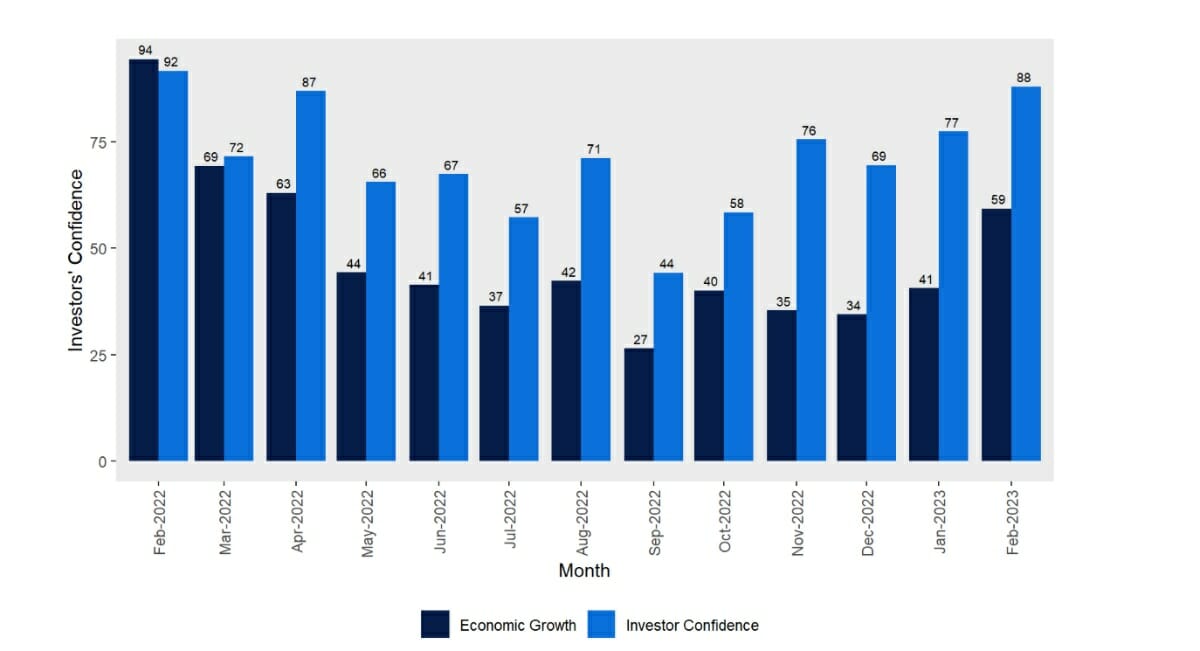

- Confidence in the UK sector rose 14% in February compared to January according to the HL Investor Confidence Survey*

- Confidence in the UK sector is down 4% from the level it was in February 2022, before Russia invaded Ukraine.

- Confidence in UK economic growth has jumped 118% compared to a low in September 2022, after the Trussenomics mini-budget.

- Confidence in UK economic growth is still 37% lower than it was before Russian invaded Ukraine.

Q4 2022 hedge fund letters, conferences and more

Investor Confidence Is Still Struggling To Recover

A year on from the devastating invasion of Ukraine, which shocked the world, sparked runaway inflation, and led to turbulence across global markets, investor confidence is still struggling to fully recover.

The HL Investor Confidence Index shows that, although there has been a marked improvement since last month, confidence in the UK market is still below the level it was last February, before it plummeted in March 2022, following Russia’s military action.

The human cost has been shocking with millions of Ukrainians fleeing for their lives, while economic repercussions have reverberated around the world. The aggression set off a chain reaction, sending commodity prices soaring as supply chains suffered fresh dislocation.

As food, raw materials and energy costs jumped, workers have clamoured for higher wages, pushing inflation even higher, forcing central banks to hike interest rates, squeezing budgets further.

A year on after the FTSE 100 dropped 3.9%, it’s now hovering close to record levels. But the forces pushing it upwards are defensive in nature, with investors largely seeking safety, security and steadier income, rather than seeking out stocks with high growth potential.

Confidence has rebounded as investors eye up China’s reopening, which has helped commodity stocks amid expectations that demand will recover. The shift to renewables, which has accelerating partly due to the war in Ukraine, as nations wean themselves off Russian energy, will require huge resources of metals and minerals which should also provide longer term demand.

BAE Systems' Earnings

Defence manufacturer BAE Systems has been the biggest riser on the FTSE 100, buoyed by record orders as countries bolstered military capability. Banks have been buoyed by the march upwards of interest rates, with the rate hiking cycle not yet forecast to be at an end. Brand pulling power of consumer goods giants has enabled them to pass on input price rise to consumers, helping to preserve margins.

Fears that a long deep recession could be sparked by the crisis have receded, with confidence in UK economic growth jumping 43% in February compared to January. Compared to September, when the Trussenomics mini-budget was unleashed prompting market mayhem, confidence in the UK economy has more than doubled.

Financial stability has been restored and given that we appear to be past the peak of inflation, there is growing hope that better times are around the corner. However, optimism in the UK economy is still around a third lower than it was immediately before Russia invaded Ukraine. Many appear to believe the ripple effect of the war is still holding back Britain’s recovery.

Volatility is set to stay a firm feature of stock markets this year as worries about the impact of high prices continue to nag investors. Over the longer term, if investors can hold their nerve, and try to resist timing the market, more time spent in the market has historically reaped rewards.

Long-term investing takes endurance and patience and rather than switching and ditching stocks, riding out market declines is often a much better strategy, as long as portfolios are diversified across a range of sectors, geographies, and asset classes.

To try and smooth out volatile effects of market movements, consider drip feeding your portfolio, or setting up a direct debit to automate the decision. The importance of making the most of tax wrappers like ISAs and LISAs can’t be over-estimated, especially with upcoming changes to capital gains and dividend allowances.’’

*Each month we send the investors’ confidence survey to 6,000 random clients plus any clients who have asked to participate in the survey again. It is sent on the first working day of the month and there is a representative split of our clients by age. On average around 10% of clients respond.

Article by Susannah Streeter, head of money and markets, Hargreaves Lansdown