Is News Just Noise to Long-Term Investors? Research by Bank of America and Empirical Research Partners Suggests Otherwise

Q2 2020 hedge fund letters, conferences and more

The news. It happens, it gets published, and then it’s old. The news is by nature ephemeral - it changes every moment of every day.

The classical view of economics is that in an efficient market the news gets absorbed into asset prices almost instantaneously. Which if it were true would suggest there is little point in the average investor reading the news, because, the chances are that by the time they have absorbed it, the market will already have reacted - and in many cases that is true.

Relatively recent developments in the fields of AI and natural language processing, however, now mean computers can scan - or better said ‘read’ - the news at Mach speed. These news-reading programs (such as those developed by RavenPack), are often used by hedge funds to drive high-frequency algorithmic trading strategies that buy and sell stocks based on signals generated from live news.

Yet, what about long-term investing as practiced by traditional mutual or pension funds? On the surface, it seems highly unlikely the news could add any value whatsoever to investors in this sphere. And yet surprisingly, there is actually research showing the potential for news-based long-term investment strategies, by which we mean investments lasting over a year.

Sounds implausible? Perhaps, but below are three examples of how even traditional pipe-and-slipper mutual and pension fund investors can use news-based trading strategies for the long-term.

Bank of America Merrill Lynch: News Sentiment Long/Short Global Stock Portfolio, 9.0% AER

When Bank of America Merrill Lynch first trialed news-based quantitative strategies, they were not too hopeful.

“Some of the white papers said that alpha generation opportunities only lasted over 3 months, and most of our investors are long-only traditional investors,” says Girish Nair, Global and APAC Quantitative strategist at Bank of America Merrill Lynch.

Yet, after subjecting the data to rigorous backtesting Girish and his team found that whilst 99% of the news had no value at all over the long-term, the remaining 1.0% did and it was helpful.

When used as the basis for a long-term news sentiment-based trading strategy the subset of high-value forecasting news generated signals that produced an average 9.0% excess annual return over a 16-year period.

What’s more, when combined with more traditional investment factors it was found to have an enhancing effect.

“When we started combining it with value, growth, momentum, dividends, risk, small-cap, large-cap, we found that the information in news was quite orthogonal. In fact, adding the news to every other factor improved the alpha over the long-term.” Said Nair.

Empirical Research Partners (ERP): News Sentiment For Value Investing, 11% AER

On first impressions, value and the news seem to add no value to each other as both are likely to be negative. As Rochester Cahan, Portfolio Analyst at Empirical Research Partners (ERP) puts it:

“If you look at value stocks they tend to have below-average (news) sentiment in general, which makes sense right - that’s probably why they are value stocks, something hasn’t gone right so they are trading at low multiples.” Given that is so, how can news data help value-orientated long-term investors, if at all? By distinguishing between those value stocks which are turn-around prospects and those that are value traps.

Research shows that when the news about stock changes and becomes more upbeat, it is often a sign that particular value stock has potential.

“It doesn’t matter how long a stock has been cheap, what you are really looking to do is pull the trigger when the sentiment turns,” says Cahan.

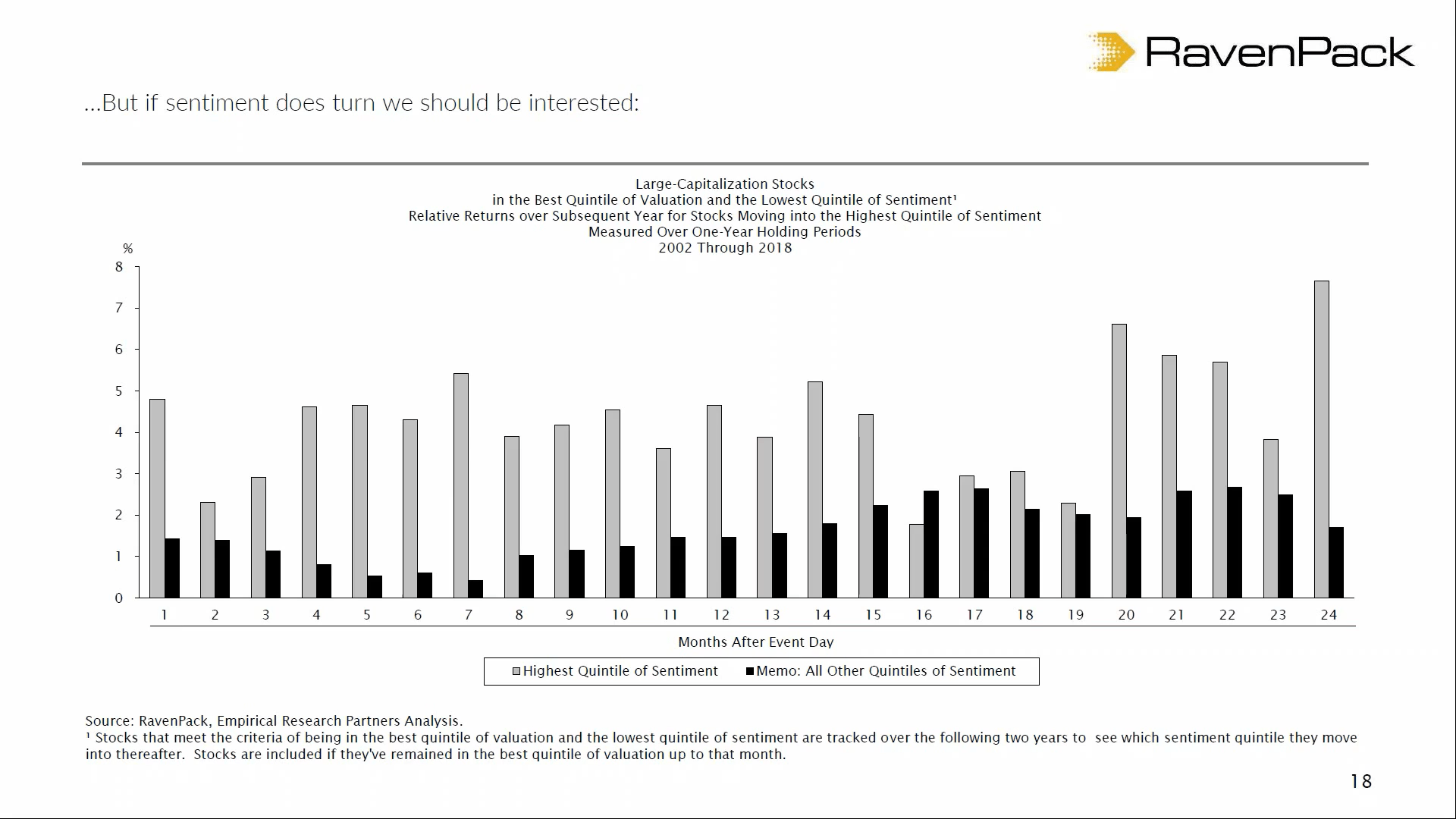

The chart below compares one-year forward returns of value stocks that have witnessed a turnaround in news sentiment - pictured in grey - and value stocks that have seen no such improvement in news sentiment - pictured in black.

As can be seen from the bars, which show month-by-month selections over a 2 year period, value stocks combined with improving sentiment showed an average 2.5% higher returns compared to stocks with other quintiles of sentiment.

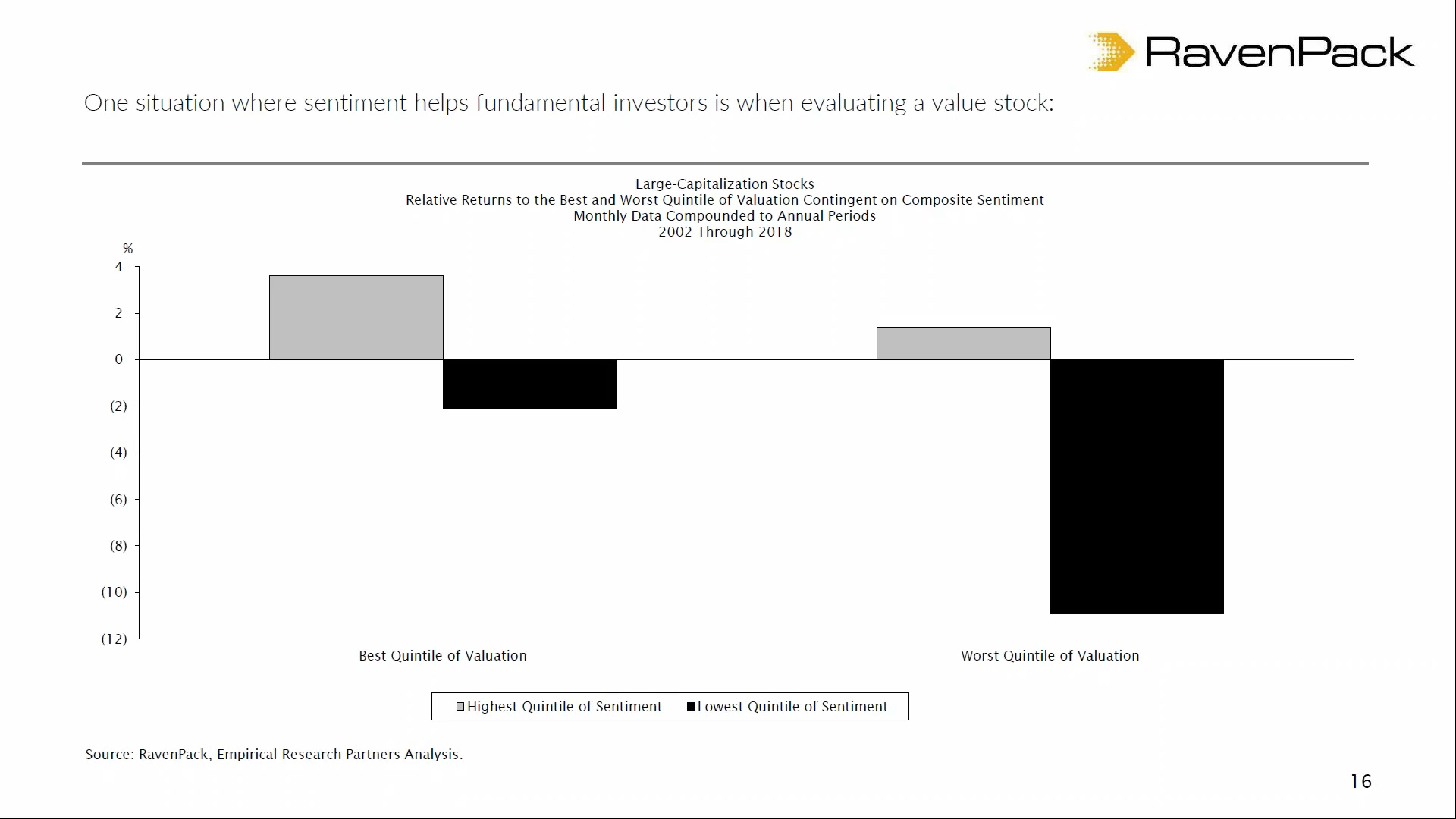

For investors willing to go short, the same strategy inverted works even better: the stocks which showed the greatest volatility were overvalued stocks that saw sentiment flip negative. These experienced an average 11% drawdown over the next year, as shown by the chart below.

Long-Term News-Based Biotech Pharmaceuticals Strategy: ERP

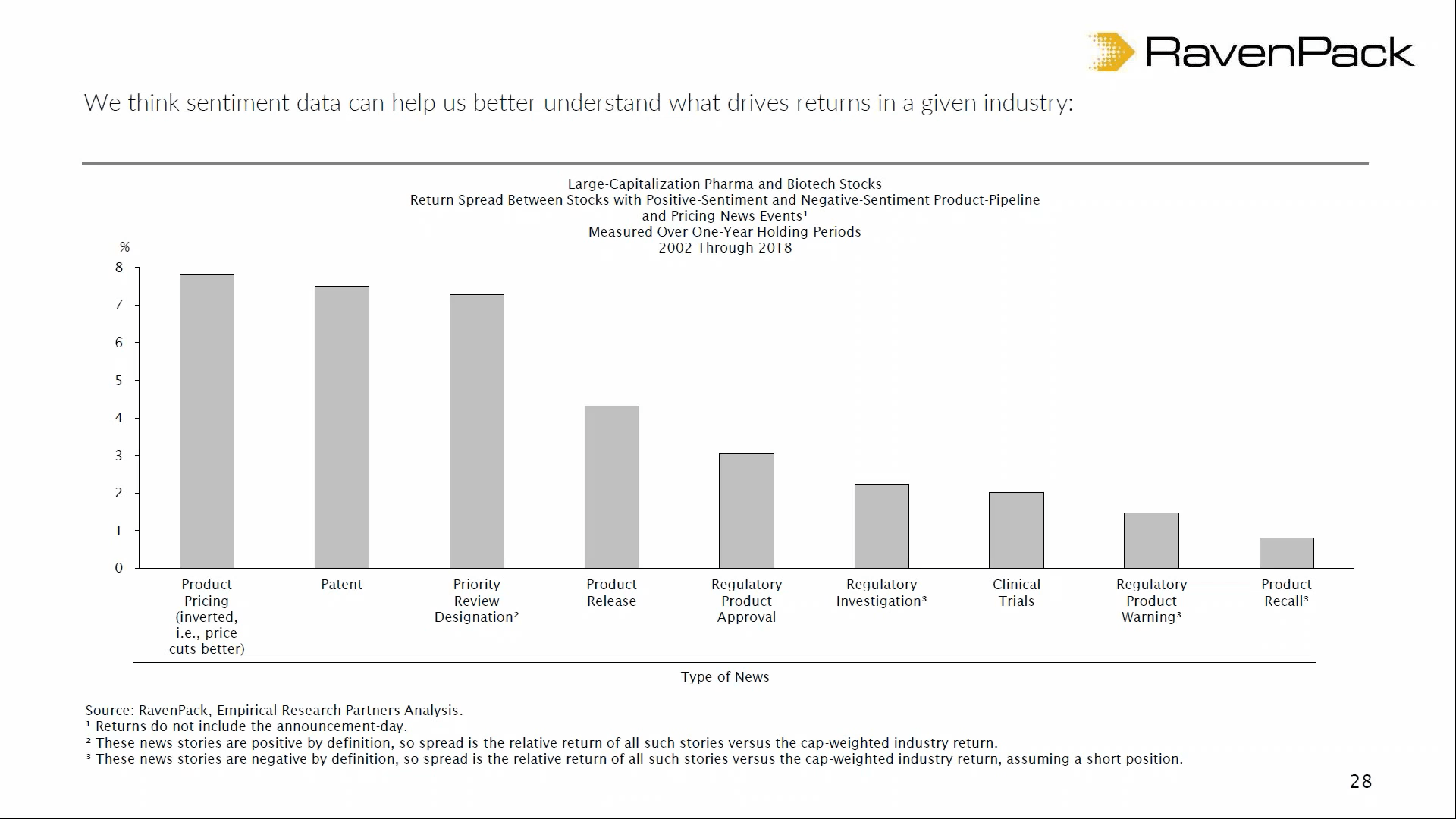

The Biotech-Pharma sector is especially well suited for news-based long-term investment strategies, according to ERP’s Rochester Cahan. Firstly, it “has a lot of moving parts”, and secondly, the sector is poor at pricing-in novel company news.

This especially goes for news about new patent approvals, FDA fast-track drug approvals, and changes in drug pricing.

Taking patent approvals as an example, Cahan shows how following the announcement of a new patent there is a slow drift higher in the stock price over the next year.

“On the news day, yes, if you do get a positive patent approval the stock does jump up a little bit, but not hugely; but what is really intriguing is by the end of the year - so 1 year later - the stocks that have positive patent news on average outperform their sector by 6-7% points,” says Cahan.

News about drug pricing sees similar long-term gains but acts inversely with drug price reductions actually leading to a positive circa 7% stock price drift higher; whilst news about drug price increases results in a negative stock price decline over the next 12 months. The reason for the unintuitive price reaction is probably due to many recent drug price scandals, which weigh on stock prices.

The chart below shows common news events for Biotech and Pharma stocks ranked by average annual drift following release.