The BRICS countries are challenging the status quo of the global financial system. As part of this effort, they’ve announced a blockchain-based BRICS currency and payment system as part of a broader initiative to promote de-dollarization.

This decentralized financial platform aims to improve the global monetary system by facilitating cross-border transactions and disrupting reliance on the U.S. currency, which dominates over 80% of international trade.

The new payment system goes beyond just a backup solution; it’s a strategic effort to introduce a new world order in which countries can trade and invest using a standard digital currency free from the fluctuations of the dollar.

BRICS currency

Spearheaded by BRICS’ core members, the initiative leverages the power of blockchain technology to potentially lower transaction costs for governments, businesses and individuals. The core principle is accessibility. This independent system is designed to be user-friendly and politically neutral, fostering a more inclusive global financial environment.

By creating a viable alternative to the dollar-centric system, BRICS could spur joint economic growth for its core members and other economies seeking to lessen their dependence on the U.S. dollar. Creating a BRICS currency and payment system could also be a significant step toward a multi-polar world order, although dethroning the U.S. dollar will be a substantial undertaking.

BRICS, a powerful, yet contentious intergovernmental organization, highlights the importance of its new currency. Established in 2009, BRICS began as an acronym for an alliance between Brazil, Russia, India, China and South Africa, highlighting promising investment opportunities. However, this initial focus has evolved, transforming the organization into a significant geopolitical bloc.

In a significant expansion, BRICS has since welcomed Egypt, Ethiopia, Iran and the United Arab Emirates as members. This now means the bloc encompasses a vast 44.3 million square kilometers and boasts a population of about 3.67 billion people.

Further underlining its significant demographic and economic weight, BRICS’ collective GDP tops US$25.85 trillion, accounting for a staggering 27% of the world’s total GDP (US$95 trillion). Their combined foreign reserves are also formidable, at US$4.5 trillion (as of 2018).

Beyond seeking economic influence, the BRICS nations have strategically positioned themselves as a counterweight to the G7. Initiatives like the BRICS Contingent Reserve Arrangement, the development of a common BRICS currency, and the BRICS basket reserve currency all demonstrate their commitment to reshaping the international financial system.

“Work will continue to develop the Contingent Reserve Arrangement, primarily regarding the use of currencies different from the US dollar.”

Yury Ushakov — advisor to the President of Russia on foreign policy issues

Understanding BRICS’ influence is vital as we discuss their new blockchain payment system. It’s crucial to know how impactful this group is and what changes it can bring to the world stage.

BRICS’ strategy and potential for change

BRICS unites emerging economies with a shared vision of a more equitable global order. Founded on non-interference and mutual benefit principles, the organization seeks to foster economic growth and development for its members and beyond.

The core objective of BRICS is eradicating poverty, unemployment and social exclusion through inclusive economic growth. This strategy, outlined in the official BRICS Strategy document, prioritizes not just economic expansion but also a focus on innovation and upskilling to create a higher quality of life for all.

The BRICS nations hold annual summits to discuss challenges to the U.S.-led global order. While not a formal alliance, the organization counters U.S. dominance in trade and finance. Friction points include the Ukraine war (Russia vs. U.S.) and currency-reserve dominance (Chinese yuan vs. U.S. dollar).

The recent expansion of BRICS to include major economies like Iran and Saudi Arabia suggests a growing movement seeking to reshape global influence.

“We should increase the influence of BRICS and build extensive partnerships. As a cooperation platform with global influence, BRICS cooperation is more than about our five countries. Rather, it carries the expectations of emerging markets, developing countries, and the international community.”

Chinese President Xi Jinping — Speech at 2017 BRICS Business Forum

“Guided by the principle of open and inclusive cooperation, we BRICS countries place a high premium on cooperation with other emerging and developing countries and have established effective dialogue mechanisms with them.”

Potential ramifications of the BRICS currency and a blockchain-based payment system

Economists and policymakers have discussed the possibility of a BRICS digital currency. While a stablecoin, which is a digital currency pegged to national currencies, offers stability in terms of its value, it might also be detrimental in the long run for two reasons.

- Limited growth: Stablecoins are designed to maintain a stable value by being pegged to existing fiat currencies or other physical assets like gold. While this feature ensures that stablecoins are less volatile than other cryptocurrencies, it also challenges independent economic growth within BRICS, where stablecoins are often used as an alternative to the local currency.

- Central bank control: Despite the “free of politics” ideal associated with stablecoins, they could still be subject to central bank regulations. This oversight could compromise the independence of stablecoins from government control, ultimately undermining their appeal as a decentralized alternative to traditional currencies.

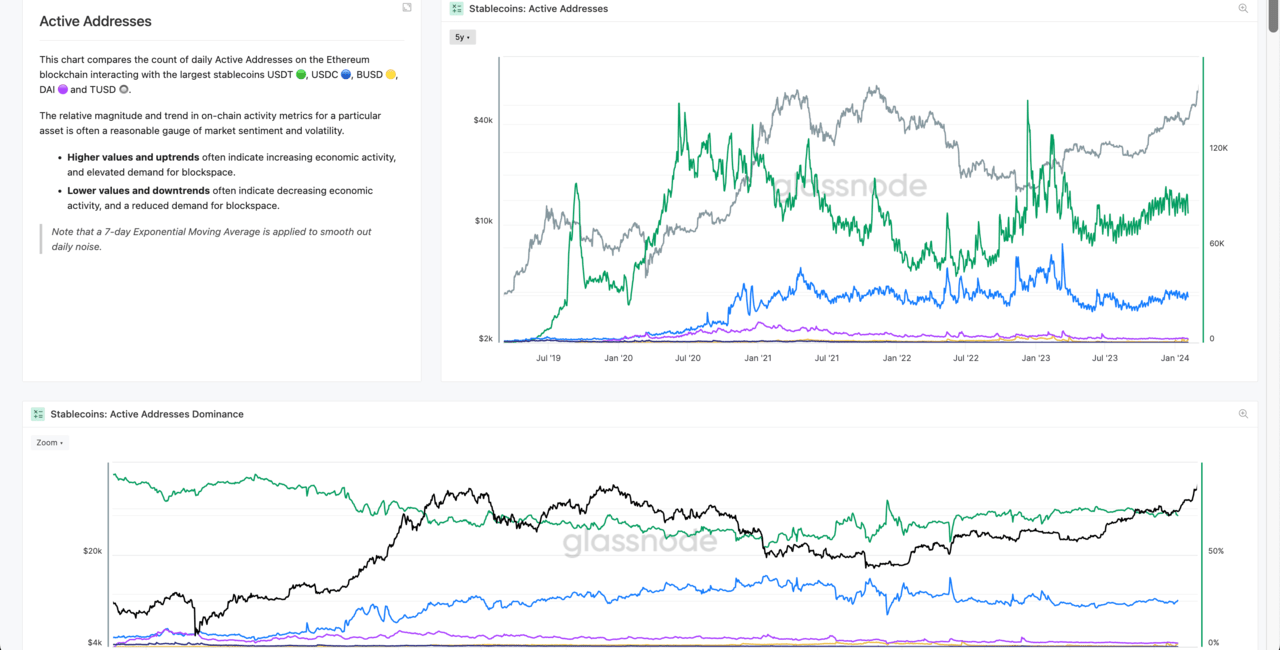

Global adoption rate of cryptocurrency

While the number of countries that view bitcoin as legal tender is small, the number of crypto holders is growing at a rapid pace.

Forty percent of Turkey holds cryptocurrency, ranking the country 12th on the Global Crypto Adoption Index and reflecting Turks’ desire to counteract currency devaluation and youths’ interest in new technology. This trend is evident in the trading volumes of Shiba Inu.

Turkey is fueled by high inflation and currency devaluation, showcasing a booming cryptocurrency market. As such, SHIB’s popularity highlights a key advantage of meme coins: accessibility.

The recent meteoric rise of meme coins such as Shiba Inu, Doge and Smog may lead to a point where they are no longer viewed as “joke coins.” If the adoption rate of meme coins continues to pick up pace, it will be unsurprising to see some of them starring in the BRICS blockchain-based payment system.