Logica Capital commentary for the month ended January 31, 2021.

Q4 2020 hedge fund letters, conferences and more

Logica Absolute Return - Up/Down Convexity - No Correlation

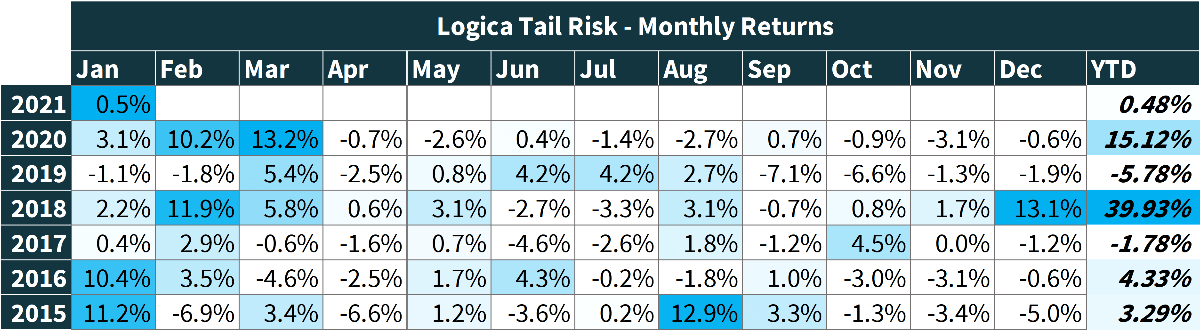

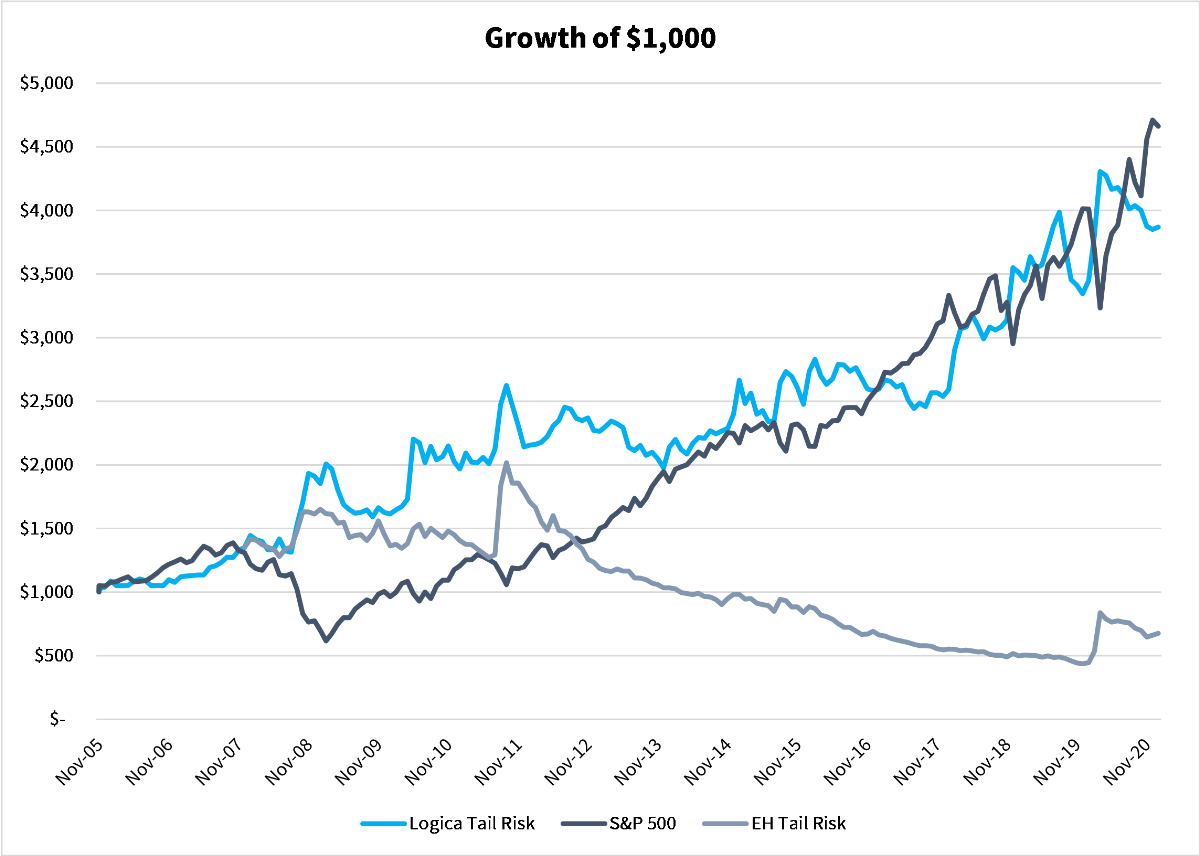

Logica Tail Risk - Max Downside Convexity - Negative Correlation

January 2021 Performance*

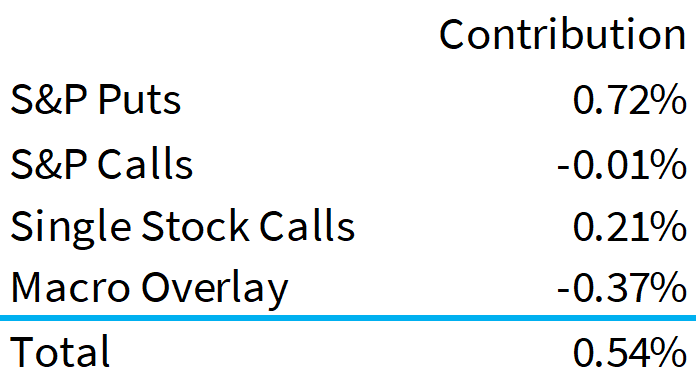

Logica Absolute Return +0.54%

Logica Tail Risk +0.48%

S&P 500 -1.02%

VIX +10.3 pts

Year To Date Performance*

Logica Absolute Return +0.54%

Logica Tail Risk +0.48%

S&P 500 -1.02%

2020 Performance*

Logica Absolute Return +14.9%

Logica Tail Risk +15.1%

S&P 500 +17.4%

*Returns are Gross of fees to illustrate strategy performance.

Logica Absolute Return Fund, LP returned +0.38% (net) for January 2021

Logica Capital January 2021 Summary

After a shaky start on the first day of trading, equity markets rallied sharply only to stumble in the last few days of the month. The pattern of small outperforming large continued and extreme behavior manifested itself in heavily shorted stocks like GameStop, which we discuss. Our trading modules managed to capture a fraction of the upside and avoid the downside, resulting in a positive gain for the month despite the modest movement overall.

“Just the facts, Ma'am”

“I've got to admit it's getting better,

A little better all the time”

The Beatles, 1967

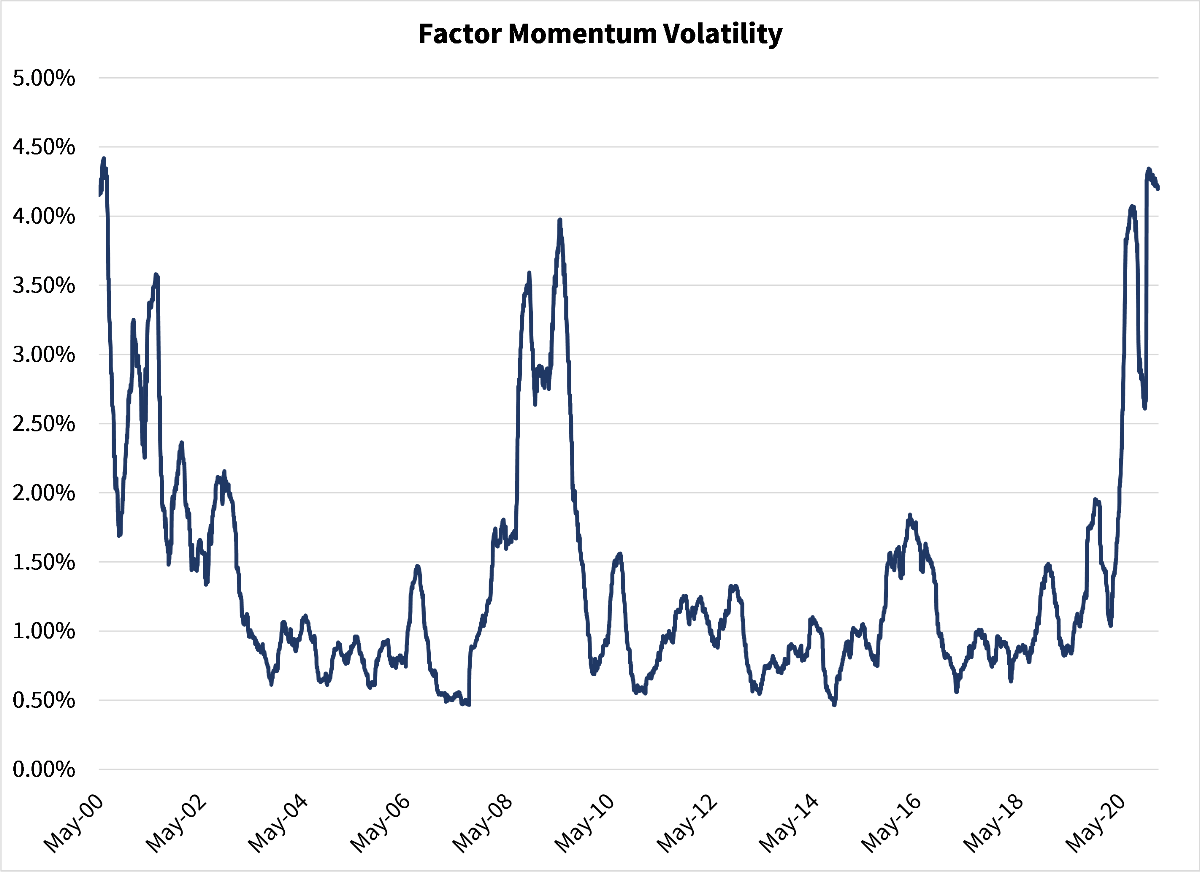

As we have often discussed in the past year, quantitative investing is not about standing still in a changing environment. One of the challenges we have experienced has been the relative underperformance of momentum strategies. While positive in aggregate, the past year has seen nearly unprecedented factor volatility, defined as daily reversions of factor returns. On Monday, momentum works brilliantly and value stumbles… on Tuesday the reverse happens… etc.

To address this challenge, Logica deployed a new module, “Logica Focus Diversification” (LFD) within our single stock call module. This is analogous to the “anti-momentum” LFB module we deployed in April following the market crash; and like that deployment, LFD has been instrumental in providing positive returns for the month of January, accounting for all the gain we experienced in single stocks. The increased diversification of return sources (or more broadly, factor exposures) both lowers volatility and raises returns – a win-win we are excited about.

“Games people play, you take it or you leave it

Things that they say are not right

If I promised you the moon and the stars, would you believe it?

Games people play in the middle of the night”

The Alan Parsons Project, 1980

Our Growing Concern

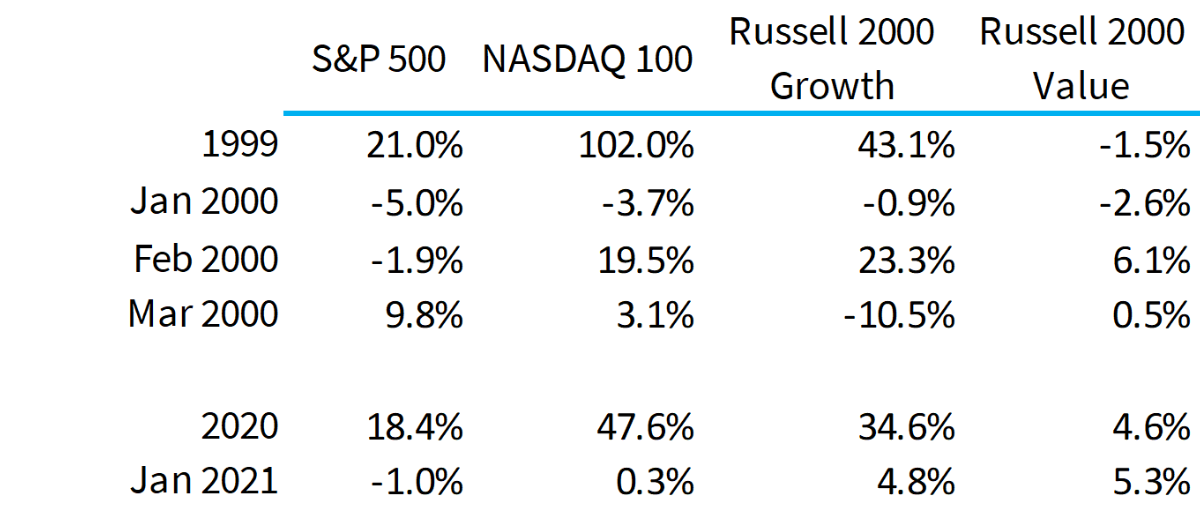

Last month we shared our growing concern at the close parallels with 1999-2000. This month we are doing more of the same. While the mists of time often obscure the memory, it is worth going back to the databases and reminding everyone of the scorecard for 2000:

While memory paints a picture of a straight up market, the challenges of January 2000 were substantial. Fed liquidity was coming into question and investors who had delayed taking profits in 1999 for tax purposes, began to do so in 2000. Small outperformed large as story stocks for the New Economy (the “dotcom” boom) continued to attract marginal flows and short covering, while not tracked as such, provided additional fuel to these stocks as hedge fund legends were forced into covering. February proved the death knell for these investors and decisions were made that indicated little awareness of the importance of the March crash in technology stocks. Most famously, Julian Robertson shared the following with his investors in a letter dated March 30, 2000 with the Nasdaq already down 11% from peak:

“There is a lot of talk now about the New Economy (meaning Internet, technology and telecom). Certainly, the Internet is changing the world and the advances from biotechnology will be equally amazing. Technology and telecommunications bring us opportunities none of us have dreamed of. "Avoid the Old Economy and invest in the New and forget about price,” proclaim the pundits. And in truth, that has been the way to invest over the last eighteen months.

As you have heard me say on many occasions, the key to Tiger’s success over the years has been a steady commitment to buying the best stocks and shorting the worst. In a rational environment, this strategy functions well. But in an irrational market, where earnings and price considerations take a back seat to mouse clicks and momentum, such logic, as we have learned, does not count for much.

The current technology, Internet and telecom craze, fueled by the performance desires of investors, money managers and even financial buyers, is unwittingly creating a Ponzi pyramid destined for collapse. The tragedy is, however, that the only way to generate short-term performance in the current environment is to buy these stocks. That makes the process self-perpetuating until the pyramid eventually collapses under its own excess.”

Julian Robertson, March 30, 2000

“Everyday I work

Bringing home my pay

Come to find out, baby

You're giving my money away”

Bo Diddley, 1958

Performed by Julian Robertson’s long-time partner, Thorpe McKenzie

A Slow-Motion Train Wreck

Almost as if we are watching a slow-motion train wreck replay, investors have predictably been seized by the “noise” that “explains” the market. Narratives range from concerted action by retail investors buying low delta call options to sloppy hedge fund managers shorting “cigar butts” to “Fed printer goes ‘Brrr!’ to “The Roaring ‘20s” gracing the covers of business magazines.

Almost predictably, no one is examining the real culprit – the increasingly fragile and illiquid market that is a byproduct of the growth of passive investing, redemptions of discretionary “active” managers, consolidation of market making activities into a few select high frequency traders, and the evisceration of prop trading desk inventory.

Assets are streaming into Cathie Wood’s ARK ETFs in a funhouse mirror version of the flows into the Janus complex in the late ‘90s and early 2000s. If only there were signs... As Kiplinger’s noted in a 2007 requiem:

“Janus had turned mainly into a two-trick pony. Its funds held enormous positions in technology and telecommunications stocks, such as America Online, Cisco Systems and Microsoft. And when the tech bubble burst in 2000, Janus funds had a tough time extricating themselves from positions in some of those companies because they held so many shares. The funds cratered like Wile E. Coyote diving onto a canyon floor. During the 2000-02 bear market, Janus fund sank 64% and Janus Twenty plunged 69%. Others suffered even more. Enterprise plummeted 78%, and Global Technology surrendered 84%.”

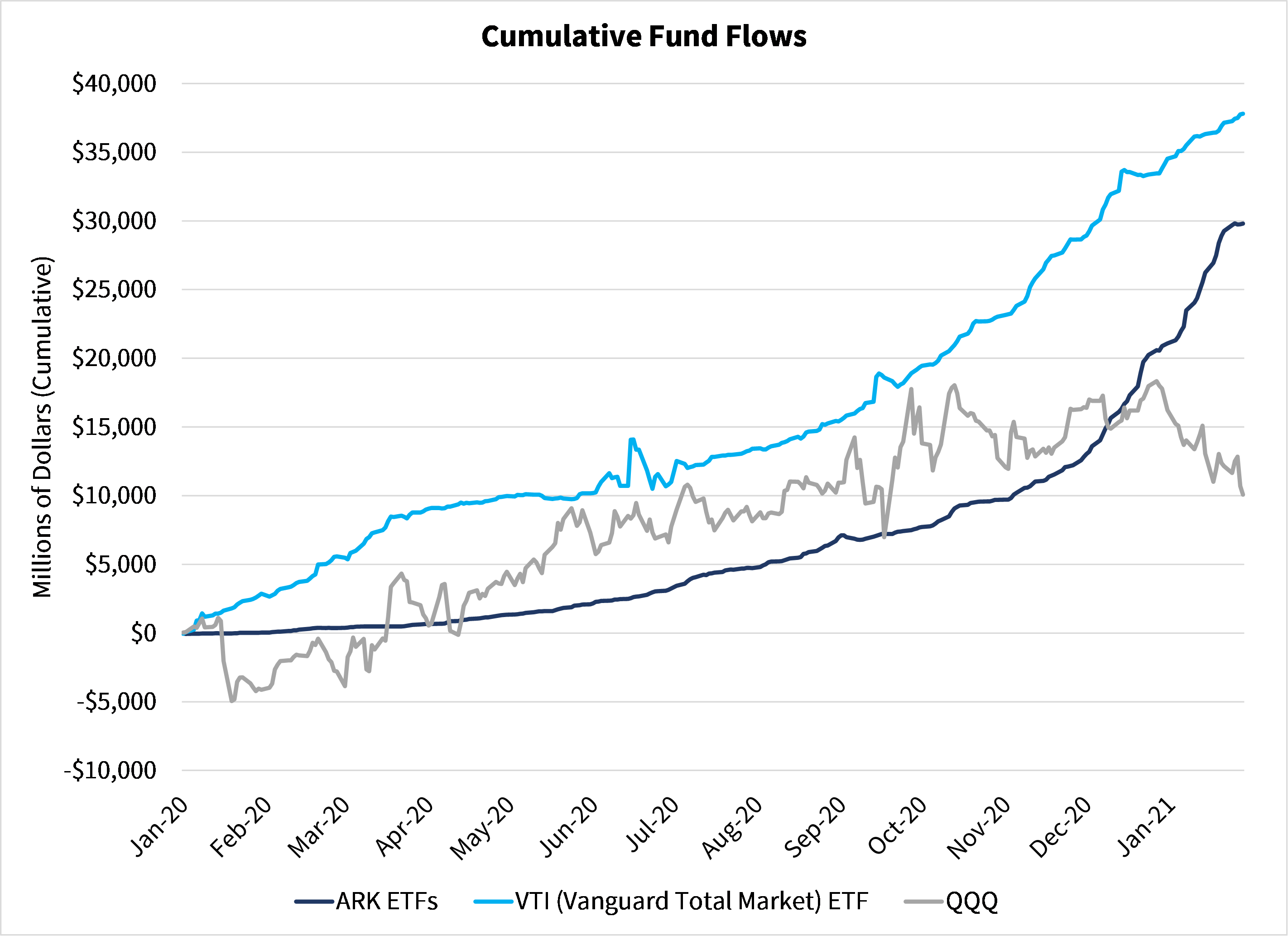

And now we see a similar pattern with a family of four ETFs with over 90% return correlation and nearly 50% rank order correlation (meaning huge overlapping ownership of individual equities) defying the Active industry outflows to nearly outpace the almighty Vanguard Total Market Index (VTI) ETF (not the full Vanguard Total Market fund family to be clear) in inflows for 2020-2021. The regularity of fund inflows for the ARK ETF family suggests high participation in self-directed IRAs and 401Ks – in other words, Mom & Pop are now firmly onboard the “innovation revolution.” Left in the dust is the mighty QQQ.

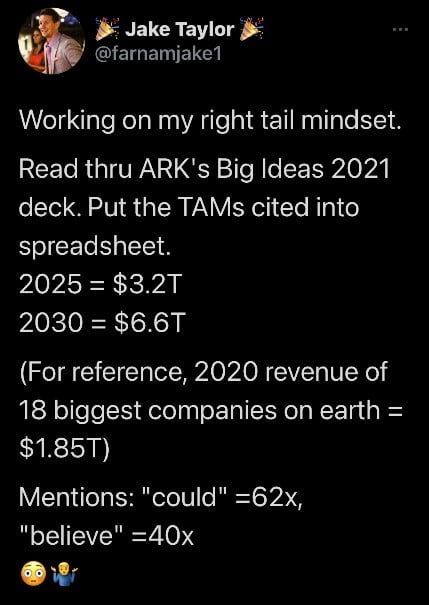

A recent tweet nicely combines the ARK saga with Michael Green’s December 2020 discussion with Jim Chanos on RealVision (https://bit.ly/2MoTzZO). Jim’s discussion of “TAMsanity” seems prescient.

“I see your Shadow coming closer

Then watch you drifting away”

Mammagamma, The Alan Parsons Project, 1982

The Changing Dynamics Of Option Skew

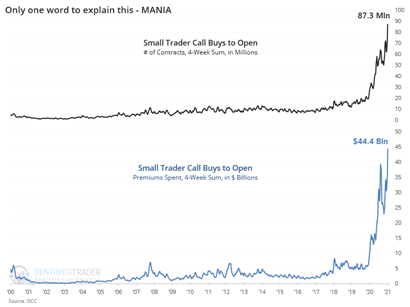

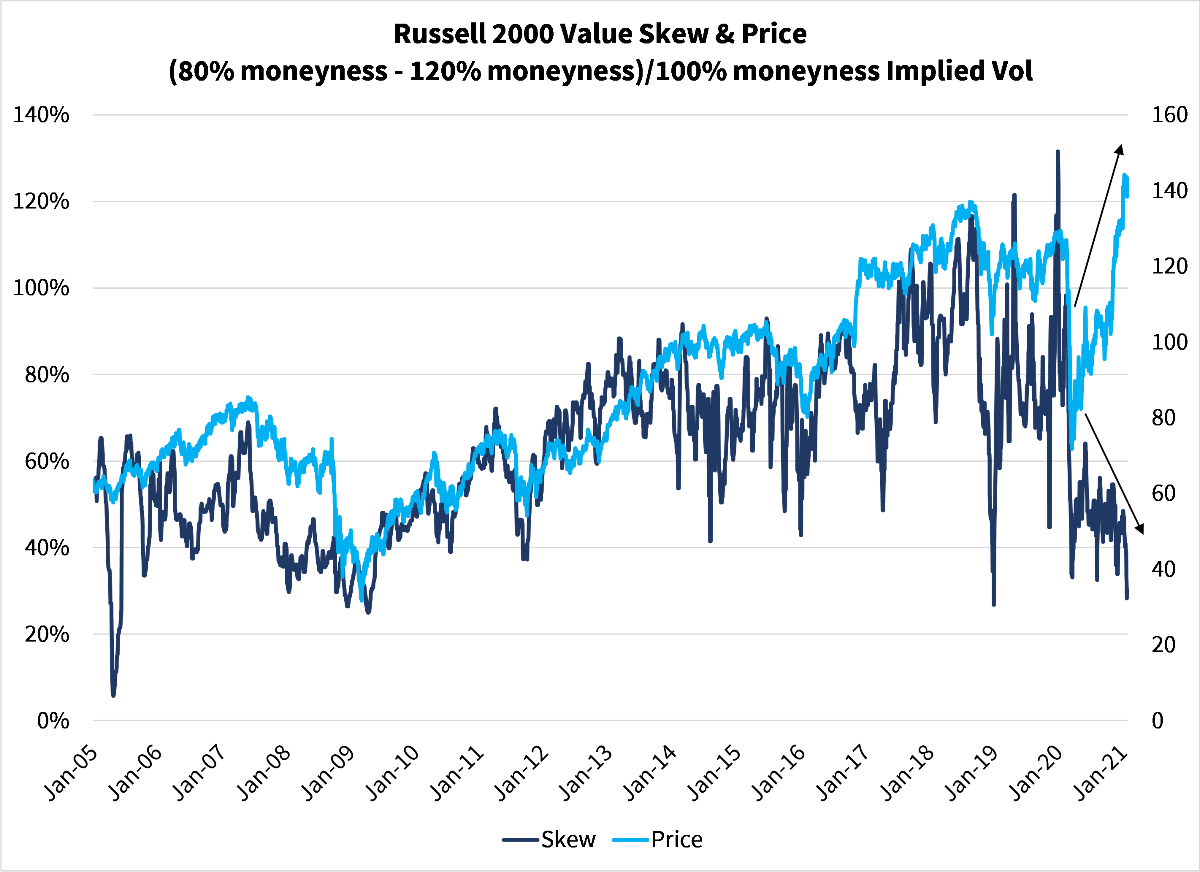

In August of 2020, we shared our analysis of the changing dynamics of option skew and noted that the primary drivers were market illiquidity and increased concentration amongst market makers. Since then, we have been treated to runaway speculation by small investors in single name call options. “Stonks always go up” has been replaced by “Calls always work” – a “genius in the naivete” observation that accurately describes the impact of thousands of small investors buying low delta calls and forcing market makers to hedge in an increasingly inelastic market – a market that rises more rapidly than anticipated as shares are purchased and dealers hedge the frenzy. This speculation, and the resulting feedback loop, has reached epic levels with dealers increasingly finding themselves exposed to gamma squeezes to the topside.

And traditional skew has collapsed as upside calls are increasingly richly valued vs puts. This is particularly true for the R2000 Value where call options are uniquely bid vs puts as credit hedgers and “cigar butt” speculators (Melvin Capital) are scrambling to cover upside risk. As we have noted previously, the closest parallel is post-2016 election; albeit we are now in an unprecedented divergence.

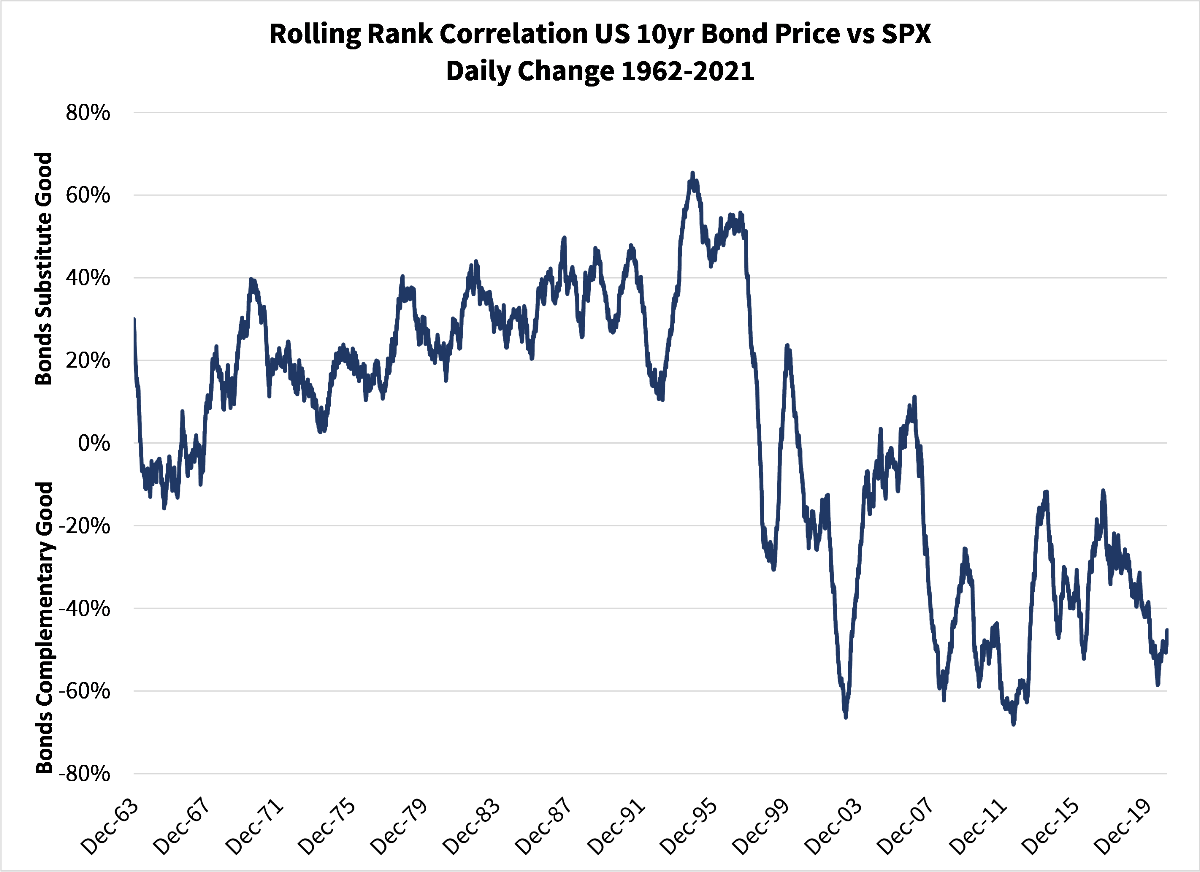

Finally, while much of the world is focused on the “Fed printer goes ‘Brrr’” meme, the much more powerful story is the Fed’s willingness to use interest rate policy to support equity risk. From the late 1960s until the 1997 Asian Flu, the Fed consistently erred on the side of inflation fighting, resulting in bonds and equities having a positive price correlation. This resulted in bonds and equities being substitutes in a portfolio. Post-1997, the relationship shifts sharply, and bonds and equities became “complementary” goods. Complementary goods, like fine wine and cheese, drive demand for each other. Why choose wine alone when a levered portfolio of wine and cheese will leave you both drunk and satiated?

With interest rates sitting near all-time lows, the continued reliance of the market on this relationship becomes increasingly tenuous. The Fed has clearly stated their reaction function if all goes well (interest rates will not be hiked); what will become interesting is to discover if they continue to have an effective game plan for a less favorable outcome. From where we sit, volatility may be one of the main games in town!

Logica Strategy Details

Note: We have comprehensive statistics and metrics available for our strategies, but only include a select few to highlight what we believe is our most valuable contribution to any larger portfolio.

- If you would like to learn more about our strategies, please reach out to Steven Greenblatt.

- If you would like to speak with Wayne or Mike on their views on Hedge Funds/Investing/Trading and trends they see shaping the industry, please contact Steven Greenblatt at [email protected] or 424-652-9520.

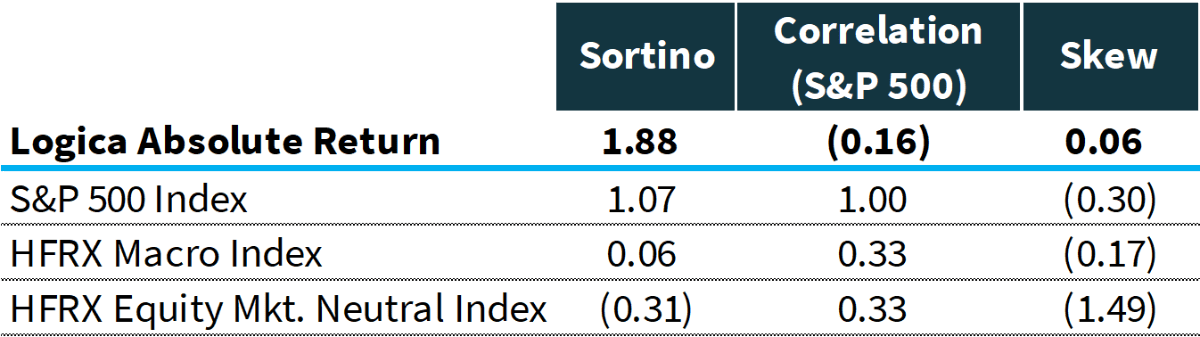

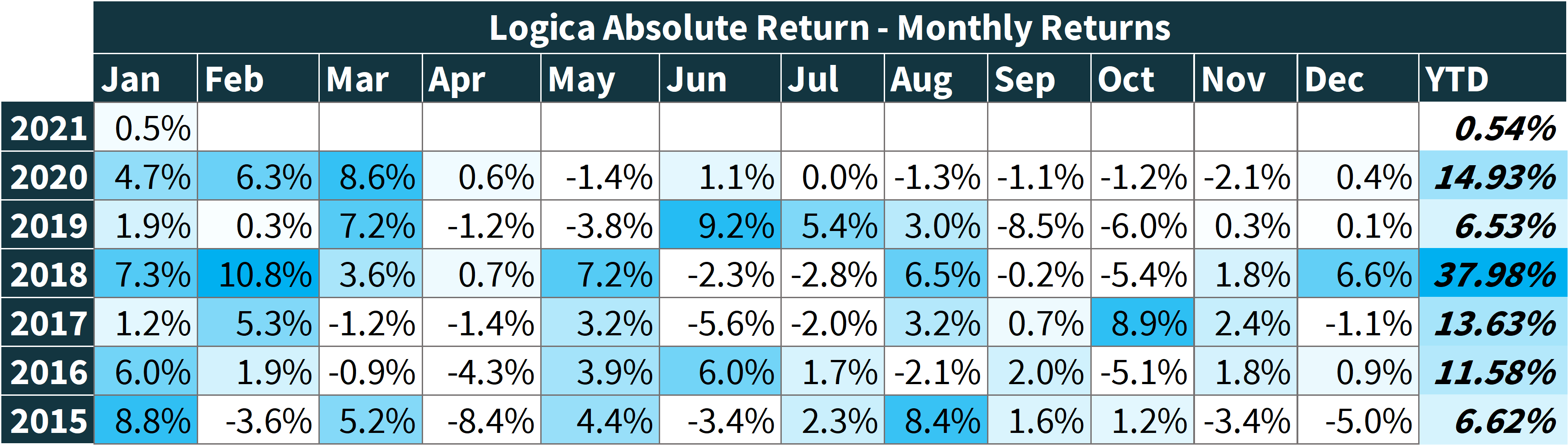

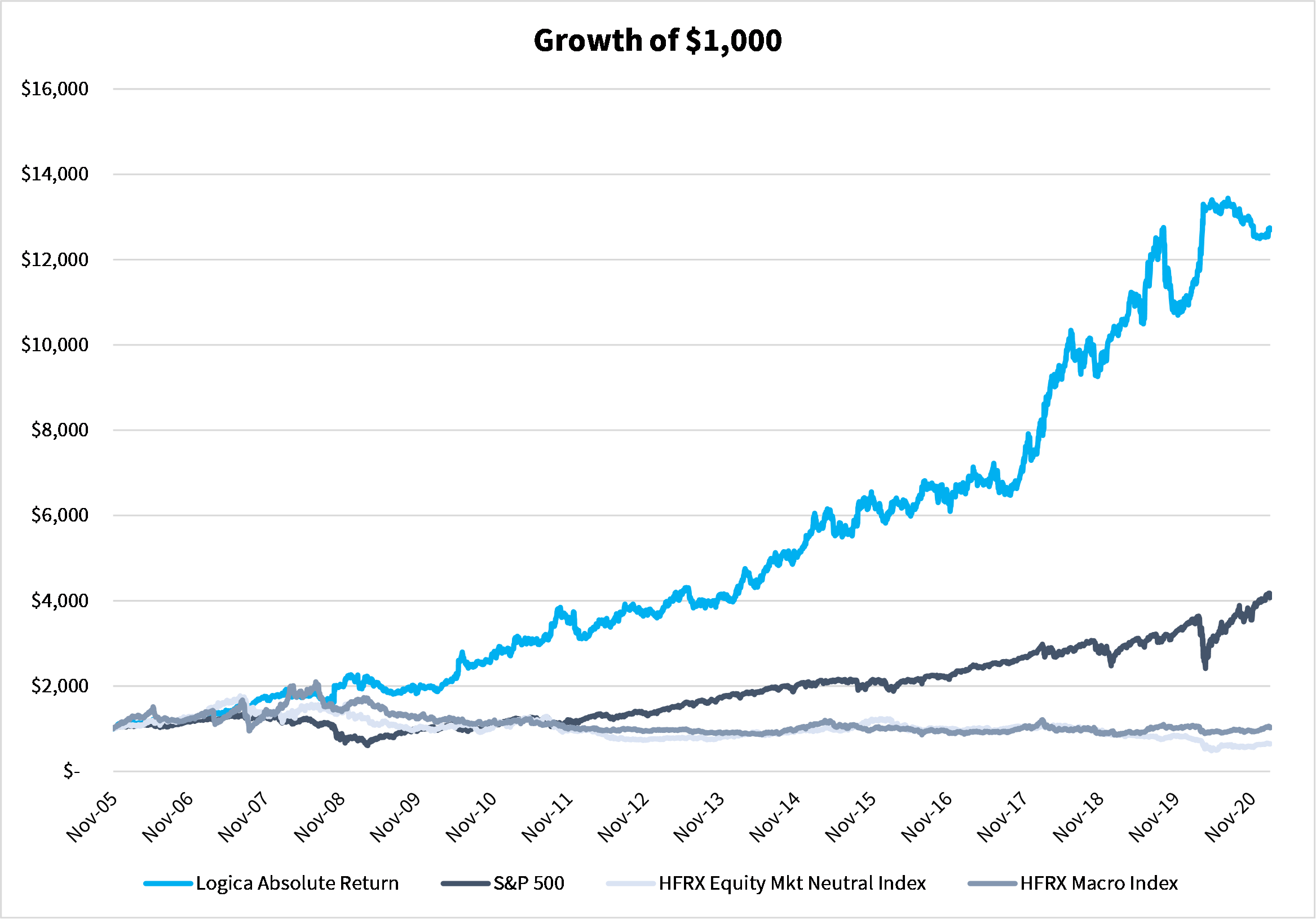

Logica Absolute Return

2015-2019 stats & grid, reconstitution of live sub-strategies normalized to 16% annualized volatility

2005 to present growth of $1000 chart, simulation

Jan 2020 live

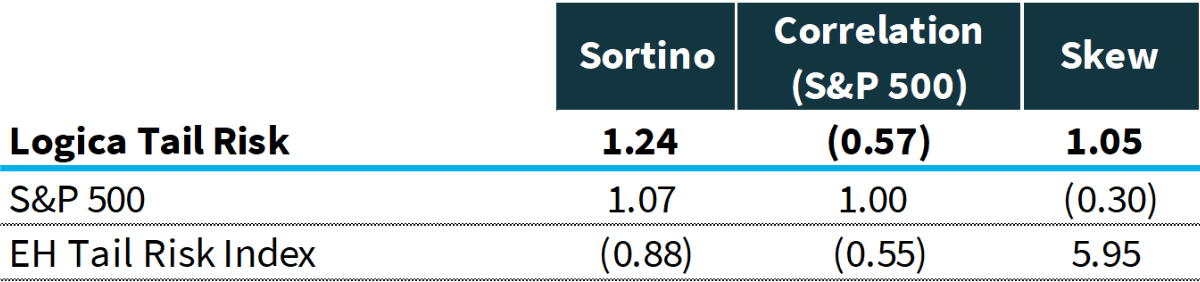

Logica Tail Risk

2015-2019 stats & grid, reconstitution of live sub-strategies normalized to 16% annualized volatility

2005 to present growth of $1000 chart, simulation

Jan 2020 live