“We are looking at the solution, but most of the time we forget the problem”. The energy scenario is changing as a result of years of green policies adopted by the major countries in the world. With energy storage playing a key role toward the integration of variable renewable energy (VRE) in the power grid, will Li-ion batteries keep dominating the stationary storage market?

Q1 2021 hedge fund letters, conferences and more

VRE Has Reached A Medium-Low Penetration Rate

In their latest redox flow battery report “Redox Flow Batteries 2021-2031”, IDTechEx estimated the role of medium duration energy storage in the context of larger penetration of variable renewable energy penetration. Up to date, variable renewable energy has reached a medium-low penetration rate between 10% and 40%. As investigated by academic research, the storage of energy will be a key tool to allow larger integration of renewable energy; the question is, which storage will be required to satisfy the growing VRE penetration?

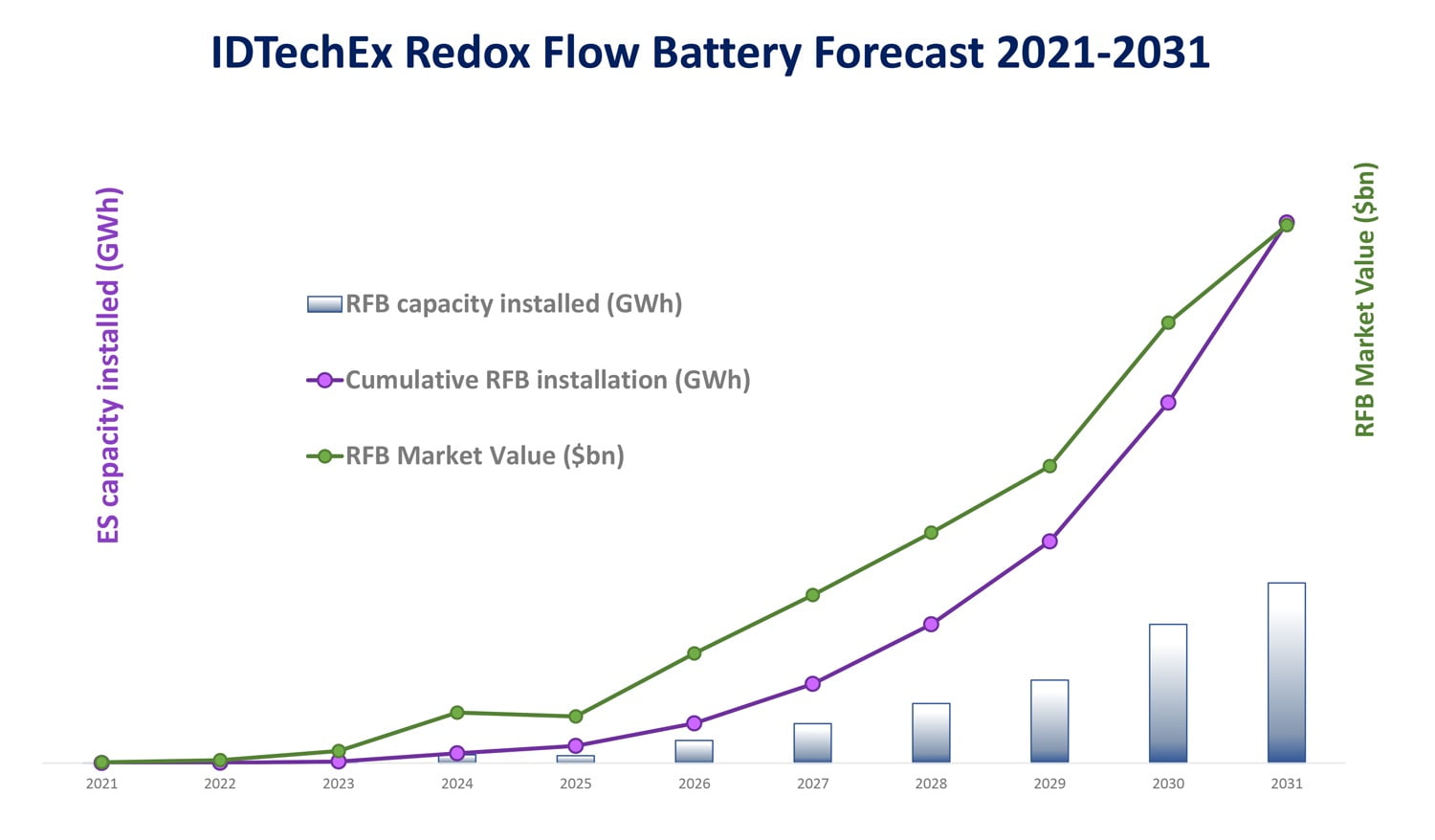

Li-ion battery technologies have dominated the stationary energy storage field, but will they continue to follow this path? From the study performed by IDTechEx based on several company profiles in the redox flow battery field and additional secondary research, IDTechEx has forecasted the possible future market penetration of redox flow batteries.

RFB Technology Will Overtake The Li-ion Battery Energy Capacity

The results from IDTechEx research shows that RFB technology might start to gain field to Li-ion batteries over the next decade, overtaking the Li-ion battery energy capacity installed before the end of 2030.

IDTechEx Redox Flow Batteries 2021-2031 Forecast. Source: IDTechEx report “Redox Flow Batteries 2021-2031” (www.IDTechEx.com/redox)

The large adoption of variable renewable energy (VRE) is substantially affecting the grid infrastructure, and more renewables will be installed, so the necessity to adjust and update the power grid will be greater. In fact, variability is one of the issues faced by the power grid.

The advent of VRE implies a variation of the existing grid infrastructure, due to the nature of renewable energy, both wind and solar. The variable and uncertainty of these renewable energy sources exacerbate the flexibility issue of the existing power plant.

Power Grid Flexibility

While the power grid flexibility is a characteristic that has existed in power systems from well before the advent of low-cost VRE, the evolution of its definitions has undoubtedly been driven by the increased adoption of VRE.

The IEA in 2017 defined flexibility as: “the ability of the power system to deal with a higher degree of uncertainty and variability in the supply-demand balance”.

In the latest redox flow battery report by IDTechEx, “Redox Flow Batteries 2021-2031”, the role of above 4h of storage has been highlighted, showing the comparison between redox flow battery and Li-ion battery in terms of Levelized Cost of Storage.

The author of the report believes, based on scientific studies, that the redox flow battery might take a larger share of the energy storage capacity toward the end of 2030, based on the expected larger renewable energy penetration.

The energy storage capacity might actually overtake the Li-ion battery storage capacity in 2031.

For more information on this report, please visit www.IDTechEx.com/Redox, or for the full portfolio of Energy Storage research available from IDTechEx please visit www.IDTechEx.com/Research/ES.

About IDTechEx

IDTechEx guides your strategic business decisions through its Research, Subscription and Consultancy products, helping you profit from emerging technologies. For more information, contact [email protected] or visit www.IDTechEx.com.