For weekend reading, Gary Alexander, senior writer at Navellier & Associates, offers the following commentary:

Thanksgiving came early this year – on the Fourth of July, as we celebrated a four-day weekend after the market soared by double-digits (+16% in the S&P 500 and twice that in the NASDAQ) and we avoided that dreaded recession that experts said was 99% certain.

What’s more, we really could have celebrated July 4th three weeks ago, since June 21 was America’s 235th birthday as the oldest surviving constituted democracy in the world. June 21, 1788 was the day when nine of the 13 original colonies ratified the Constitution to officially create the framework of our nation, enabling our first elections later that year.

This week, I want to chronicle two market surprises of the first half: No Recession + An AI/Tech Boom.

Surprise #1: Like I Said in May…No Recession in Sight

I wish Las Vegas offered lines on outcomes like “a 99% certainty of recession this year.” I’d make a lot more money than betting on sports teams that constantly break my heart (and bankroll, when in Vegas).

On May 31, I urged you to take that 99-to-1 long-shot bet against a recession this year. The Conference Board, which sports a 100% accurate track record of calling such things, assured us we would be mired in recession this year, but a downturn is nowhere in sight and is now receding farther into the distance.

Here’s the link to that piece: 5-31-23: A Recession is 99% Certain This Year? Don’t Bet on It – Navellier

In June, the mainstream press began to agree with me. First, on June 5, after the May jobs report came out, CNN’s Matt Egan observed that “the case for a 2023 U.S. recession is crumbling for a simple reason: America’s jobs market is way too strong.” (see: “The case for a 2023 US recession is crumbling”)

Later last month, on June 23, James Mackintosh opened his article in The Wall Street Journal (“Where’s the Recession We Were Promised?), by saying, “The 2023 recession is missing in action,” admitting (as I had written), “The yield curve… inversion doesn’t guarantee recession, but it is foolish to dismiss it.”

On the same date in Barron’s (“There Won’t Be a Recession This Year. You Can Take That to the Bank,” June 23), Andy Serwer ridiculed recession fears as “the most widely predicted economic event in modern history—which seems pretty certain not to happen.” Serwer argued that the $2 trillion of recently added spending from Washington DC in three large new bills will likely continue to jump-start GDP growth.

The following week, Jonathan Levin wrote (in “Is it Time to Cancel the Recession Altogether?” in Bloomberg, June 27), the “US economy keeps surprising the doomsayers.” He listed three better-than-expected economic indicators released on June 27 and quoted our favorite economist, Ed Yardeni: “The permabears will have to postpone their imminent recession yet again, based on today’s batch of U.S. economic indicators, which suggest that our ‘rolling recession’ is turning into a ‘rolling expansion.’”

Levin added: “For the past 15 months or so, economists and strategists have been obsessed with Federal Reserve … and the yield curve.” That blinded them to the strength of household and business balance sheets as well as the strong job market….”

Another Bloomberg author (Jahn Authors, in “Waiting for the Godot Recession,” June 28), wrote the next day, “The last two years have been a chronicle of a recession foretold. But global investors who had positioned their portfolios for the slowdown have been left twiddling their thumbs (and losing out) as the economy shows one sign of strength after another.”

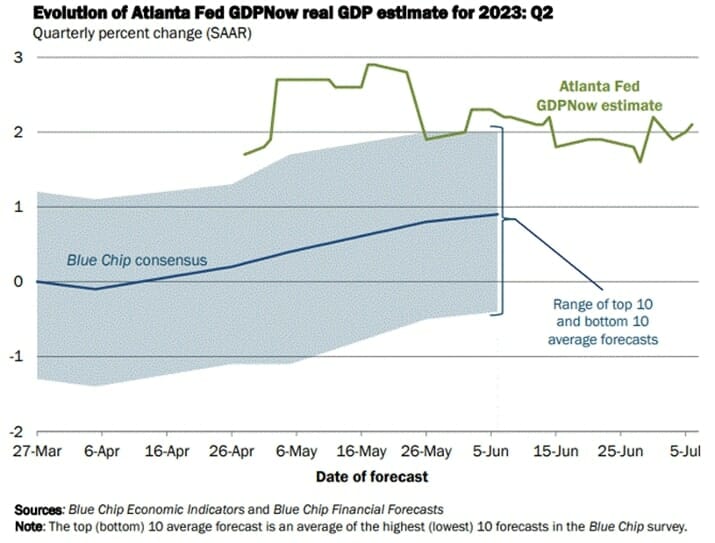

The Atlanta Fed’s GDPNow Model for the 2nd Quarter of 2023 is +2.1% (annual rate) as of July 6, 2023.

It’s nice to see my column validated so strongly and unanimously within a month, but I will admit that I’m concerned about such certainty by Barron’s and Bloomberg in phrases like “Take it to the Bank” and “Cancel the Recession Altogether.” That is way too dogmatic for this card-carrying contrarian to enjoy.

Surprise #2: “AI” Has Resurrected the Tech Boom (But Beware “GIGO”)

The second big surprise of the first half is the AI fad – oops, boom – rescuing the tech stock sector.

I call AI “Two Vowels that Saved Wall Street.” On Thursday, July 6, The Wall Street Journal summarized this new trend in a Page 1 Headline: “Boom in Artificial Intelligence Helps Lift Tech-Sector Blues.”

“Excitement over artificial intelligence is proving a powerful counter-force for a tech economy that had been slowing, lifting share prices and growth outlooks at many giants and igniting a wave of new startups. …. In the winter, the industry looked like it might be headed for an extended and painful slump. Tech titans were emphasizing efficiency and laying off tens of thousands of people.

The NASDAQ Composite Index had lost more than 30% in 2022. But enthusiasm over AI has exploded among investors, executives and technology since the startup OpenAI late last year unveiled ChatGPT, a bot that can converse in human-like language.”–Tom Dotan, Wall Street Journal, July 6, 2023, Page 1, “Boom in AI Helps Lift Tech Sector Blues”

Maybe I’m missing something in all the champagne celebration here, but I’ve seen several technological revolutions in my lifetime, dating back to the first office computers threatening to do away with all office jobs and paperwork in the 1960s. That didn’t happen. Everyone said, “Feed the data into the computer and the computer will have all the answers in an instant,” but my boss said, “Garbage in, garbage out” (GIGO). Translation: If you feed the computer bad data, you get bad data (multiplied and faster) out the other end.

It will be the same with AI, in my view, at first anyway. This year, from March 20 to April 5, Forbes Data surveyed 600 business owners on how they planned to use AI in their businesses, and I was shocked to see that nearly all (97%) identified at least one aspect of AI they planned to implement, and a huge 74% said they anticipated to use ChatGPT in generating responses to customers through chatbots. About two-thirds (64%) said that AI will improve their customer relationships and 60% expect AI to drive sales growth.

Whew! I thought we were already overloaded with computerized phone bots and clueless Web chatters. Haven’t you (like me) found it nearly impossible to generate real answers by phone or Web sites to your customer needs? Will AI be yet one more tinny voice to misunderstand your very specific questions? Will AI understand irony, inflection, satire, or disgust when you tire of its series of transfers to new portals?

When human intelligence is in such short supply, artificial intelligence is no permanent solution. What goes into the robot’s programmed answer must come from an intelligent, caring, creative human being. When our education system is broken, we can’t create enough robotic answers to replicate smart humans.

I will close with a positive angle from some short techie films I reviewed for Freedom Fest this week.

Technology is Still the Answer – But Created by Humans, Not Machines

I just reviewed 32 films for the Anthem Film Festival (held at Freedom Fest, July 12-15 in Memphis). Three of my favorite short documentaries involve technology and human inventions. The first two show why America is still the leader in technology and invention, but the conclusion to film #2 and the third film show why we still face high hurdles from big business and big government. Here is a summary of each.

Bitcoin Cowboys: Will Wyoming Become the Next Crypto Capital? (Directed by Tim Hedberg) showed a new mainstream way for banking with bitcoin in one of the more independent freedom-loving states, Wyoming, where women first won the vote (in 1870) and where Limited Liability Corporations (LLCs) were first chartered (1977).

Some inventive and courageous bankers, like David Kintsky, CEO of Kraken Bank, and Caitlan Long, CEO of Custodia Bank, bypassed the Fed and the FDIC to develop a Special Purpose Depository Institution (SPDI) to back bitcoin accounts with 100% bitcoin backing. They are willing to take reasonable risks and use creative means to provide a real service in a freedom-oriented state. The film makes the case this couldn’t have happened in Europe or even in New York or California.

The Great Equalizer (by Pritchett Cotton) is about the U.S. patent system, profiling two energetic and creative Americans, jump-rope athlete Molly Metz and electrical lineman Rayshaan Conaway, with their inventions of a “better rope” and a “better helmet” and the roadblocks they ran into with corporate thieves and a rigged system against the small inventor. The film should be called “The Great Un-Equalizer” for that reason. Small business owners can go bankrupt seeking ownership of that which they invented.

May I also remind you of a film I reviewed here last week, “Trust Us” (by Chase Kinney), which touches on the potential dangers of AI by tracing the rise of American technocracy: Governance by bureaucratic experts.

Beginning in the early 20th century, this documentary reveals how our leaders funneled power to un-elected experts who were convinced they could engineer solutions to all of our nation’s problems, but under FDR it first turned into bureaucratic arrogance, then morphed into a massive administrative state.

All three films are available via YouTube, but please rent or buy copies to support the brave filmmakers.