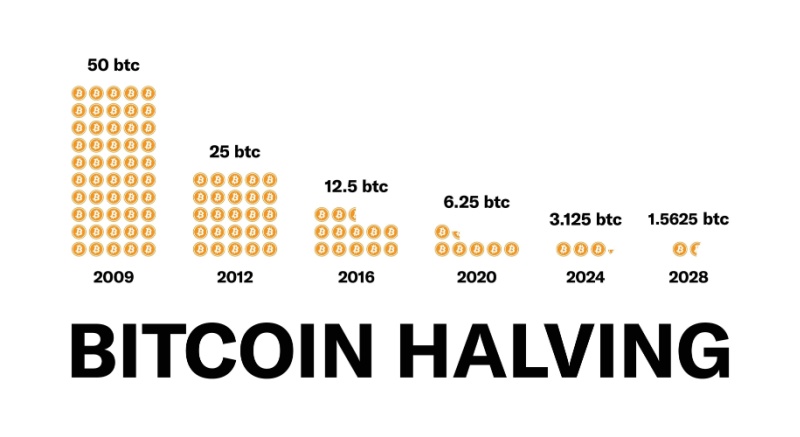

All eyes will be on the Bitcoin Halving on April 20 (approx.). Every four years, the Bitcoin rewards sent to miners for validating and securing transactions are halved.

The Bitcoin used for rewarding miners is freshly minted. This means new Bitcoins are produced (minted) to award the miners. From a historical point of view, Bitcoin enjoyed significant gains within the first 365 days after the halving.

BTC halving 2009 – 2028

As fewer new Bitcoins are minted, supply becomes limited. As a result, the price tends to kick higher. However, 2024 turned into a more volatile year than was initially expected.

Iran’s strike on Israel shook the crypto markets

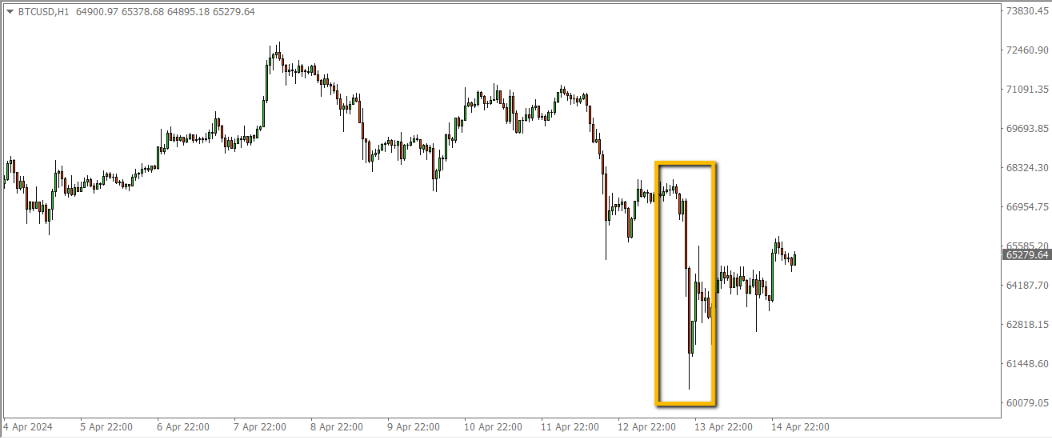

Iran’s decision to launch an attack on Israel lead to extreme volatility across the crypto markets.

According to the BBC, Iran launched over 300 drones, 30 cruise missiles, and 110 ballistic missiles.

This is how Bitcoin reacted to the news before some recovery took place.

Bitcoin 60min Chart 04/15/24

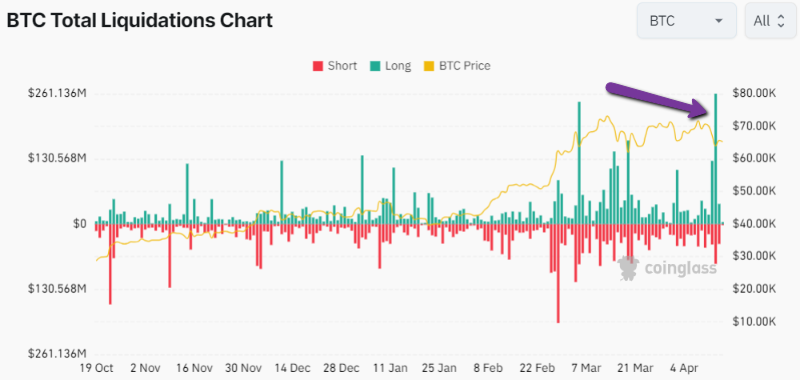

According to Coinglass, $780M were liquidated (loss) in the crypto markets following the plunge including Solana and Cardano.

Blockchain analytics platforms also point out that approximately 290,000 crypto traders were liquidated. The mass liquidations intensified the sell-off.

source: coinglass

The preoccupying question for traders is whether Bitcoin recovery continues when halving occurs.

Bitcoin’s ‘supply shock’

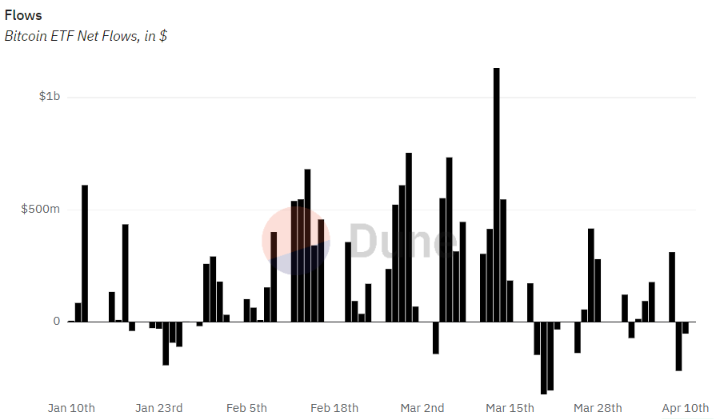

The US SEC’s approval of spot Bitcoin ETFs positively impacted Bitcoin’s price. Over $12B flowed into the ETFs. The total amount of BTC held in the ETFs is approximately 839,00, around 4.26% of BTC’s total supply.

If the inflows continue at the current pace, when less Bitcoin will be minted due to the Halving supply will be limited.

When strong demand meets limited supply, price appreciation of the asset tends to materialize. In other words, it is a ‘supply shock.’

source: dune

When the US markets open today, if we witness strong inflows into the ETFs, it may signal that investors are dismissing the tension in the Middle East ahead of the Halving.

The dip in Bitcoin appears to have attracted bargain hunters who took advantage of its lower price (discount). Therefore, today’s attention will be on the spot ETF inflows.

Bitcoin ‘presales’

BRC-20 tokens are based on Bitcoin. The smart contracts utilize a fraction of a Bitcoin to mint tokens and NFTs. Binance is among the crypto exchanges that list BRC-20 tokens.

Ongoing presales like 99Bitcoins and Dogeverse, which will launch on the BRC-20 chain, may indirectly reflect investors’ demand for Bitcoin.

Dogeverse has raised over $5M. 99Bitcoins, whose presale just began has raised $742,000 so far.

Watching those presales to litmus test investors’ interest may act as a soft signal for risk tolerance despite geopolitical events in the Middle East.

If Bitcoin posts new historic highs following the Halving, it may be well-seen in BRC-20 tokens.

Hong Kong Bitcoin and Ethereum ETFs pending approval

Hong Kong may approve both BTC and ETH spot ETFs this week. An official announcement could be made this week with some expecting it to occur as early as Monday.

The approval of the spot crypto ETFs may bring $25B into these cryptocurrencies according to Matrixreport.

‘Based on the (potential) available capacity, this might result in up to 200 billion Hong Kong dollars of available capacity for those HK Bitcoin ETFs—or US$25 billion,’ Matrixport stated.

Such news may contribute to the crypto market recovery, particularly Bitcoin, and inject greater volatility when the Halving takes place around April 20, 2024.

Bitcoin technical projection for the halving

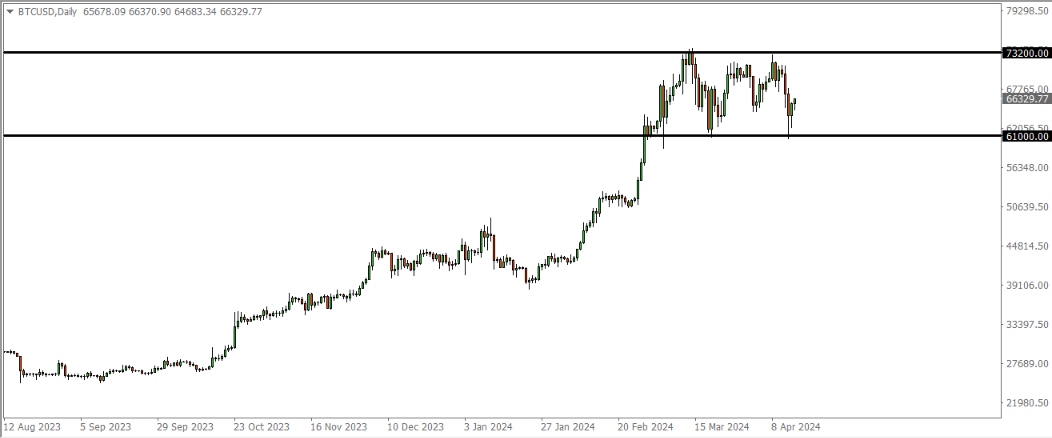

The Bitcoin daily chart reveals the recent sell-off was halted by the daily support.

bitcoin daily chart 04/15/24

From a technical angle, some recovery is projected if the support (around $61,100) holds. Any gains in Bitcoin may be limited to the resistance level (around $73,200).

For an uptrend to continue, the price must overcome the resistance (in this case $73,200) to trend higher. If the Halving leads to Bitcoin breaking above $73,200, the price may initially target $80,000.

What can dent the Bitcoin rally?

The US SEC: The US regulator must decide whether to approve a spot ETH ETF in May. Despite the SEC’s calls for public comments, the ETF’s approval is uncertain.

Israel retaliation: Although the odds of retaliation have dropped, in the event Israel does retaliate, a full-scale war may begin. Israel must affirm it will not retaliate to sustain BTC rally.

US elections: With the EU MiCA enforced at the end of 2024, strict crypto regulations and taxing may dent BTC rally. The US stance on crypto regulations may be sealed following the outcome of the US elections in November 2024.

Donald Trump stated in March that if he wins the elections, he will not crack down on the use of Bitcoin and other cryptocurrencies. The polls ahead of the elections may trigger volatility in the top cryptocurrencies.

Conclusion

Based on the above, including technical analysis, there is positive news for Bitcoin that may sustain the recovery in the short term. BRC-20 ongoing presales should be closely monitored.

The Halving may pave the way for stronger gains only if Bitcoin overcomes the $73,200 resistance.

The US elections and tension in the Middle East could reshuffle the cards or push Bitcoin to historic levels.