The Broad Market Index was up 1.43% last week and 23% of stocks out-performed the index.

The focus of the global central banks shifted last week from tighter policy to constrain inflation to a wash of new money to improve liquidity in bond markets.

This not only contradicts the lower inflation policy but also illustrates that with long bond yield at half the inflation rate, investors will not buy bonds. That leaves central banks no other choice and sure thing last week interest rates fell broadly.

Q4 2022 hedge fund letters, conferences and more

Energy Sector Still Strong

The largest part of the decline in inflation from 9% to 6.5% in the past 7 months is the drop in the price of oil. The energy sector is producing very strong growth. It is the only sector with sales growth rising and profit margins up.

Usually in a rising growth period, energy companies would be expanding capital expenditures. Increased exploration and production expenditures result in higher supply growth with a lag. In this rising growth period, companies are increasing dividends and share repurchases. The cash is going to shareholders not to future growth in supply.

We are now more clearly on a declining growth trend with inflation too high and interest rates too low. Working out those imbalances will result in lower asset prices. More debt means more leverage and more vulnerability to lower asset prices.

Too-Big-To-Fail Banks

Meanwhile, financial authorities and banks are arranging deals to carve up the assets of the failed banks. This is a common process in the US financial industry and one of the contributors to the growth of too-big-to-fail banks.

Last weekend there was the deal to remove the FDIC insurance limit to avoid inconveniencing Silicon Valley Bank depositors and this weekend it is the UBS (Union Bank of Switzerland) to take over the assets of Credit Suisse. UBS is a huge investment manager very familiar with breaking the rules and Credit Suisse is a US investment banker with a long history of corruption.

Such rearranging of deck chairs is a distraction from the real issue of falling corporate growth. Although growth has been falling for a year, it remains very high mostly due to very high sales growth in energy (56%) and Consumer Cyclicals (21%).

Both sectors could show a steep drop in the first quarter financial statements to be reported with the SEC in April. Although, sales growth remains high at 15.3% but is falling at 73% of companies. Gross profit margins are up on average but lower at 57% of companies accounting for 63% of market capital.

Growth Rates have peaked

Although the autos and housing industries remain very strong, their growth rates have peaked and sales growth is lower more broadly. That is very good news because a slowdown in these big-ticket consumer purchases can slow the economy and lower inflation.

A steep drop in corporate growth is not good for stocks and justifies a large cash position.

Maintaining large cash balances to defend against a market decline. That is easier now. With short-term interest rates near 5%, the loss to inflation is lower. Still, cash is not a good long-term strategy. Buy shares of accelerating companies displaying accelerating top line attributes companies, such as:

Enphase Energy (ENPH) $195.990 BUY This Rich Company Getting Better

Enphase Energy, Inc. (NASDAQ:ENPH) has been an exceptionally profitable company with inconsistently high cash return on total capital of 15.3% on average over the past 8 years. Over the long term the shares of Enphase Energy have advanced by 3837% relative to the broad market index.

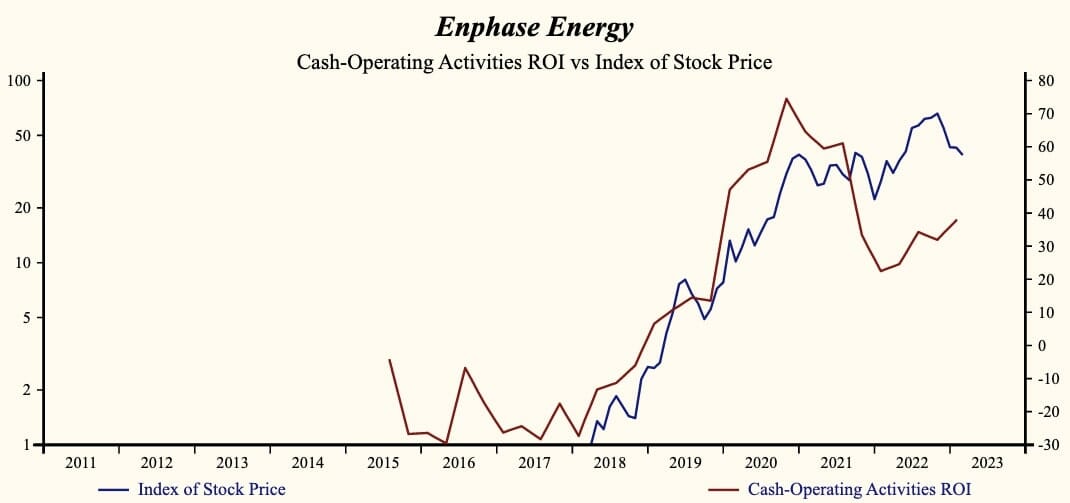

The shares have been very highly correlated with trends in Growth Factors. The dominant factor in the Growth group is Cash-Operating Activities ROI which has been 91% correlated with the share price with a five-quarter lead.

Strong Growth

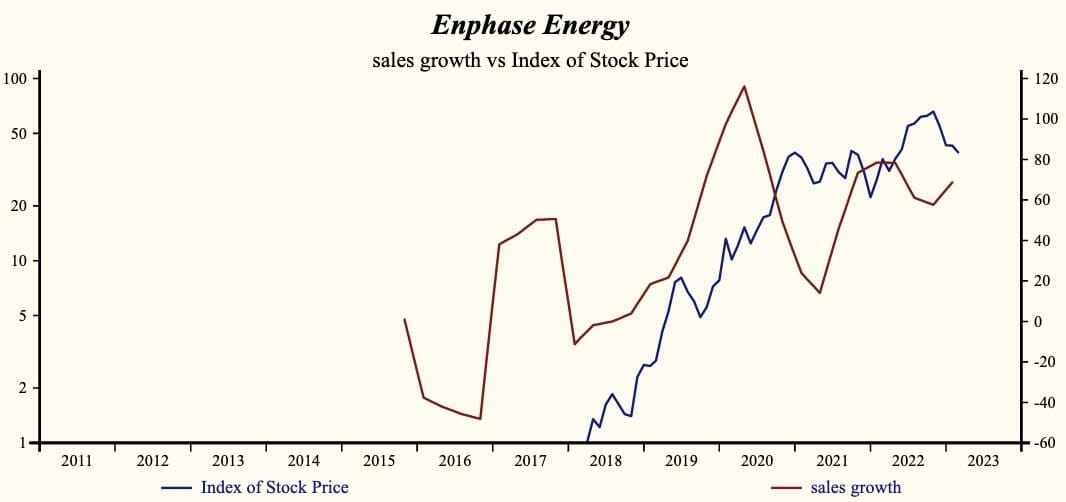

Currently, sales growth is 68.7% which is very high and higher than last quarter.

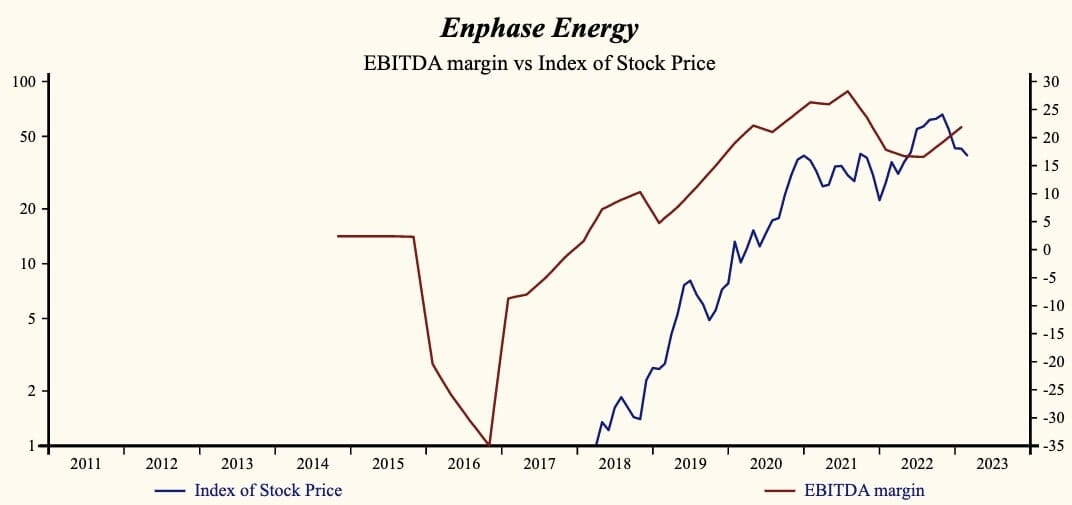

The company is recording a rising gross profit. SG&A expenses are low in the record of the company but falling. Higher gross margins and lower SG&A expenses are producing a leveraged acceleration in EBITD relative to sales.

Strong Cashflow

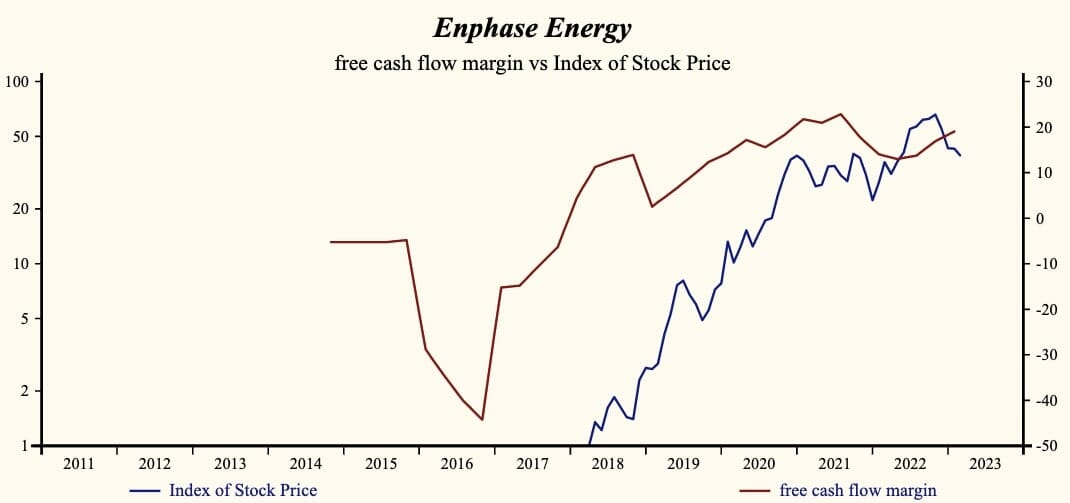

As a percentage of sales, free cash flow measures the relationship between cash flow growth and capital expenditures. The stronger gross margin and lower costs is producing an acceleration in the EBITDA profit margin thereby accelerating free cash flow growth for a third consecutive quarter.

Strong Buy

More recently, the shares of Enphase Energy have advanced by 41% since the January, 2022 low. The shares are trading at lower-end of the volatility range in a 14-month rising relative share price trend.

The current depressed share price provides a good opportunity to buy the shares of this evidently accelerating company.

The more stable the pot appears, the better the attributes. Green and gold are good. Red is bad and the more intense the red the more urgent the call to action.

Learn more and sign up for our Otos NOtos notifications at OTOS.io and experience your financial reality as FREEDOM AND EMPOWERMENT.