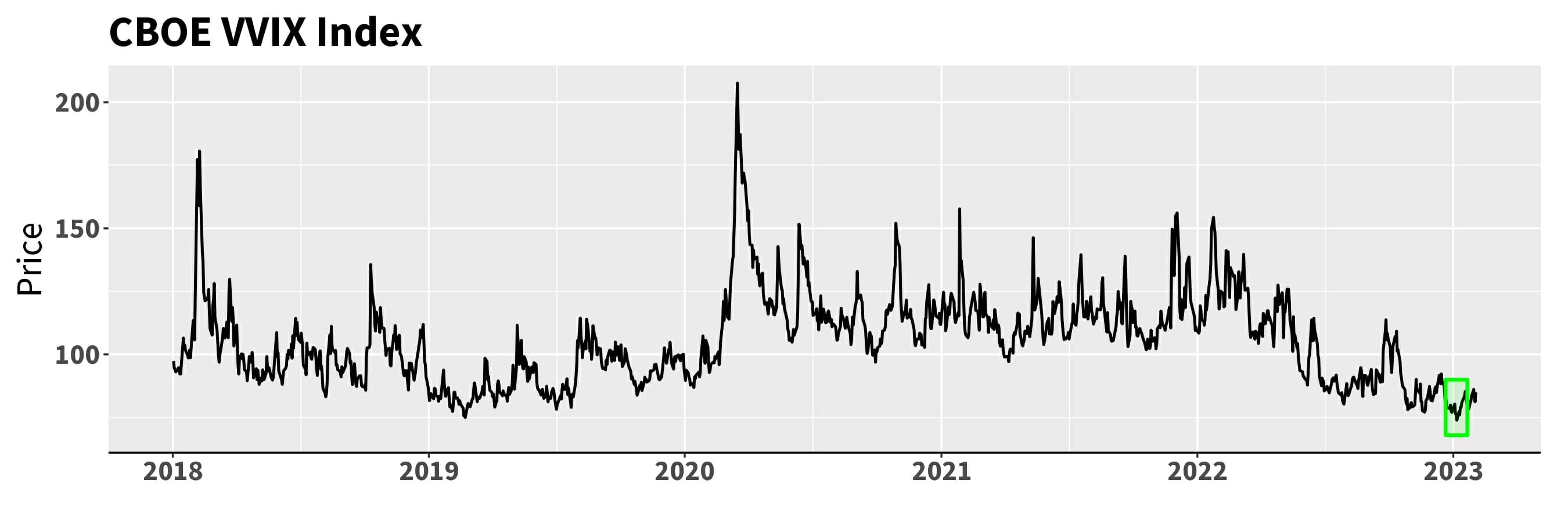

Further, in January, vol-of-vol was extremely low, as measured by the CBOE VVIX Index5, which printed its single lowest close of the “post-Volmageddon” era.

“Excessive optimism sows the seeds of its own reversal.”

– Alan Greenspan

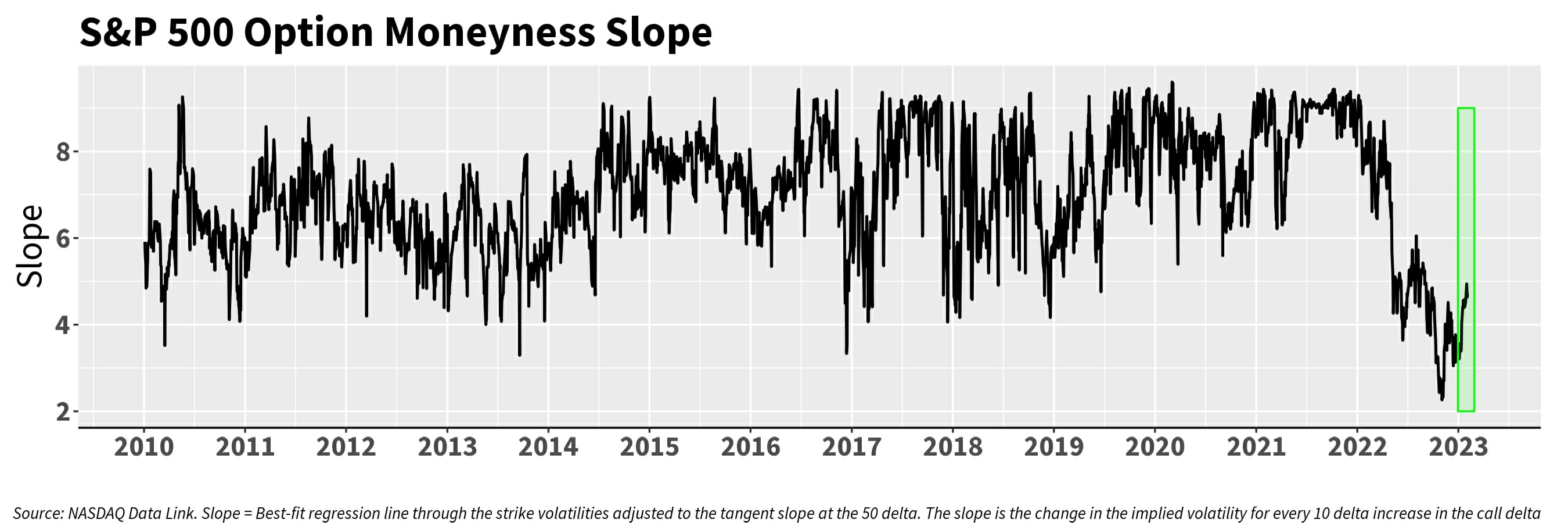

On that front, and again updating a prior chart, below we see that the skew compression trend has seen a slight tick upward in January. This relentless drop in skew in 2022 was particularly challenging for our long volatility peers who rely on an “attachment point” via OTM puts to provide protection. Not only was implied volatility across the volatility surface lower than expected in 2022 given the magnitude of the S&P 500 drawdown (as discussed above and plentifully in numerous prior letters), but in particular, the moneyness shape, or vertical slice of the volatility surface (as is popularly referred to as the “option smile”), got significantly flatter in 2022 as well. This trend reversed in January 2023: at-the-money (ATM) implied volatility was punished a bit more than out-of-the-money (OTM). That said, we don’t believe that this short term differential has any real significance outside of the somewhat extreme levels that things had reached. To some degree, and as discussed last month, the compression of skew seemed overdone, and the mean reversionary tendency of markets was likely eager to reveal itself. In this sense, it’s not so much that ATM was punished, but that OTM offered some of the expected recovery after its outsized beat down.

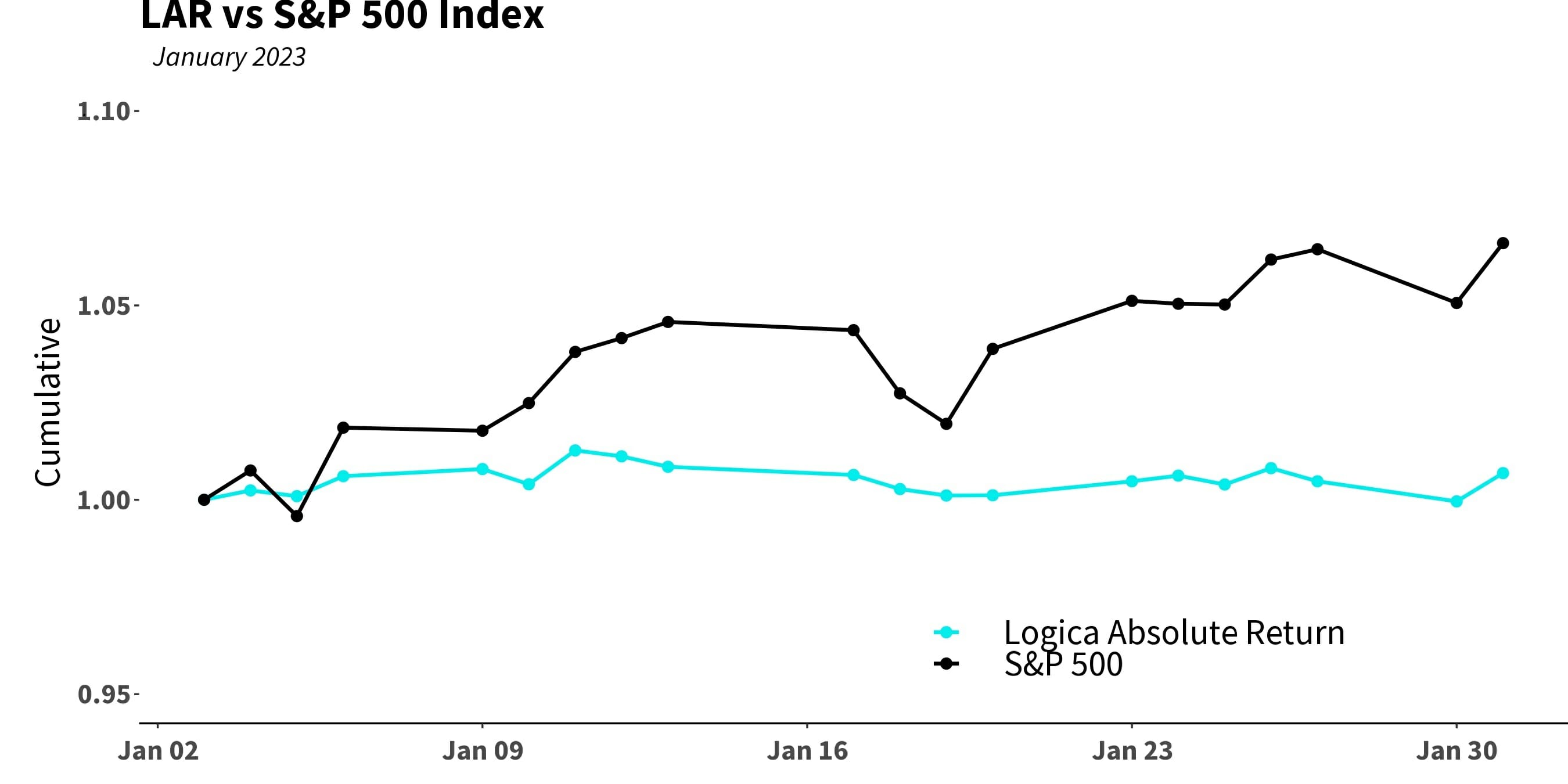

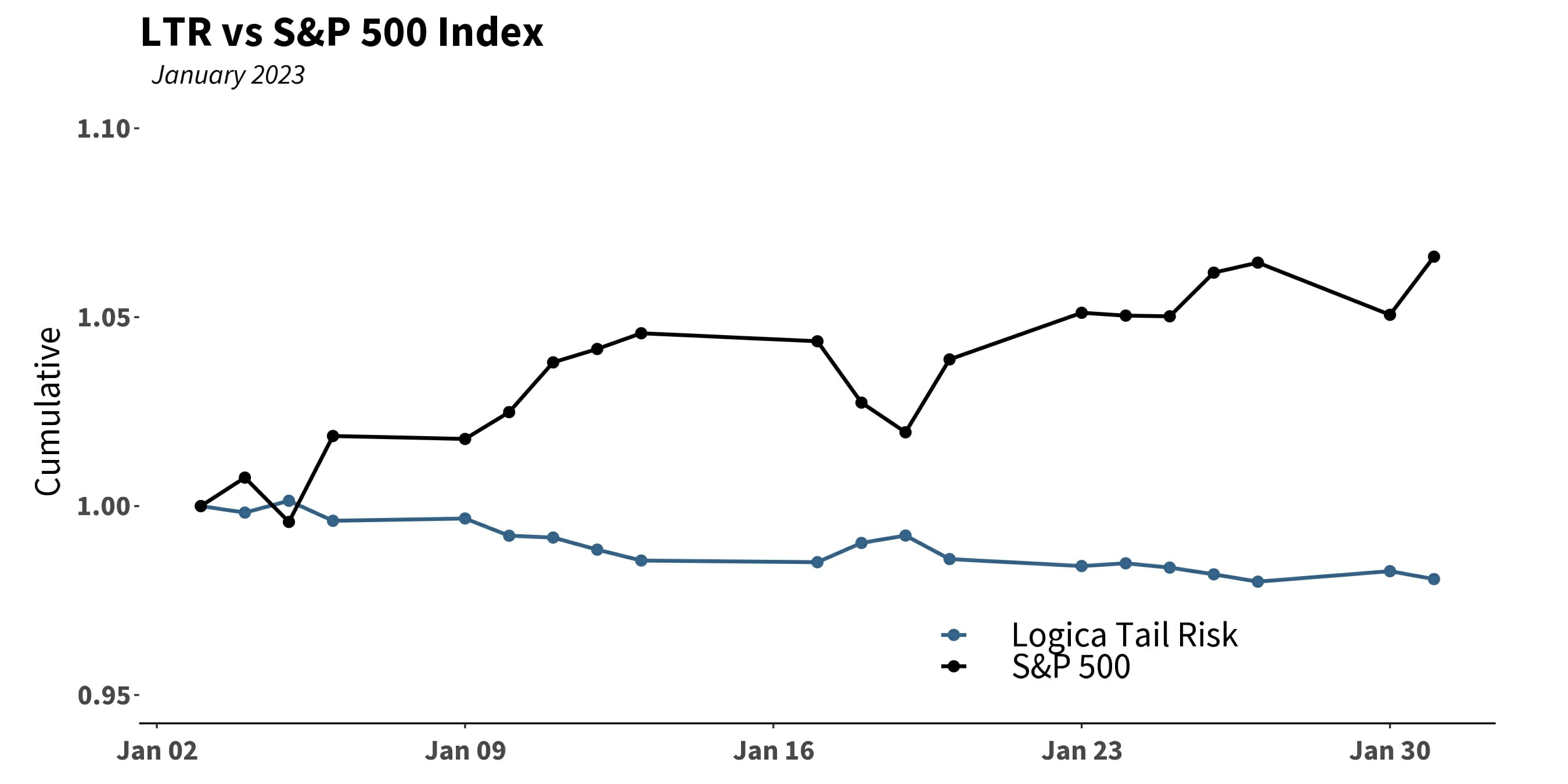

Finally, taking a closer look at the daily movement of our strategies for the month of January, we see what we’d generally expect, with LAR participating mildly, and LTR holding ground in the market’s gain, while remaining net short, with bundles of convexity in the waiting.

Follow Wayne on Twitter @WayneHimelsein