WHEN: Today, Wednesday, July 18th

WHERE: CNBC’s “Squawk Box”

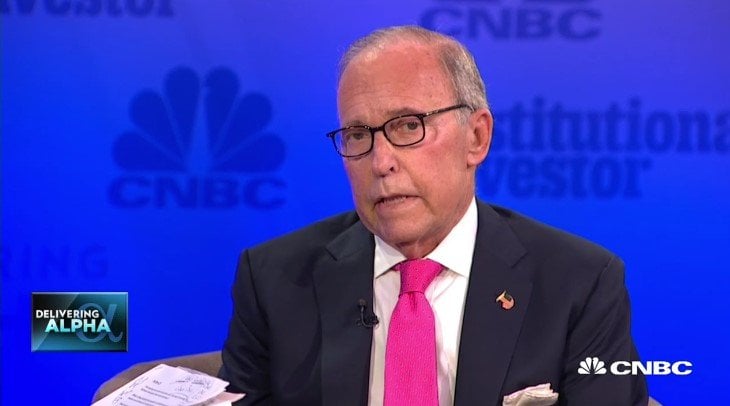

Following is the unofficial transcript of a CNBC EXCLUSIVE interview with Larry Kudlow, Director of the United States National Economic Council, live from the CNBC Institutional Investor Delivering Alpha Conference in New York City on Wednesday, July 18th.

Q2 hedge fund letters, conference, scoops etc

Following are links to the video of the interview on CNBC.com

CEA's Larry Kudlow: I'm Honored To Have This Job

Kudlow: Trade negotiations ongoing with EU

Kudlow: No recession in sight right now

JIM CRAMER: Thank you, everyone. First, Larry, you look great. You feeling great? Playing tennis?

LARRY KUDLOW: They'll let me play tennis this coming weekend. By the way, we haven't changed a bit. Not a bit. We all look the same.

JIM CRAMER: I don't know. I was 30 pounds heavier. You look younger. Congratulations.

LARRY KUDLOW: It's nice to be here. I appreciate it very much, and appreciate CNBC for having me.

JIM CRAMER: Well, we are thrilled. I miss you, partner.

LARRY KUDLOW: I miss you, too. That was a great show, by the way.

JIM CRAMER: Yeah. Agree to disagree. Now look. Five years ago, you were here. You were interviewing Tim Geithner.

LARRY KUDLOW: Oh, that's right.

JIM CRAMER: And I want to know, how does it feel to be interviewed now, rather than doing the interviewing?

LARRY KUDLOW: Oh, it feels fine. It feels great. I've done quite a lot of this, and I have to -- you know, I guess a little secret, maybe it's not a secret. I'm honored to have this job, whatever one thinks of POTUS, for me, it's a great honor. I've known him for a very long time, interviewed him many times on CNBC, on radio. But I kind of look at it, you know, it's not so much a job; it's an honor. I mean, I served in the White House OMB long time ago, 35 years plus. This is a more senior position. Probably, Jimmy, it's the most fun I've ever had, if you want to know the truth.

JIM CRAMER: Even though we know, by your own admission, there are various factions within, and you have to get the President's attention, you have to keep the President's attention. What happens if he ends up not agreeing with you?

LARRY KUDLOW: You know, you win a few and you lose a few in these jobs, like anything else. Sometimes you agreed with me; sometimes we didn't agree. You know, look, I will say this: President Trump has been very open, very accessible to me. I see him quite a bit during the day, lots of meetings. Sometimes you get an afternoon call, come downstairs and talk about one thing or another. Sometimes you're traveling on the airplane. He's just been great. He's open, and in meetings with five or six or eight, who knows, people, he'll go to me: Larry, what do you think? And I tell him. It's my job to tell him.

JIM CRAMER: Larry, what do you think? We're having a big fight with China.

LARRY KUDLOW: Well, you know, of course I like that fight with China. I don't necessarily agree with all the trade tactics. We'll talk about that some.But my point is, he really enjoys the back-and-forth, to his credit. I think he's greatly underrated in that respect. He thinks and processes. He loves facts, figures, charts. He's very attentive. When he disagrees, he'll let you know in no uncertain terms. But look, on the whole, I mean, obviously, I helped draft the tax and economic stuff during the campaign. I mean, we agree on almost everything, and where we don't agree, we talk it through. And he's been just wide open and accessible to me, and I just love that. And I will say this. A great thing about the National -- I'm an assistant to the President's National Economic Council. We have our fingers in everything. That's what makes this a really fun job, every darned thing under the sun, including stuff about which I know virtually nothing, and I have a crackerjack staff to help teach me. So, except for Kudlow and Cramer, Jimmy, this is the most fun I've ever had.

JIM CRAMER: You know, to bring it back to Kudlow and Cramer, why we ended up having such a great time is we're both serious -- the serious, rigorous side. I know, Larry, you must be thinking the way that Brian Moynihan did the other day when he was on Mad Money. He's talking 4% GDP. And we are all confused. You're the economist. How do you have a flat yield curve, 4% GDP, and have so many people who are gloomy?

LARRY KUDLOW: You know what's interesting about all that, it looks like it's 4-ish. I know nothing more than you know at this point, informationally. But could be higher. I'd be thrilled if it was 3-plus. That was our baseline. Everybody yelled at me during the campaign, after the campaign, when I came into this office, oh, you'll never get 3, you'll never get 3, including many dear friends of mine in the Democratic party, who I respect enormously. We are getting 3, and it may be 4 for a quarter or two. It may be plus, I don't know, but that's all to the good. You know, literally, millions more people are working. I mean, if you go into these jobs, what's the key point? The key point in my judgment, best way I can help the country is get the economy strong and prosperous, you know? You've got millennials out there -- I'm just going to depart for one second, and I want to come back to the GDP.

JIM CRAMER: Of course, the old days.

LARRY KUDLOW: Exactly.

JIM CRAMER: We're not adversaries. Let's put it that way.

LARRY KUDLOW: You've got kids, millennials, et cetera, some of whom are working in the White House, in junior positions, who have never seen a full-fledged, long-lasting prosperity. Honestly. They don't know what I'm talking about.

JIM CRAMER: They must think it's about to roll over at every minute?

LARRY KUDLOW: Every minute. I mean, they just won't believe it. It's not that they're cynics; they've just never seen it. We haven't had one in 20 years. Okay? You and I professionally grew up -- maybe I was through the stagflationary '70s. But the '80s and '90s, under both parties were fabulous prosperities. And, to me, that's the game. You go into these things, that's what you want to do. Do whatever you believe is best to generate a long-life prosperity. You know, there's 155 million Americans working. I believe we can get that up to 160 million or even better. We haven't had any productivity. I believe we can do that through taxes and regulation. That's why you do these things. In other words, you want to leave it better than you got it.

JIM CRAMER: But at the same time, you have never been a fan of a gigantic budget deficit. That's what people were faced with. I know the issue is, can we grow out of this? And you and I are both pro-growth. But isn't it, Larry, even if you're pro-growth, the numbers are so staggering. The deficit is so daunting.

LARRY KUDLOW: Well, I don't know. You know, yeah, gigantic deficits are not good. And we're going to run, as a shared GDP, we're going to run 4, 5%. That's not bad. I've seen worse. In the Reagan years, in the beginning, you know, you cut taxes, the first order is you lose some revenues, no question. But it's like investing in a business. You may have to borrow to make a good investment. I don't mean cash flow daily. I mean a good long-term investment. And I see the same thing happening now, the Trump tax cuts. Yes, we will lose some revenues in the very short run. I believe we'll get it back and more. We're going to have OMB mid-year review coming out soon. I'm not here to put the numbers out. Mick Mulvaney will do that. But the point is, yeah, you'll get your 4 and 5% GDP, far, far from the worst --

JIM CRAMER: Maybe taxes should be cut again?

LARRY KUDLOW: Well --

JIM CRAMER: I know there's a budding tax cut 2.0 move.

LARRY KUDLOW: That's correct. We had quite a good meeting yesterday on that very subject.

JIM CRAMER: With the President?

LARRY KUDLOW: And we're mulling over a number of very good options. Will be very pro-growth options.

JIM CRAMER: Capital gains?

LARRY KUDLOW: And will fit into --

JIM CRAMER: What's left?

LARRY KUDLOW: I don't want to go too far.

JIM CRAMER: Well, but is it Bracken?

LARRY KUDLOW: It's not in the bag. I would say this: A lot of people, and again, the policy is not yet formed, okay, so I'm not letting anything out. But there are a number of people on the Hill, for example, who would like to make a lot of the tax cuts, the individual tax cuts, permanent. Permanent. So not only did we have a successful tax cut, but we want to keep it that way. And then you may see, frankly, not only a 2.0, but you may see a 3.0, and you may see a 4.0. There's a lot of tax -- I'm an old Reagan tax reformer. Lower the rates, broaden the base. A lot of that was done in the last bill. Much needs to be done going forward. So some of those ideas are circulating and I think will come to fruition. Let me go just back, though, the GDP thing. Look, I'm not an academic guy, but I just pose this thought to people. In some respects, we are in the ninth year of a recovery, all right, from the middle of 2009 --

JIM CRAMER: Allegedly long in the tooth, for these younger people who around you in the White House.

LARRY KUDLOW: That's right, and they've never seen prosperity. So here's a thought. And I may be wrong about this, but just think about it. When I was a young economist at the Fed and Wall Street, it was easily labeled, by economists of all stripes, 2% growth was a growth recession. You follow? It was not a recovery, not really an expansion; it was called a growth recession. May have been Arthur Okun years ago, I don't know who coined that term. So just consider this possibility. We have been in a growth recession since the middle of 2009, and you can go back further if you like. Okay? Now, if we get the kind of numbers that you're suggesting and I'm suggesting -- we've already seen some of that, I mean, on a quarterly basis, four-quarter change. We're almost at 3%. We're going to go right to 3% this year. But that may be the beginning of recovery, so this may not be so long in the tooth.

JIM CRAMER: You're saying that everything could have been a prelude to what's about to occur now?

LARRY KUDLOW: Well, you know, I noticed Jason Furman was on this morning on Squawk, and he's a friend. He's a terribly smart guy. He may disagree, and I get that, but consider the possibility that a capital spending boom that we never really had, okay, widespread capital returnings back to the United States. You know, this is the hottest country right now in the world. Trillions of dollars are coming here, leaving Europe. It's leaving China. It's leaving a lot of places. We've never seen these kind of inflows probably since the 1990s. It is possible that a, "real" business growth cycle is right there in front of us for the next four, five, six years. That's a possibility, and I just want you to be open to that. Growth recession is one thing. Full-fledged recovery, where people not working can work and cap spending that never took place. Long-term projects now will be put into place, and the attitude towards business has improved enormously. Think about that. You could have a run here of five or six years, and that the rest of it, as you said, is prelude. Let's see.

JIM CRAMER: Well, the stock market is agreeing with you. At the same time, Larry, if that's the case, we're that strong, is this not the time to take on the Chinese? Do you think we are in a trade war with them, and do you think if you think we are, is it winnable?

LARRY KUDLOW: I think it's a significant trade dispute. Okay?

JIM CRAMER: More of a conflict than a war.

LARRY KUDLOW: Just pure Kudlow. It's what I do.

JIM CRAMER: We love you for it. We love you for it.

LARRY KUDLOW: And we've always done it. Look, I'm not a big fan of tariffs, you know that. I don't like blanket tariffs. Art Laffer and I wrote an op-ed piece before I lost my job at CNBC where we didn't like the steel national security 232. But I have been a long-term critic of China. All is a matter of public record, on the tape, and I think the President is doing exactly the right thing here. This should have been done years ago. A, the world trading system is broken. The World Trade Organization is broken. Just had this discussion at the G7. B, the biggest culprit is China, and particularly since it entered the WTO, which was about the year 2000, as I recall, China -- they're still labeled an undeveloped third-world country by the WTO. That's nonsense. Therefore, they are trying to use most-favored nation to have high tariffs, high nontariff barriers, which is a new game in town for Europe, particularly, but China is guilty of that. They do, in fact, steal our intellectual property left and right. They do, in fact, have a forced transfer of technology, for many American companies --

JIM CRAMER: Joint ventures.

LARRY KUDLOW: Right, it comes from the joint ventures. You're precisely right. They will not allow full American ownership, which would -- I mean, right now I have long discussion -- I'm not a China hand or China expert, but I'm getting up to speed rapidly, talking to people in business. You open a company on a joint venture basis in a Chinese province, okay, and because you only own 49%, they own 51% or more, the local party leaders -- you know, these are like mafioso Dons, I'm told. You have to go and lay your entire blueprint on the table, including the technology, and they will have their experts open it right up.

JIM CRAMER: Listen, I'm with you, Larry. You introduced me to --

LARRY KUDLOW: That's wrong. I just want to -- this is such an important point.

JIM CRAMER: -- a person who used to debate with us all the time, Peter Navarro.

LARRY KUDLOW: Yes.

JIM CRAMER: It sounds like versus what you said March 15 of 2010 on Kudlow Report, when you said, I believe the history here is that when we try to put the pressure on China in a public overt action, they don't like that, they revolt. We have to deal with them behind the scenes. It sounds like you've come much more closer to what Peter used to always argue.

LARRY KUDLOW: Actually, I have. Over the last five --

JIM CRAMER: Big change, big change. Because you debated -- I mean, I conducted dozens of interviews with you.

LARRY KUDLOW: It's taken a while for me to do this. But, yes, I've come to that view because I think the problem is getting worse. I really do. I'm not a big trade deficit guy, okay? Balance of payments, you can argue, you buy the goods, but the capital comes back in. But it is odd to me, through thick and thin, whatever the stage of the business cycle, our deficit with China continues to expand. There's something wrong there.

JIM CRAMER: At the same time, Larry, you did say once that consumers are so happy to buy reasonable quality low-priced goods from China -- this is what you taught me -- that a tariff hurts the American consumer. Sometimes it's better just to subsidize the industry that's in bad shape. Because you always said to me, there's 300 million Americans that benefit from no tariffs. That couldn't have changed for you.

LARRY KUDLOW: So I have a solution.

JIM CRAMER: Okay.

LARRY KUDLOW: America is the lowest tariff country in the world. I mean, there may be New Zealand or something, smaller countries, not to demean them. But of the major, we have the lowest tariff country in the world. Our average tariff I think is about 2.5%. Now, China's average tariff is about 14%. It was worse, but they haven't made any progress lately. By the way, Europe's is also rising. So, look, here's my solution and the President agrees with this: Lower your barriers. I want to help American consumers in business. Yes, yes, yes, full choice. If they lower their tariff barriers and they lower their nontariff barriers and open markets, we will export like crazy, because America has become the most competitive economy in the world. Give us a chance. I went to Beijing with our team, and when China came to the USA, I was involved in those discussions in the dinner. I sat next to Liu He and his young assistants, and I think they're sincere. Okay? So there's hope. On the other hand, I do not think President Xi at the moment has any intention of following through on the discussions we've made. And I think the President is so dissatisfied with China on these so-called talks, that he is keeping the pressure on. And I support that.

JIM CRAMER: Would you support tariffs on all $500 billion that we trade with?

LARRY KUDLOW: No, I --

JIM CRAMER: I mean, there's not much left. Should we just ratchet it up?

LARRY KUDLOW: You know, we have to be careful there. You can put pressure on them, which is what the President's doing. And he's a pretty good deal-maker, as you know. On the other hand, they will come at our companies in China.

JIM CRAMER: They'll come at Apple. I know you talked to Tim Cook.

LARRY KUDLOW: Particularly the joint venture companies.

JIM CRAMER: Okay.

LARRY KUDLOW: Apple's not one of them.

JIM CRAMER: Right.

LARRY KUDLOW: They've already done -- I mean, for example, Hollywood companies, movies. Chinese love American movies, right? God bless them. I think our movie-makers take home 25% of the revenues. China's government takes the rest. Huh? That's crazy. That stuff has to be fixed. We can't let China steal our technology, Jimmy. Those are our family jewels. What if the next America, the greatest economy in the world, it is our innovative and inventive use of technological advances. This is Schumpeter's gale and creative destruction at large. We can't let them do that. They haven't responded at all, not one basis point, to our request to do something about the theft of intellectual property and the forced divesture of our technology.

JIM CRAMER: You'll be telling the President in order -- how to get them to change their ways. This is obviously unacceptable for the American people.

LARRY KUDLOW: Right, right.

JIM CRAMER: And it's unacceptable for the world economy.

LARRY KUDLOW: I agree. By the way, the whole world agrees with us.

JIM CRAMER: Right.

LARRY KUDLOW: I mean, Europe agrees with us, Canada. Everyone knows this is true. By the way, our sources -- now, a lot of sources in China are telling us that the Chinese government realizes they're wrong. Okay. I hear this repeatedly from my sources; and, yet, as of today, they refuse to act on it. They know they're wrong. They know the rest of the world knows they're wrong. I call it the trade coalition of the willing, and something has to be done here. Now, for POTUS -- let me just make a point. I'm going to defend him here, lock, stock and barrel. We've had Republican and Democratic presidents in the past make these complaints to China, even take these complaints to the World Trade Organization, okay? But they never follow through. They say it, nothing happens. Life goes on. The situation gets worse. You follow?

JIM CRAMER: Yes.

LARRY KUDLOW: This guy, President Trump, has the biggest backbone. This is one of the things I talk about him in this and other places. He will not let go of this point. He will not. Nor should he, in my opinion. And China's going to have to come around. I am an optimist, by the way --

JIM CRAMER: But you remember Secretary of the Treasury Mnuchin had often indicated that this can work out; that there has been movement. It sounds like there's been no movement by the Chinese, and yet you have to step it up if you're going to get them to change.

LARRY KUDLOW: Well, we will see, you know, on the tactics, okay? But your point is well-taken. Steven Mnuchin is a good friend. We are allies. We are essentially free-traders in the administration. That's no secret. I speak to him almost every day. So, yeah, we're optimists. All right. I believe, from my experience two days in Beijing, a day in Washington, D.C., and a long dinner in Washington, D.C., I believe China wants to make a deal. Okay? So it's out there.

JIM CRAMER: Okay. You really do?

LARRY KUDLOW: I do.

JIM CRAMER: Okay. And your sources within China are indicating that that could be?

LARRY KUDLOW: That is correct. But, insofar as we know, President Xi at the moment does not wish to make a deal. Now, I'd love to be wrong on that. President Trump has a good relationship with him, as he's spoken. We are working together in numerous ways, with respect to North KoreLARRY KUDLOW: Hope springs -- you know. Communications continue. But I think Xi is holding the game up. I think the U.K. and others would like to move and haven't. Wilbur Ross went over there, $70 billion in commodities. Heck, that's where we were when we all went to Beijing in the first place. So I think he needs to move. We are waiting for him. The ball is in his court. And the tit-for-tat business, which is nobody's favorite path, but nonetheless, they can end that this afternoon, this afternoon, by providing a more satisfactory approach, and essentially, Jimmy, doing what the rest of the world knows needs to be done: Tariffs down; nontariff barriers down; IP theft, no. Allow the American or British or whomever, German, full ownership of the companies operating in China. And let me make one last point here, because I think there's confusion. People say, well, Trump is doing it. President Trump inherited this mess and a broken trading system. If you talk to him, as I have so many times in the last three or four months, and I wrote an op-ed piece about this in the "Washington Post," the first day of G7, he sees himself as a free trader. People don't get this. Don't blame Trump. Blame China, please. Blame Europe. It's going down the wrong road. He sees himself as a free trader. He has said in the group of seven and since -- I mean, I was there fixing the communique -- let's have no tariffs. Let's have no tariff barriers. Let's have no subsidies. Let's have a tariff-free trade system. That's his view.

JIM CRAMER: But at the same time, he --

LARRY KUDLOW: He's got to protect the country.

JIM CRAMER: Right. But let's take NAFTA, for instance.

LARRY KUDLOW: Yes.

JIM CRAMER: You have a 4-1 ratio with the peso, when it's created. It's now 19-1. I mean, that is a trade barrier in itself. How do we adjust NAFTA? How do we make it so that American commerce -- and you heard Jay Powell yesterday say the countries that remained open to trade, that haven't erected barriers, including tariffs, are growing faster. They have higher incomes, higher productivity. And countries that have gone in a more protectionist direction have done worse, emperical result. Worried about NAFTA? Start raising barriers, raise a wall, have them pay for the wall.

LARRY KUDLOW: Jay Powell's right. Look, I'm the hard-cast free trader, you know? I'm simple: Lower tax rates, roll back regulations, keep the dollar steady and free trade advances. That's me. That's pro-growth solution. Jay's 100 percent right. By the way, Jay Powell's doing a great job over there, in my opinion. We're talking to Mexico, unlike China. We're having very productive talks with Mexico.

JIM CRAMER: More constructive.

LARRY KUDLOW: Robert Lighthizer is our trade ambassador, is a good man. He and I were children during the Reagan administration years ago. So I can report -- without specifics, I can report good progress on Mexico. That could be a very promising avenue by the by.

JIM CRAMER: Okay. Again, the stocks are saying that that is absolutely the case. I want to talk about inflation and why you can be optimistic about inflation, despite the fact that we've got a high budget deficit. And, again, why is the two-year tenure in such an odd frame, versus what I've come to expect you to be able to come up with an answer for all these things.

LARRY KUDLOW: Okay, good barrel full of questions here. Let me do the best I can in limited time. I get that. Kudlow axiom. You've heard this a zillion times before. Economic growth does not cause inflation. More people working and producing do not cause inflation. Okay? Bad money, excess money, a sinking currency -- and you'll see it fast in the market, as you well know: Bond markets, commodity markets, whatever. I don't see it, and I'm very happy -- the Fed is independent. I made some remarks a few weeks ago, not aimed against that. I support what Jay Powell's doing. I'm just saying, I believe the new management at the Fed does understand that, by itself, economic growth, particularly what I call supply-side growth, where you're increasing the economy's potential, more capital spending, more investing, more productivity, right, that's not inflationary.

JIM CRAMER: No. So why raise lock-step if the truth is that we're just beginning to get certain parts of this country to get some of these workers more money? It's happening now, just the last three quarters.

LARRY KUDLOW: I agree. I think -- you know, again, I don't want to spend a lot of time critiquing the Fed, because I basically agree with what they're doing. I think their gradualist approach is very good. I do. I think it's very good. And I think that approach, by the way, will get things done rather more quickly, instead of holding it out. Now, regarding the spread. Actually, we're reading the spread wrong. Okay? This is an interesting point. I want to give a hat tip to my friend and colleague and former anchor and so forth, Ron Insana, who is no fan of Trump. I think he and I get along very well. He wrote me beautifully when I was in the hospital. I love the guy. But Ron wrote a good article. He went back and looked at the yield curve model from the New York Fed, which was done by this chap, Estrella, who is now teaching up at RPI. It's actually not 10s to 2s; it's 10s to 3-month treasury bills. Very important. And I actually went and got the model. The New York Fed is still publishing the model. The spread is flatter, but it's 100 basis points or so. It's not 20 or 30.

JIM CRAMER: Right.

LARRY KUDLOW: That's very important. So it's 10s to the 91-day bill. This is Professor Estrada. And so from his work, the probability of a U.S. recession predicted by the spread over the next year is only 12.5% through the month of June. 12.5%. So I think people are making too much of the 10s to 2s. Watch the 10s to 91 days. Now, every recession has been led by an inverted curve, 10s to the 3-month bill. And you can look this up -- I think Estrella still has -- he's at RPI. I think he has his website. But the New York Fed is still publishing it. And I give a hat tip to Ron Insana who worked this out. We found it on the CNBC website. So, you know, good for you and good for Ron.

JIM CRAMER: All right. Do you think the yield tariffs --

LARRY KUDLOW: No recession in sight. No recession in sight. I just want to make that point. No recession in sight right now.

JIM CRAMER: So, then, we can put more tariffs, if we have to -- let's say if we put tariffs on German oil.

LARRY KUDLOW: Look, a lot of discussions are being held with the individual countries.

JIM CRAMER: Right now.

LARRY KUDLOW: Right now. Right now. Jean-Claude Juncker, the head of EU, is coming to Washington next week. We will be in discussions. I am told he is bringing a very important free trade offer. Okay. I'm told. I can't confirm that. This is what I'm hearing.

JIM CRAMER: That could lower barriers from both sides. That would be very bullish, Larry.

LARRY KUDLOW: Yes, it could. Look, I was in the bilaterals -- just to step back for a minute -- with Justin Trudeau and President Trump, and with President Macron and President Trump. And our team was there. Bolton was there, Lighthizer was there. Then they had their team. So President Trump said to both Trudeau and Macron, and later to Merkle: Let's abolish tariffs, nontariff barriers and such. Let's work together to do that, okay? We made progress. There were no deals, okay. That communique broke down not because of those bilaterals. The bilaterals were great. Because of the press conference that Trudeau never should have given. Now, I am told, through sources, including our ambassadors, that Merkel has been working on that, shaking up the EU --

JIM CRAMER: Even after NATO, even after what looked like a very tough NATO discussion.

LARRY KUDLOW: Yes.

JIM CRAMER: You're more positive than I've heard about this.

LARRY KUDLOW: Yes.

JIM CRAMER: Last question, because --

LARRY KUDLOW: I'm here to work with you on this. So we may be -- you know, in this game, predictions are impossible.

JIM CRAMER: Right.

LARRY KUDLOW: But I'm just saying, the President has put things on the table. The Europeans are looking at them, okay, and we may be pleasantly surprised. If not a factual deal, Jimmy, at least good, solid negotiations on these topics.

JIM CRAMER: All right. Last question. Just go back to China. It does sound like things could get out of control with China; boycotts, kick-outs, things going worse before they get better. Is that an accurate depiction of what could occur with China?

LARRY KUDLOW: Not necessarily. Not necessarily. I mean, at the moment the trade negotiations are kind of stalled, but other discussions are red hot. I mean, most cases, according to the President, they have helped us with the North Korean situation. That could be one of the greatest breakthroughs in history, possibly. And President maintains -- I've never been on these calls, but his calls with President Xi are quite cordial. Okay? This is good. It's just the trade area where they're lagging. So if I have a message to you, don't be gloomy and doomy in an overboard sense.

JIM CRAMER: Okay.

LARRY KUDLOW: I mean, the American economy is in very good shape. When you do the arithmetic on these things, the volume of goods subject to tariffs times the tariff rate itself, it's still a very small number relative to our GDP. Okay? That's important. I think that can be overrated. From someone who doesn't like tariffs, but nonetheless, we're in good shape here. And the discussions are ongoing. So I want to be as optimistic as I can, even though we're dissatisfied with China on this point. These things may change. Got a lot going on here. There's a lot at stake here. But I do want to say again, you know, you mentioned Peter Navarro, who's an old friend of ours, from our show and so forth and my show. We agree on some things.

JIM CRAMER: All right.

LARRY KUDLOW: We don't agree on others. He's a wonderful person, by the way. Personally, we're very friendly. But the point is, the Trump administration is a lot more together on these things than people think. Journalists do their job. You're a TV journalist. I used to be a journalist. They're doing what they have to do, and they love to cause trouble, but it is a bit overrated inside the administration. And I'm here to say, on that point, not only is the economy strong because of many of Trump's actions on taxes and regulations, but also POTUS is by and large, an advocate of free Kudlow trade, okay? I wouldn't have taken the job -- that doesn't mean he agrees with me on every tactic and every meeting and so forth and so on. He's a very hands-on, decisive guy, as you well know.

JIM CRAMER: Yes, I do.

LARRY KUDLOW: And we've all interviewed him many times. But he's on the right track. The story's on the right track. Listen, nothing succeeds better than success, all right? 35, 40 years ago, when I was a child working for Reagan, Reagan went to G7 meetings the first couple years. I thought he was nuts; tax cuts, deregulation, I thought it was nuts. Then, all of a sudden, we started growing at 4, 5%, and then they decided to copy it. Okay? USA is starting to grow at 4, 5%. Others will copy it. I hope they do, and I hope free trade is still going to be a pillar of our policies. I love the fist bumps. This is how we started.

JIM CRAMER: Yeah, so let's leave that on a positive note. Larry Kudlow, thank you so much.